In the last two trading sessions, gold has declined by just over 2% after attempting to consolidate around its historical high levels, as demand for safe-haven assets has weakened in the short term. This reaction is largely due to the market seemingly digesting the recent escalation in trade tensions. For now, gold remains fluctuating near its highs, showing signs of a neutral pattern, which could be decisive in upcoming trading sessions.

Escalation of Geopolitical Conflict

The conflict between Iran and Israel escalated on June 13, when Israel launched Operation “Rising Lion”, an aerial offensive against Iranian nuclear and military facilities. Iran responded swiftly with over 200 missiles and drones targeting Israeli cities, including Tel Aviv.

Initially, this escalation drastically increased demand for safe-haven assets, such as gold, driven by uncertainty over the regional impact and the potential threat to critical trade routes. In this context, gold surged back to the $3,400 per ounce zone, once again reaching its all-time highs.

However, the outlook has shifted. Although the conflict persists, it has remained geographically contained and has not spread to other countries in the region. Moreover, markets have shown a remarkable ability to absorb negative headlines, especially after months of trade war volatility. For now, the fact that the situation has not escalated further seems to have weakened the buying momentum in gold at the start of this trading week.

That said, it’s essential to note that in this type of sensitive geopolitical environment, safe-haven assets can react quickly. If no agreement is reached and the military conflict worsens, gold could regain its status as the go-to safe haven, driving renewed buying pressure over the coming weeks. This is why it is imperative to closely monitor how the situation evolves, as tensions remain high.

What’s Happening with Market Confidence?

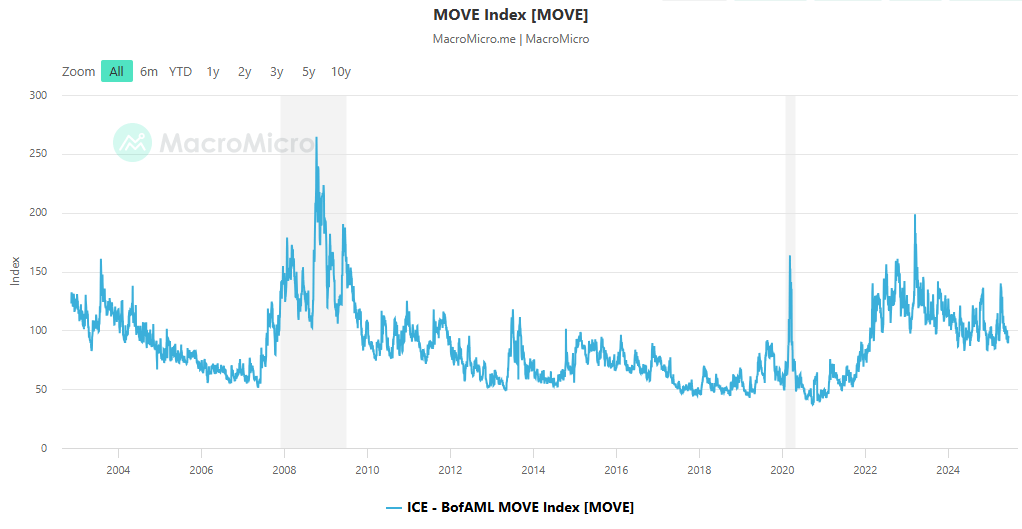

Currently, the MOVE Index, which measures implied volatility in the U.S. Treasury bond market and can be interpreted as a market confidence indicator, has been steadily declining, falling below the 100-point level and showing a persistent downward bias.

Source: Macromicro

This suggests a reduction in perceived macroeconomic risk, as the bond market is no longer pricing in large short-term moves, reflecting a more relaxed risk sentiment. In this environment, despite ongoing conflict in the Middle East, the situation has not been severe enough to trigger renewed safe-haven demand. If the MOVE Index continues to trend lower, gold demand may weaken further, opening the door to relevant selling pressure.

Gold Technical Outlook

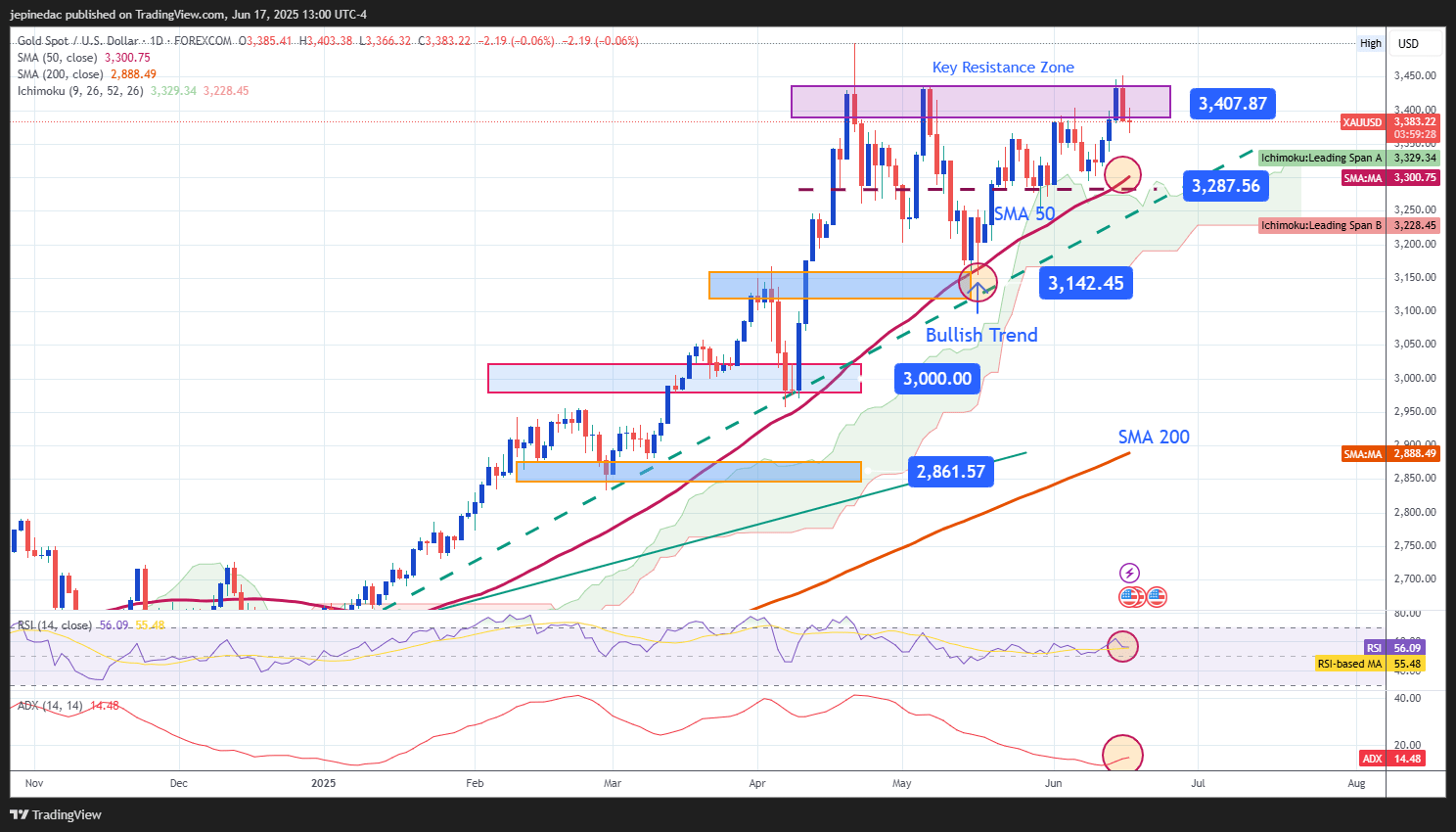

Source: StoneX, Tradingview

- Bullish Trend: Recent price action has allowed gold to maintain a solid bullish trend, returning to the all-time high zone. However, the buying momentum has been insufficient to break this barrier, leading to a sideways consolidation, which, if it persists, may result in downward corrections. While the long-term bias remains bullish, gold is now facing critical technical levels.

- ADX: The ADX line remains below the neutral 20 level, indicating low average volatility. If price continues to face resistance zones under these conditions, it could lead to a prolonged consolidation phase.

- RSI: The RSI remains above 50, reflecting a dominant bullish bias. However, the flattening of the RSI line suggests a possible pause in the uptrend, with increasing risk of range-bound movement in the sessions ahead.

Key Levels to Watch:

- $3,400 – Major Resistance: Recent all-time high. A sustained breakout above this level would confirm the bullish bias and likely extend the trend further.

- $3,287 – Key Support: A technical area that aligns with short-term neutral levels, supported by the Ichimoku cloud and the 50-period moving average. It may act as a barrier against potential selling.

- $3,140 – Critical Support: Marks the lowest level in recent months. A breakdown below this point would put the long-term uptrend at risk.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25