Last week I outlined a case for a low on the US dollar to form. While it did not nail the exact low, recent developments are shifting in favour of one forming. President Trump stated on Tuesday that he has no plans to fire Fed Chair Jerome Powell. Trump's apparent U-turn must come as a relief to Powell, which has helped support the US dollar on bets he won't be replaced with someone more dovish. But trade is the bigger story here - as how tariffs play out will dictate where the US economy, and therefore US interest rates, are headed.

And if US Treasury Secretary Bessent is correct in thinking that trade tensions with China are to recede, it could prompt prove to be the trigger that USD bulls were looking for. And that could bode well for a potential long setup on USD/JPY.

View related analysis:

- AUD/USD Rebound Stalls Near 64c, 200-day EMA; PMIs In Focus

- 2025 could be one heck of a ride if bearish AUD/JPY clues are correct

- Tentative Signs of a US Dollar Rebound Ahead of Powell speech

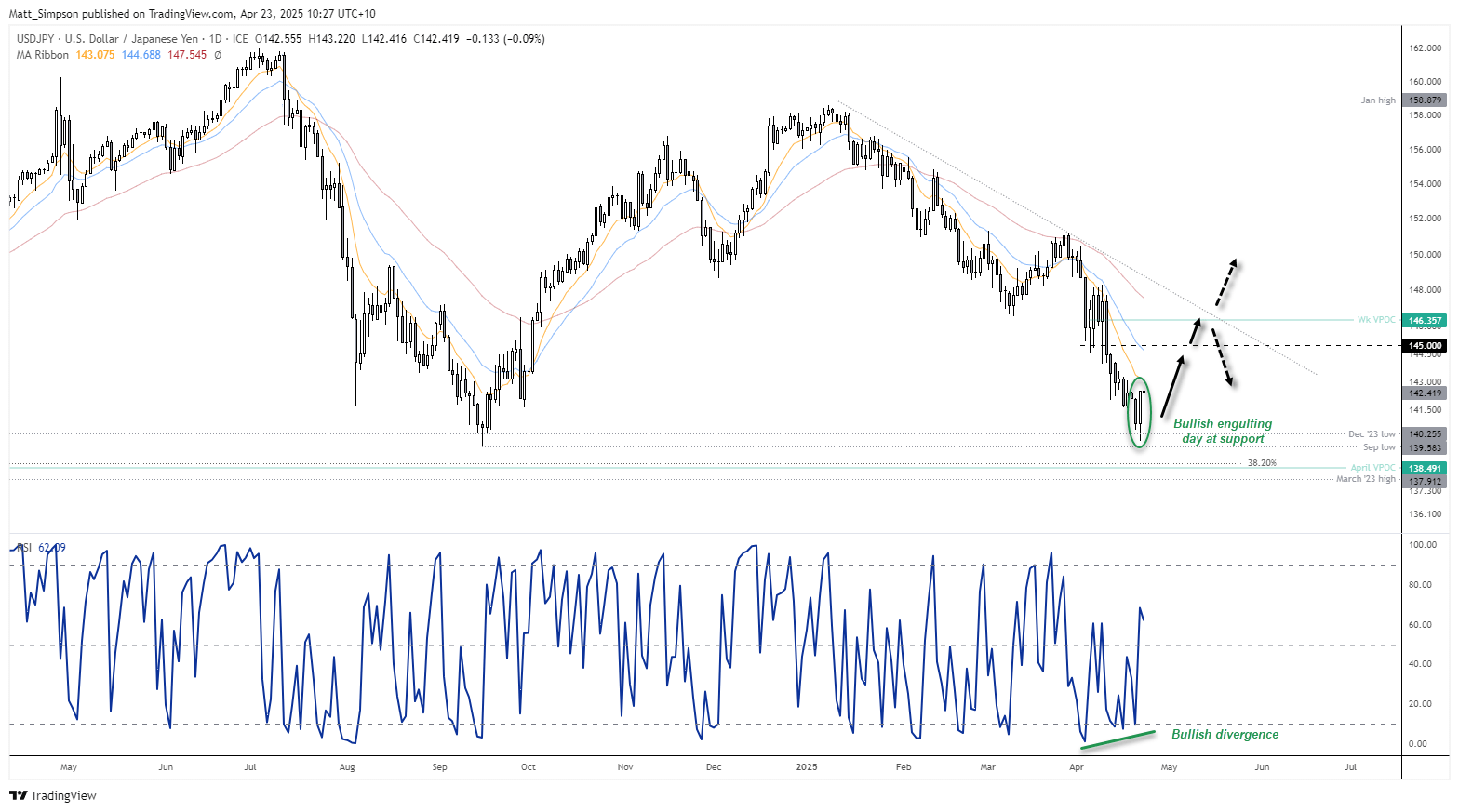

Japanese Yen Technical Analysis (USD/JPY): Weekly Charts

USD/JPY has fallen around 12% from its January high, but with several key levels of support nearby I am inclined to suspect this phase of the decline is much closer to the end than the beginning. The weekly RSI (2) formed a bullish divergence in the oversold zone last week, and this week’s low has heled above the 200-week EMA and September low. If prices were to close the week around current levels, a bullish pinbar / hammer would also form.

