British Pound Outlook: GBP/USD

GBP/USD clears the April high (1.3445) following a larger-than-expected rise in the UK Consumer Price Index (CPI), and the exchange rate may continue to track the positive slope in the 50-Day SMA (1.3144) as it still holds above the moving average.

GBP/USD Rallies to Fresh Yearly High as UK CPI Shoots Higher

GBP/USD rallies to a fresh yearly high (1.3469) as the headline UK CPI shoots up to 3.5% in April from 2.6% per annum the month prior, with the core rate of inflation printing at 3.8% versus forecasts for a 3.6% reading.

Signs of persistent inflation may push the Bank of England (BoE) to the sidelines amid the 5-4 split to implement a 25bp rate cut at the last meeting, and the central bank may adjust the forward guidance for monetary policy as Chief Economist Huw Pill warns that ‘as long as disinflation back to target is not complete, maintenance of some restriction will still be required.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, Pill argues that ‘withdrawal of policy restriction has been running a little too fast of late’ while speaking at an event hosted by Barclays but goes onto say that ‘the prospective path of Bank Rate from here is downward.’

The comments suggest the Monetary Policy Committee (MPC) will further unwind its restrictive policy to keep the UK out of recession, and it remains to be seen if Governor Andrew Bailey and Co. will respond to the CPI report as there appears to be a growing dissent within the central bank.

With that said, the British Pound may face headwinds ahead of the next BoE meeting in June as the MPC keeps the door open to implement lower interest rates, but the recent rally in the exchange rate may lead to a test of the February 2022 high (1.3644) as it breaks out of the April range.

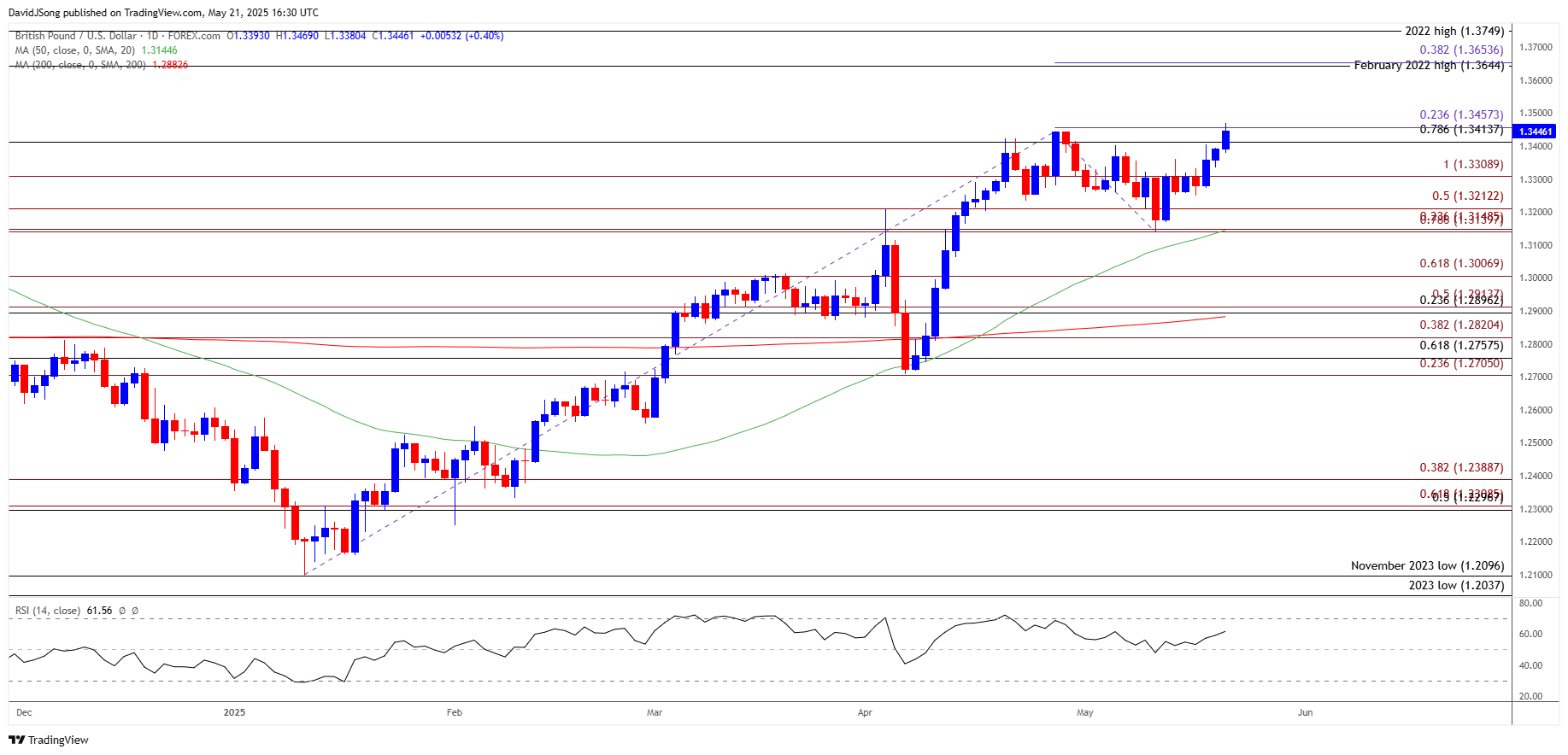

GBP/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD extends the advance from the start of the week to register a fresh yearly high (1.3469), with a close above the 1.3410 (78.6% Fibonacci retracement) to 1.3460 (23.6% Fibonacci extension) region bringing the February 2022 high (1.3644) on the radar.

- A break/close above 1.3650 (38.2% Fibonacci extension) opens up the 2022 high (1.3749), but GBP/USD may consolidate over the remainder of the week should it struggle to close above the 1.3410 (78.6% Fibonacci retracement) to 1.3460 (23.6% Fibonacci extension) region.

- Failure to hold above 1.3310 (100% Fibonacci extension) may push GBP/USD back toward 1.3210 (50% Fibonacci extension), with the next area of interest coming in around 1.3140 (78.6% Fibonacci extension) to 1.3150 (23.6% Fibonacci extension).

Additional Market Outlooks

US Dollar Forecast: EUR/USD Bounces Back Ahead of Monthly Low

Canadian Dollar Forecast: USD/CAD Falls amid Sticky Canada Inflation

USD/JPY Decline Persists amid US Credit Rating Downgrade

Gold Price Struggles to Close Below 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong