Following a string of record highs earlier this year, gold finally took a breather as global equity markets found renewed strength—helped along by a more sanguine tone after the sharp April sell-off triggered by Trump’s retaliatory tariffs. There’s renewed optimism about trade deals, with China apparently also ready to start talks. While those talks could take a while, investors have been piling back to equities as if deals have already been reached. The S&P 500 has rallied more than 17% from its lowest point in April. Yet, gold’s decline from its highest point to this week’s low has been a more modest 8.5% or $298 in nominal terms. Obviously other factors are at play for gold, such as the dollar. But from a purely haven point of view, demand should have weakened for gold more meaningfully if stock market investors are correct in pricing in trade agreements. On that basis, the near-term gold forecast is looking a little murky, and a possible drop to, and potentially below, the $3K mark could be on the cards.

Gold forecast unlikely to be swayed by NFP

Today, gold staged a modest rebound ahead of the monthly US non-farm payrolls report, due for release shortly. The US economy is expected to have added 138K new jobs compared to 228K the month before. A stronger NFP report could boost the dollar and undermine gold, while a weaker set of figures may have the opposite impact. But my gut feel tells me that gold’s direction will be determined by direction of equities and risk appetite in general than just data. So, I am leaning a little on the bearish side of things, regardless of how weak or otherwise NFP turns out to be.

Diminishing safe haven demand for gold?

The precious metal, which has been on the defensive since topping out near $3,500 a fortnight ago, is attempting to find its footing once again. The recovery comes after three days of declines, so there is an element of short-covering at play here, with bearish traders wary of not overstepping the mark because of the fact the long term trend has been very strong. But with safe-haven demand softening, prices could ease back even more and potentially break this week’s support near the $3,200 area.

Technical gold forecast: Trends and levels to watch

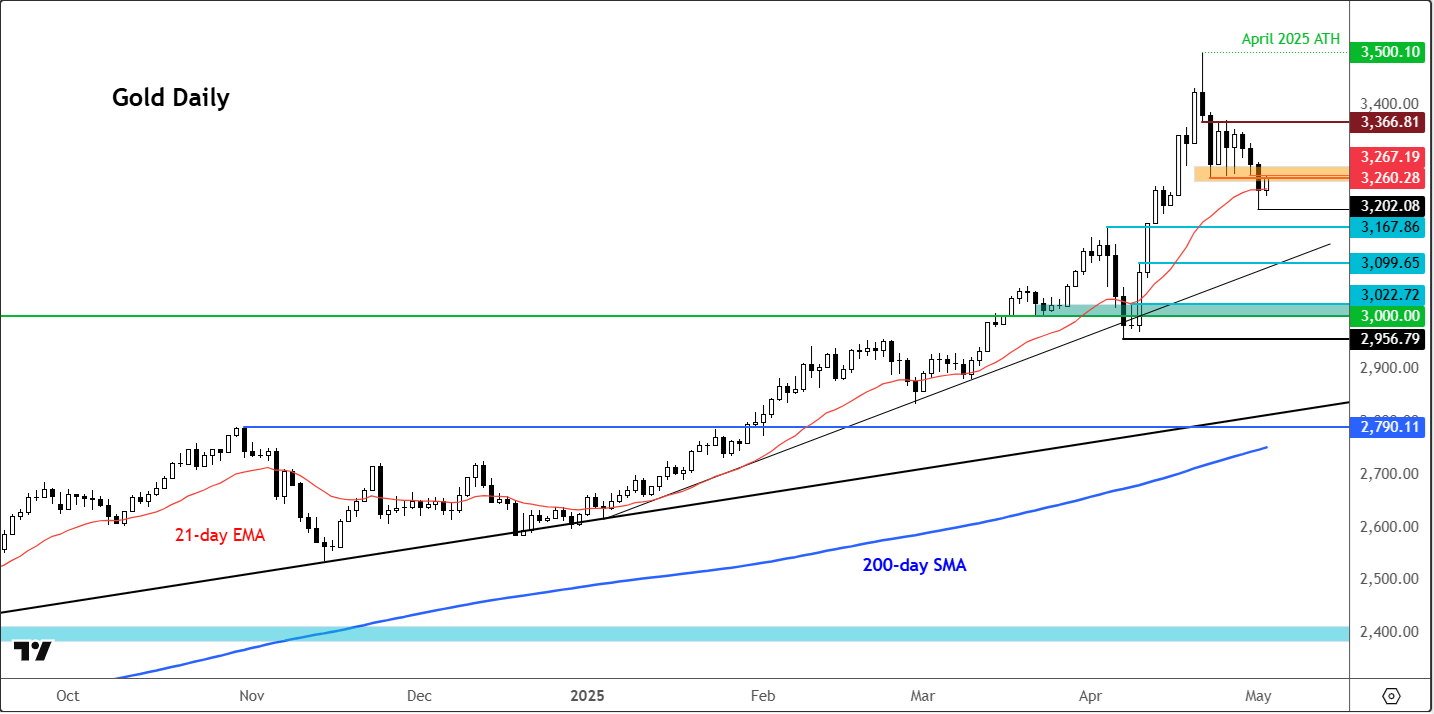

Objectively, the broader gold forecast still leans constructive, despite a modest fade in haven appeal. The bulls would argue that unless we begin to see a clear pattern of lower highs and lower lows, coupled with meaningful breakthroughs in trade talks—rather than more political grandstanding from Washington—the prospect of fresh highs can’t yet be ruled out. That said, the bears also have a compelling reason to exert pressure, as discussed above. And given the historically overbought momentum indicators on the long-term charts of gold, they have good reason to start defending broken support levels. So, I reckon the path of least resistance appears to be tilted lower.

Source: TradingView.com

Much now hinges on whether the bearish group of traders re-emerge as the price of gold revisits the $3,260–$3,280 old support zone—an area that, after holding firm for several sessions, finally gave way on Thursday. Should this zone now hold as resistance, the next level in focus becomes $3,167, which marked the breakout point earlier in April.

The next big levels is the rising trendline near $3,100. Only a sustained break below that region, alongside a structural shift in price action, would begin to challenge the longer-term bullish narrative.

To the upside, initial resistance, as mentioned, comes in around the $3,260–$3,280 zone. If we break convincingly above that area, then $3,366 stands as the next meaningful resistance, followed by $3,430.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R