Unsurprisingly, with risk assets rallying, we’ve seen a sharp drop of 3.5% in gold prices today. But at the time of writing, sock indices were coming back down a little, with US Treasury Secretary Bessent saying there was no unilateral offer from Trump to cut tariffs on China, and that the full China trade deal may take two to three years. Those comments were enough to send the S&P noticeably off its earlier highs. As far as the gold outlook is concerned, well the precious metal has dropped quick a bit in the last couple of days, but that is still merely a drop in the ocean compared to how much it has gained. Will dip buyers step in as the metal now tests short-term support levels beath the $3300 area?

Trade war uncertainty lingers

US Treasury Secretary Scott Bessent has kind of quashed speculation around any unilateral move from Donald Trump to slash tariffs on China, confirming there’s no such offer on the table. Bessent admitted there's no clear timeline for the resumption of China talks, which, notably, would unfold at levels far beneath the high-profile theatrics of Trump and Xi. As for a comprehensive trade deal? Don't hold your breath—Bessent reckons it could be a slow grind, likely two to three years in the making. All in all, today's headlines feel like all the optimism priced in the markets on Trump’s remarks, may have gone too far, too fast. Risk appetite may sour once more.

Risk rally loses momentum as scepticism lingers

Earlier today, it was all about the unwinding of the recent “sell America” trade which had picked up pace with indices building on a similarly strong showing the day before. It was a broad-based risk rally—global equity indices, Bitcoin, you name it—all catching a bid. Meanwhile, traditional safe havens took a back seat. Gold, in particular, saw a dramatic retreat, tumbling as much as $240 from Tuesday’s record high of $3,500.

So, what was behind that optimism? Well, it began with murmurs that the US was inching closer to new trade agreements with partners such as India and Japan. The rally then received a shot in the arm from Donald Trump, who sought to calm the waters by suggesting Jerome Powell’s job is safe for now and even floated the prospect of cutting tariffs on China. Bold words, as ever. But whether he can follow through remains to be seen. And judging by Bessent’s comments made earlier, a trade agreement could take a long time.

Therefore, for now, we remain cautious on risk and maintain a bullish long-term gold outlook.

Technical gold outlook: Key levels to watch

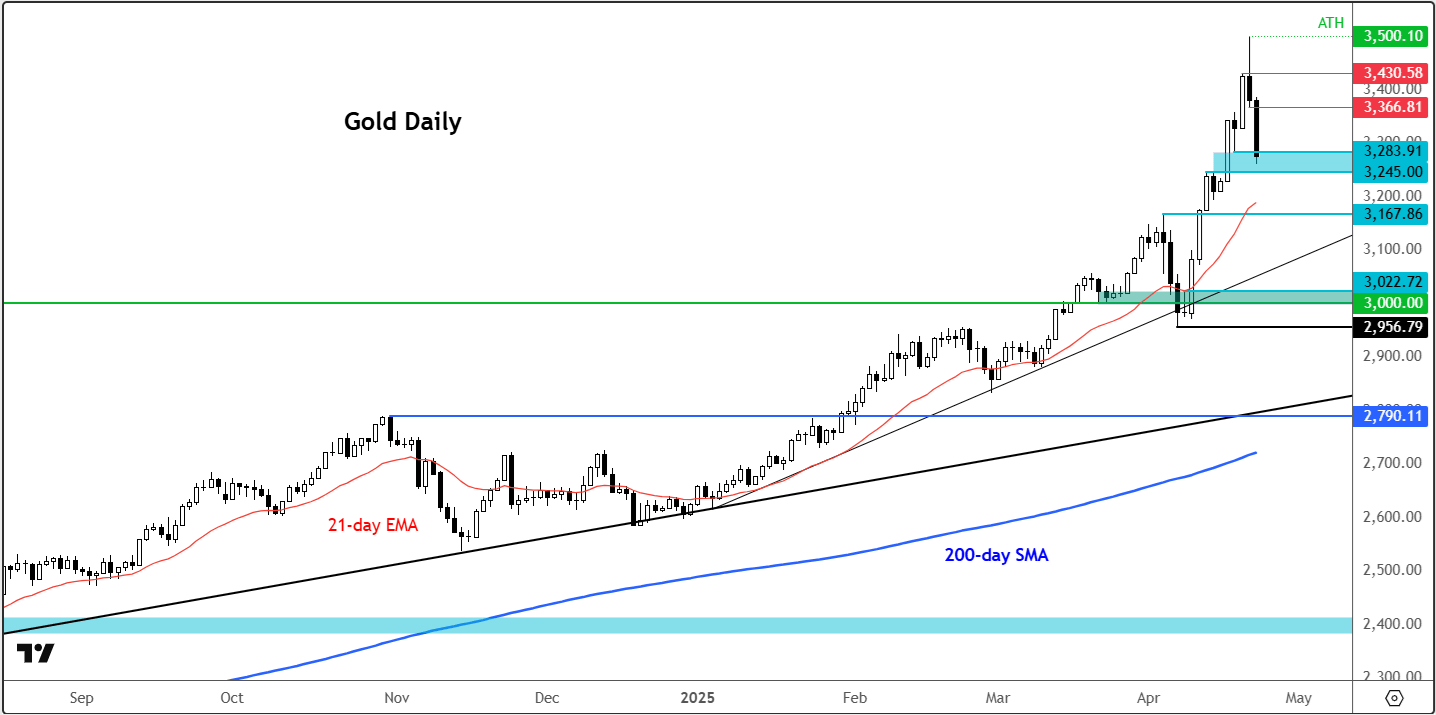

At the time of writing, gold was still down sharply for the second day in a row after finding significant resistance at the psychologically important 3,500 level (all-time high). The sharp two-day pullback means gold was now down by 6.8% from the all-time high, hitting a low of roughly $3260, which is a big move to the downside. However, the long-term trend is clearly still bullish.

Source: TradingView.com

Could we see dip buyers step back in when the price of gold gets to some support levels? The key levels to watch now include the area between $3,283 to $3,245, which is the first area of potential support I’ve marked on the daily chart. Below that, we have $3,167, marking the previous high made earlier this month before we broke above it. This is also where the 21-day exponential average is converging.

For me, the line in the sand is the short-term bullish trend line, which comes in at around $3,100. I’m not necessarily saying we’ll get there, but if we do, we may well see a potential bounce. The long-term technical gold outlook will only turn negative if we start to print lower lows and lower highs.

With that in mind, keep an eye on the $2,956 level, which was the most recent significant low prior to gold breaking to new record highs. For as long as that level remains intact, any short-term pullback should be taken with a pinch of salt and viewed as potential long opportunity than reason to look for bearish setups. However, if that level breaks, then you’d have to drop your bullish bias—at least in the short-term outlook.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R