GBP/USD rises after CPI eases & ahead of the Fed

- UK CPI cools to 3.4% from 3.5% in April

- FOMC rate decision is in focus

- GBP/USD tests 1.3450 support

GBP/USD as rising after data showed UK inflation cooled in May, and as investors look ahead to the Federal Reserve interest rate decision later today.

UK CPI eased to 3.4% annually in May, down from 3.5% in April but ahead of expectations of 3.3%. Service sector inflation, a key metric for the Bank of England, eased to 4.7%, down from 5.4%, in line with the BoE forecast. The data comes as UK wage growth also eased more than expected. UK wage growth is intrinsically linked to service sector inflation.

However, these figures are unlikely to shift interest rate expectations, and economists and investors expect the Bank of England to leave interest rates unchanged when they meet tomorrow.

The market is pricing in an 87% probability that the central bank will leave rates on hold, with two 25 basis point cuts expected by the end of the year.

Meanwhile, the US dollar is falling amid a slight improvement in the market mood. While the Iran-Israel conflict has entered a sixth day, Trump has said that Iran's supreme leader is safe for now. The market will continue to monitor developments closely.

Attention is also turning to the Federal Reserve interest rate decision later today. The central banks are expected to leave rates on hold at 4.25 to 4.5%. The market will be watching updated growth and inflation forecasts and the dot plot closely for clues over the future path for interest rates.

Given recent weak data, Fed Chair Powell could adopt a slightly more dovish tone, which may weigh on the dollar. However, the Fed will want to wait to cut rates to assess the impact of Trump's tariffs on the economy.

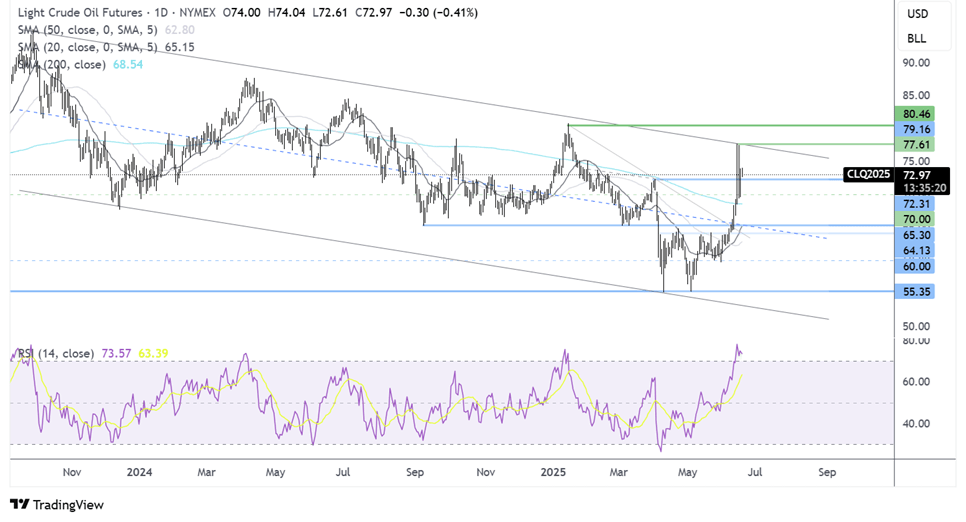

GBP/USD forecast – technical analysis

GBP/USD trades within a rising channel. The price reached a multi-year high at 1.3630 before falling sharply lower yesterday. The bearish engulfing candle took the price back to the 1.3450 support, which is holding the price for now.

Sellers will need to take out this horizontal support and the lower band of the rising channel. A break below here opens the door to 1.34 round number and 1.33.

Should buyers successfully defend the 1.3450 level, bulls will look to rise towards 1.36. A rise above 1.3630 creates a higher high and brings 1.36750 into focus, a level last seen in 2022.

Oil eases as the Israel-Iran conflict enters a sixth day

- Trump called for Iran's unconditional surrender on Tuesday

- The Fed is expected to leaves rates unchanged

- Oil eases back but remains at a 5-month high

Oil prices are easing lower but still trade at a five-month high after rising 4% in the previous session. Markets continue to consider the likelihood of supply disruptions from the Iran-Israel conflict.

The Middle East and conflict have entered its sixth straight day, and President Trump called for Iran's unconditional surrender on Tuesday, although he has said that the supreme leader of Iran is safe for now.

Concerns with oil supply disruption focus on the Strait of Hormuz, a waterway that carries around a fifth of the world's seaborne oil. Iran is OPEC’s largest producer, extracting 3.3 million barrels per day. Spare capacity in other OPEC countries could readily cover this.

The market will be monitoring this situation closely. Any further escalation, particularly involving the US, could sharply increase oil prices.

Attention is also on the Federal Reserve interest rate decision later today. Any sense that the Fed is adopting a more dovish stance could benefit oil prices, given that lower interest rates generally boost economic growth and demand for oil.

However, the Fed will be watching this situation in the Middle East closely, given that rising oil prices could add upward pressure to inflation.

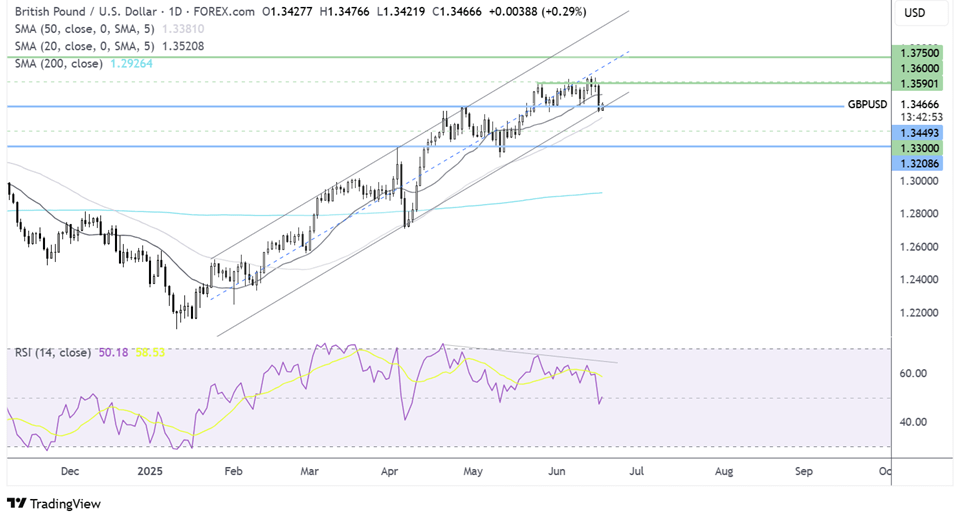

Oil forecast - technical analysis

Oil trades within a longer-term descending channel. The price extended its rally 55.30, the April low, rising above the 200 SMA to a five-month peak of 77.60. While the price has eased back from this peak, it holds above 72.30, the April high. The RSI is overbought territory, so some consolidation or a lower move could be on the cards.

Support is at 72.30, the April high. A break below here negates the near-term uptrend, bringing 70.00. From here, the 200 SMA is exposed at 68.50.

Buyers will look to hold above 72.30. A rise above 77.60, the June high, is needed to create a higher high and rise out of the falling channel.