Japanese Yen (USD/JPY): Daily Chart

The daily chart shows that USD/JPY formed a bullish engulfing candle on Monday, following its false break of the December 2023 low earlier in the day. Prices have continued higher early in the Asian session, although the 10-day EMA is capping as resistance.

Bulls could seek dips within yesterday’s range in anticipation of a move towards the 20-day EMA, near the 145 handle. But traders should also take note that the prior correction which began on March 11 say prices mean revert to the 50-day EMA before its next leg lower from 151.20. Should prices retrace again to the 50-day EMA, a move up to 147.57 could be on the cards.

Personally, I suspect the weekly VPOC (volume point of control) at 146.35 and the bearish trendline make likely resistance areas for bears to target over the near term.

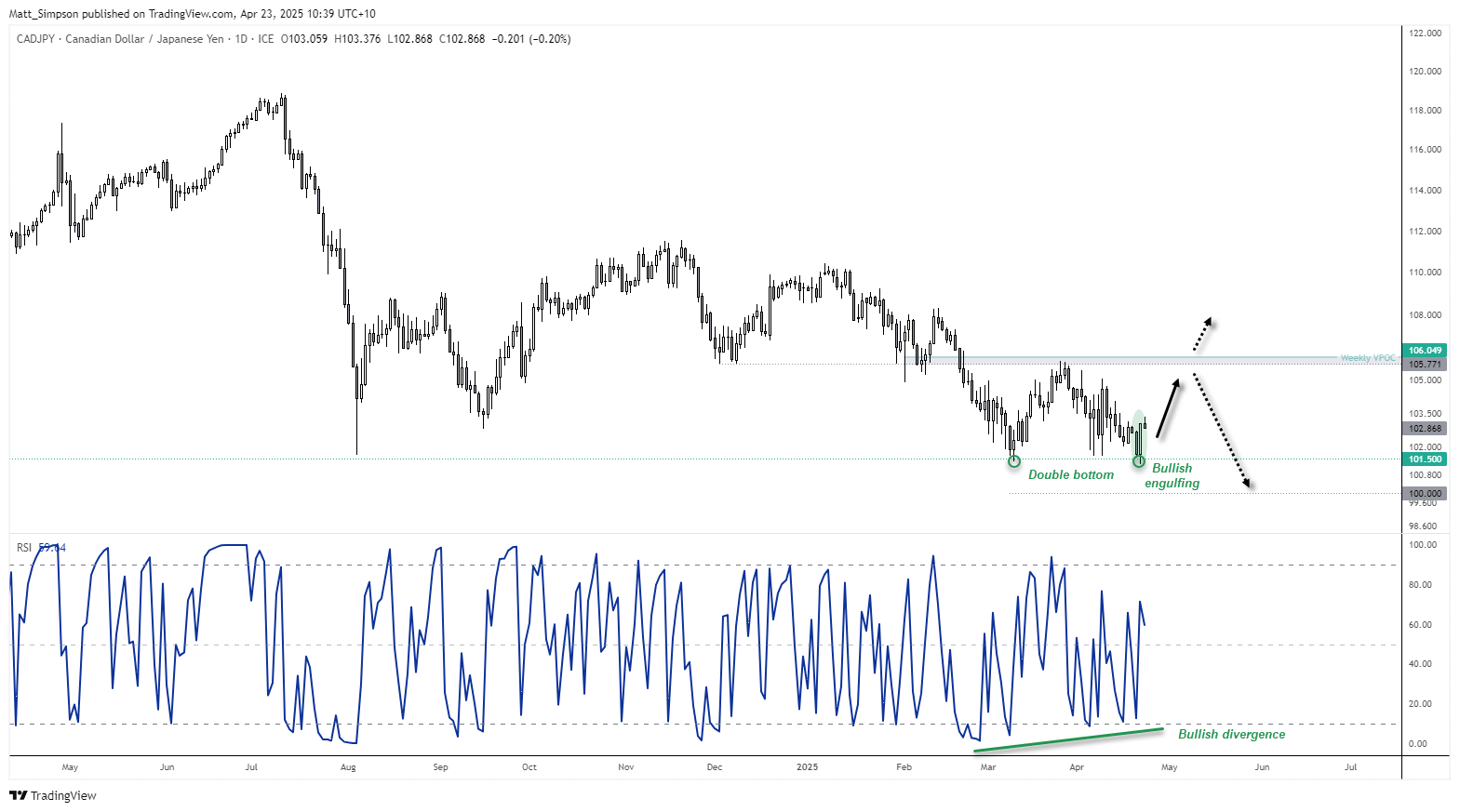

Canadian Dollar, Japanese Yen Technical Analysis (CAD/JPY)

There have been multiple instances since August 2022 that the 101.50 area has provided support for CAD/JPY. So it is interest to see that CAD/JPY respected that level of support again on Tuesday, following a false, intraday break beneath it. A bullish engulfing day also formed to suggest a swing low has arrived, following a multi-week bullish divergence on the daily RSI (2). It could also mark a double bottom around the historical support level of 101.50.

I am not seeking for an over-sized bonce on CAD/JPY at this stage, especially with Canada’s Federal election looming. But perhaps it could muster up the energy for a move to 105 or even 106, which has proven to be a pivotal level since December.

Beyond that, should we re-enter a phase of risk-off which drags commodity currencies such as the Canadian dollar lower, a break beneath Tuesday’s low assumes a move to 100.

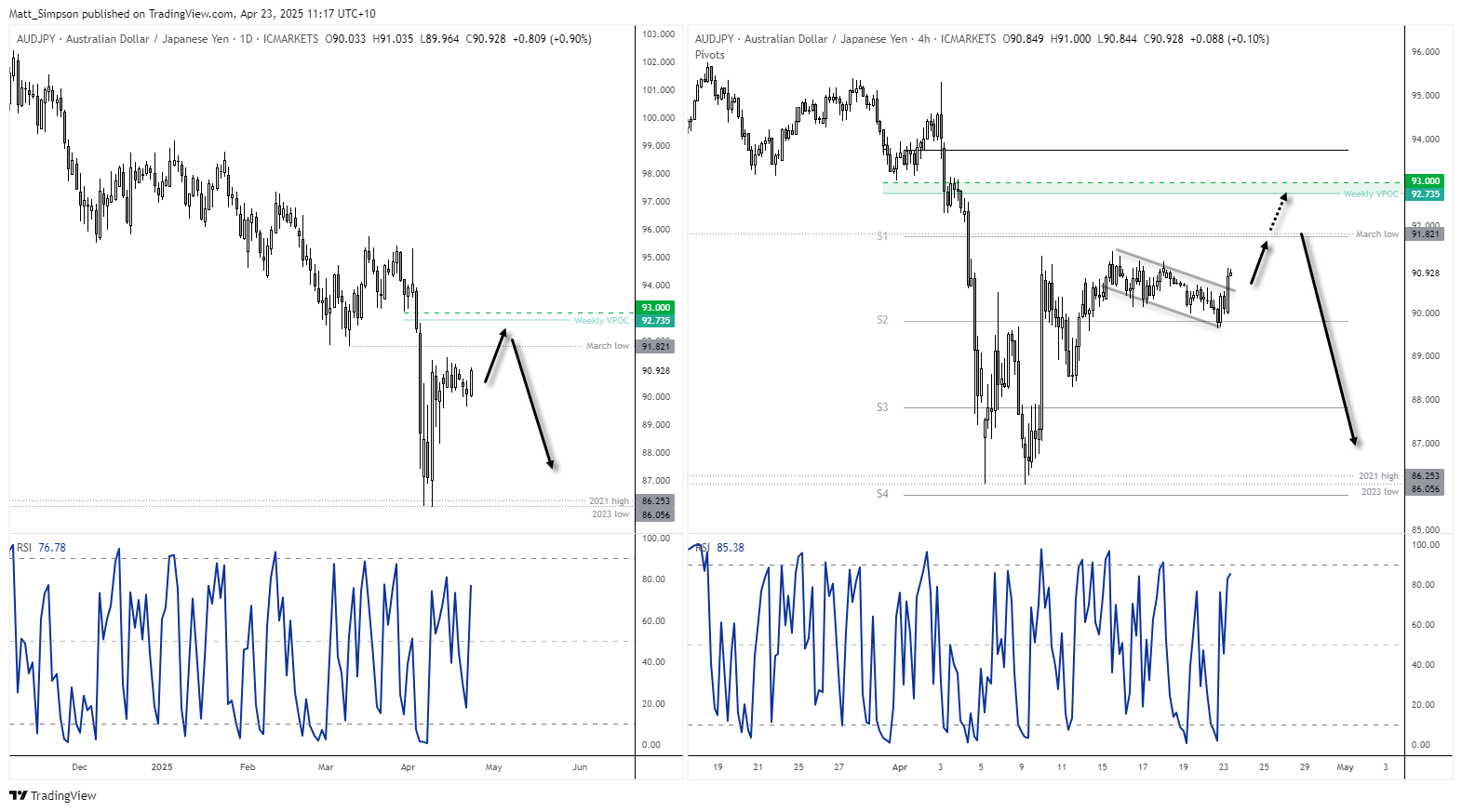

Australian Dollar, Japanese Yen Technical Analysis (AUD/JPY)

The daily trend structure on AUD/JPY is much mor bearish than that of CAD/JPY, which is why I suspect any bounce on the former may be outpaced by the latter. But this also ties in with my hunch that AUD/USD could be due a retracement lower, given I am also looking for a semi-decent bounce on USD/JPY.

AUD/JPY is already up 1% during the first half of Asian trade, which places it on track for snap a 3-day bearish streak. A move to at least the March low (91.82) could now be on the cards, or perhaps the weekly VPOC (92.73) at a stretch, just below the 93 handle. However, should these near-term bullish targets be met, I will also be on the lookout for a potential swing high to form.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge