British Pound Outlook: GBP/USD

GBP/USD may stage further attempts to test the February 2022 high (1.3644) as trades near the monthly high (1.3633), but the British Pound may face headwinds ahead of the Bank of England (BoE) meeting on June 19 as the UK Consumer Price Index (CPI) is anticipated to show slowing inflation.

GBP/USD Susceptible to Slowing UK CPI Ahead of BoE Meeting

Keep in mind, GBP/USD broke out of the opening range for June after defending the advance from the monthly low (1.3454), and the exchange rate may continue to track the positive slope in the 50-Day SMA (1.3355) as it holds above the moving average.

UK Economic Calendar

However, the UK CPI may sway GBP/USD as both the headline and core rate are expected to narrow in May, and signs of slower price growth may generate a bearish reaction in the British Pound as it puts pressure on the Bank of England (BoE) to further unwind its restrictive policy.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, GBP/USD may struggle to retain the advance from the start of the month amid speculation for lower UK interest rates, but a higher-than-expected CPI print may push the BoE to the sidelines following the 5-4 split to implement a 25bp rate-cut in May.

With that said, the range bound price action in GBP/USD may turn out to be temporary should it continue to hold above 50-Day SMA (1.3355), but the exchange rate may threaten the positive slope in the moving average if it fails to defend the advance from the monthly low (1.3454).

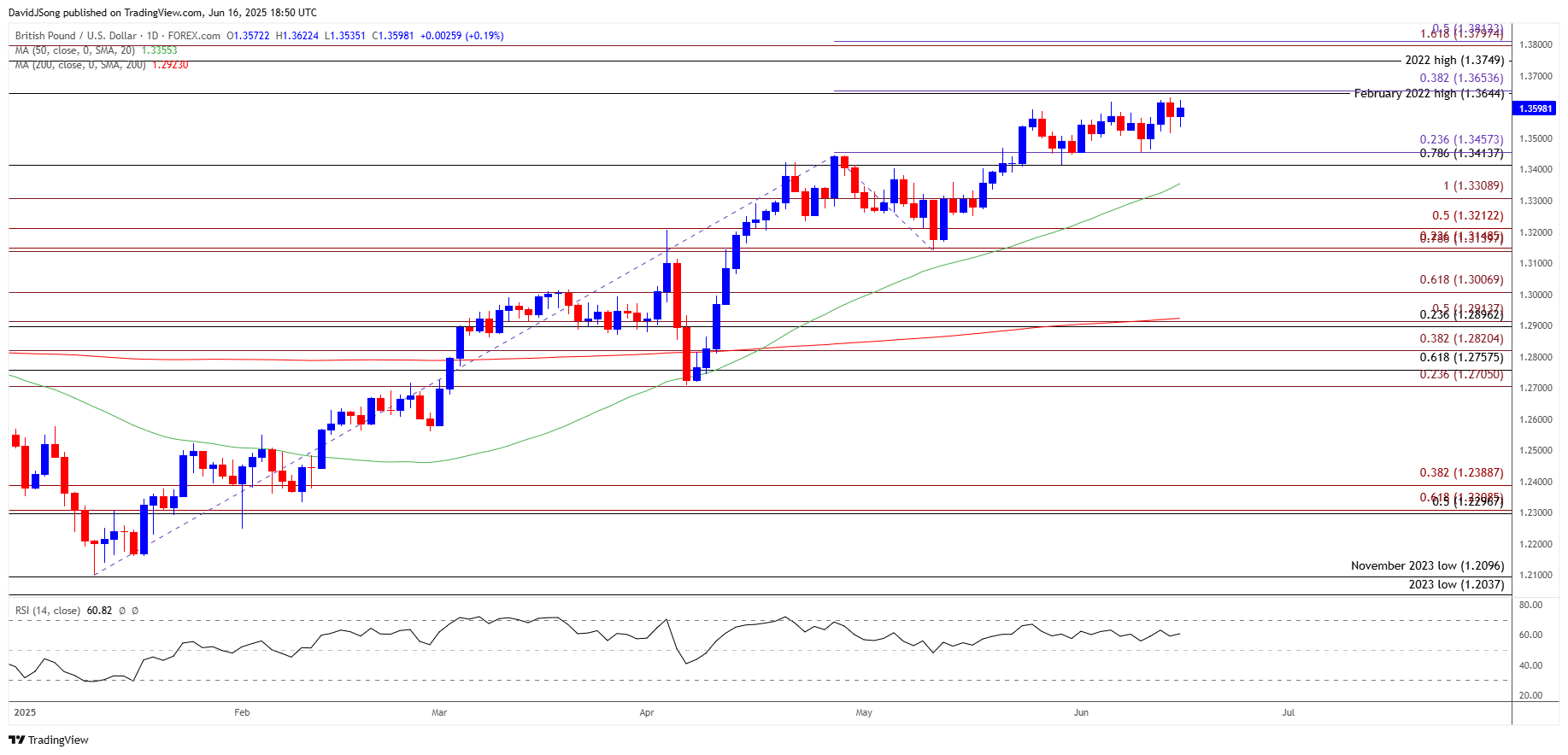

GBP/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD may stage further attempts to test the February 2022 high (1.3644) as it holds above the 1.3410 (78.6% Fibonacci retracement) to 1.3460 (23.6% Fibonacci extension) zone, with a break/close above 1.3650 (38.2% Fibonacci extension) opening up the 2022 high (1.3749).

- Next area of interest comes in around 1.3800 (161.8% Fibonacci extension) to 1.3810 (50% Fibonacci extension), but lack of momentum to clear the February 2022 high (1.3644) may push GBP/USD back towards the monthly low (1.3454).

- A break/close below the 1.3410 (78.6% Fibonacci retracement) to 1.3460 (23.6% Fibonacci extension) zone brings 1.3310 (100% Fibonacci extension) on the radar, with the next area of interest coming in around 1.3210 (50% Fibonacci extension).

Additional Market Outlooks

EUR/USD Outlook Hinges on Federal Reserve Forward Guidance

Canadian Dollar Forecast: USD/CAD Slump Pushes RSI into Oversold Zone

USD/JPY Weakness Persists with US PPI Unfazed by Higher Tariffs

US Dollar Forecast: USD/CHF Falls Toward Monthly Low amid Soft US CPI

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong