After testing the $3,200 per ounce level, gold has posted a significant recovery of more than 1.5%, as a renewed buying bias takes shape in the metal’s price action. The bullish momentum has held in the short term, supported by the uncertainty following the U.S. credit rating downgrade and the lack of a consistent rebound in the U.S. dollar in recent trading sessions.

Moody’s Downgrade

At the close of trading on May 16, 2025, Moody’s announced a downgrade of the U.S. credit rating from Aaa to Aa1, citing concerns over the rising fiscal deficit and the growing cost of debt servicing, which could negatively impact the U.S. government’s ability to meet its obligations in the coming months.

This decision has raised questions about the country’s financial sustainability, prompting investors to once again seek refuge in gold, a historical safe-haven asset. The downgrade has acted as a key catalyst, helping to boost demand for XAU/USD in the short term.

In the medium and long term, this downgrade could have broader implications: if investor demand for U.S. Treasuries weakens due to concerns over sovereign solvency, capital may shift into safer alternatives like gold. This could result in sustained buying pressure on the precious metal as long as risk perceptions remain elevated.

What’s Happening with Market Sentiment?

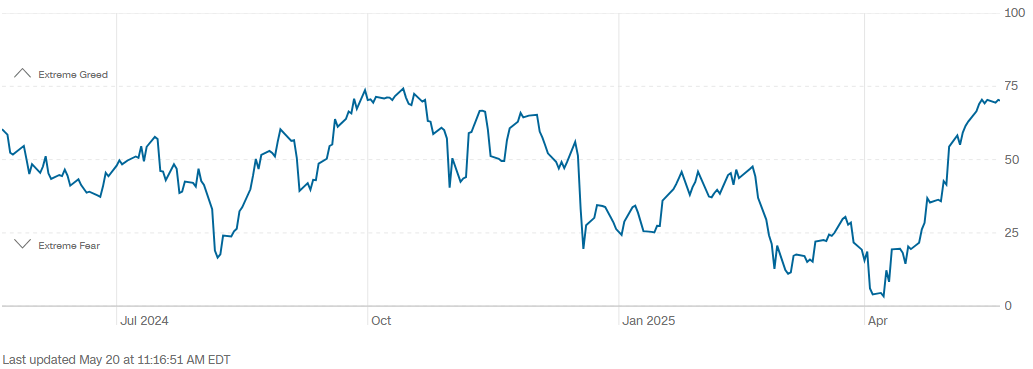

In recent trading sessions, the CNN Fear & Greed Index has shown a notable recovery, reaching nearly 75 points, approaching the “extreme greed” zone. However, as the index reaches these levels, it has begun to flatten, suggesting that the recent surge in optimism may be entering a consolidation phase.

Source: CNN

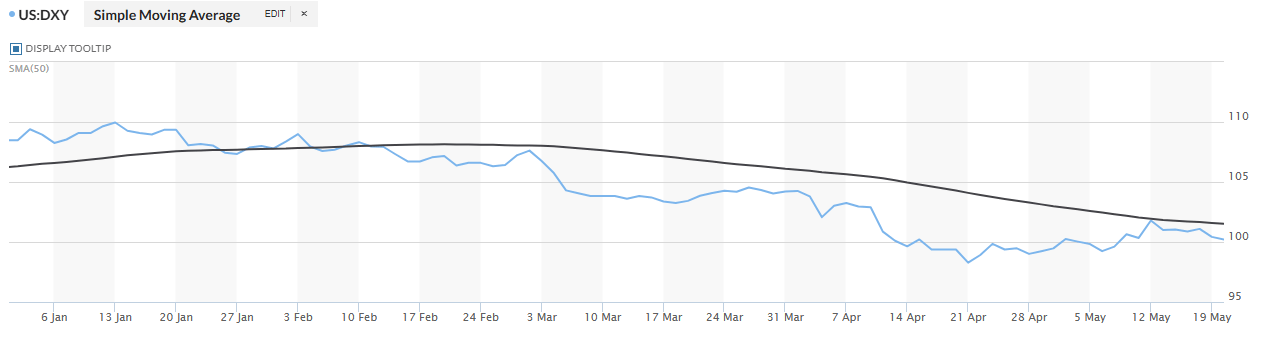

Meanwhile, sentiment around the U.S. dollar has also shown signs of weakness. The DXY index, which measures the dollar’s strength, has slipped back toward the 100 level, after showing a modest recovery in previous sessions. This reflects a general sense of softness around the greenback.

Source: MarketWatch

In this environment, both the cooling of market optimism and the lack of dollar strength have provided room for a renewed uptick in gold demand. As a safe-haven asset, gold typically benefits when confidence falls and the dollar weakens, which could help sustain bullish pressure on XAU/USD in the short term.

