- Gold seems likely to be in for another good year overall, bumps in the road aside

- Central Banks are expected to remain in the driver’s seat and bid gold

- We may need to see the US dollar index break beneath its November low before assuming a sustained move above $3,000 for gold

- Over the near term, we should be on guard for a shakeout if spot gold reached $3,000 (~$3013 for future)

Gold futures have reached a fresh record high of $3,000 following softer-than-expected producer prices from the US. With CPI data also coming in softer this week, Fed Fund Futures (FFF) are now pricing in a June rate cut with a 70% probability, up from 20% just a few weeks ago. Weaker PMIs and the infamous Trump tariffs have further fuelled the gold bulls.

This must be frustrating for the gold traders who have been offloading their bullish bets in recent weeks, presumably in hopes of a pullback to rejoin the trend at more favourable prices. It raises the question of whether they will feel compelled to chase this trend higher.

But when I zoom out to truly admire the view, it doesn’t look like we’re in for much of a pullback. Its bullish trend is accelerating, and the recent surge from 2620 was met with a healthy 38.2% retracement ahead of a breakout of a retracement line.

Gold seems likely to be in for another good year overall, bumps in the road aside.

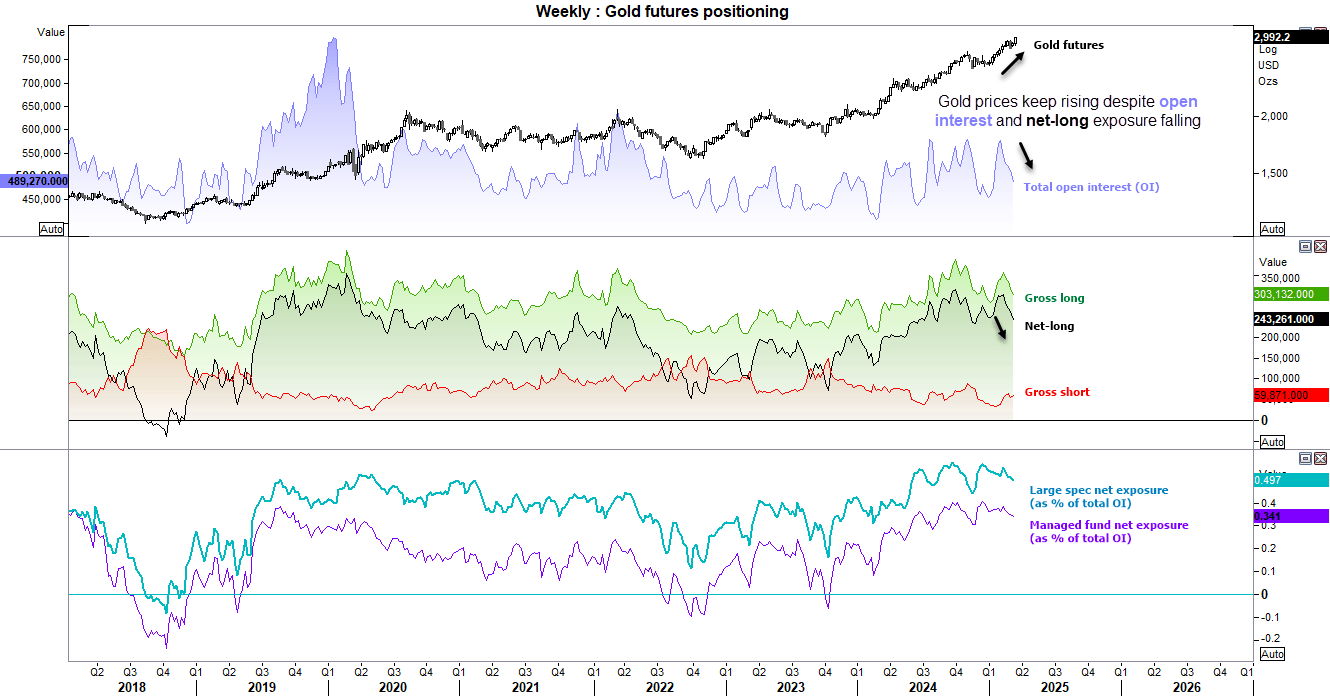

Gold futures (GC) market positioning – COT report

Since September, a bearish divergence has emerged between the net-long positions of large speculators and gold prices. This divergence has been primarily driven by reduced long positions rather than increased bets against the trend. Furthermore, open interest (a proxy for volume across all futures traders) has also been moving lower. This would usually point to a weak move for gold prices, but given the supporting fundamentals I suspect traders may need to chase this trend. Especially with central banks buying physical gold and ETFs tracking the move.

The recent gold trend reports speaks of record-levels of central bank purchases, and that their outlook is for “central banks to stay in the driving seat and gold ETF investors to enjoy the frey”.

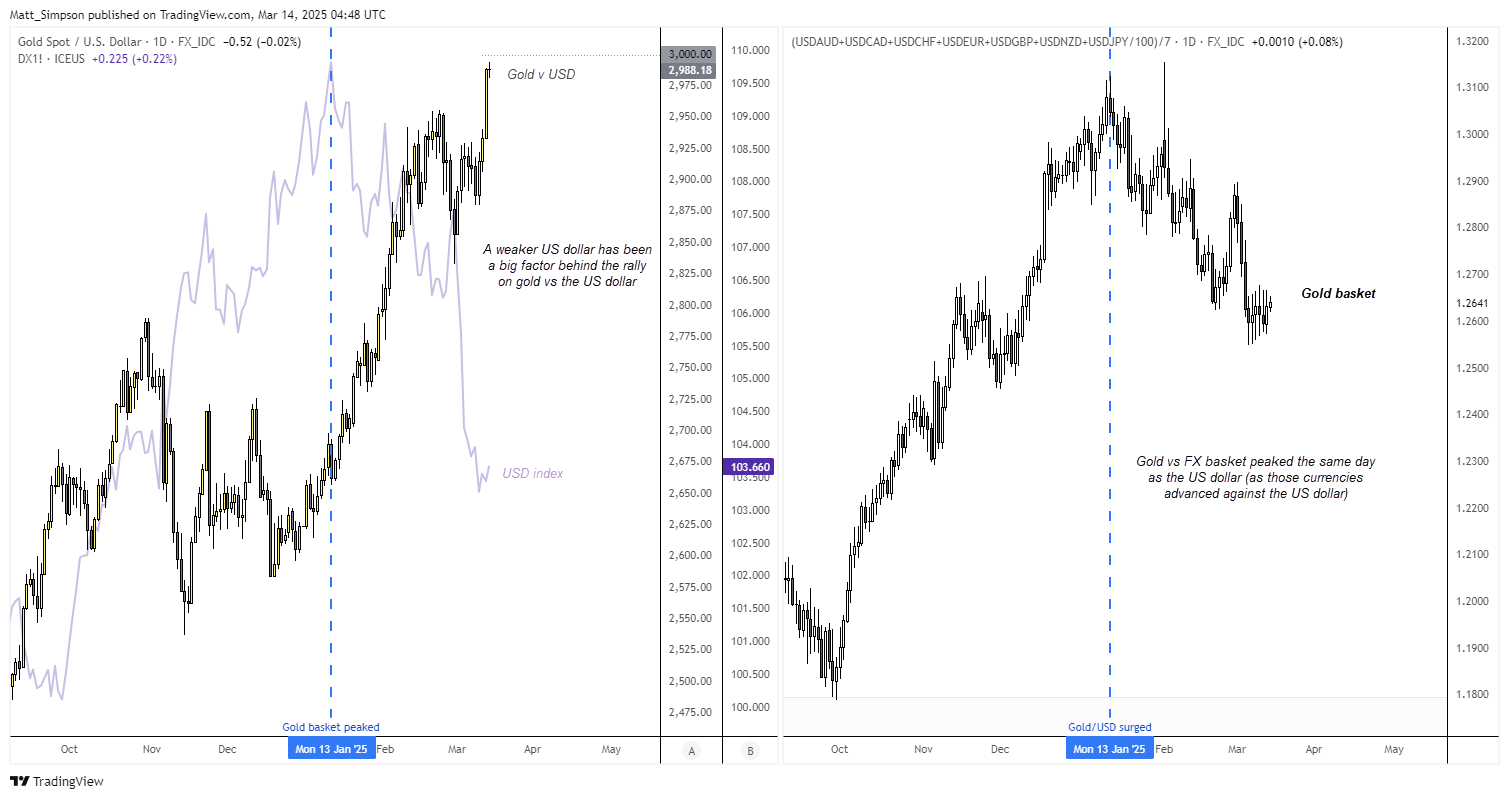

Gold is benefiting from a weak US dollar (for now)

Additionally, we should consider that the recent surge in gold prices has largely been influenced by the weakening of the US dollar. The chart on the left depicts gold versus the US dollar, while the chart on the right shows gold against a basket of major FX currencies. Although gold has rallied against the US dollar, the gold basket reached its peak on January 13 and has since lagged behind XAU/USD. And that means if US dollar strength returns, it could prompt a pullback on gold – even if only briefly.

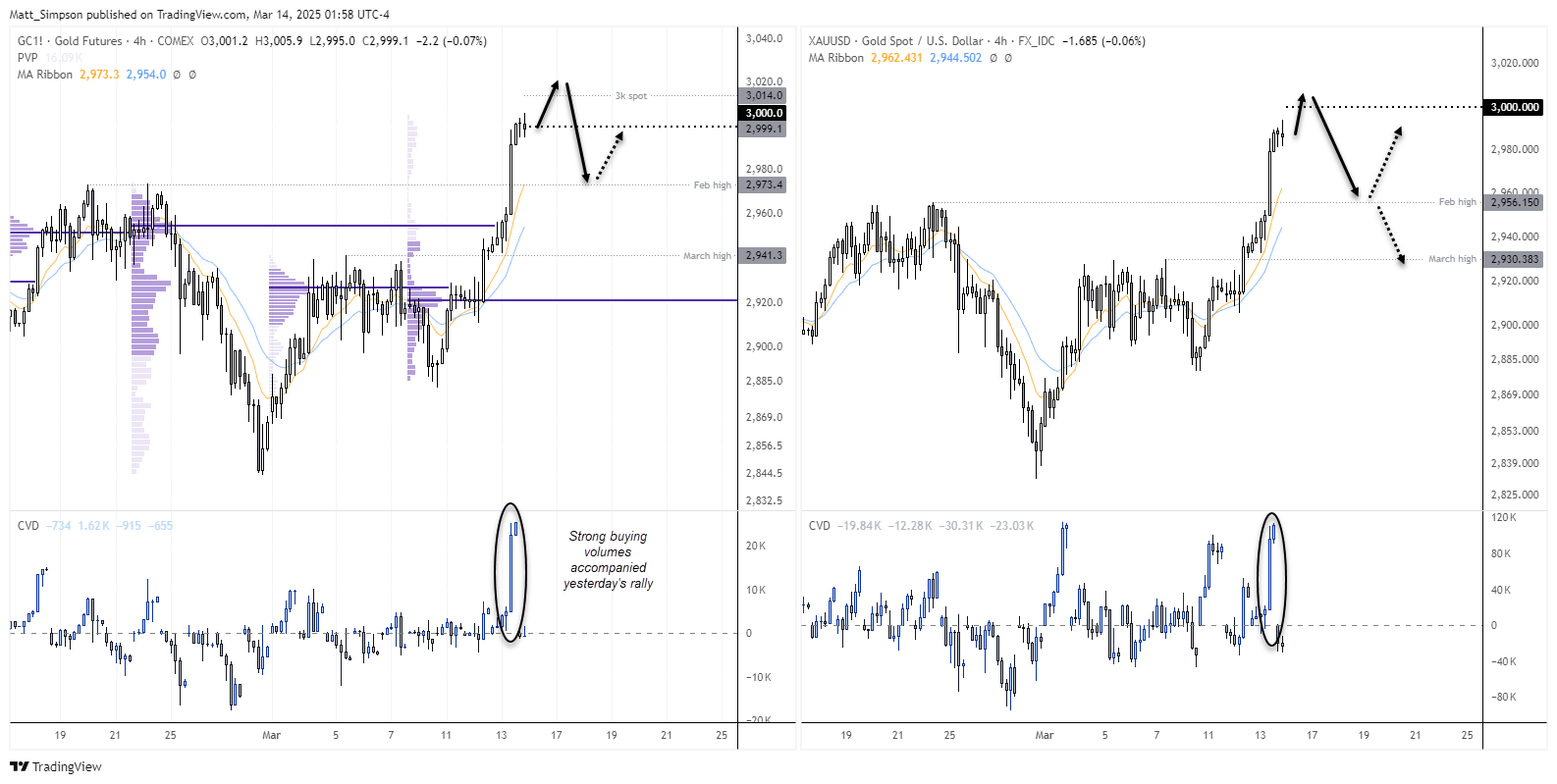

Gold futures technical analysis

The 4-hour chart shows gold futures meandering around the 3k milestone, whereas spot prices are yet to follow. But a 0.5% move for spot will see it reach that very level, and futures prices could be around $1313. Although at the time of writing there doe appear to be some nervousness in the air.

But if we look at yesterday’s cumulative volume delate (CVD), it shows a strong surge of bids alongside the rally. And that suggest a decent level of support within yesterday’s range should prices dip.

If a shakeout around the highs occurs, bears could seek a move down to the February high. But I would not be surprised to see buyers step in around that key level for now.

Keep an eye on the US dollar index as it is holding above its November low. So we’d need to see the US dollar break beneath its November low before assuming a sustained move above $3000 for gold.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge