In recent sessions, the GBP/USD pair has shown limited movement, fluctuating by just 0.5% as the U.S. dollar gradually regains strength, in anticipation of the U.S. inflation report scheduled for tomorrow. For now, the pound maintains a consistent bearish bias, preventing the pair from reaching new highs in recent sessions.

CPI Release Approaches

On June 11, the U.S. Consumer Price Index (CPI) will be released, and markets currently expect a slight increase, with a forecast of 2.5% versus the previous 2.3%. While inflation has generally trended downward this year, concerns are growing that the new data could exceed both the prior reading and expectations, raising the risk of persistent inflation in the U.S. economy.

Chart: Annual CPI Performance – United States

Source: Forex Factory

This release is especially important because last week's NFP report showed 139k new jobs, surpassing the expected 126k and rekindling inflation fears. If tomorrow’s CPI confirms this upward trend, it would reinforce the view that the U.S. remains far from its 2% inflation target, potentially influencing the Federal Reserve's monetary policy decisions.

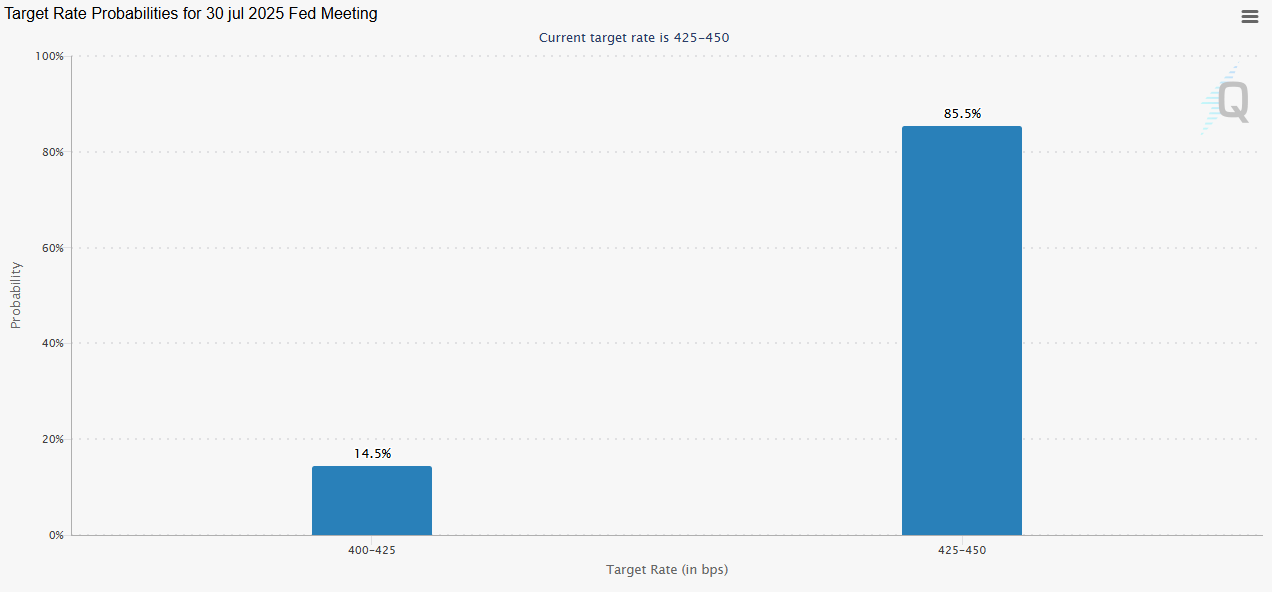

So far, the Fed has maintained a neutral tone, holding the rate steady at 4.5%. However, if inflation persists, this level could remain unchanged for longer. According to the CME FedWatch Tool, there's an 85% probability that the Fed will keep rates steady at the next meeting on July 30, indicating limited short-term scope for rate cuts if inflation remains elevated.

Source: CMEGroup

In this scenario, high interest rates in the U.S. could continue to attract flows into dollar-denominated assets, increasing demand for the greenback relative to the pound and applying downside pressure on GBP/USD.

What’s the Role of the BoE?

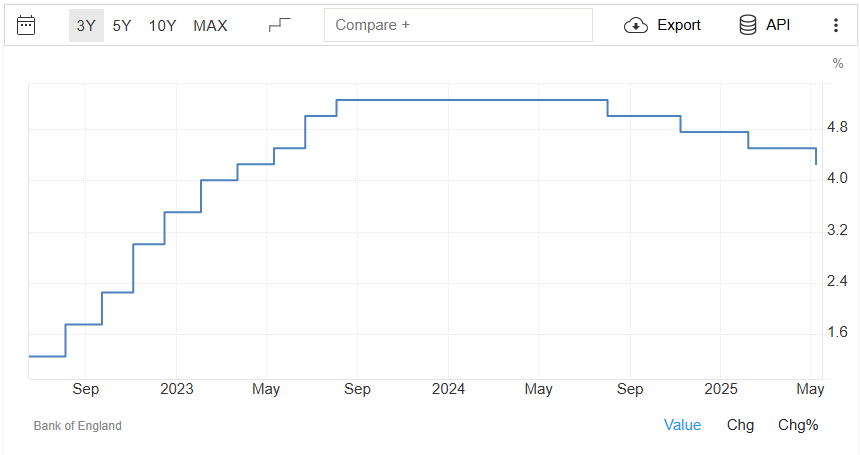

The next Bank of England (BoE) policy meeting is scheduled for June 19. So far this year, the BoE has adopted a gradual easing path, currently setting its benchmark rate at 4.25%.

