British Pound Outlook: GBP/USD

GBP/USD continues to rebound from a fresh monthly low (1.3383) after dipping below 50-Day SMA (1.3398) for the first time since April, and the exchange rate may stage further attempts to test the February 2022 high (1.3644) after failing to close below the moving average.

GBP/USD Rebound Emerges amid Failure to Close Below 50-Day SMA

GBP/USD snaps the series of lower highs and lows from earlier this week even though the Bank of England (BoE) votes 6-3 to keep the Bank Rate at 4.25%, and the exchange rate may further retrace the decline from the monthly high (1.3633) amid the limited reaction to the larger-than-expected decline in UK Retail Sales.

However, signs of a slowing economy may lead to a greater dissent within the BoE as private-sector spending contracts 2.7% in May, and the central bank may come under pressure to implement lower interest rates especially as the ‘Committee expects a significant slowing over the rest of the year.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, speculation for a looming BoE rate-cut may produce headwinds for the British Pound as Governor Andrew Bailey and Co. acknowledge that ‘a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate,’ but GBP/USD may continue to track the positive slope in the 50-Day SMA (1.3398) amid the failed attempt to close below the moving average.

With that said, GBP/USD may continue to retrace the decline from earlier this week as it no longer carves a series of lower highs and lows, but lack of momentum to test the February 2022 high (1.3644) may lead to range bound price action in the exchange rate.

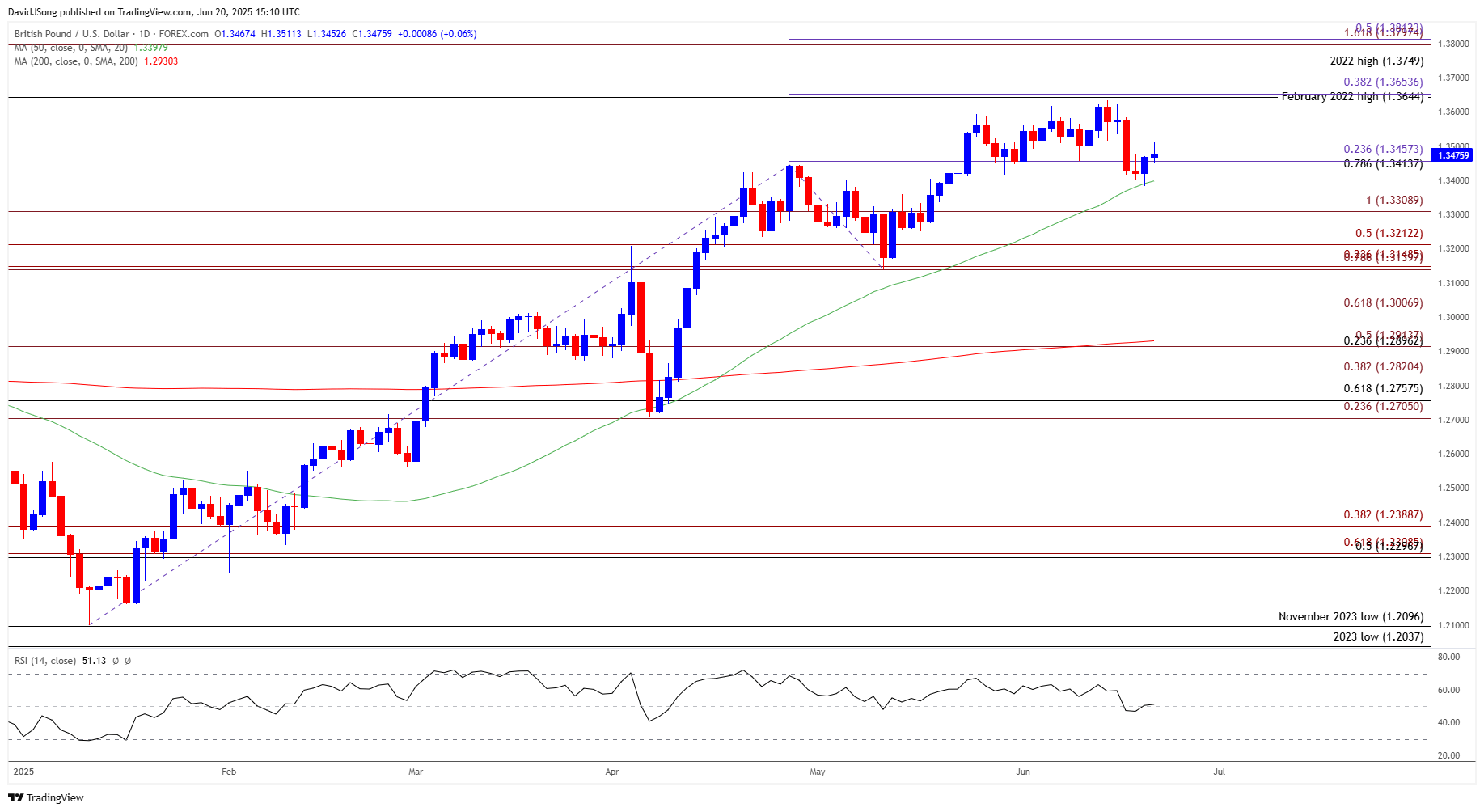

GBP/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD may further retrace the decline from earlier this week should it continue to close above the 1.3410 (78.6% Fibonacci retracement) to 1.3460 (23.6% Fibonacci extension) zone, with a breach above the monthly high (1.3633) raising the scope for a test of the February 2022 high (1.3644).

- Need a move/close above 1.3650 (38.2% Fibonacci extension) to open up the 2022 high (1.3749), but GBP/USD may no longer track the positive slope in the 50-Day SMA (1.3398) as it failed to defend the advance from the start of the month.

- A close below the 1.3410 (78.6% Fibonacci retracement) to 1.3460 (23.6% Fibonacci extension) zone may push GBP/USD toward 1.3310 (100% Fibonacci extension), with a move/close below 1.3210 (50% Fibonacci extension) bringing the May low (1.3140) on the radar.

Additional Market Outlooks

USD/CHF Recovery Persists Ahead of SNB Rate Decision

USD/JPY Consolidates with Fed Expected to Keep US Rates on Hold

Canadian Dollar Forecast: USD/CAD Reverses Ahead of October Low

AUD/USD Coils After Trading to Fresh 2025 High

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong