British Pound Outlook: GBP/USD

GBP/USD reverses ahead of the March low (1.2579) to stage a three-day rally, and the exchange rate may further retrace the decline from the monthly high (1.3207) as US President Donald Trump pauses the reciprocal tariffs for 90 days.

GBP/USD Reverses Ahead of March Low to Stage Three-Day Rally

GBP/USD extends the rebound from the weekly low (1.2709) as the US Consumer Price Index (CPI) narrows more than expected in March, with the headline reading printing at 2.4% versus forecasts for a 2.6% reading.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, signs of a slowing US economy may keep GBP/USD afloat as the ongoing shift in trade policy puts pressure on the Federal Reserve to implement lower interest rates, and the exchange rate may continue to track the positive slope in the 50-Day SMA (1.2757) after testing the moving average for the first time since February.

With that said, the British Pound may continue to outperform against its US counterpart as GBP/USD attempts to trade back within the ascending channel from earlier this year, but the rebound in the exchange rate may turn out to be temporary if it struggles to hold above channel support.

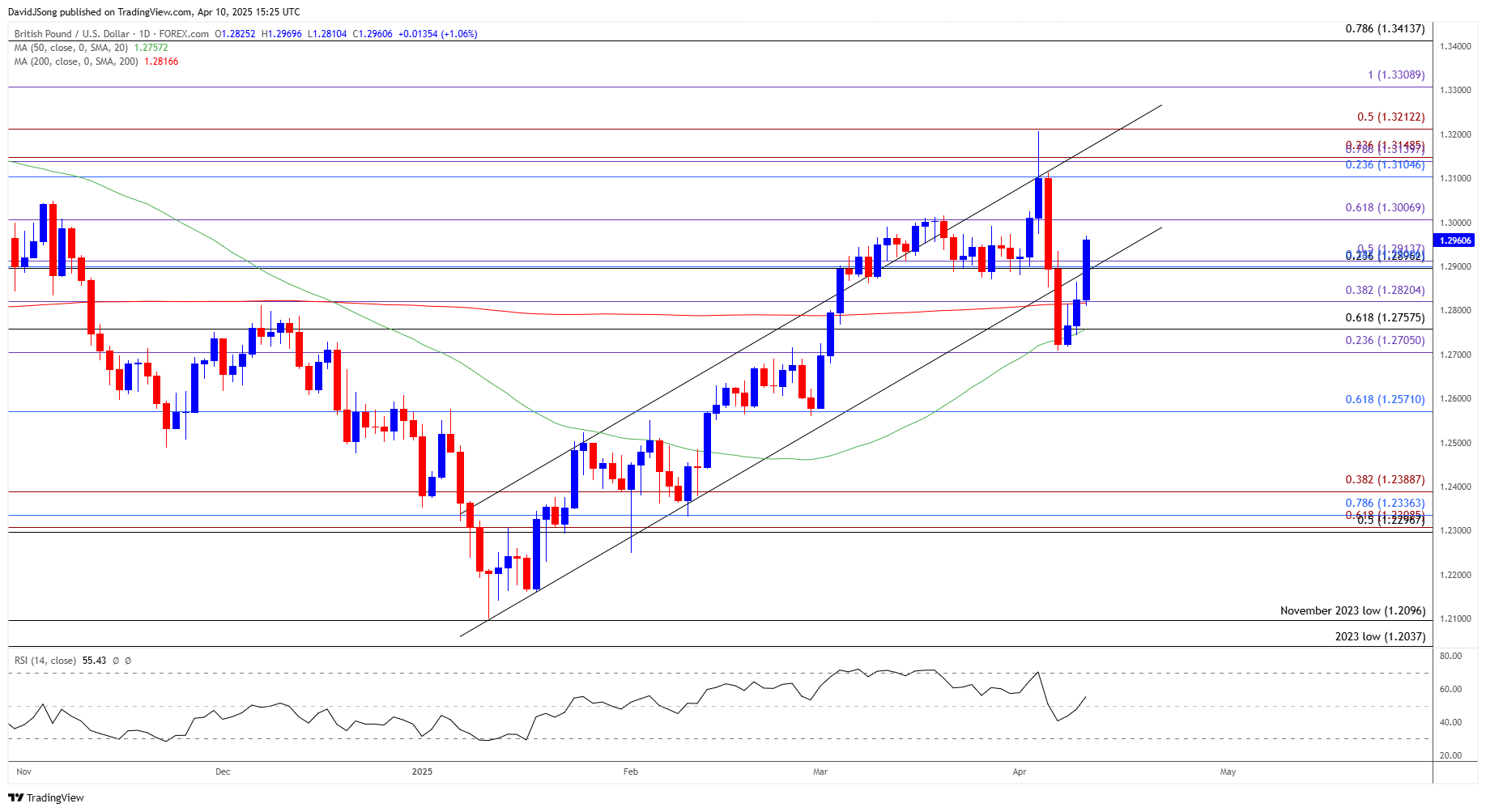

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD carves a series of higher highs and lows after defending the 1.2710 (23.6% Fibonacci extension) to 1.2760 (61.8% Fibonacci retracement) zone, and a break/close above 1.3000 (61.8% Fibonacci extension) may push the exchange rate back towards the 1.3110 (23.6% Fibonacci retracement) to 1.3150 (23.6% Fibonacci extension) region.

- Next area of interest comes in around the monthly high (1.3207), but lack of momentum to hold/close above the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) region may curb the recent series of higher highs and lows in GBP/USD.

- Need a move below 1.2820 (38.2% Fibonacci extension) for GBP/USD to threaten the bullish price series, with the next area of interest coming in around 1.2710 (23.6% Fibonacci extension) to 1.2760 (61.8% Fibonacci retracement).

Additional Market Outlooks

USD/JPY Eyes October Low as China Responds to Trump Tariffs

Canadian Dollar Forecast: USD/CAD Rebound Fizzles amid Trump Tariff Negotiations

AUD/USD Selloff Persists as US Threatens Additional 50% Tariff for China

Euro Forecast: EUR/USD Completes Cup-and-Handle Formation

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong