Gold has begun the new week on the back foot, trading around 1.2% lower by mid-morning in London. Following a series of record highs in recent weeks, the precious metal finally paused for breath, as global stock markets — including the S&P 500 — found renewed strength last week. As the demand for safe-haven assets softened, the gold price, having surged to a record $3,500, pulled back sharply to a weekly low of $3,260, before mounting a modest recovery to settle near $3,319. All told, it was a relatively muted week for bullion despite the volatility. The broader gold forecast and price direction remains constructive, even with some of its haven appeal diminishing. Until we witness clear patterns of lower highs, lower lows, and firm trade agreements rather than more political bluster from the Trump administration, the prospect of fresh highs for gold cannot be dismissed.

Surface calm masks underlying risks

While last week's market action and today’s early session suggest calmer waters, any sense of security is precarious. Underneath the surface, key risks persist — trade tensions, recession worries, and monetary policy uncertainties are very much alive. The ongoing US-China trade talks remain a pivotal factor. Should the US dig its heels in on tariffs or if negotiations collapse, risk aversion could quickly return, boosting demand for gold once more.

Economic data could shift the gold forecast

Although trade developments have dominated sentiment recently, the spotlight will shift back to economic fundamentals and corporate earnings this week, albeit after a quiet day today. The calendar for the rest of the week is a busy one: GDP prints from major economies, China’s crucial April PMI surveys, and results from the heavyweight ‘Magnificent 7’ tech names are all lined up. Trade war aftershocks will also be scrutinised via US ISM manufacturing data, alongside updates from Canada and Mexico. Even though the first-quarter US GDP figure may already seem stale, fresh consumer confidence surveys and corporate earnings should provide more timely insights. To cap off the week, Friday’s US labour market report presents a potential flashpoint. Should the data disappoint, the Dollar Index could head lower, creating an even more supportive backdrop for the gold forecast.

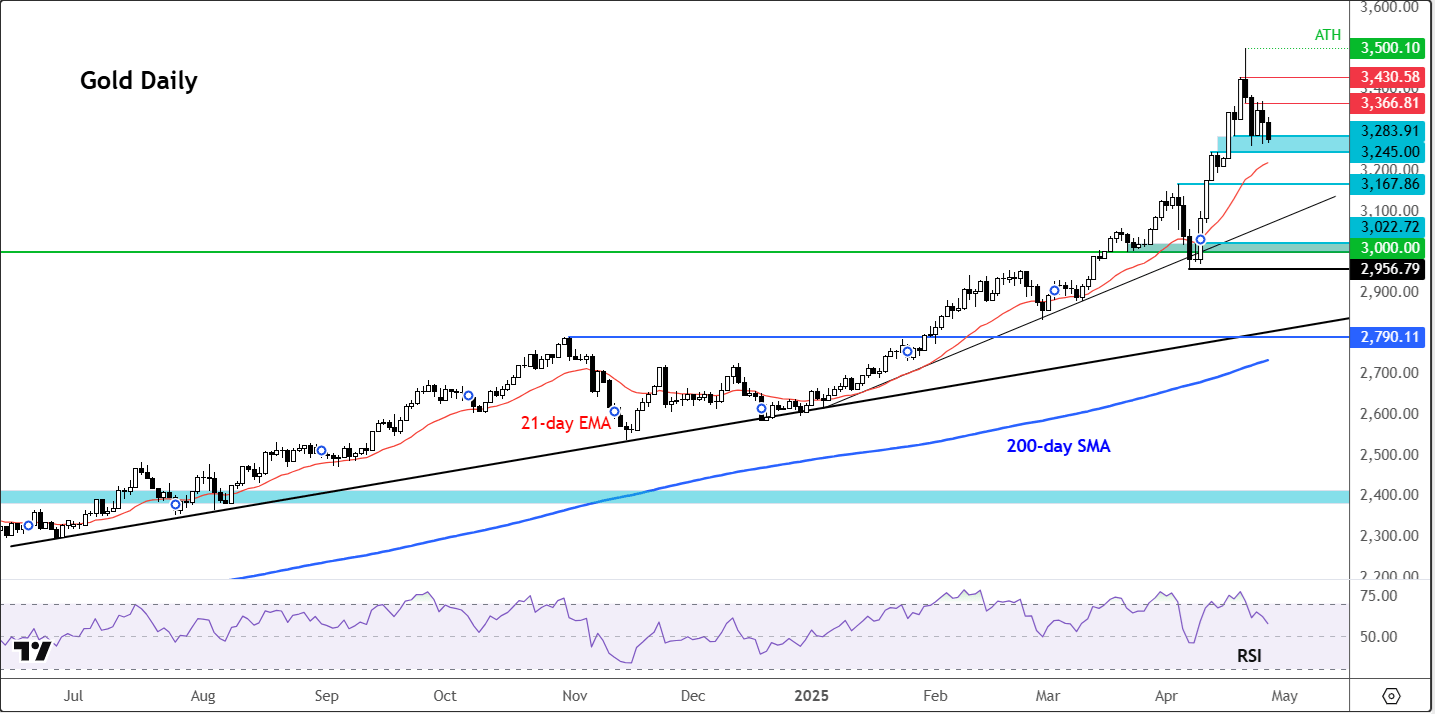

Technical gold forecast: Key levels to watch

Source: TradingView.com

The pullback from $3,500 highlights just how formidable that level was as psychological resistance. Nonetheless, the broader technical structure stays firmly bullish for XAUUSD forecast unless we see lower lows and lower highs in the days and weeks ahead.

The key question now is whether dip buyers will step back in as gold tests critical support levels. Immediate focus falls on the $3,245–$3,283 zone, which was being tested at the time of writing. This area held firm last week and could offer a floor once again. But if this region gives way, attention would then shift to $3,167 — the previous breakout high earlier this month.

Personally, I view the rising trendline around $3,100 as the crucial "line in the sand." A deeper decline to that point would be significant but might also present a compelling bounce opportunity. Only a convincing break beneath that threshold, accompanied by a series of lower highs and lower lows, would signal a meaningful deterioration in the longer-term bullish case for the technical gold forecast.

On the upside, initial resistance is pegged at $3,366, followed by $3,430. Should bullish momentum reassert itself, a fresh assault on the all-time high of $3,500 could soon be in sight.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R