Gold Technical Outlook

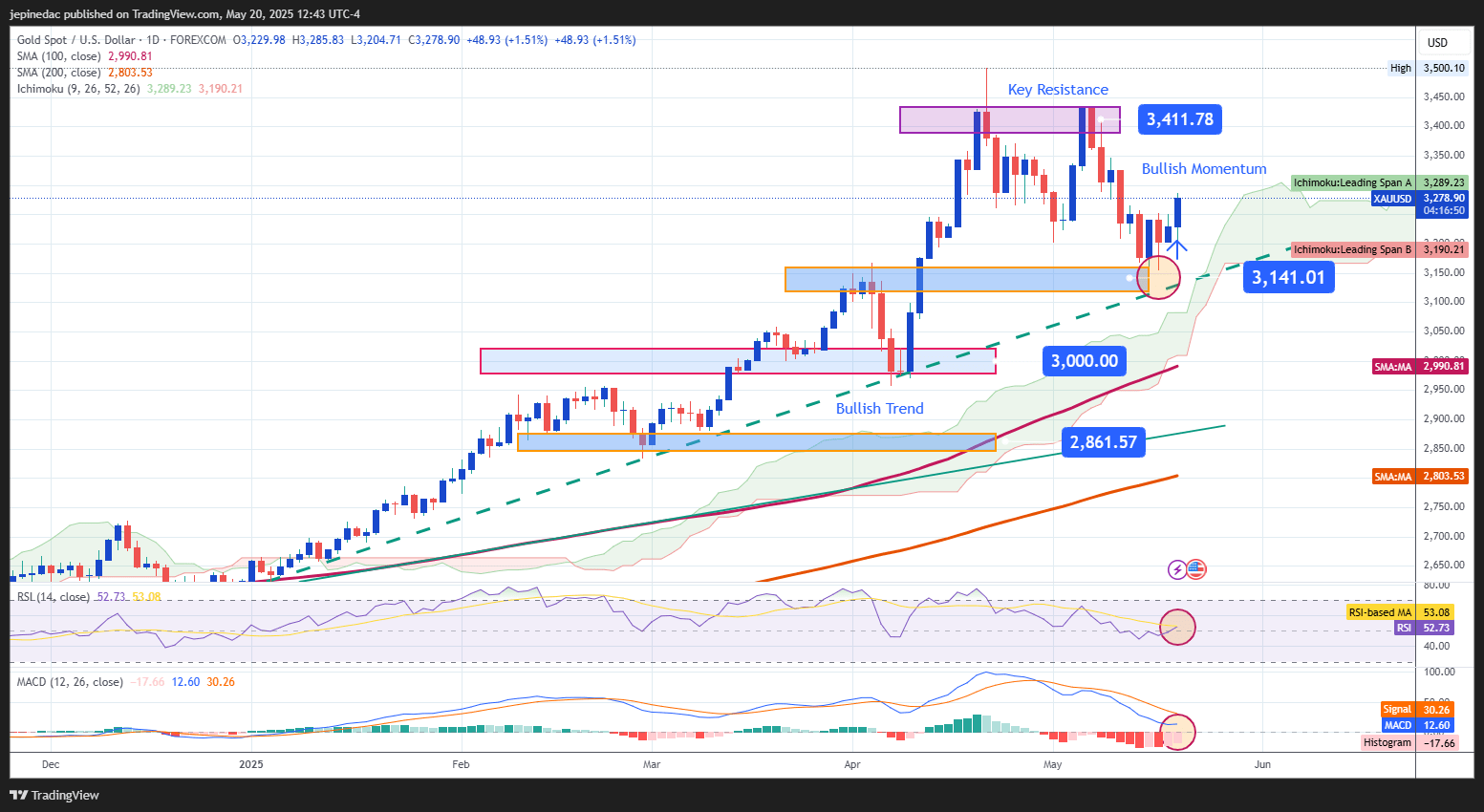

Source: StoneX, Tradingview

- Bullish Trend: The technical structure of gold has remained clearly bullish in recent months. Since the beginning of 2025, price action has followed a steep ascending trendline, breaking through the psychological barrier at $3,000 per ounce. Although there have been recent downward moves, they have not been strong enough to break key support levels, so the uptrend remains intact, and the overall bias continues to favor the bulls.

- RSI: The RSI line has once again moved into bullish territory, above the neutral 50 level, suggesting that buying momentum is gaining strength. If the RSI continues rising, it could confirm a new upward impulse in the short term.

- MACD: The MACD histogram has begun to exit bearish territory, which may indicate that selling momentum is weakening. If the histogram continues moving toward the zero line, this could reinforce a renewed bullish bias.

Key Levels to Watch:

- $3,400 – Major Resistance: This level corresponds to recent all-time highs. A sustained breakout above this zone could confirm the bullish bias and extend the long-term uptrend.

- $3,140 – Key Support: A technical zone that has acted as a recent area of indecision, aligned with the ascending trendline. A break below this level could compromise the current market structure.

- $3,000 – Critical Support: A key psychological level, now considered a more distant support barrier. A drop to this level could trigger stronger selling pressure.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25