- Canada core inflation hit 13-month highs in April

- Odds of a BoC June cut slashed, CAD gains

- UK core CPI also expected to reaccelerate

Central bankers may have won the battle to tame inflation driven by supply and demand shocks post-pandemic, but the war may be far from over. Long gone are the days of persistent inflation undershoots across major developed economies, replaced instead by far more uneven outcomes.

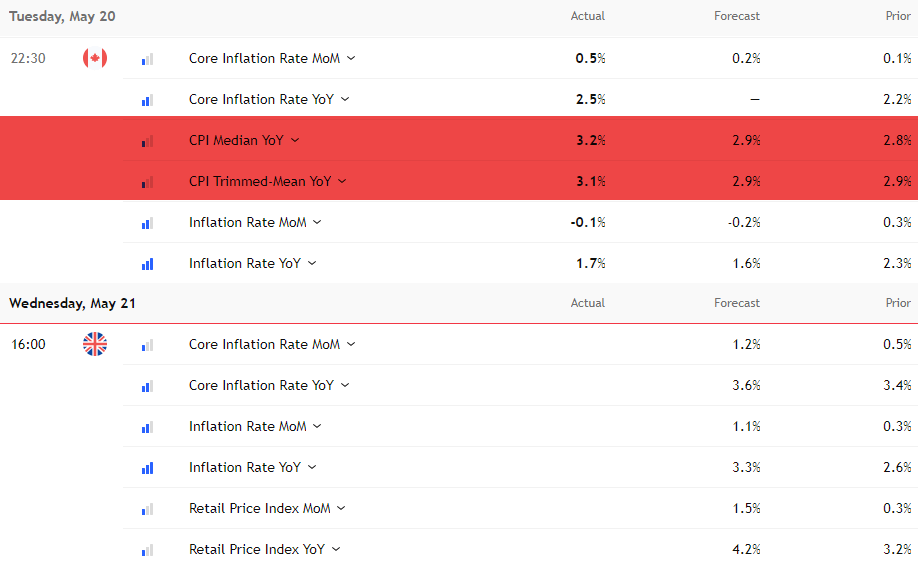

Source: Refinitiv

Data from Canada on Tuesday underlined the risk of easing monetary policy prematurely, with underlying inflation reaccelerating sharply in April. A similar outcome is expected from the UK later Wednesday, leaving core readings in both nations well above mandated levels.

Source: TradingView

Canada Core Inflation Reaccelerates

Canada’s annual inflation rate fell six tenths to 1.7% in April on falling energy prices, but core measures moved sharply in the other direction, complicating the Bank of Canada’s (BoC) task of bolstering economic activity.

The CPI median and trimmed mean annual rates—used by the BoC to gauge underlying inflationary pressures—rose to 3.2% and 3.1% respectively, both hitting 13-month highs and remaining well above the bank’s 2% target.

