FTSE 100 holds steady with geopolitical tensions & PMI data in focus

- Oil stocks rise, travel sector falls

- UK PMIs rise from May, highlighting resilience in the economy

- FTSE recovers from 8720 low

The FTSE 100, along with its European peers, has risen from earlier lows but continues to hover around the flat line amid a cautious mood following the escalation of tensions in the Middle East after the US involvement in Israel's strikes on Iran over the weekend.

Market sentiment is mixed, with energy stocks such as BP and Shell rising, tracking oil prices higher. Oil prices are elevated as Iran weighs up its response to the US, and the market is watching the Strait of Hormuz closely. Should Iran block this key checkpoint for oil and gas flows, oil prices could push higher still.

Meanwhile, travel-related stocks are under pressure, with EasyJet and IAG down almost 1% amid concerns over the potential travel disruptions.

On the data front, the flash composite PMI for June came in lower than expectations at 50.7. Manufacturing contracted at a slower-than-expected pace of 47.7, and services came in with expectations of 51.3. All sectors showed an improvement from May, suggesting some resilience in the UK economy despite geopolitical headwinds.

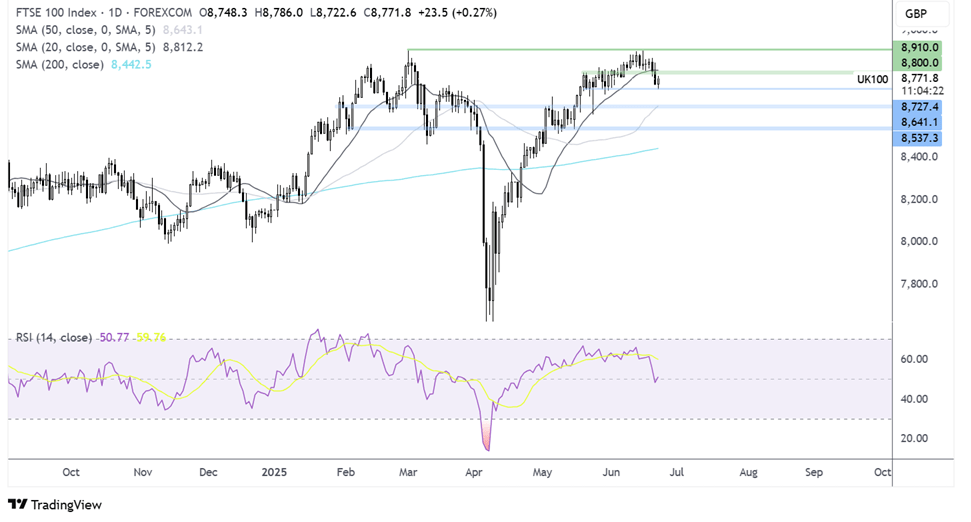

FTSE 100 forecast – technical analysis

After running into resistance at 8900 last week, the FTSE 100 has rebounded lower, dropping below the 20 SMA and the 8800 psychological level to a low of 8720 – a level that offered support at the end of May.

The price has since recovered to 8775, and buyers will look to extend this recovery above 8800. Above here, 8900 comes back into play.

On the downside, sellers will need to take out 8720 to create a lower low and bring 8650 into focus.

EUR/USD stays under pressure after PMIs

- USD is the safe haven of choice

- EZ PMIs miss forecasts

- EUR/USD trades below 1.15 although the uptrend remains

EUR/USD is falling for a third day amid USD safe haven demand after the US became directly involved in the Middle Eastern war and following the latest eurozone PMI surveys, which missed expectations.

The U.S. dollar is proving to be the safe haven of choice amid a significant escalation as the US joined Israel’s conflict with Iran.

Meanwhile, the EUR, which had outperformed this year, is under pressure as Middle East tensions remain high. Europe is negatively exposed to oil prices owing to the region's energy dependence.

Meanwhile, the euro has been trading lower as business activity stalled in June. The eurozone composite PMI was unchanged at 50.2. The manufacturing PMI held steady in contraction at 49.4, and the services PMI ticked up from 49.7 to 50, barely returning to expansion. The data suggests that the bloc is struggling to gain momentum. While Germany is showing some signs of improvement, France continues to act as a drag.

Looking ahead, attention will remain on developments in the Middle East as well as US PMI data, which is due later today. Later in the week, US core PCE, the Fed’s preferred gauge for inflation will be a key focus.

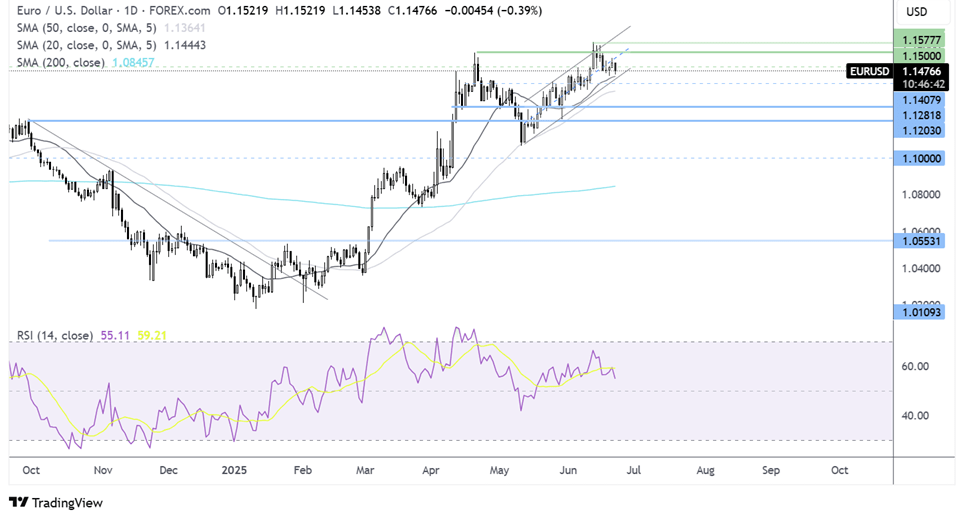

EUR/USD forecast – technical analysis

EUR/USD ran into resistance at 1.1630 before easing back below 1.15. However, EUR/USD continues to trade in its rising channel, holding above its 20 and 50 SMA. The RSI is pointing lower, suggesting momentum is waning. However, there are no concrete signs of reversal.

Immediate support is around 1.1450, the 20 SMA, and the lower band of the rising channel. A break below here could open the door to 1.14 and 1.1280.

Buyers will look to rise back above 1.15 and 1.1580 to bring 1.1630 and fresh multi-year highs into focus.