Gold Price Outlook: XAU/USD

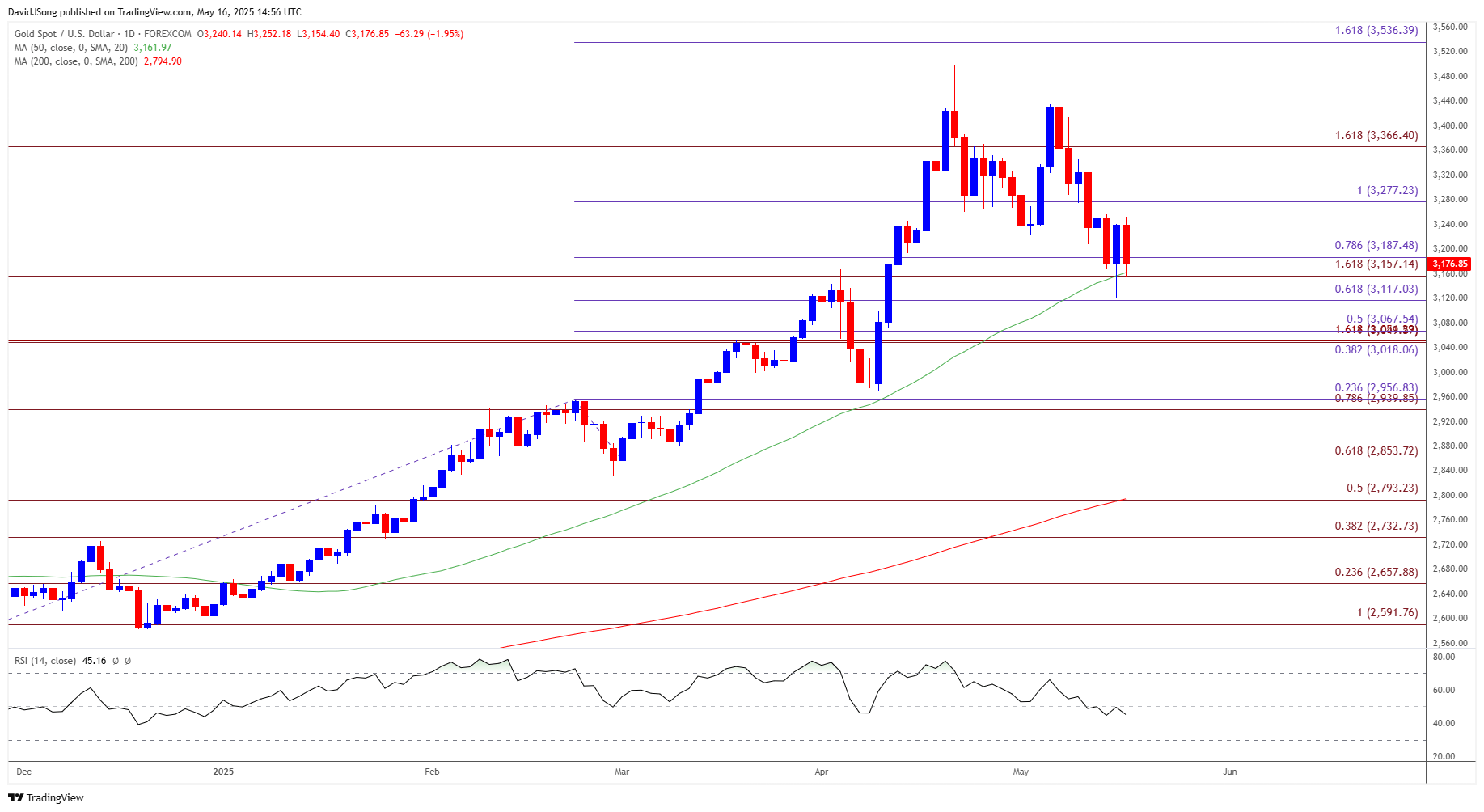

The price of gold may continue to track the positive slope in the 50-Day SMA ($3162) as it struggles to close above the moving average.

Gold Price Struggles to Close Below 50-Day SMA

Keep in mind, the decline from the start of the week pushed the price of gold below the moving average for the first time since January, but the precious metal seems to be defending the rebound from the weekly low ($3121) as it no longer carves a series of lower highs and lows.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, gold may continue to reflect the bullish trend from earlier this year as it offers an alternative to fiat-currencies, and the precious metal may stage a larger recovery as the ongoing shift in US fiscal policy clouds the outlook for the global economy.

With that said, the price of gold may attempt to retrace the decline from the monthly high ($3435) as it snaps the bearish price series from earlier this week, but bullion may continue to give back the advance from the April low ($2957) on a close below the 50-Day SMA ($3162).

XAU/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; XAU/USD on TradingView

- The price of gold is on track to mark the largest single-week decline since June 2021 as it threatens the positive slope in the 50-Day SMA ($3162), and a close below the moving average may indicate a potential change in trend as a double-top formation seems to be taking shape.

- Failure to hold above $3120 (61.8% Fibonacci extension) may push the price of gold towards the $3050 (100% Fibonacci extension) to $3070 (50% Fibonacci extension) region, with a break/close below $3020 (38.2% Fibonacci extension) bringing the April low ($2957) on the radar.

- At the same time, the price of gold may defend the rebound from the weekly low ($3121) as it struggles to close below the moving average, with a push above $3280 (100% Fibonacci extension) raising the scope for a move towards $3370 (161.8% Fibonacci extension).

Additional Market Outlooks

GBP/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

Canadian Dollar Forecast: USD/CAD Coils Above of Weekly Low

US Dollar Forecast: USD/JPY Reverses Ahead of April High

Australian Dollar Forecast: AUD/USD Defends V-Shape Recovery

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong