View related analysis:

- USD/JPY, USD/CHF, EUR/USD Analysis: USD Reversal Grinds Away

- AUD/USD, AUD/CAD, GBP/AUD Analysis: Australian Dollar Falters

- EUR/AUD Analysis: April’s Candle is Eerily Similar to 2008, 2020 Highs

- Japanese Yen (JPY) Sentiment Could Be at an Extreme: COT Report

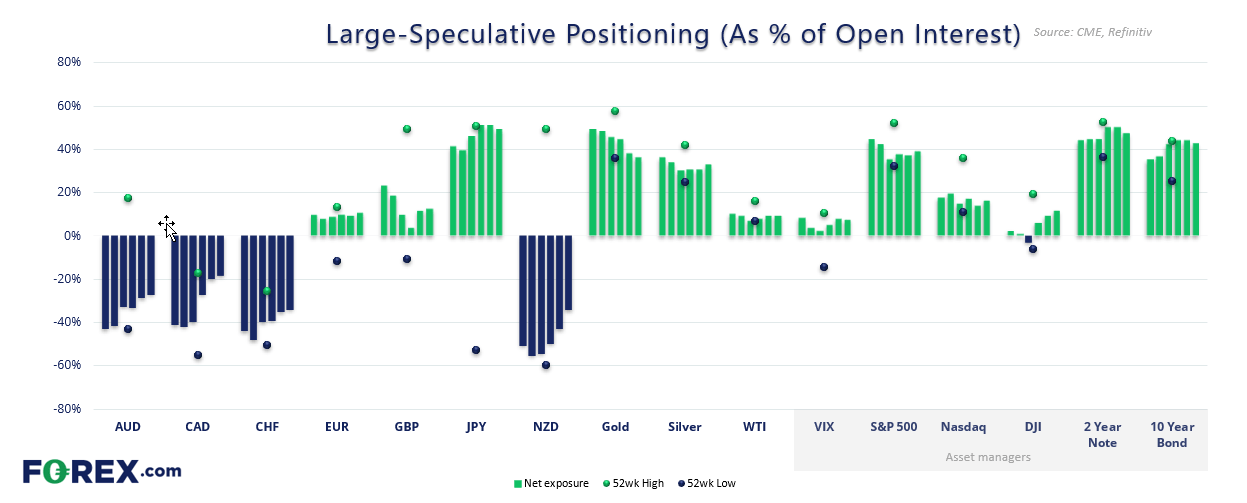

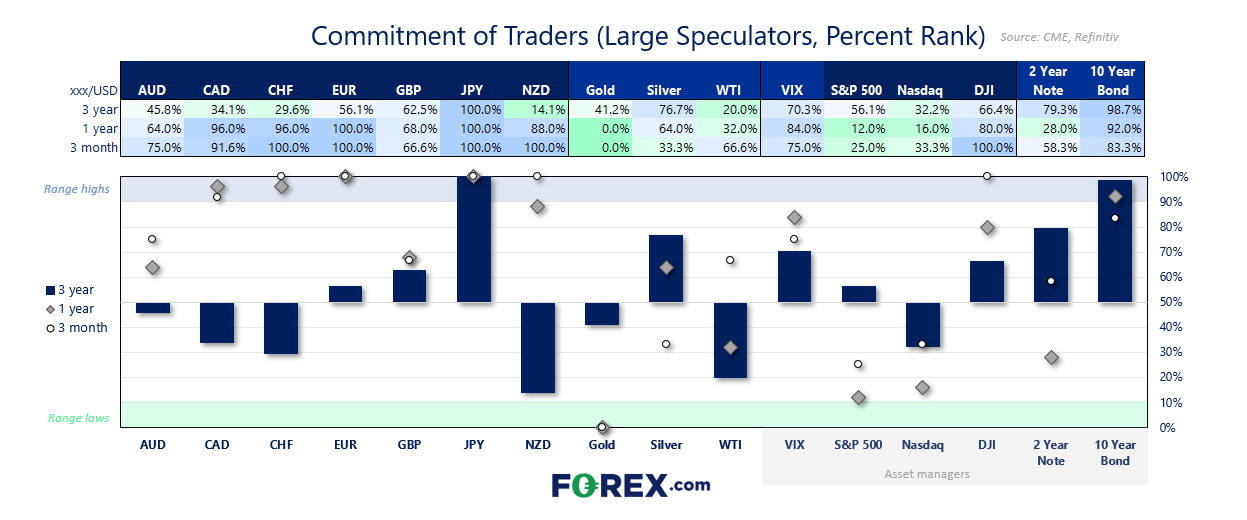

Market positioning from the COT report – 29 April 2025:

- US dollar (USD) net-short exposure reached -$18.3 billion, the most bearish level since August 2023

- USD net-shorts have increased in 11 of the past 12 weeks, reinforcing the view that USD is oversold

- Large speculators were net-short the US dollar index (DXY) by just 449 contracts

- Asset managers held a net-short of 3,000 contracts on DXY — their most bearish since October

- JPY (Japanese yen) net-longs reached another record high, though the weekly increase was marginal (+1.4k contracts)

- NZD (New Zealand dollar) net-shorts declined to their least bearish since November

- EUR (Euro dollar) net-longs among large speculators rose to the most bullish level since September

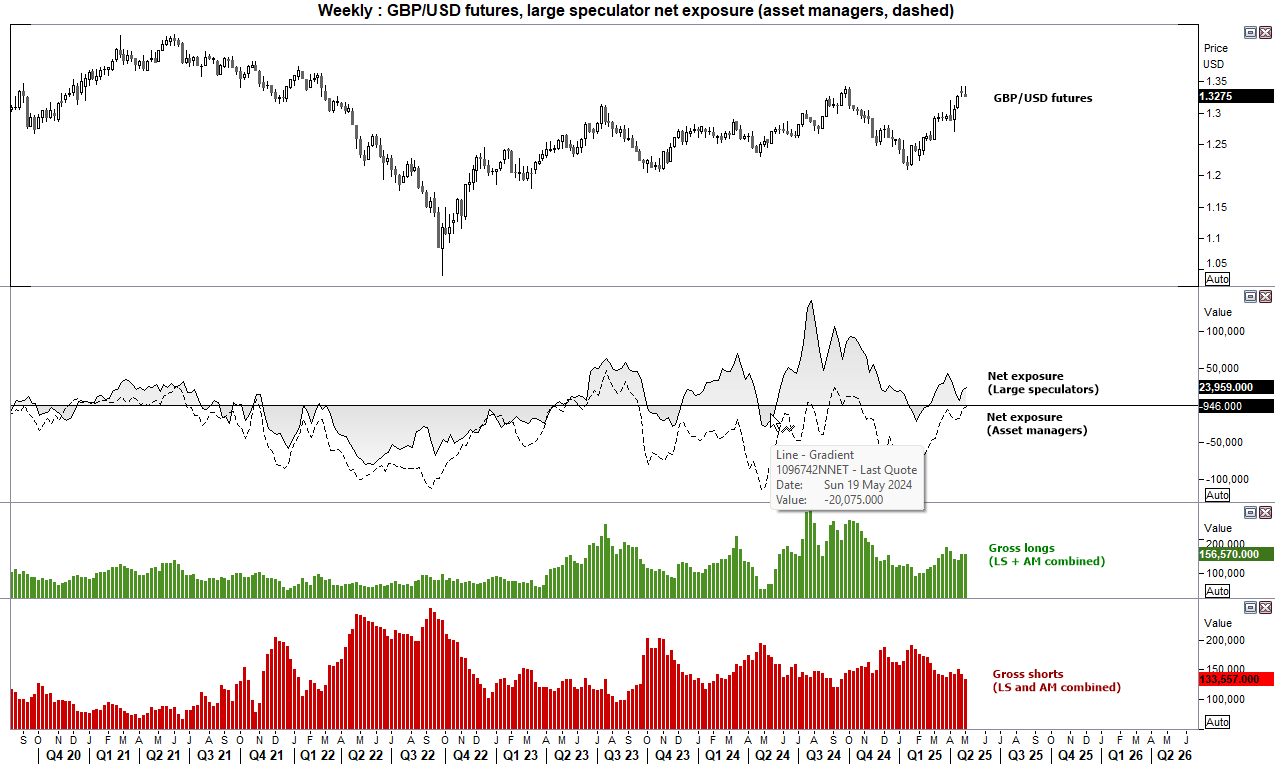

- GBP (British pound) net-shorts by asset managers narrowed to just -946 contracts, nearing a flip to net-long

- AUD (Australian dollar) net-shorts were reduced by 4.6k contracts, their least bearish in seven weeks

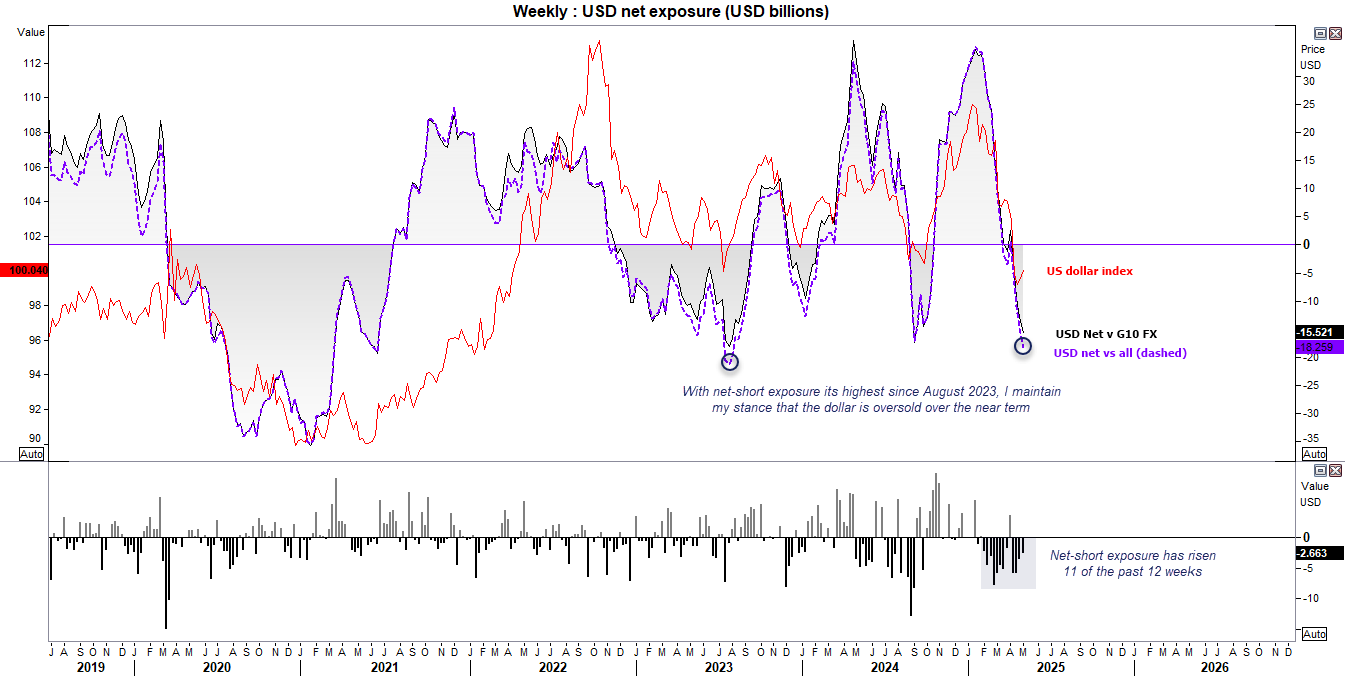

US Dollar (DXY) Positioning – IMM Futures Data

Futures traders are increasingly bearish on the US dollar, pushing net-short exposure to -18.3 billion, the highest since August 2023. Despite this, the US dollar index (DXY) actually rose last week, suggesting a growing divergence between positioning and price action.

While large speculators held a modest net-short of -449 contracts, this reflects a reduction in bearishness from the previous week. Asset managers, however, remain notably net-short at -3,000 contracts, their most bearish stance since October. This skewed sentiment, coupled with extended net-short trends, reinforces the view that the US dollar may be oversold in the near term.

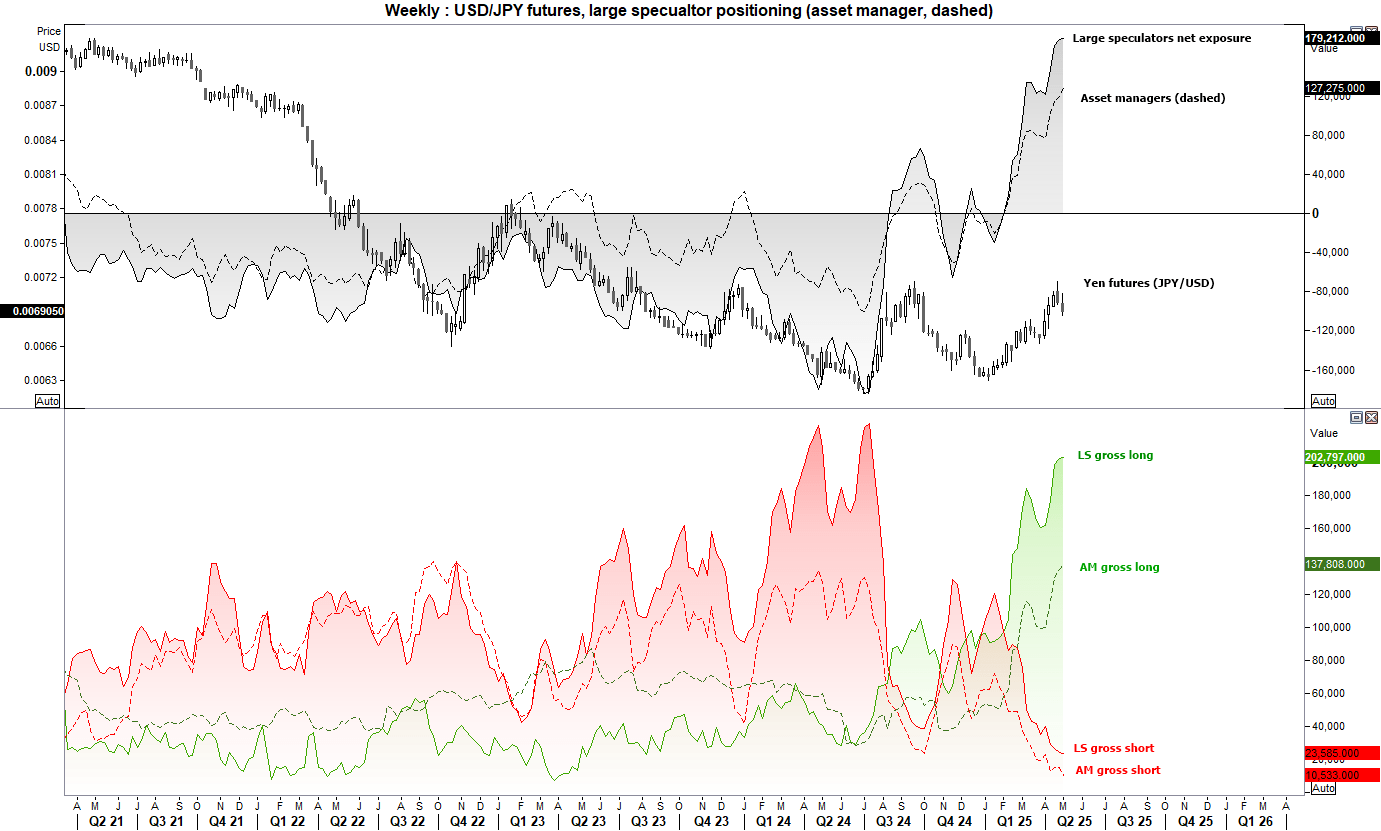

Japanese Yen (JPY/USD) Positioning – Sentiment Extreme: COT Report

Japanese yen futures positioning shows that large speculators have increased net-long exposure for a fourth consecutive week, setting another record high. Yet, despite this aggressive bullish positioning, the yen fell for a second straight week, indicating a growing sentiment dislocation.

In my view, the JPY is at a sentiment extreme. The Bank of Japan (BOJ) remains dovish and shows little urgency to hike rates, while the US dollar appears oversold. This sets the stage for a continued rebound in USD/JPY, and I favour fading JPY rallies — in other words, buying dips on USD/JPY.

British pound futures (GBP/USD) positioning – COT report:

GBP/USD looks set for a pullback, given the spinning top doji and shooting star reversal weekly candles, around the 2024 high. There are no signs of a sentiment extreme on GBP positioning, and while asset managers are on the cusp of flipping to net-long exposure, it has mainly been a function of short covering over bullish initiation.

