- Gold forecast clouded by improved risk sentiment and potential dollar strength

- US-China trade optimism dulls haven demand

- Key US data ahead could shape gold’s near-term trajectory

Gold was trading higher first thing this morning, despite hopes that the US and China will put their differences aside and work on a trade deal. That optimism has helped to fuel a big rally in stock prices in recent weeks, which has reduced demand for haven assets a little -- hence, we haven’t seen a fresh record for gold since it peaked at $3,500 in April. With high-level US-China trade talks set to take place in London today, there is the potential for more optimism to emerge, after a "very positive" Trump-Xi call last week. Against this backdrop, the near-term gold forecast doesn’t appear too bullish. What’s more, Friday’s stronger US jobs report could encourage traders to bid up the dollar, which, in turn, could weigh on gold. So, could we potentially see a short-term correction in gold prices, perhaps towards the psychological $3,000 level, before we see the next up leg?

Gold forecast undermined by improving risk appetite

Gold was unable to break decisively back above the $3400 level last week, despite a major breakout in silver which reached its highest point since 2012 of around $36 per troy ounce. We have also seen some big moves in other precious metals, including palladium and in particular platinum in recent weeks, owing to reports of increased jewellery demand as a more affordable alternative to gold, and shrinking supplies of the metal. But having made its move first in repeatedly breaking to new record highs in in the past couple of years, gold is now lagging other precious metals, unable to ride the wave.

The yellow metal was trading higher, though, as the European session got underway. But judging by its lacklustre performance in recent weeks and given the improvement in risk sentiment amid optimism over a potential US-China trade deal, I wouldn’t be surprised if more weakness now follows for gold as investors book profit and continue to re-distribute into other, more risk-sensitive, assets. What’s more, the positive risk appetite should also boost the flagging US dollar, especially against the likes of the pound, euro and yen – currencies that have done well when trade uncertainty was at the forefront. A stronger dollar is usually not a positive factor for dollar-priced gold.

Speaking of the dollar, we have some important US data coming up later in the week that could impact the greenback, and, in turn, gold…

Key US data this week: US CPI and UoM consumer sentiment

Following a data-heavy week, this week’s macro calendar is quieter, especially today with most of Europe out on holiday. The key data as far as gold is concerned is from the US, which could impact the buck-denominated precious metal. We have CPI on Wednesday and UoM Consumer Sentiment on Friday.

US CPI surprised to the downside last month with a print of 2.3% vs. 2.4% eyed, while several other data releases came in weaker to put pressure on the Fed to cut rates. But it was tariffs uncertainty that weighed the most on the greenback. However, with the US and China starting trade talks again, some of those worries have receded. Will CPI data provide the dollar bulls some encouragement?

The UoM Consumer Sentiment will be in focus on Friday, June 13 as the week’s last major macro release. With the US stock markets recovering strongly in recent weeks amid optimism about trade deals, let’s see if this optimism will also be reflected in this popular measure of consumer sentiment. Revised figures from last month showed a slight improvement but with trade uncertainty receding further, a bigger improvement in sentiment could support to the dollar and undermine safe haven gold.

Technical gold forecast: Waning bullish momentum point to potential drop

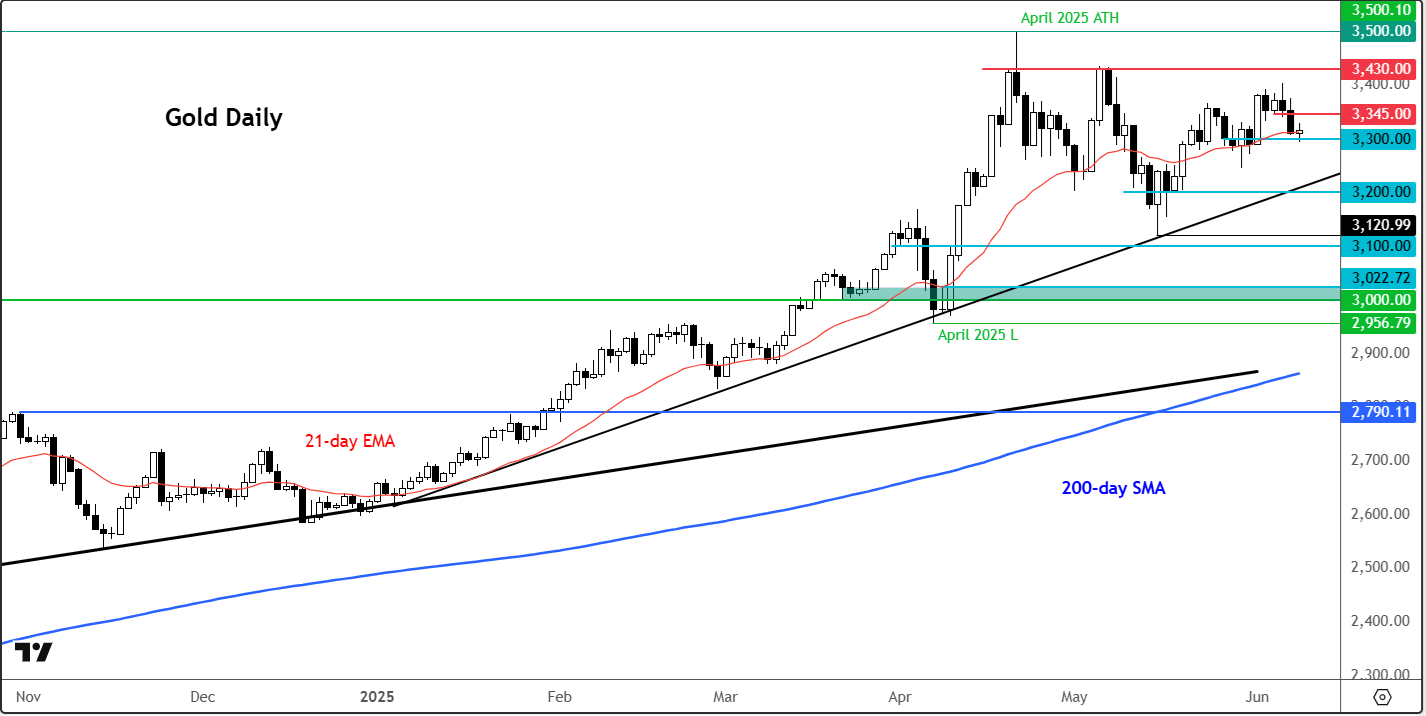

Source: TradingView.com

The small rebound in the price of gold comes on the back of a two-day drop at the end of last week. While no major bearish reversal signals have emerged, the lack of new highs since the peak in April suggests the downside risks are now on the rise, potentially shifting the gold forecast to neutral or even slightly negative from a technical point of view – especially if risk appetite improves further. Any weakness we see here, of course doesn’t mean the long-term bull trend is over. For now, support at $3,300 is just about holding. Things will get a bit more interesting should this support give way now, because there are no immediate support levels to watch until the trend line which comes in near the $3,200 level. In other words, we could potentially see a $100-drop in a short space of time if we get a decisive break below the $3,300 level. The mid-May low of $3,120 will then come into focus, below which there is not a lot of intermediate support until the big one: $3,000.

Now, before we get too excited about the downside potential, let’s remember that the trend is still technically bullish and for that reason we shouldn’t rule out the potential for renewed gains. Therefore, watch your resistance levels closely, because if they don’t hold, then that would speak volumes about bear’s control – or a lack thereof. The first resistance level to watch is in the low $3340s near $3345, marking the lows from mid las week, which were cleared by Friday’s breakdown. Once support these levels could turn into resistance now. Above this area, $3400 will again be in focus, followed by $3,430.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R