Key Events:

- Soft inflation readings from both CPI and PPI this week left the DXY under pressure against major currencies.

- Next week’s key data releases, including UK and Canadian CPI, retail sales, and flash PMIs across the Eurozone, UK, and U.S., are expected to test ongoing trends in the currency market amid evolving trade negotiations.

Powell’s latest comments shifted market focus from trade deal optimism to concerns over tariff-induced supply shocks in the U.S. He also emphasized the need to adjust the ideal interest rate environment to the "new normal" of inflation, following the Fed's recent rate-hold decision

DXY and the Bigger Picture

While the U.S. Dollar Index (DXY) remained relatively stable, the price action in EURUSD and GBPUSD suggests a broader challenge to the dollar’s recent recovery. DXY remains below the 102-resistance zone but continues to hold above its long-term support at 98, which coincides with oversold momentum levels last seen in 2020 and 2024.

Looking Ahead: Next Week’s Macro Drivers

While trade developments will likely remain in the spotlight, next week’s macro data may inject volatility — particularly for GBPUSD and USDCAD. Key releases include:

- UK and Canadian CPI

- UK and Canadian Retail sales

- Flash PMIs across the Eurozone, UK, and U.S.

These figures could offer deeper insight into how economies are responding to tariff pressures and evolving trade negotiations, shaping the next moves in FX markets.

What are the key levels to watch?

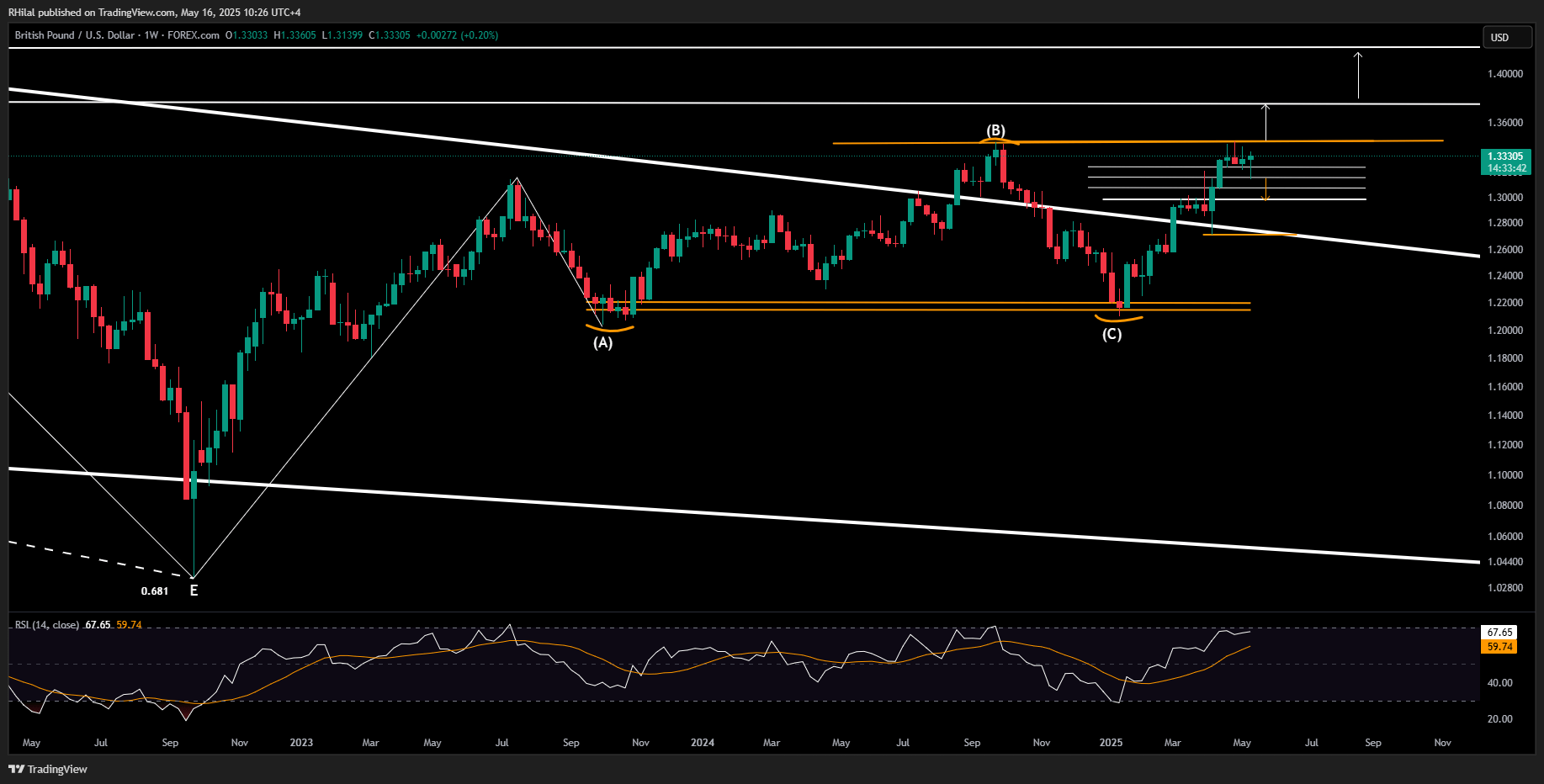

GBPUSD Outlook: Weekly Time Frame – Log Scale

Source: Tradingview

On the back of softer U.S. inflation data and stronger-than-expected UK figures (with GDP at 0.2% vs. 0% expected and claimant count change at 5.2k vs. 22.3k), GBPUSD held above 1.33.

Bullish scenario: A clean hold above 1.3350 could push the pair toward 1.3450, with potential for new 2025 highs at 1.3750 and 1.4210, aligning with the highs of 2021.

Bearish scenario: A break below 1.32 may bring support levels at 1.3150, 1.3070, and 1.2980 into view. In extreme cases, 1.22 could be tested, aligning with overbought RSI levels last seen in July 2023 and September 2024, and the long-term trendline from 2014–2021.

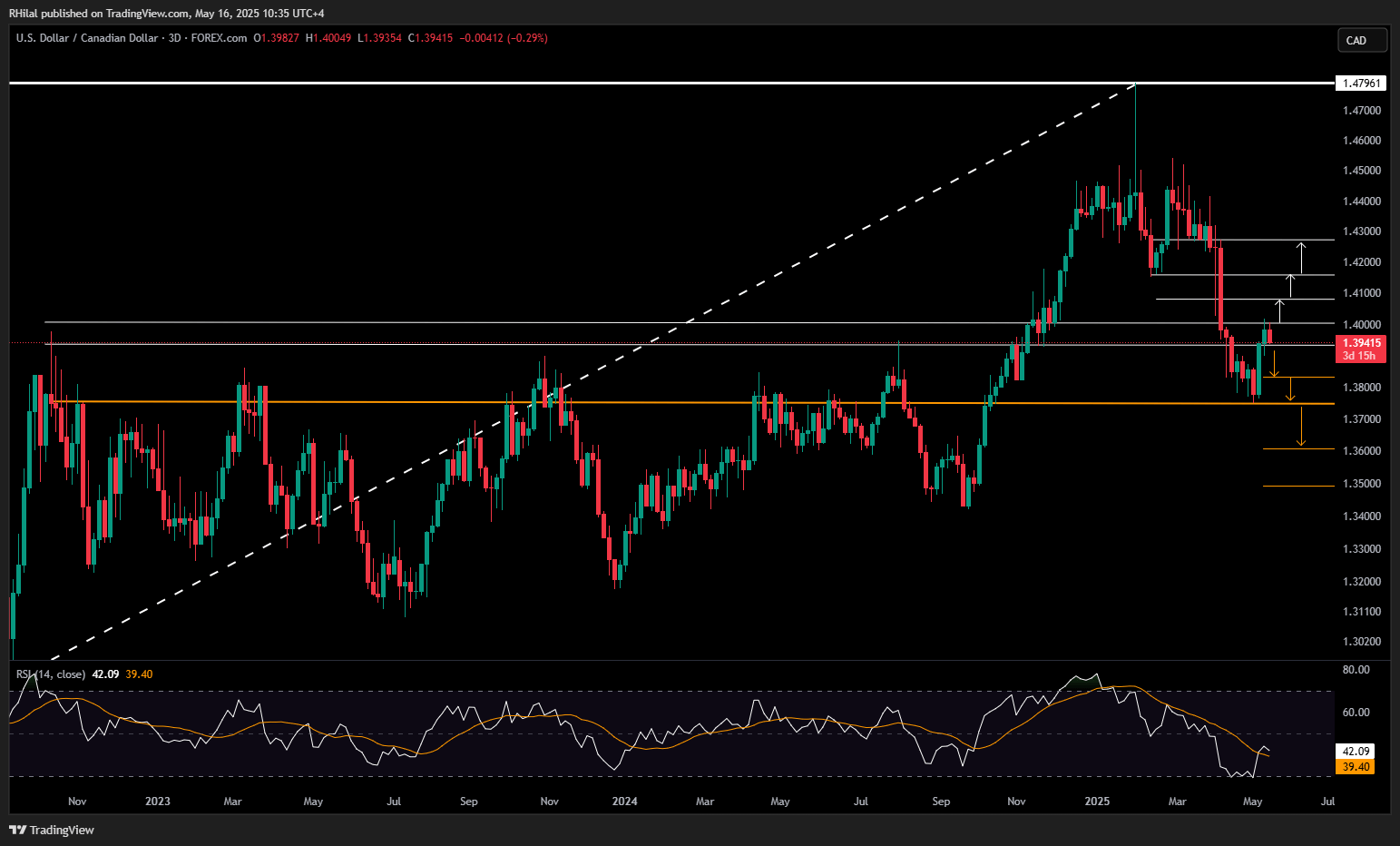

USDCAD Outlook: 3-Day Time Frame – Log Scale

Source: TradingView

USDCAD is mirroring the DXY’s broader trend — rebounding off oversold momentum levels last seen in 2021 but now facing resistance due to softer Canadian economic data.

Bullish Scenario: A break and hold above 1.4020 may open the way for gains toward 1.4080, 1.4150, and 1.4270.

Bearish Scenario: A decisive break below 1.3930 could trigger further downside toward 1.3830, 1.3750, and 1.3600.

Written by Razan Hilal, CMT

Follow on X:@Rh_waves