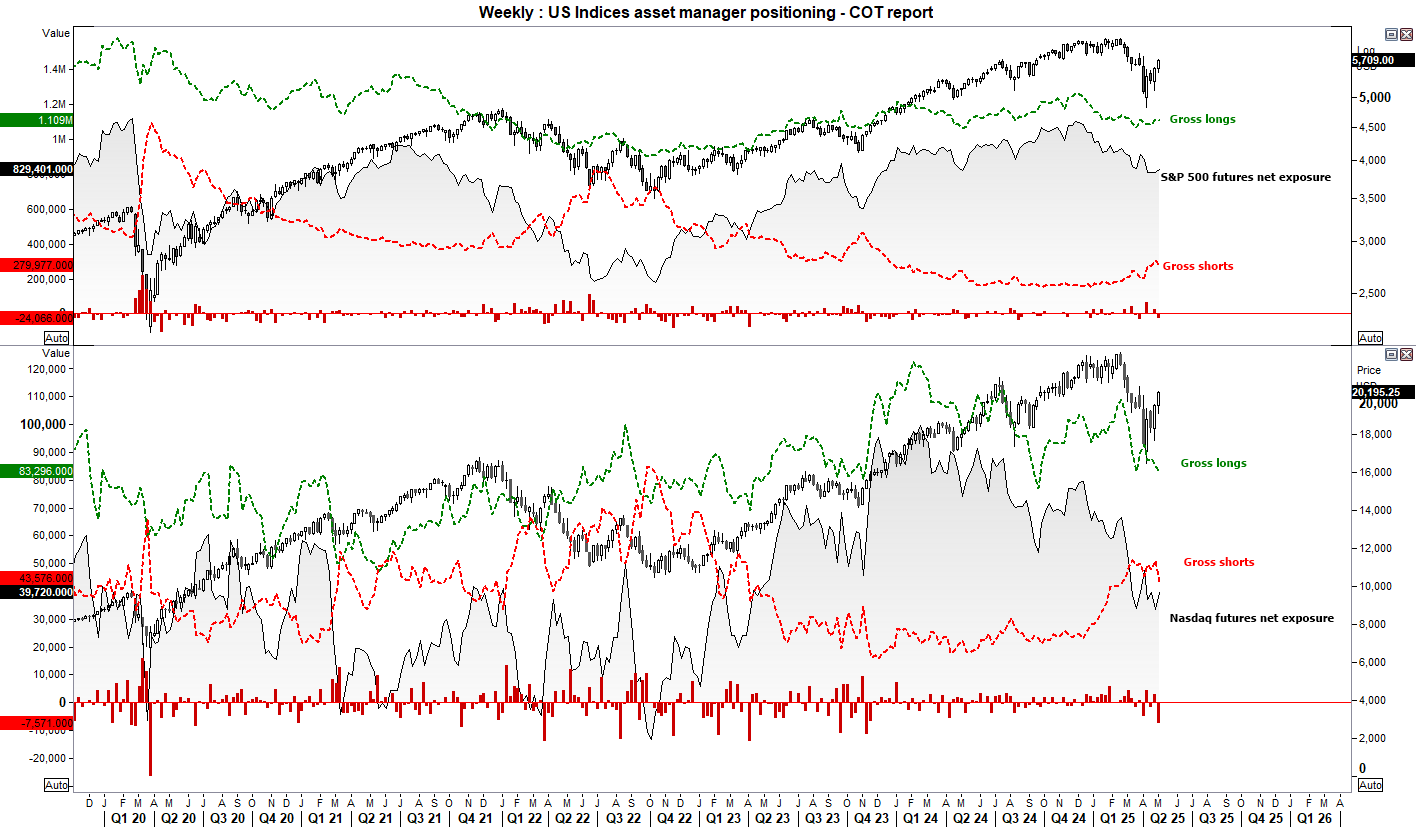

Wall Street indices (S&P 500, Dow Jones, Nasdaq 100) positioning – COT report:

I am coming around to the potential that we have seen the cycle lows in indices. Not only are prices rising, but we’ve seen a notable drop of gross-short exposure to Nasdaq 100 and S&P 500 futures. While longs are yet to perk up, I suspect we have seen the worst of President Trump’s trade war headlines, and that could bode well for risk and support the Nasdaq 100 and S&P 500.

Metals (gold, silver, copper) futures - COT report:

Gold futures fell for a second week, which suggests the much-needed correction is underway. Traders have been shying away from gold, with net-long exposure to gold falling since early February among large speculators and managed funds. And given in epic bullish rise, gold could still be overvalued over the near term. Still, should bulls be treated to a decent pullback, I am sure they will be very tempted to load up on longs once more.

Net-long exposure to silver futures was higher for a second week, though price action provides little confidence that silver will break to new highs soon. Especially since gold is seemingly in a retracement of its own.