FTSE inches higher ahead of UK banks’ earnings this week

- No news is good news on the tariff front

- HSBC, Standard Chartered, Barclays, Lloyds, and NatWest report this week

- FTSE tests 100 SMA resistance

The FTSE 100 and its European peers are edging slightly higher on Monday ahead of a busy week for corporate earnings and economic data from Europe and the US. Meanwhile, trade tariff developments also remain in focus.

The mood remains uneasily calm, with the feeling that no news regarding further tariff announcements is good news. Instead, some brokers comment on stocks such as Berkeley Group, which is lifting the index.

This week is also a key week for UK earnings, with banks set to release Q1 results in the wake of Trump's tariff turmoil. Q1 earnings reflect the January to March period, which preceded President Trump's “Liberation Day” announcement on April 2. However, investors will still be concerned about any signs of caution surrounding earnings forecasts.

The issue of Trump's trade tariffs divides UK banks into two groups: those focused on domestic customers, such as Lloyds and NatWest, reporting on Thursday and Friday, and those with large operations focused on the US, China, and the EU. Banks such as Standard Chartered and HSBC, due to report on Tuesday and Friday, respectively, will be under the spotlight.

Barclays is due to report on Wednesday. Barclays has a sizable exposure to U.S. consumer lending and investment banking operations. It's also worth noting that U.S. investment banks broadly posted solid Q1 earnings, which could bode well for Barclays.

FTSE 250 Shares of Deliveroo jumped over 16% on Monday following a takeover offer from US-based DoorDash last week. On Friday, the online food delivery firm disclosed it had received a 2.7 billion acquisition proposal from DoorDash earlier in April. The company has said it's inclined to recommend the 180P per share offer to shareholders.

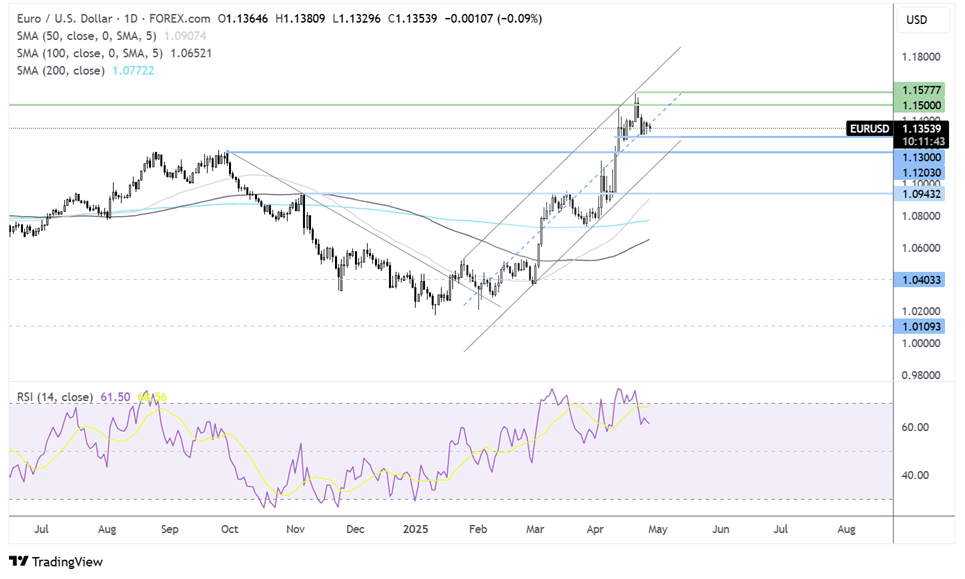

FTSE forecast – technical analysis

The FTSE has recovered from the 7535 low, rising above the 200 SMA, but has run into resistance at the 50 SMA at 8450.

Buyers, supported by the rise above the 200 SMA and the RSI above 50, will likely rise above the 200 SMA to the 50 SMA at 8500 and 8600, respectively.

If the price fails to rise above the 100 SMA, it could retest the 200 SMA at 8350. Below this, sellers could gain momentum towards 8200.

EUR/USD falls away from its 3-year high ahead of a busy week

- USD rises as trade war fears ease slightly

- EZ & US inflation and GDP data & US NFP figures are due this week

- EUR/USD consolidates around 1.1350

EUR/USD has eased back from the 1.1575 three-year high, towards 1.1350 as investors continue to monitor developments on the trade front and look ahead to a busy week of economic data.

Last week, hopes of easing US-China trade tensions lifted the US dollar, which posted its first weekly rise after 4 weeks of losses. However, there is still some confusion about whether Beijing and Washington are in trade tariff negotiations after mixed rhetoric from both sides.

This week, attention will be on inflation data from the eurozone and the US, GDP figures from both regions, and the highly anticipated US nonfarm payroll report on Friday.

Any sign of weakness in US data, particularly jobs data, could fuel recession worries and pull the USD lower.

Federal Reserve Chair Jerome Powell said the central bank is in a wait-and-see mode. However, weak jobs data could tilt the balance towards a more dovish outlook.

The ECB cut rates by 25 basis points to 2.25% last week, bringing borrowing costs to their lowest level since early 2023. Cooling inflation and weak growth data this week could support expectations of another 25-basis-point cut in June.

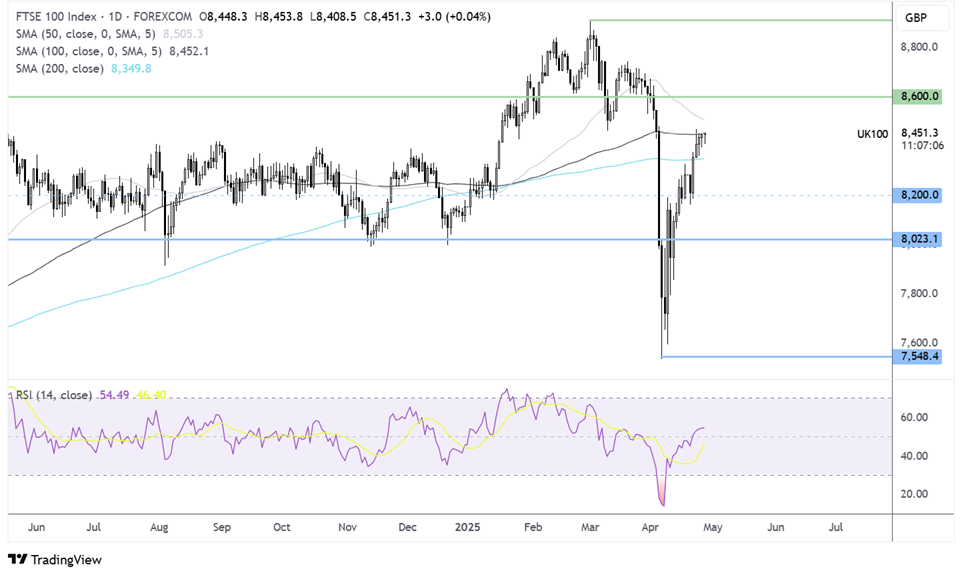

EUR/USD forecast- technical analysis

EUR/USD continues to trade within its ascending channel dating back to mid-January. The price ran into resistance at 1.1575, the upper band of the rising channel, before easing lower and is consolidating around 1.13, pulling the RSI out of overbought territory.

Sellers would need to break below 1.13 to create a lower low and open the door to a deeper selloff towards 1.12.

Should the 1.13 support hold, buyers will look back towards 1.15, and a rise above 1.1575 is needed to extend the bullish run.