Source: TradingEconomics

This more flexible approach has not favored the pound, especially as its rate is now lower than the U.S. rate, which reduces the attractiveness of pound-based investments in the short term. If the BoE continues lowering rates, demand for the pound may weaken, paving the way for a stronger dollar and a more pronounced bearish bias in GBP/USD, particularly if the interest rate gap between the two countries continues to widen.

GBP/USD Technical Outlook

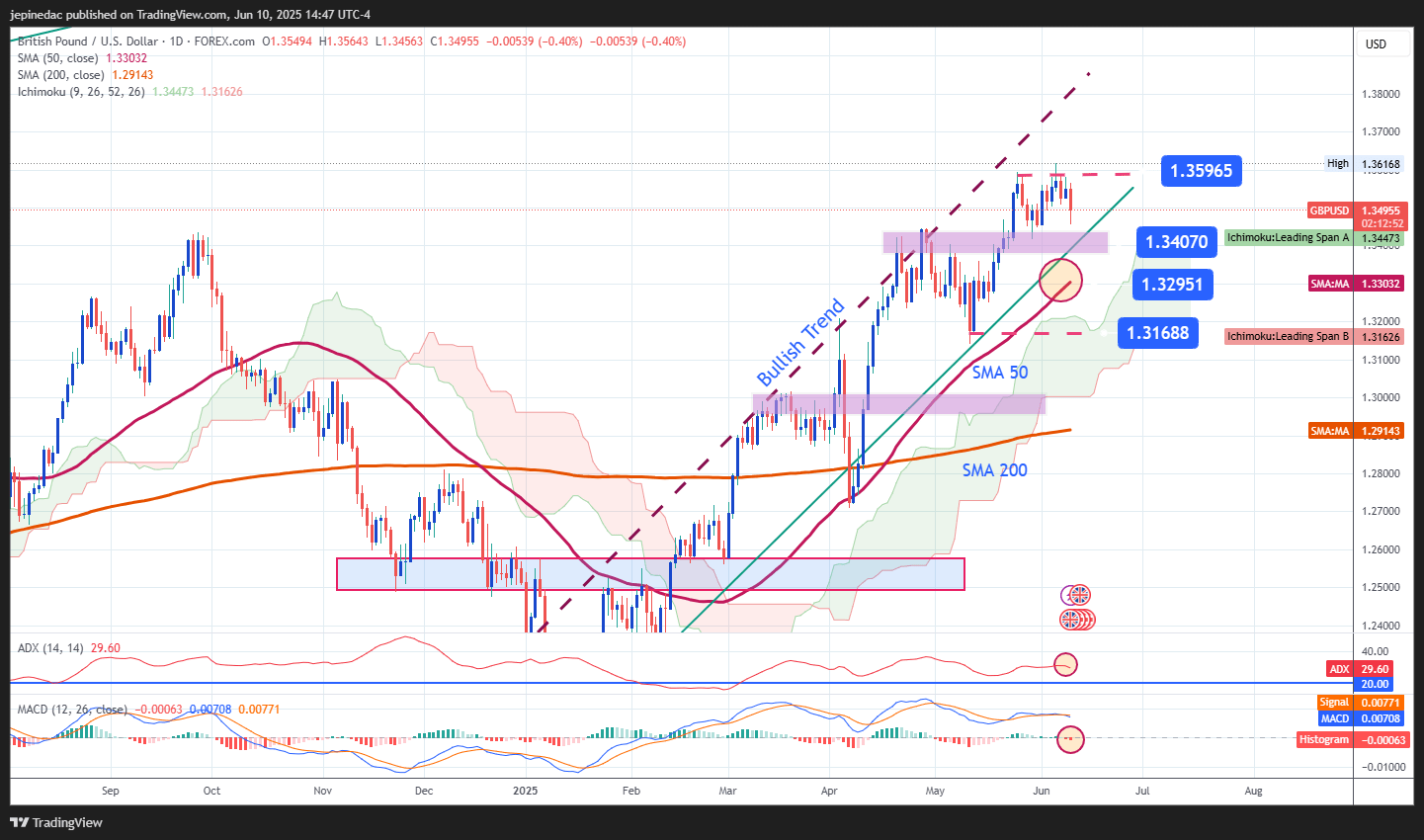

Source: StoneX, Tradingview

- Uptrend Under Review: Since January 15, the pair has maintained a sustained upward trend, with notable technical advances. While recent sessions have seen some downside corrections, they haven’t been strong enough to break the prevailing bullish structure. However, recent highs have failed to set new peaks, suggesting that bullish momentum may be fading. If this continues, the market could enter a consolidation or neutral phase.

- ADX: The ADX index currently hovers around 29, above the neutral threshold of 20. However, a flattening slope indicates declining trend strength and volatility. If this pattern persists, we could see a technical indecision phase in upcoming sessions.

- MACD: The MACD and signal lines have started to cross frequently, while the histogram shows negative oscillations below the zero line, suggesting moderate bearish momentum may be developing. If the histogram continues to post lower readings, selling pressure could intensify.

Key Levels:

- 1.35965 – Near-Term Resistance: Matches recent highs. A sustained breakout above this level could strengthen the bullish bias and extend the uptrend.

- 1.34070 – Near-Term Support: A technical neutral zone that has recently held back declines. It may act as support against deeper pullbacks.

- 1.32951 – Major Support: Aligns with the ascending trendline and the 50-period moving average. A break below this level could put the current trend at risk and signal a shift to a more bearish outlook.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25