- FTSE 100 forecast mildly optimistic following trade truce-led rally

- UK equities lifted by global risk sentiment

- Index breaking out of short-term consolidation pattern

The FTSE 100 forecast has brightened—along with other global markets, which were given a boost yesterday as the US and China reached a much-needed truce on tariffs, igniting a rally that spilled across European indices. London’s blue-chip benchmark responded in kind, with the FTSE 100 ticking higher before dipping back down today. But while the short-term momentum appears lost, I wouldn’t be surprised to see the FTSE now rise towards a new all-time high, which is something the likes of the German DAX index has already achieved. Can the UK’s benchmark follow suit now?

Global optimism propels FTSE 100

The truce between the world’s two largest economies was exactly what risk markets wanted. With US tariffs on Chinese goods slashed from 145% to 30%, and reciprocal cuts from China, investor sentiment surged. Equities rallied globally, and the FTSE 100 was no exception, albeit it didn’t rise as much as the likes of the DAX or S&P 500. Still, the index leapt higher on improved risk appetite, aided by firming crude oil prices helping some energy names.

While the short-term FTSE 100 forecast shows some buoyancy, it’s not without caveats. The UK economy remains exposed to global growth trends, and while this week's bullish mood helps, it now needs to persist, reinforced by strong macro data or dovish central bank signals.

UK wages fall less than expected

The BoE delivered a 25 basis point rate cut last week, trimming the base rate to 4.25%. But it was hardly a unanimous affair — two members of the Monetary Policy Committee pushed for a deeper cut, while two preferred to keep rates on hold. Hardly a picture of consensus. The Bank also struck a cautious note on inflation, warning that it could well tick up again later this year. Well, today’s UK wages and jobs data may have helped ease those concerns somewhat, even if the data were stronger than expected. The key takeaway was that wage pressures are, ever so slowly, starting to ease. Average weekly earnings, excluding bonuses, rose by 5.6% in the three months to March — down from 5.9% previously. It’s a modest dip, but a step in the right direction. The BoE will need a few more months of this steady drift before it feels comfortable enough to pivot fully on the wage narrative.

Key UK data to watch next: GDP

Investors are now turning to upcoming UK GDP data on Thursday, coming in following today’s release of wages and last week’s Bank of England meeting. All eyes will be on GDP data on Thursday. March’s unexpected growth spurt suggests first-quarter GDP will be in the black, though don’t be surprised if April brings a more subdued reading. A cooling labour market and lingering cost pressures mean the recovery may remain a rather stop-start affair.

Beyond this week’s events, next week’s services inflation will be in focus next. There’s a decent chance it lands a touch below the Bank’s forecast — and if it does, it would go some way towards paving the way for a rate cut come August.

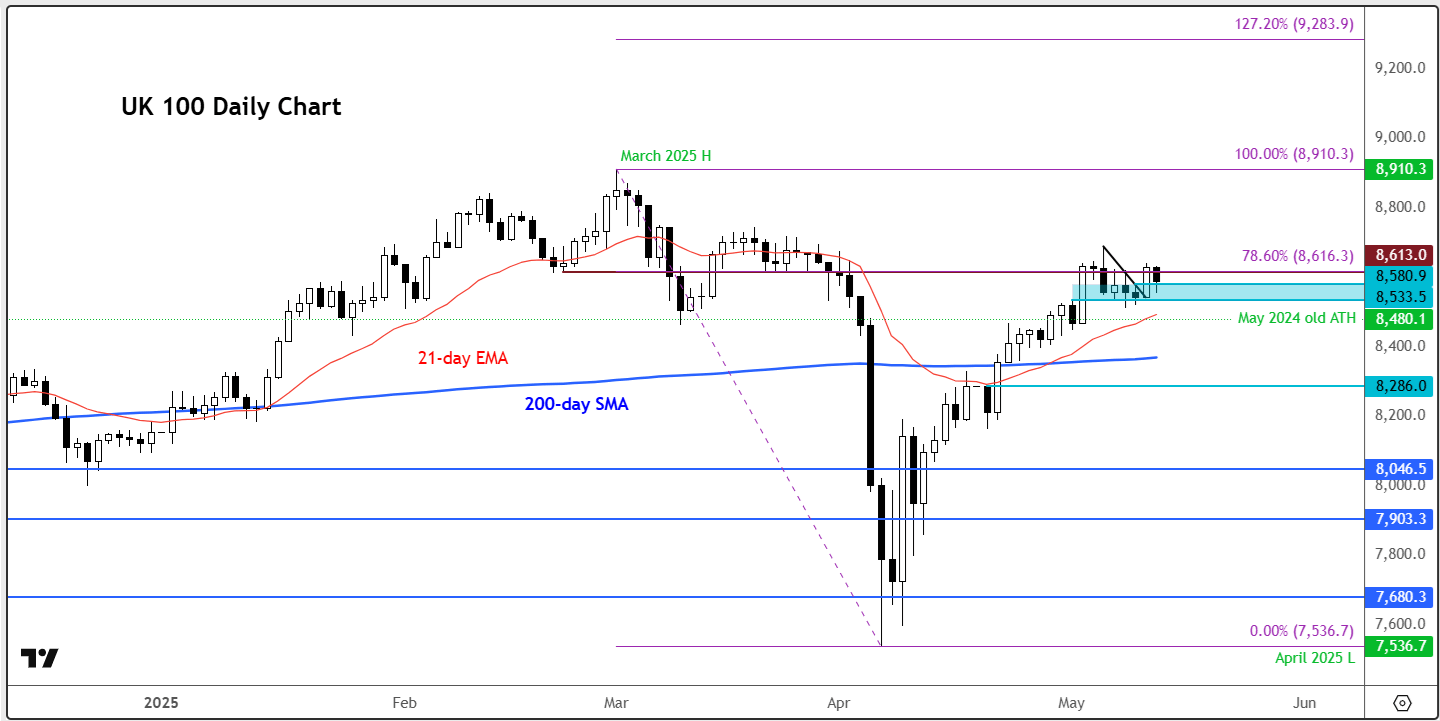

Technical FTSE 100 forecast: Gearing up for breakout

Source: TradingView.com

From a technical point of view, the bullish trend on the FTSE has been re-established: the index is residing above both the 21- and 200-day moving averages, making interim higher lows and breaking resistance after resistance. The momentum is getting stronger. In recent days, it has been consolidating, however, and last week it ended a 4-week winning run. That consolidation allowed the short-term oscillators to work off their overbought conditions, through time, which is a bullish sign.

But following Monday’s rally, the index seems to have broken out of that continuation pattern, and ready to kick on again.

Key levels to watch

It is essential, though, that short-term support in the 8533-8580 area now holds (shaded in light blue on the chart). This area is the point of origin of this week’s breakout.

IF the above support levels break, then the next support is seen around 8480, which was the old all-time high from May 2024, and where the 21-day exponential averages also come into play. Below that is the 200-day average at 8370, followed by 8285.

In terms of resistance, well the 8610-15 area has proved a tough nut to crack in the last few days. Here, we also have the 78.6% Fibonacci retracement level against the March all-time high coming into play as well. If and when this area gets cleared, there are no other major resistance levels to watch until that March high of 8910, apparent from obvious round handles like 8,700, 8,800 etc.

In a nutshell…

To summarise, the FTSE 100 forecast appears cautiously constructive in the short term, buoyed by US-China trade talks providing relief and improving sentiment.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R