- Gold forecast remains skewed to the upside despite brief pullback

- Middle East conflict keeps investors on their toes

- Central bank decisions and G7 summit in focus this week

Gold may have cooled from its recent highs but make no mistake—the precious metal is far from out of the spotlight. After flirting with a record high on Friday, gold began the week on the back foot, retreating slightly in the London session. Yet, the bigger picture hasn’t changed much: risks remain tilted upward, underpinned by geopolitical tensions, long-term inflation concerns, and continued central bank buying. Against this backdrop, our near-term gold forecast remains bullish.

At the weekend fighting continued between Israel and Iran, and although world leaders have called for ceasefire, the conflict continues for now. The latest new being that Netanyahu has urged residents of Tehran to evacuate, saying “we are on our way to achieve our two main objectives, eliminating the nuclear threat and eliminating the missile threat”. This doesn’t sound very promising, and points to an escalation in the conflict unfortunately.

Still, markets remained quite calm by midday in London after an initial textbook market reaction at the Asian open overnight, when safe-haven flows surged, oil rallied over 5%, and equity futures tumbled. But by Monday morning, the panic had begun to settle. Crude gave back gains, the S&P 500 bounced, and gold edged lower. Still, investors would be unwise to get too comfortable.

Temporary calm but more gains could follow for gold

While the gold market has retreated from the brink of another all-time high, the geopolitical backdrop remains highly combustible. The Israeli strikes on Iran have injected a clear risk premium across commodities. Even if oil supplies remain uninterrupted for now, concerns about the Strait of Hormuz—through which a fifth of the world’s oil passes—are unlikely to fade anytime soon. As it stands, the April high around $3,500 remains a tantalising target for the bulls. Gold has not (yet) managed to surpass it, but given the volatility of the region and the potential for events to spiral, any escalation could catapult the metal to fresh records.

Gold isn’t just supported by geopolitics

The gold rally can’t be chalked up to geopolitics alone. It’s worth remembering the yellow metal was already on an upward trajectory well before the latest flare-up between Israel and Iran. Central bank demand—led most notably by the People’s Bank of China—remains strong. Inflation, though off its peak, continues to eat away at fiat currency value, bolstering gold’s role as a long-term store of value. Add to that growing unease over ballooning government debt and deficit spending, and it is little wonder that institutions are swapping sovereign bonds for bullion. The US dollar, too, has weakened, giving further lift to gold priced in greenbacks. And let’s not forget speculative appetite from retail investors, which has remained resilient through recent volatility.

Later in the year, developments on trade policy could become more influential. If Washington and its partners finally manage to dial down tariff tensions, it could temper inflation expectations and weigh on gold. But those negotiations have dragged on for months with little to show, and in the meantime, the uncertainty only strengthens gold’s hand.

Central banks and G7: this week’s key catalysts

Eyes will turn to central banks and the G7 summit later this week. The Federal Reserve and Bank of Japan are both expected to announce policy decisions this week, and their tone on inflation and interest rates will be crucial. Should the Fed adopt a more dovish stance—or even hint at future rate cuts—gold could get another shot in the arm.

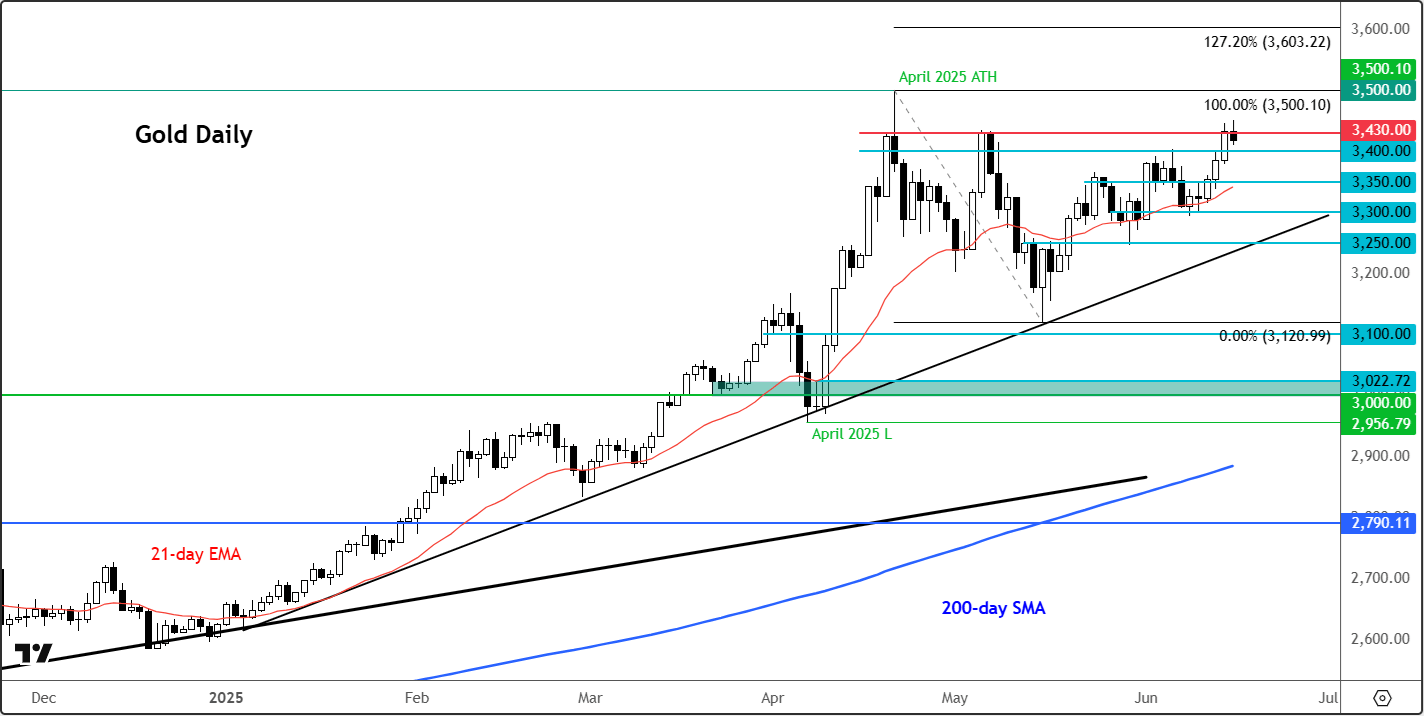

Technical gold forecast: Levels to watch

Source: TradingView.com

Short term, the price of gold may be starting to look a touch pricey. Dips are shallow and well-supported, suggesting dip-buyers are ready and willing to step in.

Support now sits near the $3,400 mark, a former ceiling that may now serve as a floor. If this level holds, it could attract renewed interest from bulls. Below that, $3,350 and $3,300 are the next key supports.

On the upside, $3,430 has proved stubborn, but a break above opens the door to a retest of the April peak at $3,500. Beyond that lies the 127.2% Fibonacci extension at $3,603—uncharted territory, but increasingly within reach if current conditions persist.

So, the gold forecast remains tilted to the upside. The brief pullback in price reflects tactical repositioning more than a change in the strategic outlook. Until geopolitics calm, gold’s appeal as a safe haven will continue to shine.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R