Key Events

- The upcoming Fed rate decision and FOMC meeting are the next major catalysts for market volatility, alongside press conferences from the BOJ, BOE, and SNB, all taking place amid escalating trade war and geopolitical tensions

- Israel has ended its two-month ceasefire agreement with Gaza, while ongoing Trump-Putin-Ukraine negotiations continue to keep geopolitical risks elevated, sustaining demand for gold as a haven asset

- Safe-haven demand and declining confidence in the US Dollar have driven gold above the $3,000 mark

Trade War and Geopolitical Risks

Although gold has technically entered overbought territory, its rally beyond $3,000 is fueled by strong haven demand amid intensifying geopolitical risks. Renewed strikes between Israel and Gaza following the ceasefire's collapse, coupled with ongoing negotiations between Russia and the US involving Ukrainian assets, are driving uncertainty and supporting gold prices.

Beyond geopolitical concerns, escalating trade war tensions—particularly retaliatory tariffs between the US, Canada, and the EU—have eroded global risk appetite and economic confidence, making gold one of the few reliable hedges against an uncertain market landscape.

However, extreme price movements and overheated momentum indicators signal a potential reversal ahead, as markets react to heated conditions.

Monetary Policy Decisions: BOJ, FED, BOE, and SNB

With trade war risks intensifying, central banks are shifting their focus from inflation control to economic growth concerns. The combination of tariffs, weakened risk appetite, and declining economic confidence has prompted policymakers to reassess their strategies.

- The Fed, BOJ, and BOE are expected to maintain their current policies.

- The SNB is anticipated to cut rates, responding to mounting economic pressure.

- Post-decision press conferences are expected to reflect the evolving monetary policy outlook amid trade war developments, potentially amplifying market volatility or supporting short-term reversals.

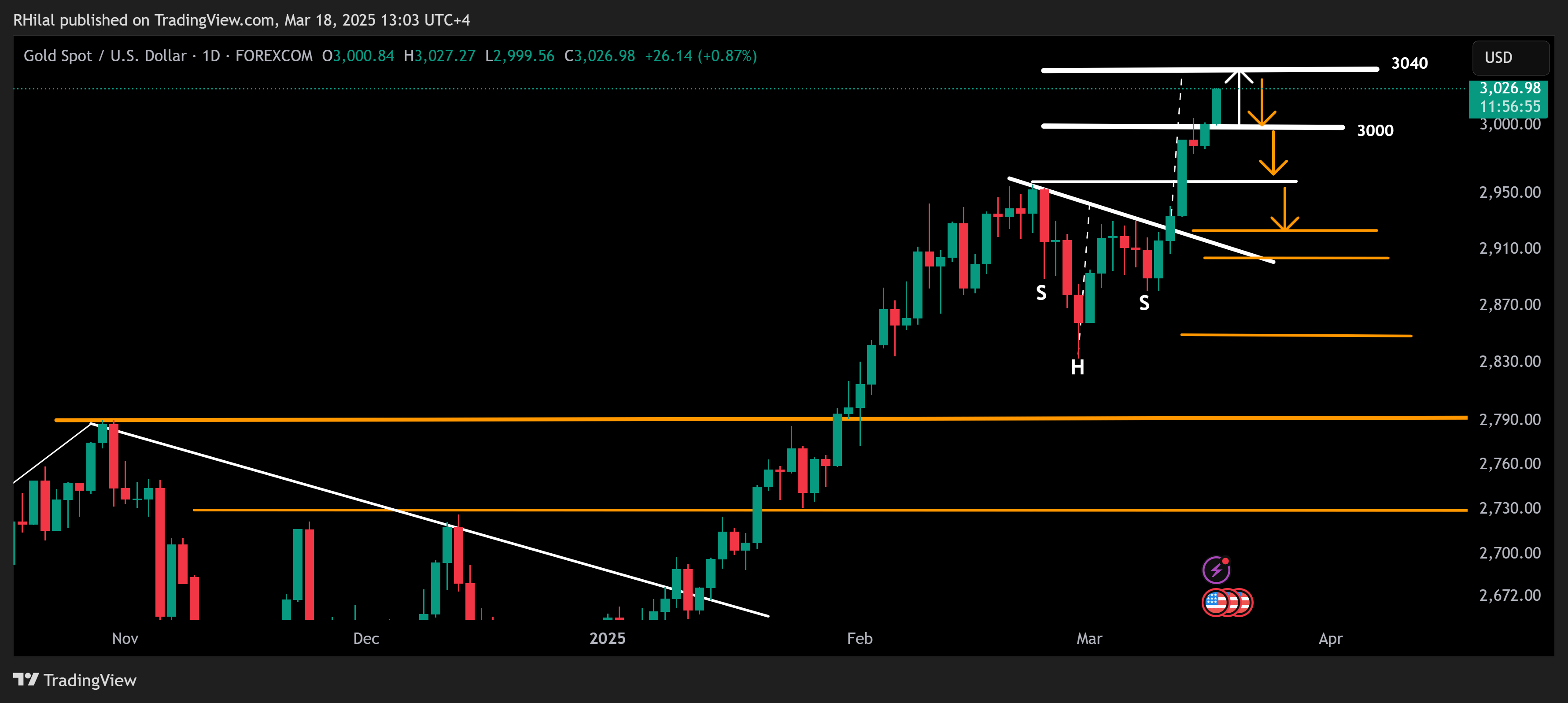

Gold Forecast: Daily Time Frame – Log Scale

Source: Tradingview

On the daily time frame, an inverted head and shoulders pattern appears to be in play, targeting the 3,040 level. Should gold test 3,040 as a resistance zone, a sharp wick may develop, establishing a 3,040-3,050 range as a potential turning point.

