British Pound Outlook: GBP/USD

GBP/USD holds above the 50-Day SMA (1.3109) as it appears to be defending the advance from the weekly low (1.3140), and the exchange rate may attempt to retrace the decline from the monthly high (1.3403) should it continue to track the positive slope in the moving average.

GBP/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

GBP/USD trades near the weekly high (1.3361) as the UK Gross Domestic Product (GDP) report shows a 0.7% expansion in the first quarter of 2025 versus forecasts for a 0.6% print, and little signs of a looming recession may push the Bank of England (BoE) to the sidelines amid the 5-4 split to implement a 25bp rate cut earlier this month.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, the British Pound may continue to outperform against its US counterpart ahead of the next BoE meeting in June, but the ongoing adjustment in US fiscal policy may sway GBP/USD as the Trump administration continues to negotiate with its trading partners.

With that said, GBP/USD may further retrace the decline from the monthly high (1.3403) should it defend the rebound from the weekly low (1.3140), but failure to hold above the 50-Day SMA (1.3109) may push the exchange rate toward the April low (1.2709) as there seems to be a shift in US Dollar sentiment.

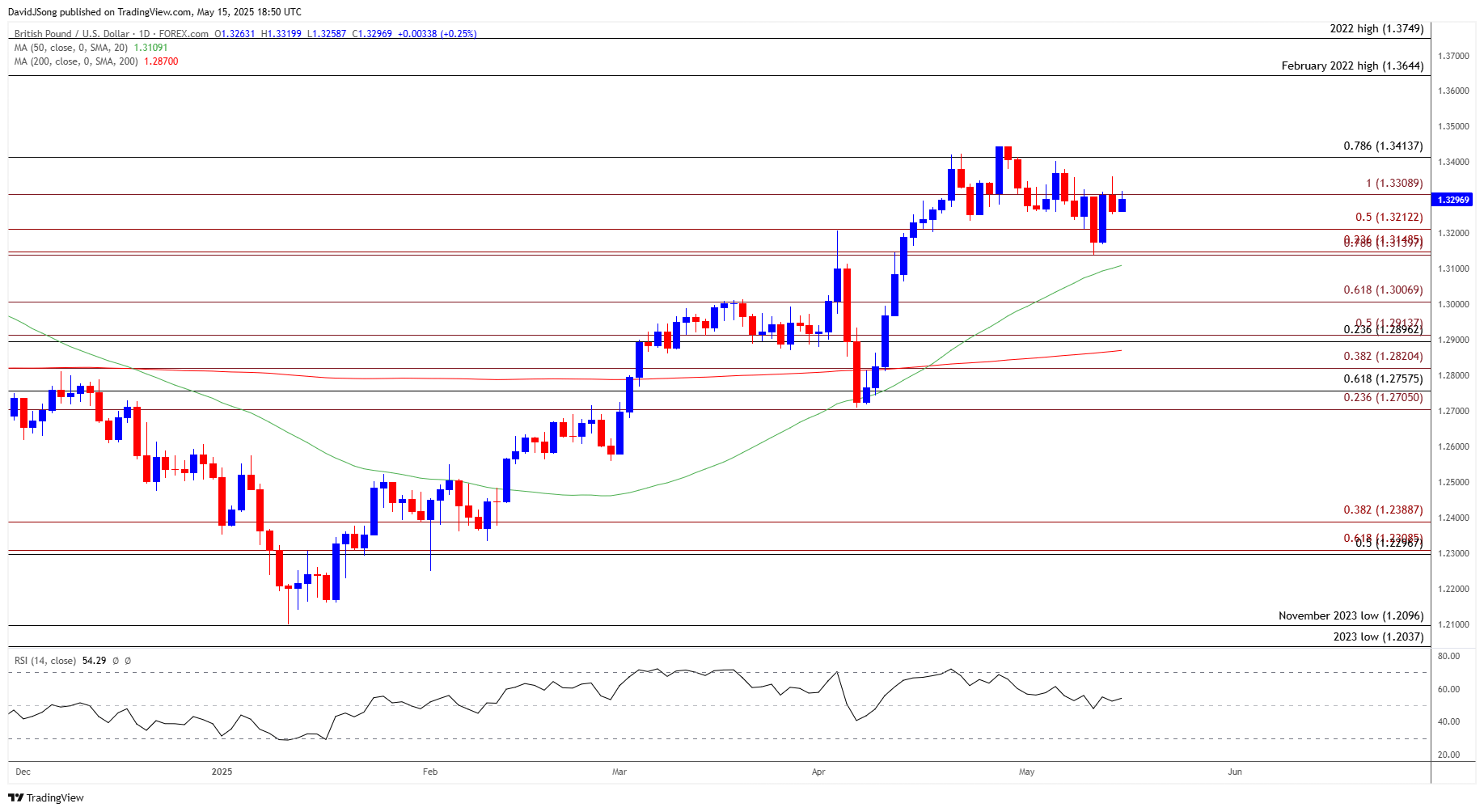

GBP/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD may continue to track the positive slope in the 50-Day SMA (1.3109) amid the failed attempt to push/close below the 1.3140 (78.6% Fibonacci extension) to 1.3150 (23.6% Fibonacci extension) region but need a close above 1.3310 (100% Fibonacci extension) to bring 1.3410 (78.6% Fibonacci retracement) on the radar.

- A breach above the April high (1.3445) may push GBP/USD toward the February 2022 high (1.3644), with the next area of interest coming in around the 2022 high (1.3749).

- At the same time, GBP/USD may no longer hold above the moving average on a move below the 1.3140 (78.6% Fibonacci extension) to 1.3150 (23.6% Fibonacci extension) region, with a break/close below 1.3010 (61.8% Fibonacci extension) bringing the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) zone on the radar.

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Coils Above of Weekly Low

US Dollar Forecast: USD/JPY Reverses Ahead of April High

Australian Dollar Forecast: AUD/USD Defends V-Shape Recovery

EUR/USD Rebounds Following Failed Attempt to Close Below 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong