Gold, Bitcoin Key Points

- Concerns about the rising US debt and prospects of continued large deficits are intensifying, driving yields, gold, and bitcoin higher.

- Gold has little in the way of resistance between the current levels and near the all-time closing high in the mid-$3400s

- Bitcoin’s uptrend remains healthy after a gradual pullback through Q1, and a clean breakout to record highs could well lead to a quick continuation toward $115K or even $120K in short order

After weeks of international trade headlines driving trade, this week’s catalysts have been more prosaic: Higher-than-expected inflation in countries like Canada and the UK driving down expectations of central bank rate cuts and the ever-changing prospects for a US budget bill winding its way through the legislative branch.

Keying in on the “Big, Beautiful Bill,” the US House of Representatives is facing a critical vote on President Donald Trump's budget package, with Speaker Mike Johnson aiming for a vote later today.

However, key elements of the bill, including final changes, are still being negotiated. As of writing, the House Rules Committee is in a marathon session to finalize the manager’s amendment, which is essential to securing the support of holdout GOP members.

The bill, a key part of Trump's broader agenda, has encountered resistance, particularly from conservative and moderate Republicans. Key sticking points include Medicaid work requirements and the green energy tax credits, with conservatives pushing for quicker implementation of these provisions. Meanwhile, moderate Republicans, particularly from high-tax states, are holding firm on the State and Local Tax (SALT) deduction cap, demanding higher limits than currently proposed, though news this morning suggests an agreement to bump it up to $40K may have been reached.

Speaker Johnson’s timeline remains aggressive, with discussions expected to extend through the week as GOP leaders struggle to reconcile differences. President Trump is expected to visit Capitol Hill to further lobby for support, particularly targeting skeptical Republicans.

More to the point for readers, market concerns about the rising US debt and prospects of continued large deficits are intensifying. The Treasury bond market has shown volatility, with yields rising, partly in response to the proposed tax cuts in Trump’s plan. Bond investors are increasingly worried about the long-term impact of the bill, particularly given the already-high levels of government debt.

Against that backdrop, we’ve seen rallies in so-called “fiat alternatives” like gold and bitcoin, which can benefit when confidence in traditional financial assets is fading. Below, we break down the technical situation for both of those key assets:

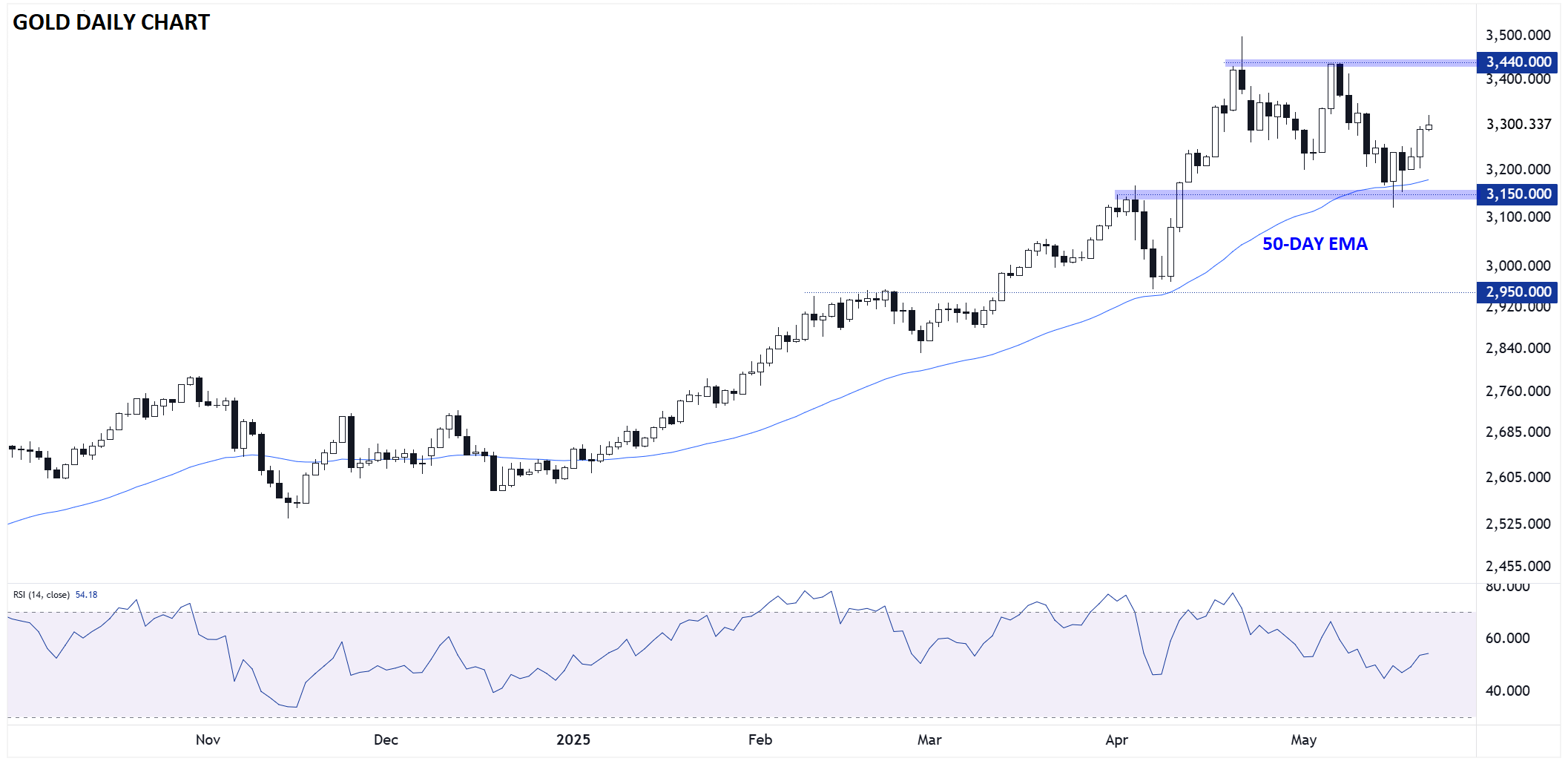

Gold Technical Analysis: XAU/USD Daily Chart

Source: TradingView, StoneX

Focusing in on gold first, the yellow metal is bouncing off its 50-day EMA this week, mirroring similar pullbacks to that key dynamic support level that we’ve seen throughout this year. At this point, there is little in the way of resistance between the current levels and near the all-time closing high in the mid-$3400s, hinting at the potential for a continuation higher from here.

Bulls maintain the upper hand as long as gold can hold above the 50-day EMA and previous-resistance-turned-support in the $3150 area.

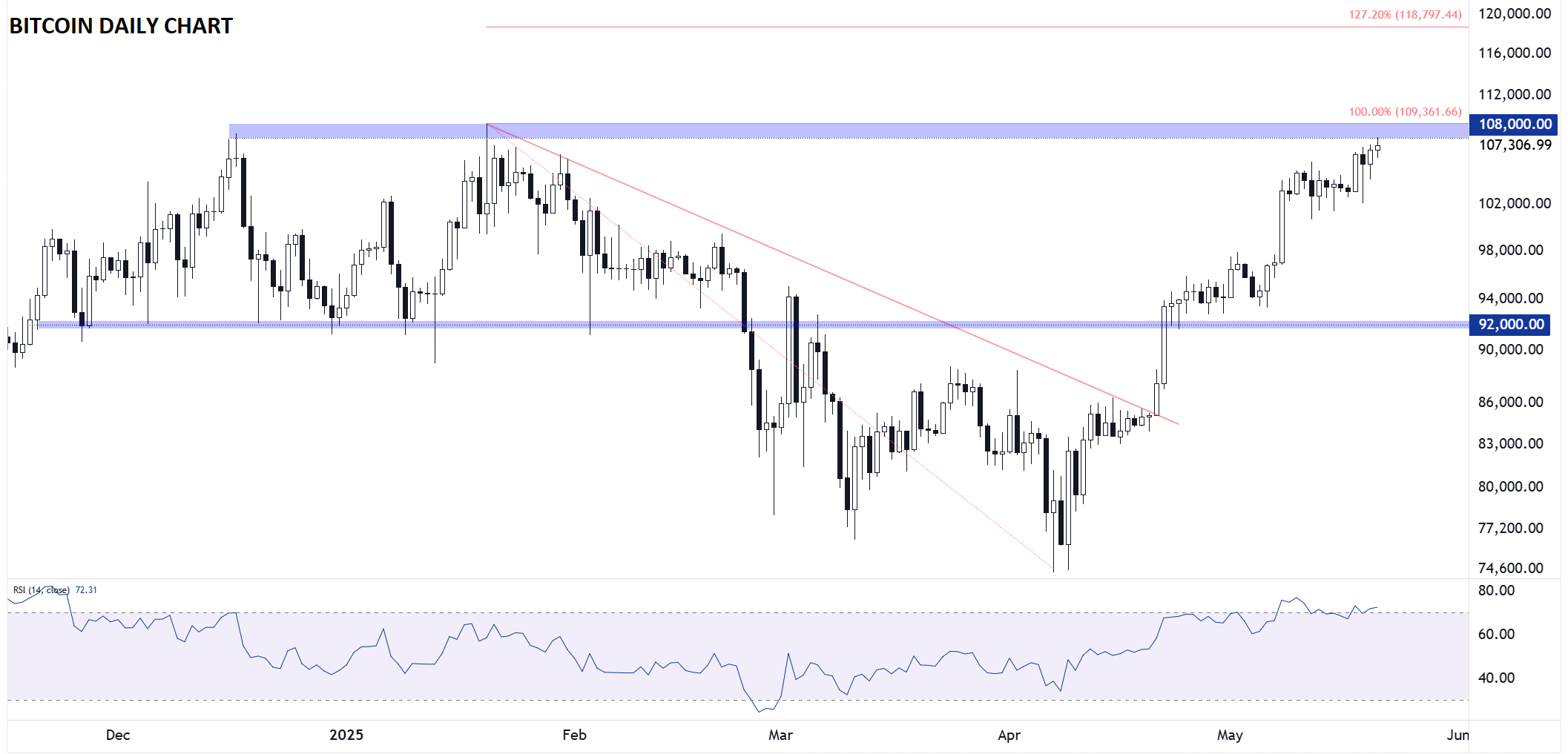

Bitcoin Technical Analysis: BTC/USD Daily Chart

Source: TradingView, StoneX

After setting an all-time record “closing” high yesterday (to the extent that an asset that trades 24/7 has a closing price), Bitcoin is extending its gains toward the intraday record at $109,362 today.

Broadly speaking, the uptrend in bitcoin remains healthy after a gradual pullback through Q1, and a clean breakout to record highs could well lead to a quick continuation toward $115K or even $120K in short order as momentum traders join the breakout in progress. For now, the near-term bias remains to the topisde as long as Bitcoin holds above last week’s low near $101K.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX