View related analysis:

- WTI Crude Oil Analysis: Bears Eye Another Assault on $60

- AUD/USD Weekly Outlook: Yuan Correlation Supports Aussie Strength

- Japanese Yen Bulls Still Pushing Their Luck: COT Report

Wall Street Futures Pull Back Ahead of Fed Meeting

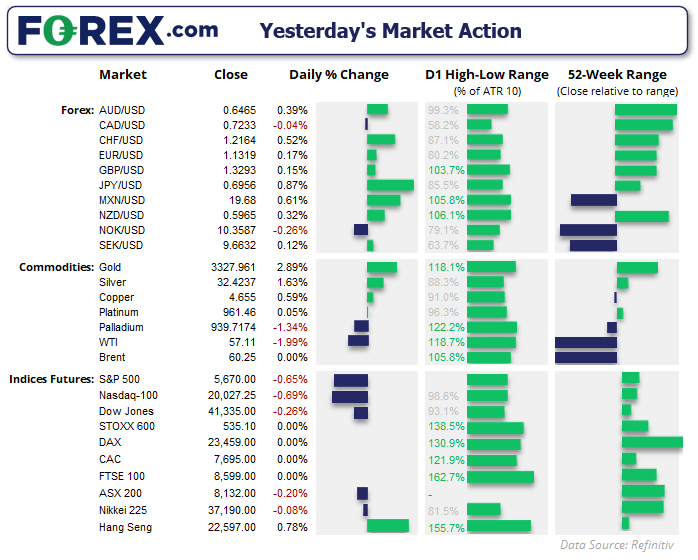

Wall Street futures closed lower on Monday during thin holiday trade, as investors booked profits ahead of this week’s Federal Reserve (Fed) meeting and adopted a cautious tone amid ongoing trade negotiations. The Nasdaq 100 (-0.69%), S&P 500 (-0.65%), and Dow Jones (-0.26%) all formed small bearish inside days, highlighting a reluctance to commit in either direction ahead of the FOMC meeting.

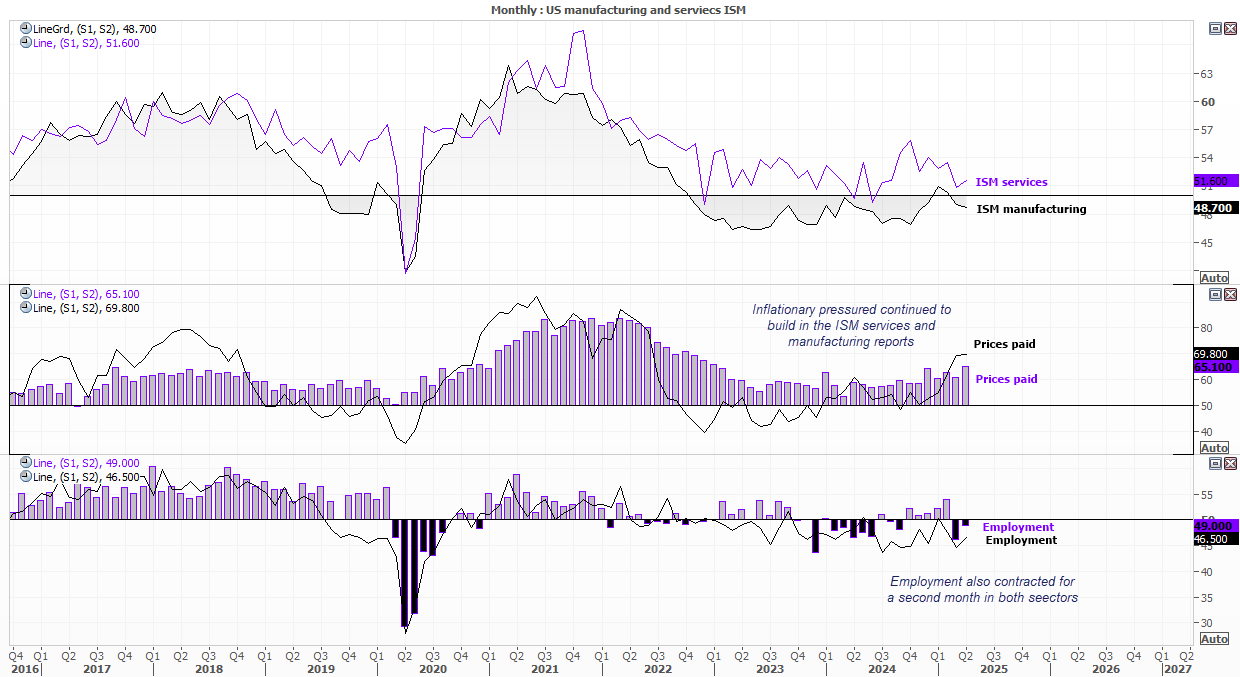

ISM Data Highlights Sticky Inflation Ahead of FOMC

ISM services expanded slightly faster in April, rising to 51.6 from 50.8. The internals were generally solid, with the main concern being the ‘prices paid’ component, which jumped to a 28-month high—signalling persistent inflationary pressure. Employment also contracted for a second consecutive month, though at a slower pace (-49 vs -46.2 previously). This followed last week’s ISM manufacturing report, which showed the sector contracting at its fastest pace in six months, with prices paid rising at their fastest rate in nearly three years and employment also stalling for a second month.

These inflationary pressures make it difficult for the Fed to adopt a dovish tone this week. Fed funds futures currently favour a rate cut in July, but it’s unlikely the Fed will tip its hand two months in advance—especially with trade negotiations still in progress.

Economic Events in Focus (AEST / GMT+10)

- Public holiday in Japan, South Korea

- 11:00 – New Zealand commodity price index (ANZ)

- 11:30 – Australian building approvals

- 11:45 – Chinese services PMI (Caixin)

- 15:45 – Swiss unemployment

- 17:35 – Swiss National Bank (SNB) Vice Chairman Schlegel Speaks

- 18:00 – EU HCOB Eurozone Composite PMI (Apr)

- 18:30 – UK S&P Global Composite PMI (Apr)

- 19:00 – EU PPI (MoM) (Mar)

- 22:30 – Canadian trade balance (Mar)

- 00:00 – Canadian Ivey PMI (Apr)

CI Gold Q2

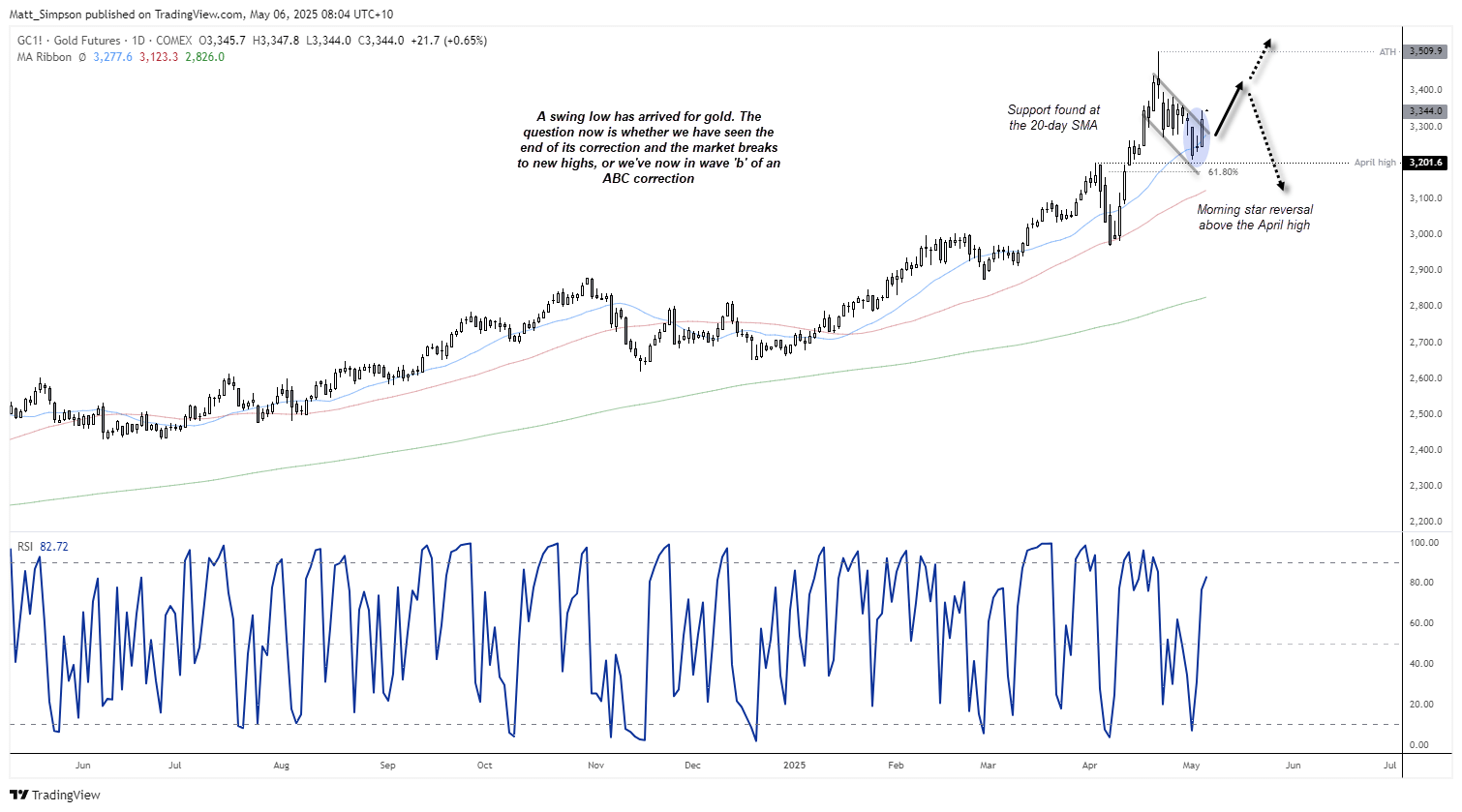

Gold Futures (GC) Technical Analysis

Gold snapped a four-day losing streak on Monday, delivering its best daily gain in two weeks at 2.4%. Friday’s inverted hammer candle — which was also an inside day — signalled hesitancy for the sell-off to continue or for prices to retest the April high. Support has since been found at the 20-day SMA, and momentum has realigned with the well-established bullish trend on the daily chart. Given gold had already fallen 8.5% from its record high in just seven days, a bounce almost feels overdue from a market that has repeatedly scalded bulls this year.

Traders will now watch closely to see if this rally can extend beyond short-covering and stabilise above key support and resistance levels.

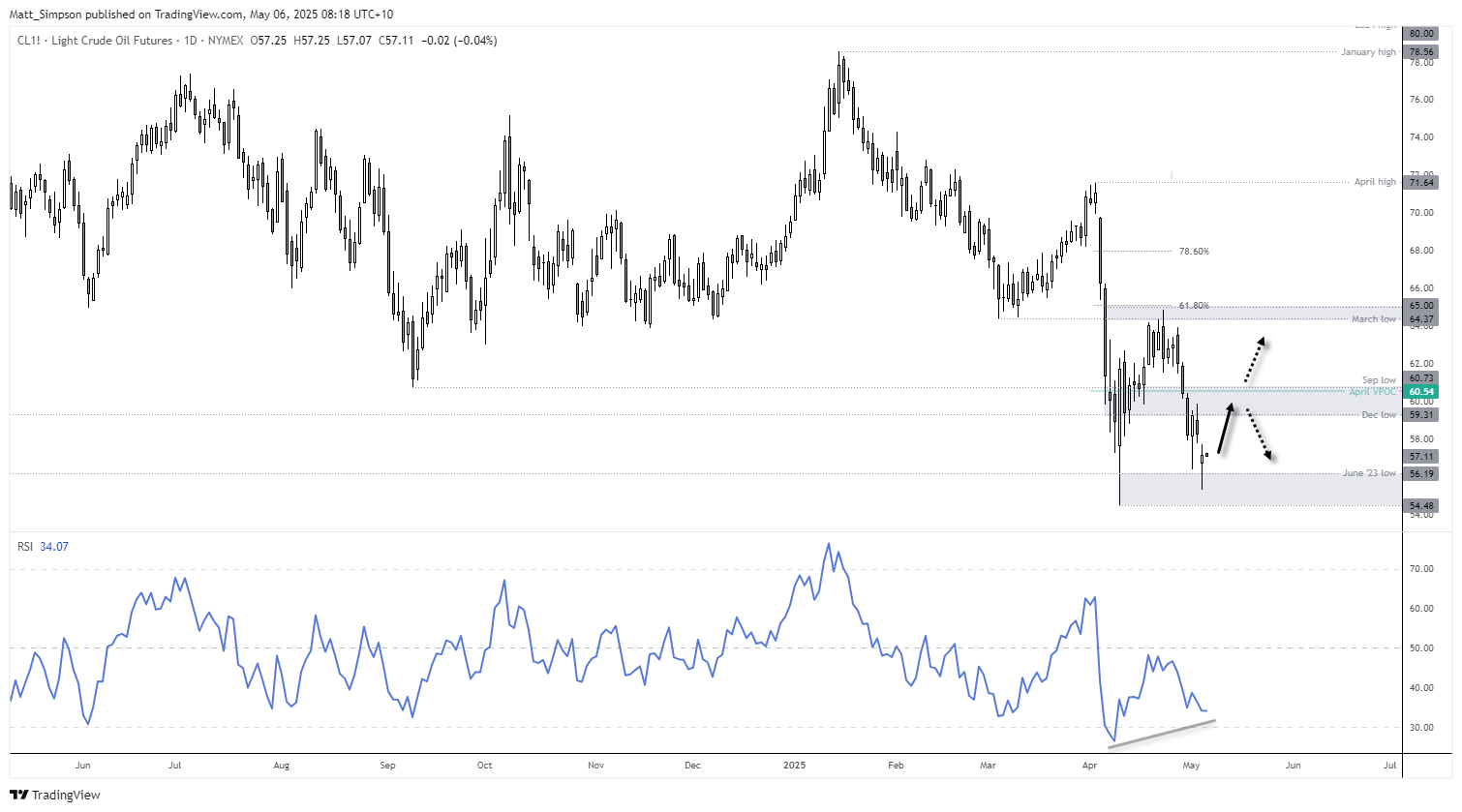

WTI Crude Oil Futures (CL) Technical Analysis

Crude oil was back in the headlines over the weekend after OPEC+ announced another surprise output increase, catching markets off guard. My bearish bias on WTI crude, outlined on 23 April, played out well, with prices breaking below key support zones. However, the much-watched $60 area failed to provide meaningful support, and prices have now slipped toward the $57 handle.

That said, Monday’s daily candle resembles either a doji or hammer, both of which are potential reversal signals. This could mark the start of a bullish mean reversion, especially as price action becomes stretched and sentiment tilts heavily bearish.

And given that prices held above the April low and closed above the June 2023 low on Monday, alongside a bullish RSI (14) divergence, these are not levels that bears may want to linger around. Yes, fundamentals ultimately drive price, but if OPEC’s output increase was supposedly so bearish for oil, why is WTI crude still trading above recent swing lows?

This disconnect between narrative and price leads me to suspect a period of bullish mean reversion is due. Should that unfold, it could bring the December low at $59.31 and the $60 psychological handle back into focus — an area that also aligns with the split VPOC (Volume Point of Control) at 60.54.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge