- Gold outlook dulled by improved sentiment around US-China trade talks

- Potential dollar strength could weigh on the yellow metal

- Key US data releases may dictate the next directional move

Gold prices have started this week with a modest bounce. After rising a little on Monday, prices recovered from a weak start today to turn positive on the session by mid-day in London. But beneath the surface, the momentum has started to feel rather fragile. After touching a record high of $3,500 in April, the yellow metal has failed to reclaim that glory, even if other precious metals like silver and platinum have surged higher. The appeal for the safe-haven gold has moderated a little, owing to the improved global risk sentiment. On top of this, the US dollar has shown some signs of life, although it has yet to come back meaningfully. If and when it does, coupled with further improvement in risk appetite, this could limit the upside potential on gold, and may even cause a bearish reversal. Therefore, the near-term gold outlook is starting to look a bit shaky. We just need to see the breakdown of a few levels before the sellers potentially emerge in force. For now, consolidation is the name of the game.

Risk appetite strong but gold also holding firm – for now

Investors appear cautiously optimistic that the US and China may be on the brink of putting some of their longstanding differences aside, with high-level trade talks taking place in London. This comes after last week’s “very positive” phone call between Presidents Trump and Xi. With equity markets remaining largely in a “buy-the-dip” mode, investors may soon start trimming their exposure to haven assets like gold — and that shift in mood is beginning to be felt with XAU/USD unable to make a new all-time high after peaking in April at $3,500.

So, despite a positive start to this week’s trading, I remain sceptical on gold. The precious metal could further lose its bullish momentum should traders continue reallocating into more risk-sensitive assets, particularly equities. If that’s the case, there’s little reason to expect a strong bid in gold unless macro data turns sharply dovish, or a new geopolitical shock emerges.

A stronger dollar, if fuelled by upbeat economic data or a hawkish shift in expectations from the Fed, would only make matters worse for gold. With the greenback showing signs of revival — especially against the likes of the Japanese yen and British pound — the risk to gold is twofold: diminished safe-haven demand and currency headwinds. Yet, none of these factors have weighed heavily on gold as things stand.

US CPI and consumer sentiment among week’s macro highlights

This week’s economic calendar is lighter than last, but two key data points out of the US could impact the gold outlook: Wednesday’s CPI and Friday’s University of Michigan (UoM) Consumer Sentiment.

Last month’s inflation print surprised to the downside at 2.3%, below the forecast 2.4%, fuelling some chatter around Fed rate cuts. But with trade tensions easing, some of the downside pressure on the dollar has lifted. A firmer inflation number this week could reinforce that shift and further dampen the gold outlook. However, if CPI comes in very weak then this would be music to the ears of the gold bulls.

Meanwhile, Friday’s UoM report will shed light on whether recent equity gains and trade optimism are filtering through to consumer sentiment. If Americans are feeling chirpier and more willing to spend, it may strengthen the dollar and reduce the allure of safe-haven assets.

Technical gold outlook: Key levels to watch

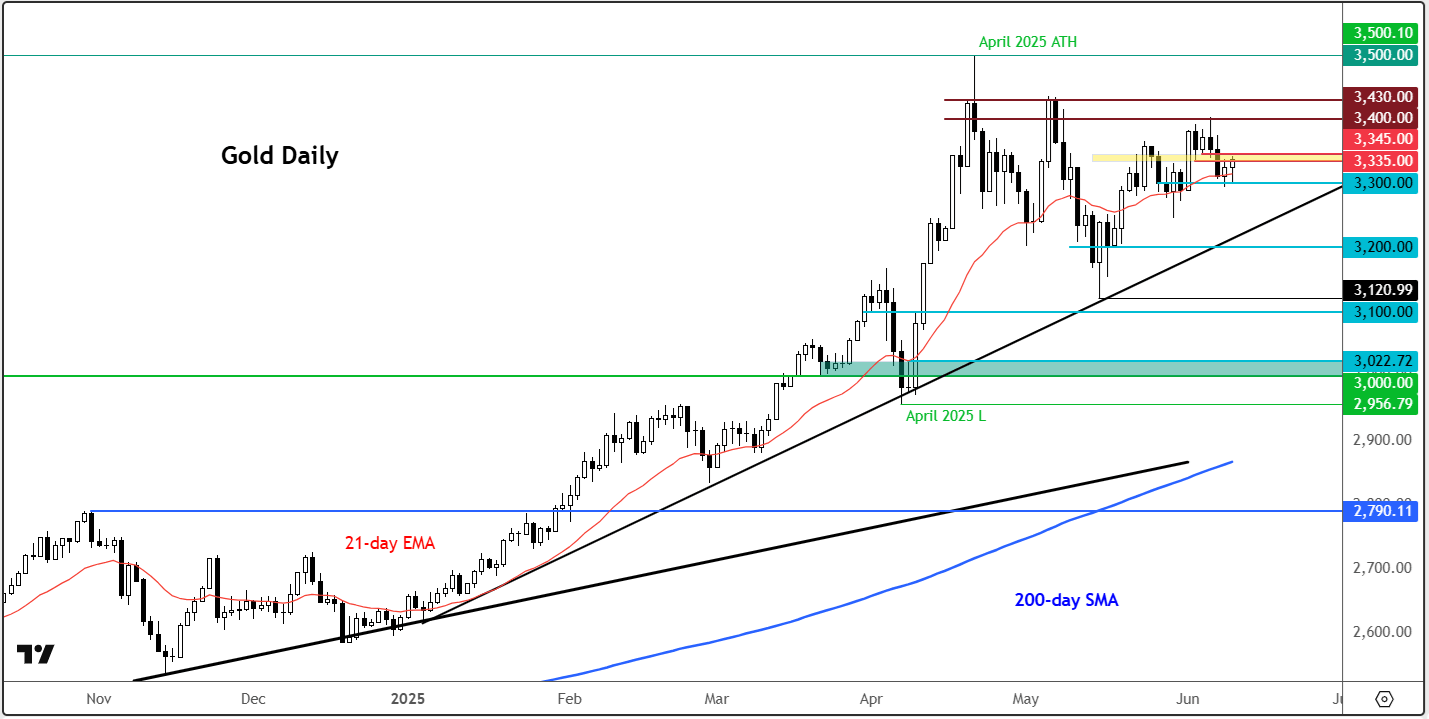

Source: TradingView.com

Technically speaking, the gold price chart remains firm for now. Support around $3,300 has so far held firm, but the absence of new highs since April is noteworthy. Should that support break decisively, traders will be eyeing the 2025 trendline around $3250. Below that, we have the crucial round handles $3,200, $3,100 and finally the psychologically important $3,000 level.

That said, we’re not writing off the bulls just yet. The broader trend remains upward, and the current pullback could simply be a breather before another charge higher. Resistance is layered at $3,335-45 area, which was being tested at the time of writing. Above that, $3,400 would come into focus. If gold reclaims those levels, the case for another leg up strengthens.

So, in short, the near-term fundamental gold outlook is starting to look a little wobbly, but technically we haven’t seen a breakdown of any important levels yet. Gold’s inability to convincingly reclaim the $3,400 mark last week — especially in the face of a sharp breakout in silver — is telling. Silver surged to levels not seen since 2012, with platinum and palladium also climbing on a mixture of demand recovery and supply concerns. Yet gold, which has so often been the trailblazer, now appears to be dragging its heels a little.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R