- Rates and risk both driving USD/JPY again

- Trade talks in Switzerland the key event

- Strong link between yen and bitcoin, gold, stocks

- U.S. inflation, retail sales data also in focus

- Support at 145 and 144, resistance at 146.20

Summary

Interest rates matter again for the Japanese yen, joining risk aversion as the primary drivers of USD/JPY movements. While there is major economic data released in the United States this week—headlined by the inflation report for April—the main event will arrive before markets open with trade talks between the U.S. and China getting underway this weekend in Switzerland.

They may only be informal discussions, but for markets the outcome screens as binary: progress should result in immediate upside for USD/JPY, although the scope may be limited given this outcome is already favoured. What could really shake things up would be an outcome where no further dialogue between the two nations is forthcoming, carrying the potential to spark a sharp unwind of long USD/JPY positions.

Rates and Risk Drive USD/JPY Again

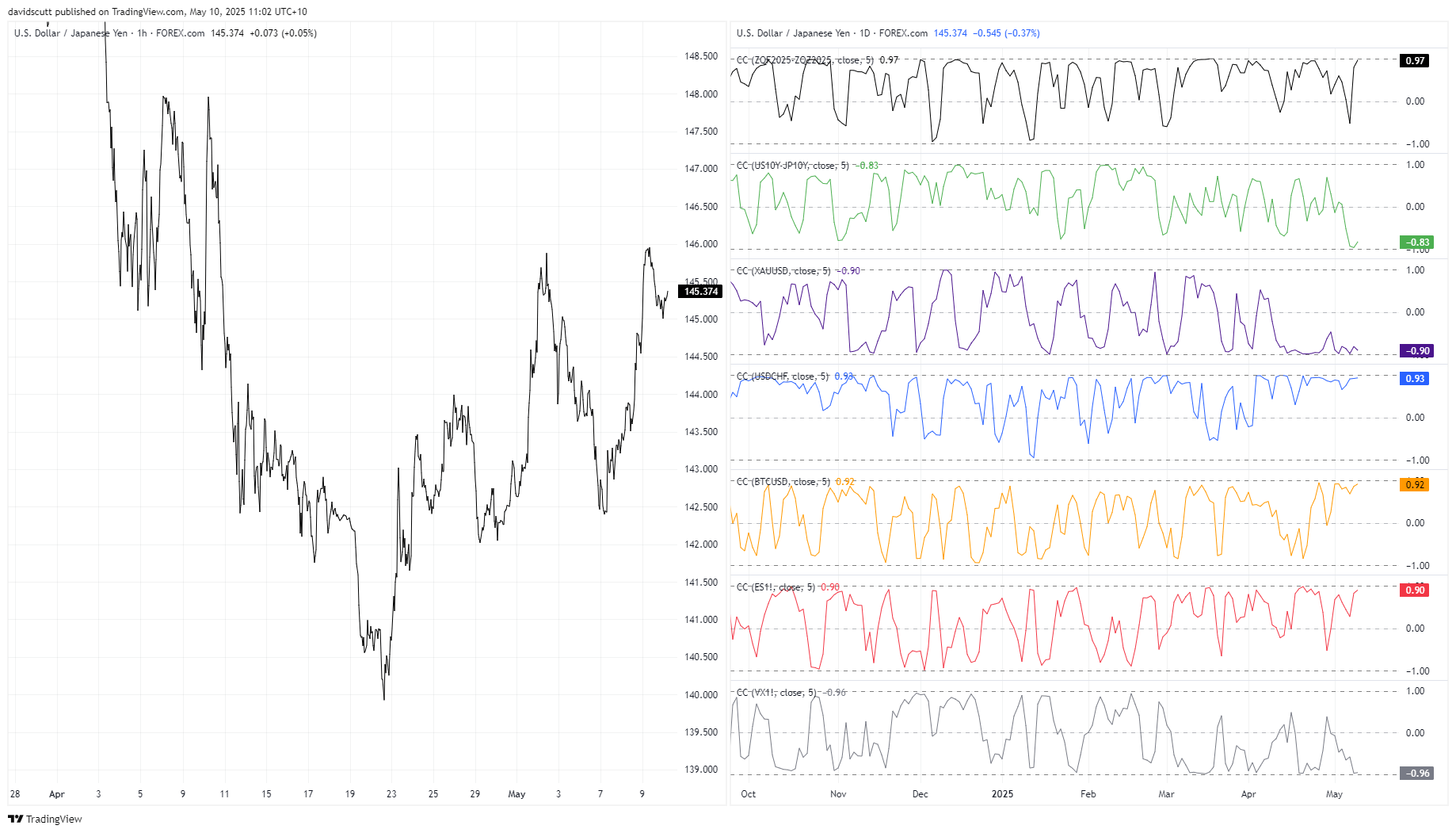

For the first time in around a month, interest rates matter again for the yen. That’s demonstrated below, looking at the rolling five-day correlation between USD/JPY and a variety of different market variables. The short timeframe has been selected to account for how rapidly sentiment swings have occurred since U.S. ‘Liberation Day’ in early April. From top to bottom in the right-hand pane, it shows the correlation coefficient with 2025 Fed rate cut pricing (black), 10-year yield spreads between the U.S. and Japan (green), gold (purple), USD/CHF (blue), bitcoin futures (yellow), S&P 500 futures (red), and VIX futures (grey).

Source: TradingView

It's remarkable just how strong the relationship was with every variable over the past week, with all but yield differentials sitting at an extreme levels. While that’s a continuation of the pattern seen throughout much of April with safe havens and riskier markets, the big change last week was the strengthening of the relationship with interest rates. That had been absent for several weeks, but the reversal of that trend suggests USD/JPY is not only being viewed as a risk asset but also a proxy for the U.S. economic outlook. When U.S. economic data impressed, USD/JPY rallied. When progress on trade talks was conveyed, USD/JPY rallied, explaining the scope of the rally seen late last week.

Trade Talks Major Binary Market Event

That trend is likely to extend into the new week, amplifying the importance of this weekend’s trade talks between the U.S. and China in Switzerland. The meeting is scheduled to take place on Saturday, meaning traders should have ample time to digest the headlines before markets open.

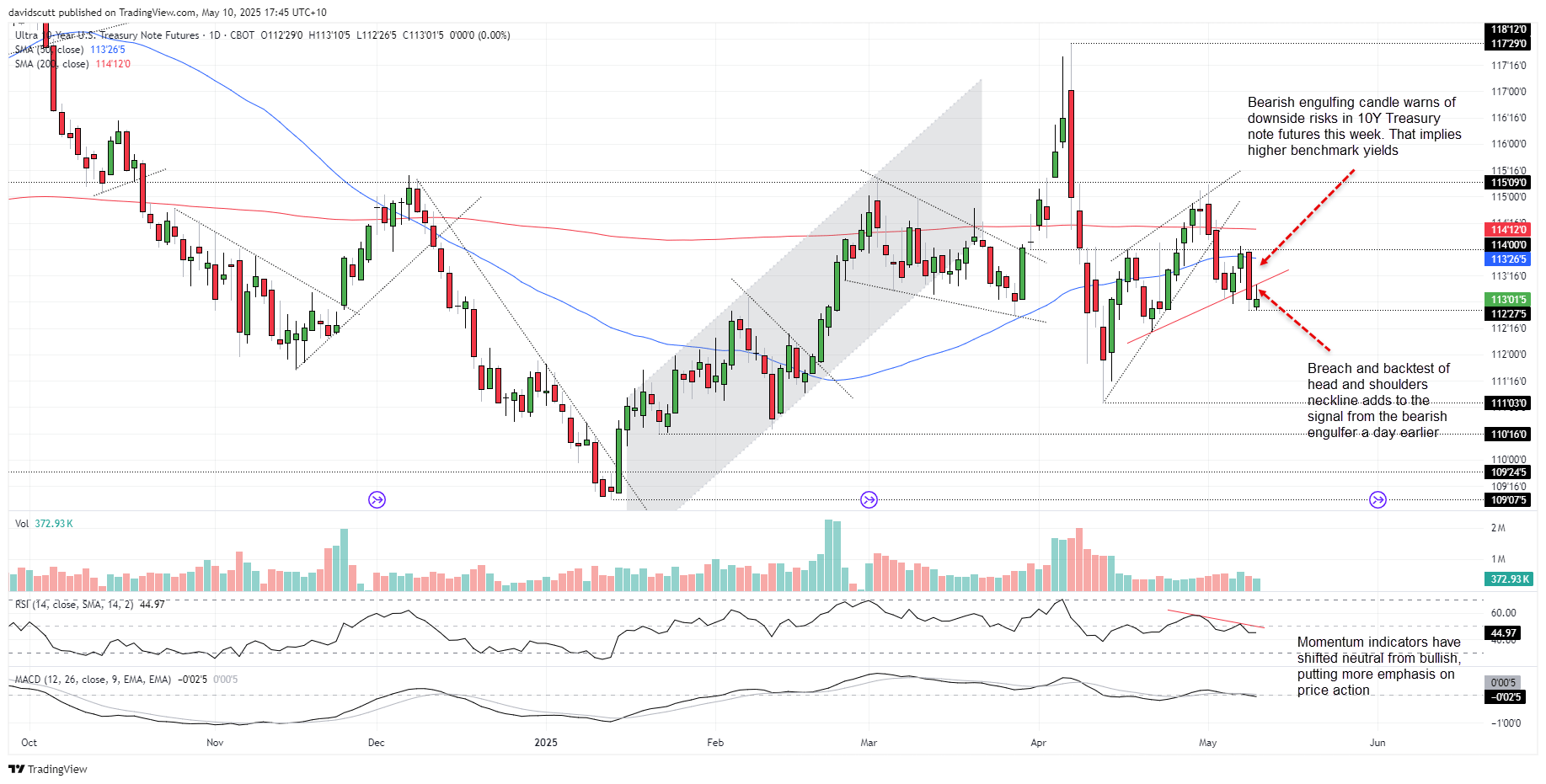

There’s little to say about the talks other than they’ll likely need to show progress and compromise to extend the USD/JPY bullish trend, especially with limited evidence of weekend hedging having taken place. There was little to no reversal of the big market moves earlier in the week on Friday, hinting a positive outcome is anticipated. Price and momentum signals from U.S. bond futures discussed on Friday also point to the likelihood of higher yields ahead—that’s a sure sign bond traders expect progress.

Source: TradingView

While that’s what’s expected, if the meeting ends in spectacular failure, it would amplify the probability of a sizeable risk rout in Asia on Monday. For