Over the past five trading sessions, gold has once again attempted to reach its all-time high zone, located around $3,400 per ounce. Shortly after the bullish momentum approached this level, a new wave of short-term selling pressure emerged, reaffirming the strength of this technical barrier. However, buying interest has remained steady, mainly driven by market uncertainty and geopolitical tensions, which continue to support gold’s appeal as a safe-haven asset.

Key Factors Behind Gold’s Recent Recovery

The trade war remains a key catalyst for short-term gold price action. Earlier this week, the market was unsettled after new tariff threats from President Trump toward China, due to stalled negotiations. Shortly after, the two countries held a phone call to resume discussions, during which China requested the removal of hostile U.S. tariffs as a condition to move forward.

It’s important to note that the White House has attempted to reignite trade tensions not only with China but also with the European Union, and the lack of a clear resolution has sustained global economic uncertainty. This, in turn, has helped gold reach new record highs and reinforced its role as a key defensive asset in this environment.

Meanwhile, the conflict between Ukraine and Russia continues, with renewed military actions further delaying a potential diplomatic resolution. Although new efforts are being made this week to bring both parties to the table, it remains unclear if a new peace round will materialize or when the conflict might end. This has added more global geopolitical tension.

Both the trade war and geopolitical conflicts are important drivers for gold, as demand for safe-haven assets tends to rise when perceived economic and political risks increase. If no resolution is reached in the near term, buying pressure on gold could intensify in the coming sessions.

What’s Happening With Market Sentiment?

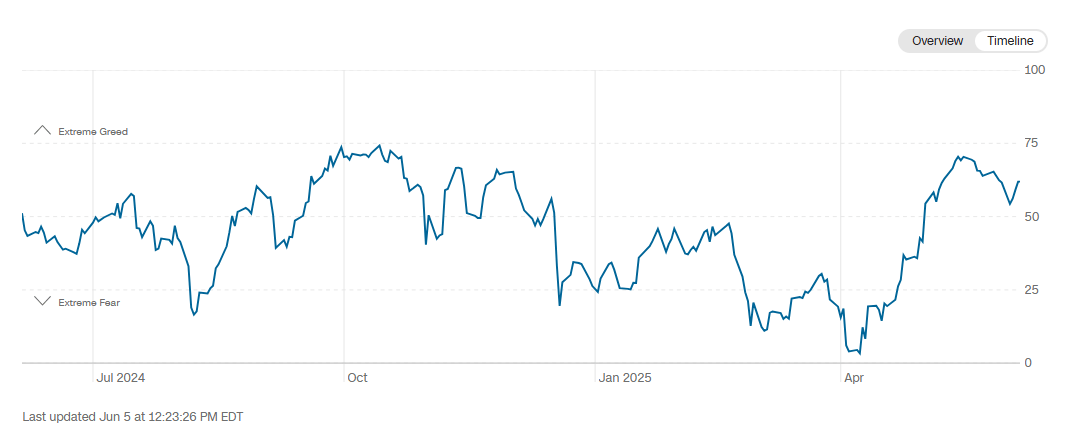

The Fear & Greed Index is currently hovering around 62 points, in the “greed” zone. This reflects a mild recovery from prior declines, when the index nearly returned to the “neutral” zone. For now, sentiment appears stable but has yet to regain the “extreme greed” levels of previous weeks.

Source: CNN

If the index continues to recover, it could be interpreted as a negative signal for gold, as safe-haven demand weakens when confidence improves. If sentiment remains in the greed zone, it could reduce perceived risk, acting as a bearish catalyst for gold. On the other hand, if the index fails to stay elevated, renewed uncertainty may fuel buying pressure once again.

Gold Technical Outlook

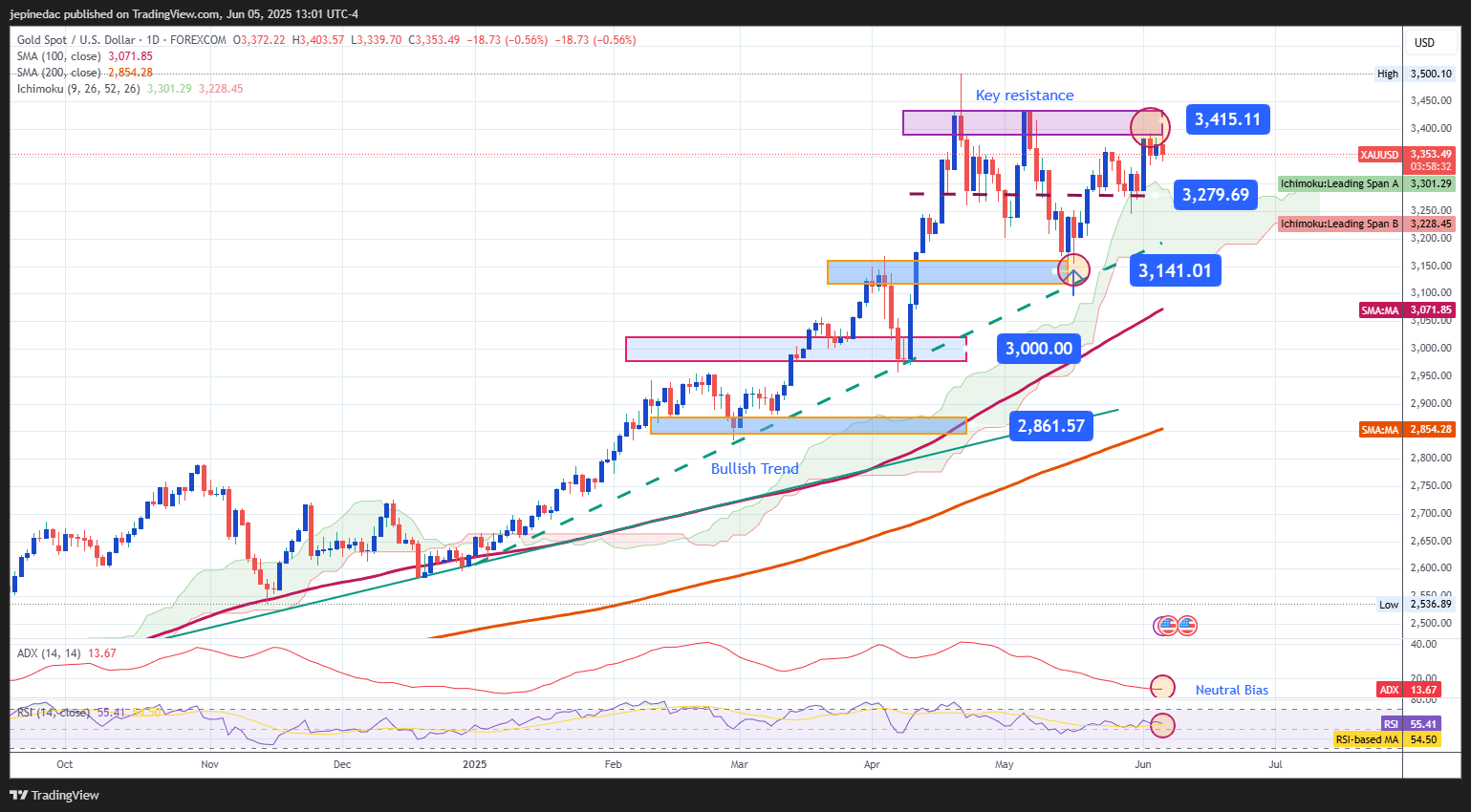

Source: StoneX, Tradingview

- Uptrend Still Intact: Gold’s technical structure remains firmly bullish in recent months. Since early 2025, the price has followed a strong upward trendline, surpassing the key $3,000 psychological barrier. While some minor pullbacks have started to appear, they are still insufficient to threaten the current uptrend. As a result, the market remains in bullish territory in the short term.

- ADX: The ADX line remains below the neutral 20 level, indicating that average volatility is still low. As gold tests key resistance areas again, this low volatility suggests a potential consolidation phase may emerge.

- RSI: The RSI continues to trade above the 50 level, showing that bullish momentum remains dominant. However, the flattening of the indicator may signal a pause in the current uptrend, with increased risk of a sideways move in the near term.

Niveles clave a tener en cuenta:

- $3,400 – Major Resistance: Recent all-time high. A sustained breakout above this level could confirm the bullish bias and extend the long-term uptrend.

- $3,270 – Key Support: A technical zone that has acted as a recent area of indecision. It may serve as strong support against short-term pullbacks.

- $3,140 – Critical Support: Aligns with the recent ascending trendline. A drop below this level could trigger a deeper bearish phase and threaten the current market structure.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25