Gold was bouncing off its earlier lows at the time of writing, though remained lower on the weak after being unable to drive much higher despite the tensions between Israel and Iran for the past 7 days. Out of all weeks it could have corrected itself, this week shouldn’t have been it, the bulls would argue. For that reason, there is some sign of weakness creeping into gold. But to declare an end to the bull trend when Iran and Israel are at each other’s throats would be a brave call by anyone. The trend is still bullish and key support levels are still holding firm. Thus, it is far too earlier to declare an end to the bullish gold forecast, especially ahead of the weekend when things could heat up again in the Middle East.

Risk appetite improves – for now

The key theme in the market so far today has been a recovery in risk appetite. With oil dropping back, stocks managed to bounce back. Elsewhere, gold and silver fell, while the US dollar give back some ground, too, though not against haven currencies like the yen and franc. This came after the US president, Donald Trump, indicated he would take up to a fortnight to decide on direct military action against Iran. He is giving opportunity for diplomacy a chance, but this doesn’t mean that a swift de-escalation in the region is possible as both Iran and Israel continuing to bombard each other. Still, there is now some hope for talks to end or pause the conflict. Reuters reported that a senior official has said Iran is 'ready' to discuss limitations on its uranium enrichment, although "zero enrichment will undoubtedly be rejected" by Tehran "especially now, under Israel's strikes." Brent, down around 3.5% on the day, still maintains some of the risk premium it built since the conflict started, though it appears to lack sufficient momentum, for now, to head much higher above last Friday’s spike high of around $78.00.

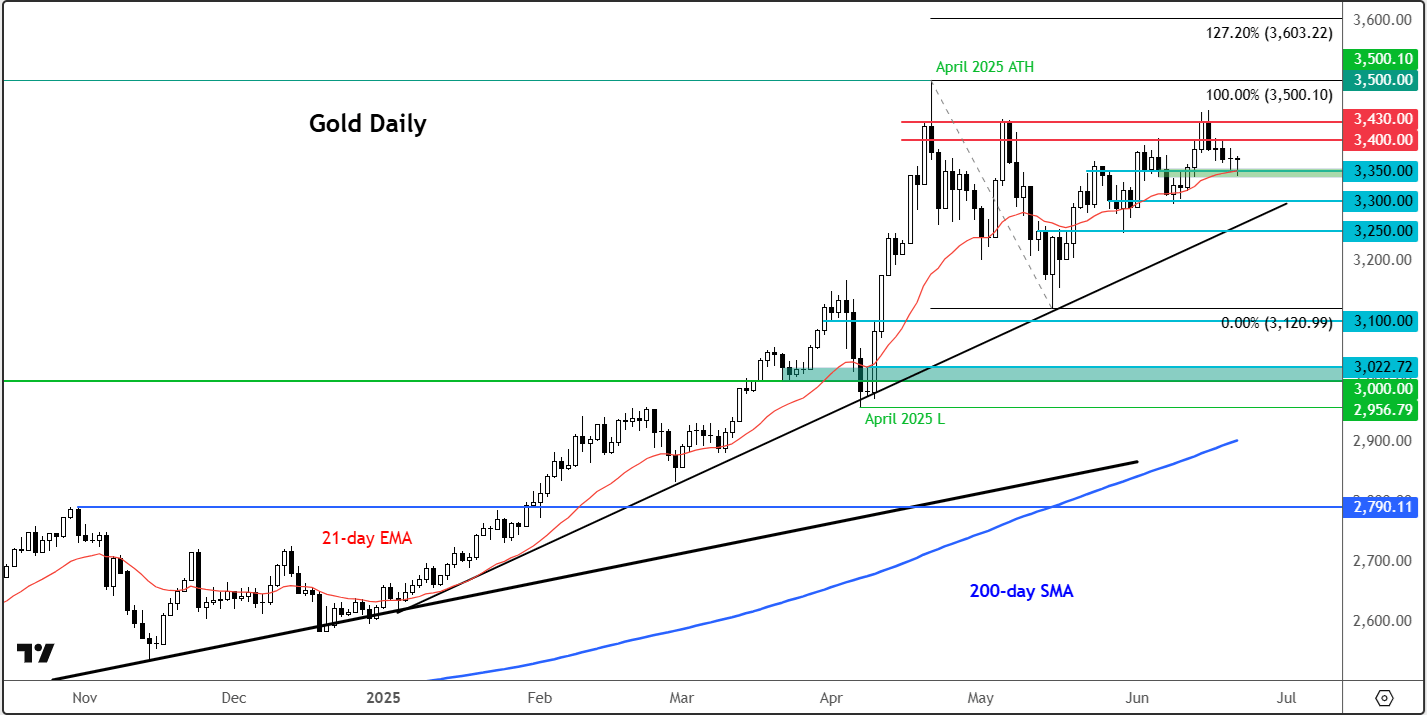

Technical gold forecast and key levels to watch

Source: TradingView.com

Key support on the daily XAU/USD chart comes in at around $3350 – this level being formally resistance and where the 21 day exponential moving comes into play. Below $3350, the next downside target is at $3300, marking the prior lows. Below that, the bullish trend line that has been in place since the start of the year will be in focus next. In terms of resistance, $3400 is the key level to watch on the upside. Above it, $3430 is the next level of resistance where gold has struggled to close above. Beyond that, there's not much further resistance until the April all time high of $3500. As things stand, the gold forecast remains bullish from a technical standpoint.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R