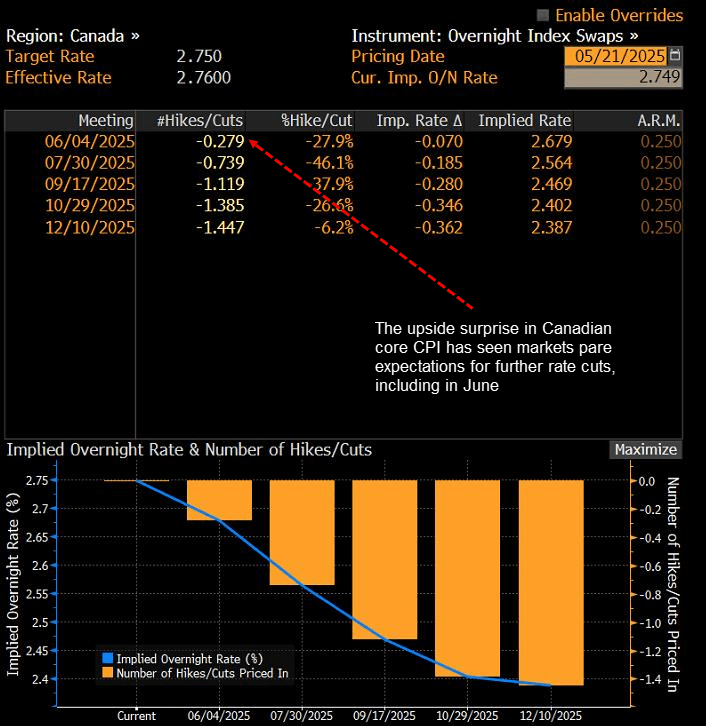

Markets slashed the odds of a June rate cut to 28% from 65% in response, helping push the Canadian dollar higher against the Greenback. Ahead of the BoC’s June 4 interest rate decision, Canadian retail sales figures will be released this Friday, with Q1 GDP following on May 30. Given the heat in underlying inflation, it may require weakness in both reports to see the BoC extend its rate cutting cycle beyond the 225bp already delivered.

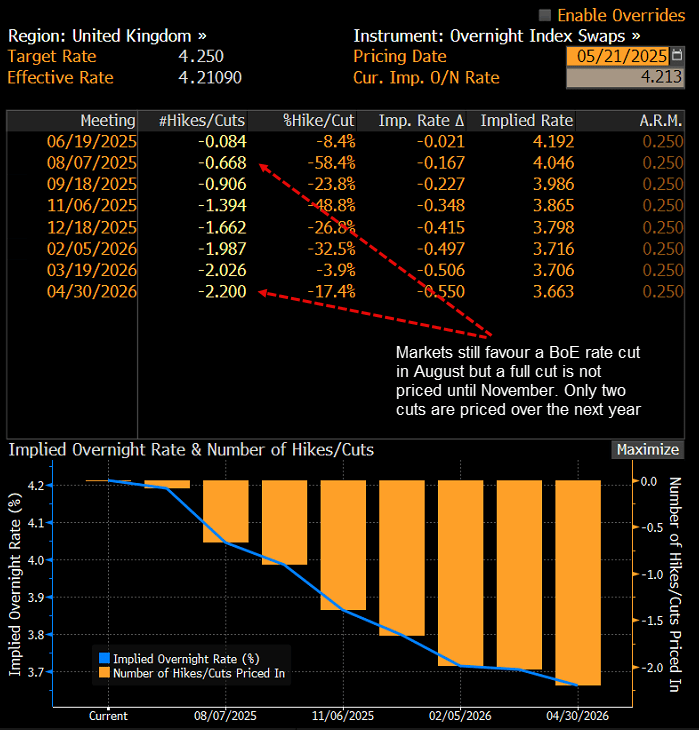

Source: Bloomberg

U.K. Inflation Set to Heat Up

Like its counterpart across the Atlantic, policymakers at the Bank of England (BoE) may face a similarly difficult decision on whether to continue cutting rates, with UK inflation expected to reaccelerate in April when the data drops later Wednesday.

Headline inflation is expected to have jumped to an annual rate of 3.3% in April, up from 2.6% in March, driven by higher energy bills and regulated price hikes. Stripping out volatile items, core inflation is seen lifting 1.2% over the month and 3.6% over the year. The latter would mark an acceleration from March’s 3.4% pace.

On Tuesday, BoE chief economist Huw Pill warned that 25bp quarterly cuts were “too rapid.” He argued the UK’s inflation dynamics have become more persistent, justifying a “higher for longer” base rate path.

Markets still favour another rate cut in August, but sticky inflation, firm wage growth, and US trade tensions could delay that timeline. Reflecting that risk, a full 25bp move is not fully priced until November, with only two cuts now expected over the next 12 months.

Source: Bloomberg

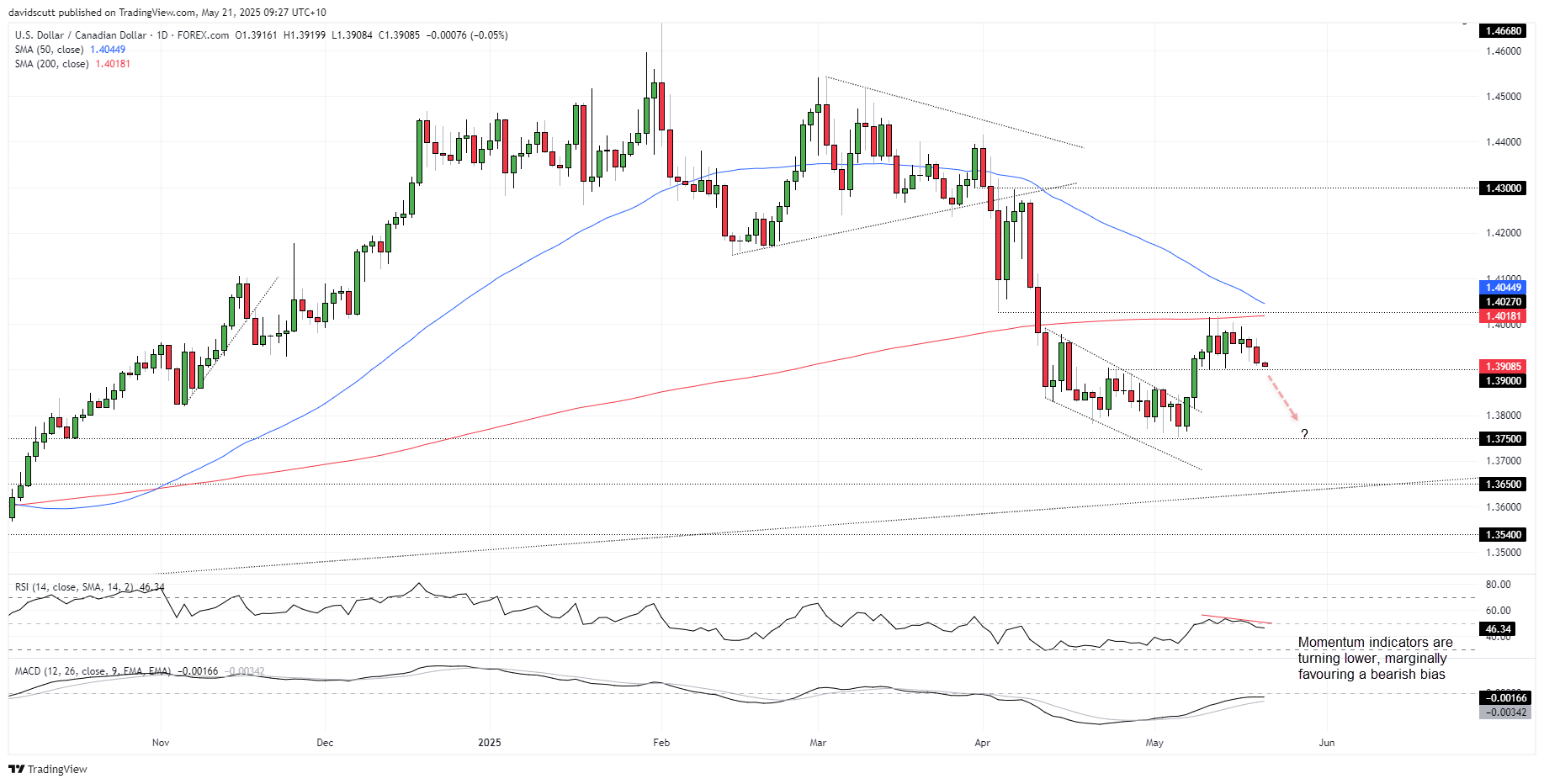

USD/CAD Bears Eye Range Break

Source: TradingView

USD/CAD has been rangebound between the 200DMA on the topside and 1.3900 on the downside over the past fortnight, edging back towards support following the inflation update.

With RSI (14) and MACD either trending lower or threatening to do so below neutral levels, momentum risks appear skewed to the downside, putting a potential break below support on the table near-term.

If USD/CAD pushes and holds beneath 1.3900, it may encourage bears to sell the break, targeting a move towards 1.3800 where the pair attracted solid buying interest down to 1.3750 in late April and early May. A stop above 1.3900 would provide protection against reversal.

If the range continues to hold, the setup could be flipped, with longs established above 1.3900 and a stop below for protection, targeting a retest of the resistance zone comprising the 200DMA, 1.4027 and 50DMA. Given recent price and momentum signals, this scenario screens as a lower probability play.

GBP/USD Sets Sail for 2025 Highs

Source: TradingView

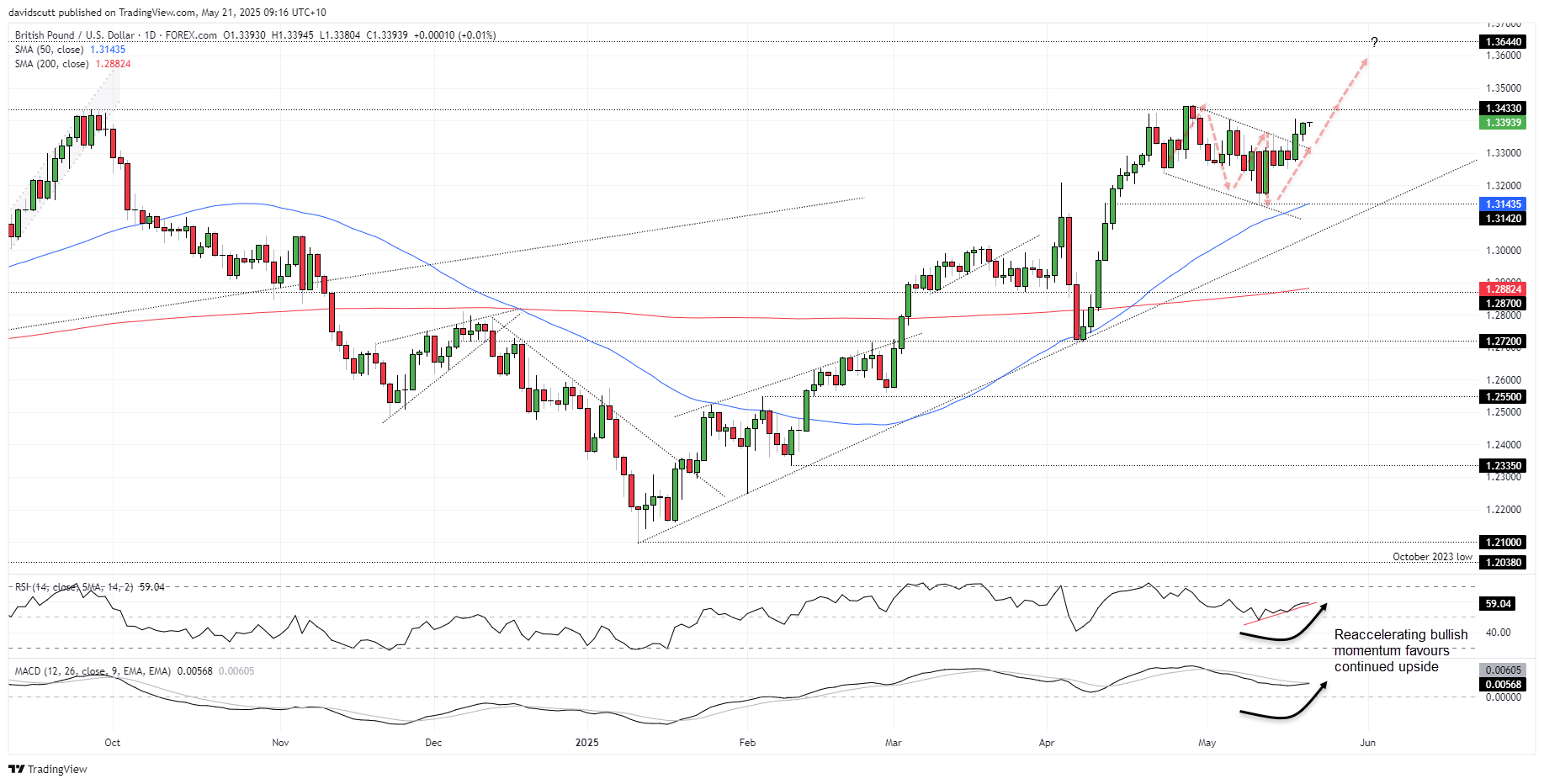

GBP/USD finally broke out of the bull flag pattern it had been trading in earlier this week, with the pair running higher before stalling at 1.3400.

If the move extends—which is not out of the question with momentum signals swinging bullish just as the breakout occurred—watch for another retest of resistance layered above 1.3433. This zone has proven difficult to overcome recently, making it a key battleground for Cable’s medium-term trajectory.

If it gains a foothold above, 1.3644 screens as the next logical target for bulls. If price fails again around these levels, former flag resistance around 1.3300 and the 1.3142/50DMA area are the key downside levels to watch.

-- Written by David Scutt

Follow David on Twitter @scutty