British Pound Outlook: GBP/USD

GBP/USD may stage further attempts to test the 2024 high (1.3434) as it retraces the decline from earlier this week, but data prints coming out of the UK may drag on the British Pound should the Retail Sales report reveal a slowing economy.

GBP/USD Rebound Vulnerable to Weak UK Retail Sales Report

Keep in mind, GBP/USD pushed to a fresh yearly high (1.3424) after marking a ten-day rally for the first time since 2020, and the pullback in the exchange rate may turn out to be temporary as it bounces back ahead of the weekly low (1.3234).

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

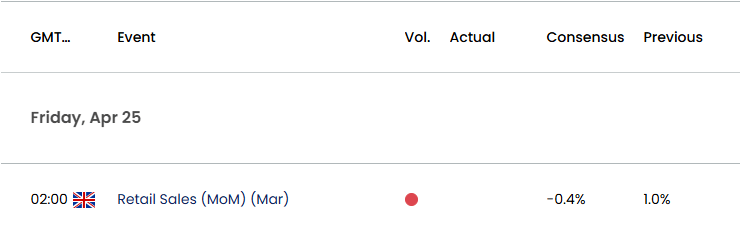

UK Economic Calendar

However, the UK Retail Sales report may sway GBP/USD as household spending is expected to contract 0.4% in March, and signs of a slowing economy may generate a bearish reaction in the British Pound as it puts pressure on the Bank of England (BoE) to implement lower interest rates.

As a result, the British Pound may face headwinds ahead of the next BoE on meeting on May 8, but a better-than-expected Retail Sales report may fuel the recent rebound in GBP/USD as it curbs speculation for lower UK interest rates.

With that said, GBP/USD may stage further attempts to test the 2024 high (1.3434) as it seems to be defending the weekly low (1.3234), but the exchange rate may consolidate over the remainder of the month as the Relative strength Index (RSI) falls back from overbought territory.

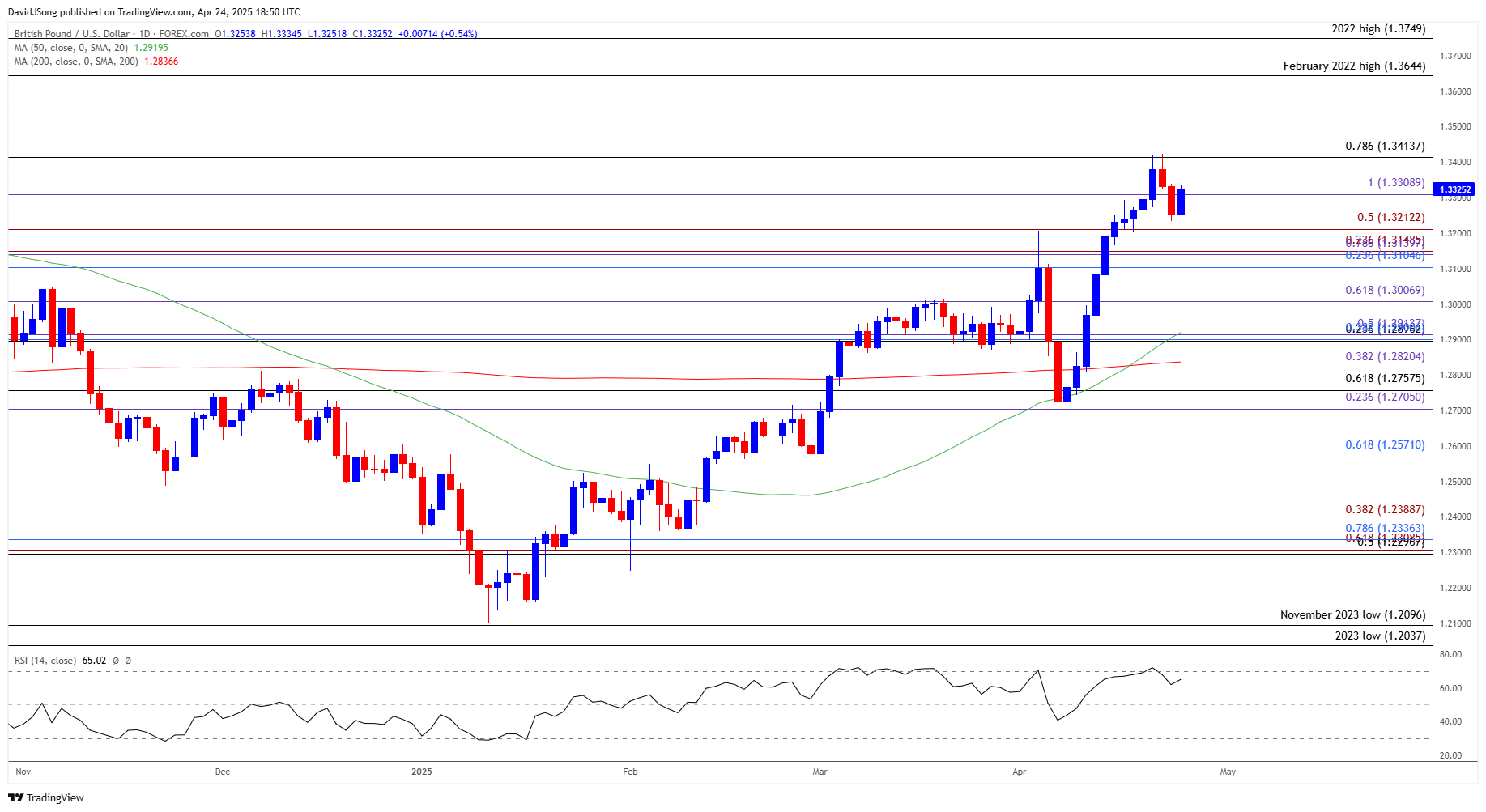

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD may continue to track the positive slope in the 50-Day SMA (1.2920) as it still holds above the moving average, and a close above 1.3310 (100% Fibonacci extension) may push the exchange rate back towards 1.3410 (78.6% Fibonacci retracement).

- A breach above the monthly high (1.3424) may lead to a test of the 2024 high (1.3434), with the next area of interest coming in around the February 2022 high (1.3644).

- Nevertheless, lack of momentum to hold above 1.3210 (50% Fibonacci extension) may push GBP/USD towards the 1.3110 (23.6% Fibonacci retracement) to 1.3150 (23.6% Fibonacci extension) zone, with the next area of interest coming in around 1.3010 (61.8% Fibonacci extension).

Additional Market Outlooks

Gold Price Coils Above 50-Day SMA

Euro Forecast: EUR/USD Reverses Ahead of November 2021 High

Canadian Dollar Forecast: USD/CAD Cracks November Low Ahead of Election

AUD/USD Extends V-Shape Recovery to Push Above February High

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong