- Gold, silver hit fresh cyclical highs ahead of ‘Liberation Day’ tariffs

- Citi sees major upside for silver if reciprocal tariffs exceed expectations

- Gold pushes past $3,057.50, with $3,200 in sight for Q2

- Silver bulls target $34.87, with multi-decade highs in reach

Gold, Silver Hit Cyclical Highs Before ‘Liberation Day’

Gold and silver prices surged to fresh cyclical highs on Thursday, following through on the bullish breakout risks flagged earlier this week. Beyond technical factors, the lingering threat of retaliatory tariffs—if the U.S. proceeds with slated levies on April 3—could drive a significant upward adjustment in prices. This risk appears underpriced by markets, suggesting next week could bring substantial volatility for metals.

Commodity strategists at Citi highlighted the risk to silver prices in a recent note, particularly if U.S. tariffs announced on ‘Liberation Day’ exceed consensus expectations.

As a reciprocal tariff trade, Citi said it is “very bullish” on price spreads between the U.S. and U.K., noting CME-London six-month forward differentials for silver are currently trading around 3-6%, implying a similar tariff rate. Citi suggested this could create "substantial upside on April 2 should reciprocal tariff headlines come in at 15-30%, with even greater potential should tariffs be implemented over the next six months.”

Recent moves in copper spreads between the two nations—where copper trades at a significant premium in the U.S.—provide an example of what traders could expect under such a scenario.

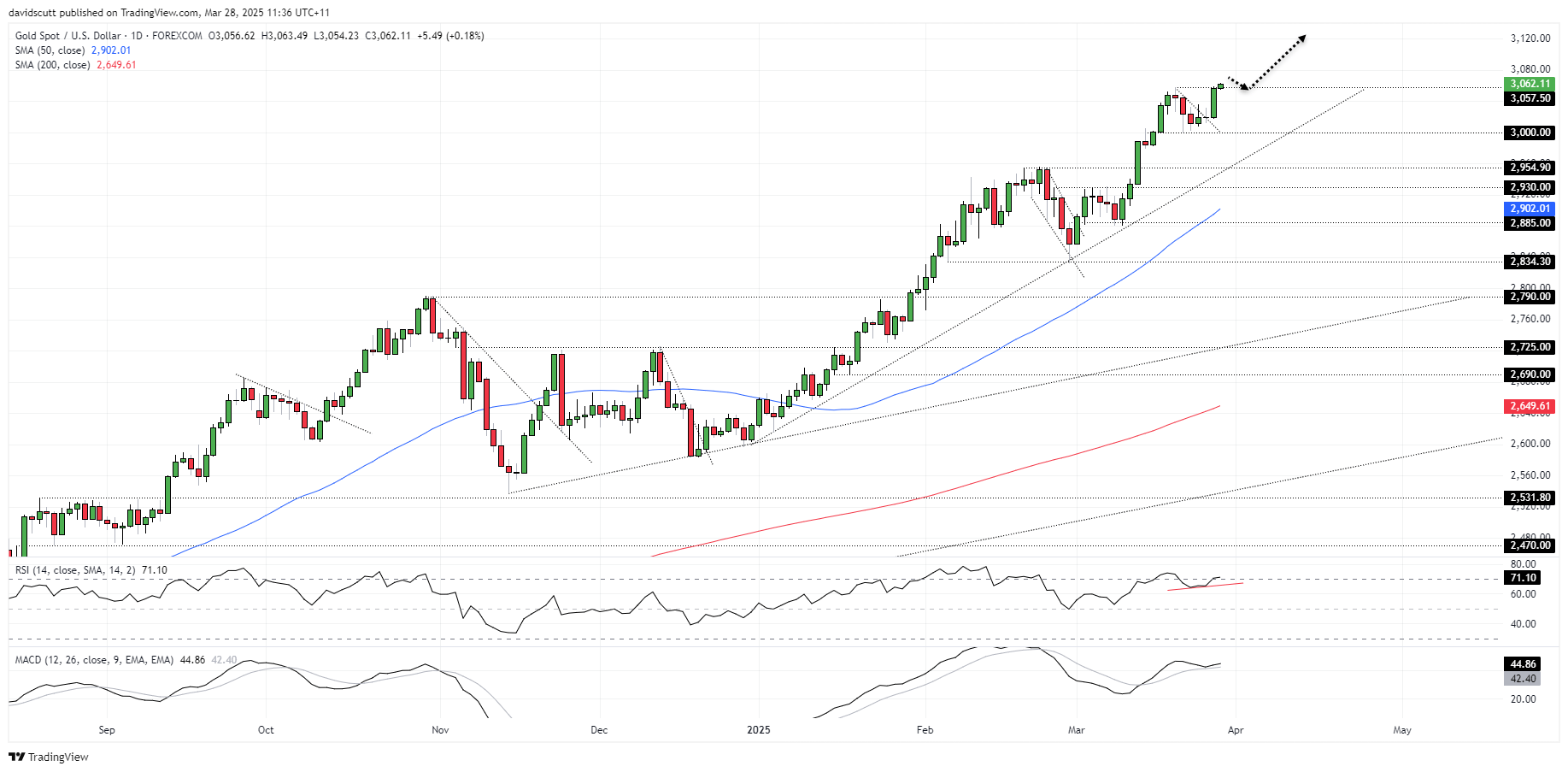

Gold Resumes Run Higher

Source: TradingView

The break of minor downtrend resistance triggered another sharp rally in gold on Thursday, with prices closing above the former record high of $3,057.50 set on March 20. The move extended into Asian trade on Friday, creating a potential bullish setup where longs could be established above $3,057.50 with a stop beneath for protection. RSI (14) and MACD are providing bullish momentum signals that favour continued upside.

For potential targets, the preference remains to wait for a topping signal given the prevailing bullish trend, rather than specifying extension levels. When one appears, traders can reduce, cut, or reverse positions accordingly.

If gold reverses back below $3,057.50, the setup would be invalidated, opening the way for a potential retracement toward support at $3,000.

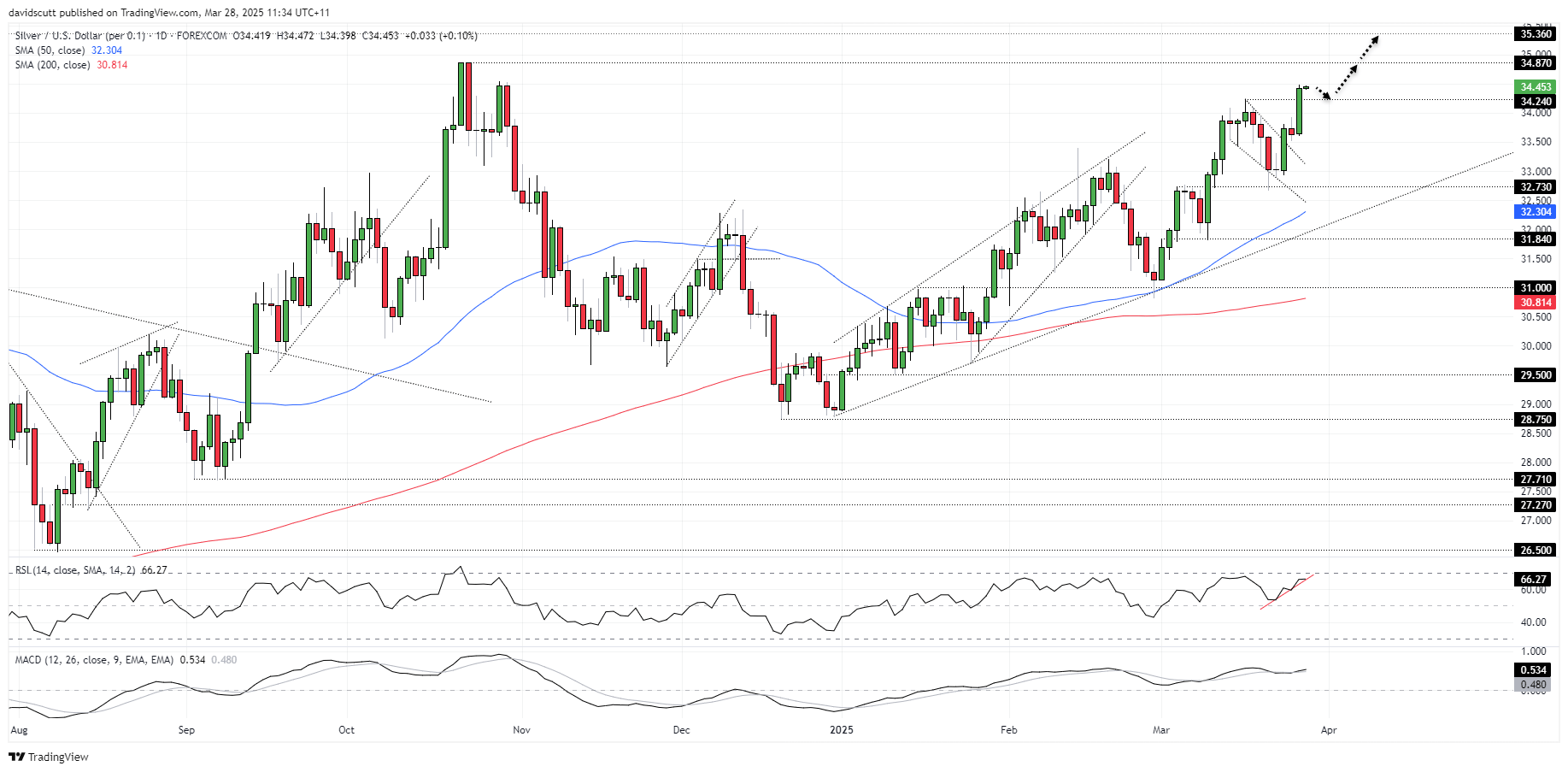

Silver Bulls Eye October Swing High

Source: TradingView

The bullish move in silver we anticipated played out nicely following the break of wedge resistance earlier this week, with the price squeezing above $34.24 on Thursday. Bulls will now be eyeing a retest of the October 24 swing high of $34.87.

Momentum indicators such as RSI (14) and MACD are trending higher, reinforcing the bullish setup and favouring buying dips and bullish breaks.

A retrace back toward $34.24 would create a setup where longs could be established above the level with a stop beneath for protection. While resistance may emerge around $34.50, $34.87 screens as a more appropriate target for those seeking greater risk-reward. A break above that would leave silver trading at multi-decade highs.

If silver were to reverse and close beneath $34.24, the bullish bias would be invalidated.

-- Written by David Scutt

Follow David on Twitter @scutty