A reversal from this zone could push gold prices back toward 3,000, 2,980, 2,955, and 2,930. A deeper retracement would require gold to drop below 2,900, which could open the door for a decline toward 2,850 and 2,790. Conversely, if gold holds above 3,040, the next resistance level is projected at 3,080 as an extreme scenario.

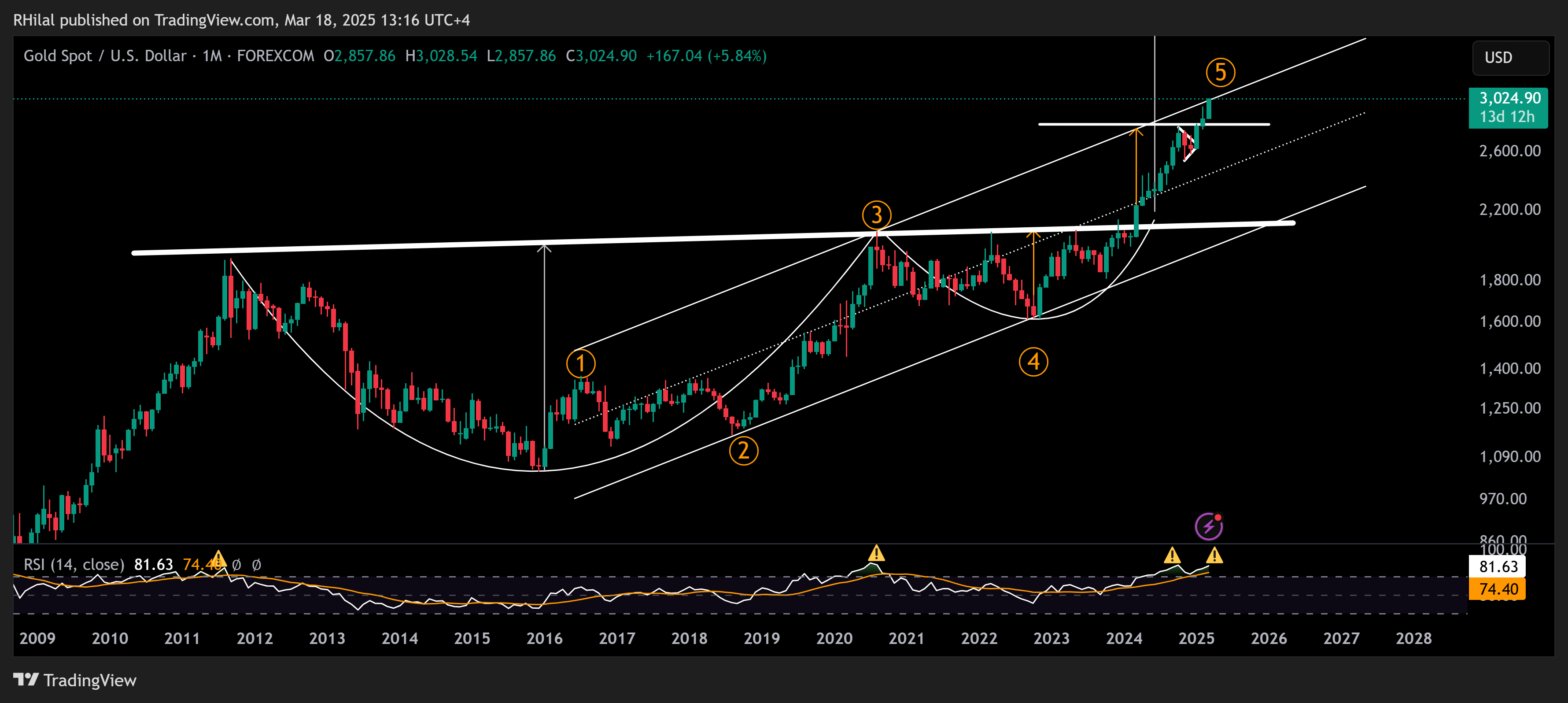

Gold Forecast: Monthly Time Frame – Log Scale

Source: Tradingview

Analyzing gold from a monthly time frame and a Relative Strength Index (RSI) perspective, overbought conditions near 80 have historically triggered notable corrections:

- In 2011, an overbought RSI led to a nearly 900-point retracement

- In 2020, a similar overbought condition resulted in a nearly 450-point decline

- In November 2024, another overbought reading triggered a nearly 250-point drop

- Now, gold has once again reached these overbought levels, raising caution for a potential momentum recharge

While escalating trade wars and geopolitical tensions are expected to sustain haven demand, peace deals or easing monetary policy concerns could trigger sharp reversals. Should tensions continue to rise and confidence in both monetary policy and the US Dollar weaken further, gold is expected to maintain its long-term bullish trend.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves