- GBP/USD forecast under pressure as rate cut bets grow

- US CPI and UK spending review take centre stage

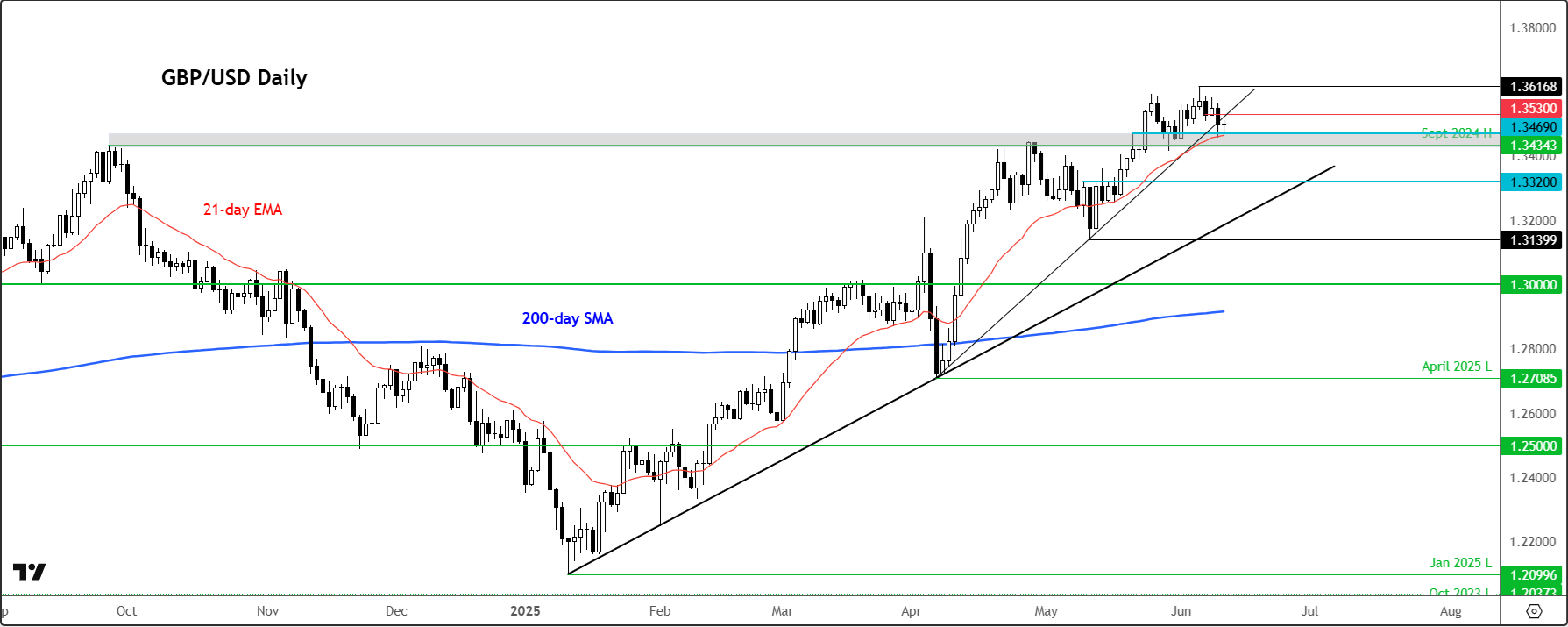

- Technical analysis suggest GBP/USD may be heading lower

The FX markets have been fairly quiet thus far this week, but things could pick up with the release of US CPI today and more data later in the week. The GBP/USD forecast is beginning to sour a little as the pound shows signs of vulnerability amid weakness in UK labour market, though more evidence of a slowdown is needed before the BoE hawks through in the towel. Today’s UK spending review is likely to be a non-event for the pound. With this week’s macro calendar featuring US inflation data, dollar traders could face some much needed volatility. At the same time, US-China trade talks have offered little clarity so far, but there is optimism in the air this time around following marathon talks in London. All told, the US dollar is starting to look attractive again, which may be bad news for the GBP/USD.

Dollar in holding pattern ahead of US CPI

While the US dollar hasn’t exactly roared back to life, it hasn’t fallen either. Markets were initially soothed by signs of progress in US-China trade discussions—namely the suggestion of a framework for rare earths exports—but Beijing’s unwillingness to narrow its trade surplus leaves room for US pushback. Still, both sides have now established a framework for implementing the Geneva consensus that last month brought down tariffs. Any further de-escalation in the trade war should benefit the US dollar.

Meanwhile, attention now pivots to the upcoming US CPI print. Economists are eyeing a 0.2% month-on-month rise in headline inflation and a 0.3% climb in core CPI. Add to that, a 10-year Treasury auction later today, and the dollar could find fresh fuel—leaving sterling looking increasingly exposed.

UK spending review won’t be a game changer

In the UK, Chancellor Rachel Reeves will unveil her Spending Review—but expectations are low. The headline takeaway is simple: the coffers are tight. Departmental spending is set to grow by just 1% in real terms annually over the next three years, with most of that going to health, defence, and education. This isn’t a full Budget, and with no Office for Budget Responsibility forecast alongside it, there’s not much scope for headline-grabbing fiscal moves. Don’t expect fireworks in gilts or the pound as a result.

Labour market data fuels BoE cut bets

The pound stumbled by disappointing UK labour data released on Tuesday. Wages cooled, with the Average Earnings Index dipping to 5.3% (down from 5.6%), and jobless claims jumped by over 33,000. That’s not the kind of data that bolsters confidence in the UK’s economic resilience. In response, markets have ramped up bets on an August rate cut from the Bank of England, with a second move in November not out of the question. With the policy outlook tilting dovish, the pound’s four-month rally now appears to be running on fumes.

Technical GBP/USD forecast: bulls on borrowed time?

Source: TradingView.com

From a technical point of view, the GBP/USD chart is entering choppy waters. The 1.3430–1.3470 support zone is holding for now, but any decisive break below could trigger a slide towards 1.3320 and beyond. Should bearish momentum gather pace, the 2025 trendline near 1.3300–1.3330 may come into play, followed by a deeper dip toward 1.3140 and potentially the psychological 1.3000 mark.

On the upside, the 1.3520/30 zone now flips to resistance, with 1.3600 the next level to beat. But perhaps most crucially, the cable is once again testing the post-Brexit resistance band between 1.35 and 1.40—a region it has struggled to reclaim convincingly in years gone by.

In short, the GBP/USD forecast remains delicately poised. With inflation data from the US to come later on and US-China trade talks looking positive, the coming days could prove pivotal for the next leg in this FX pair’s journey. We think it will be to the downside.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R