clues as to how USD/JPY may perform, keep an eye on how crypto markets trade on Sunday. The direction they move could be instructive for USD/JPY given how strong the relationship with bitcoin futures was last week. It’s also likely markets will put far greater weight on perceptions from the U.S. delegation given comments from the Chinese side have often been overlooked since Liberation Day.

U.S. inflation, retail sales data also in focus

Source: Refinitiv

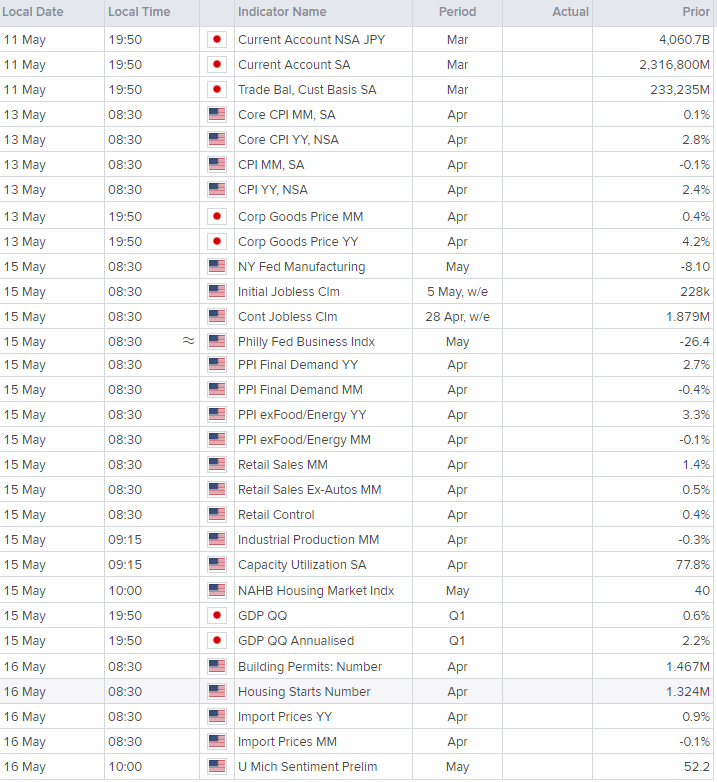

While the trade meeting is the key binary event for the week, the economic calendar is busy in the United States with the main events being inflation data on Tuesday, followed by producer price inflation and retail sales figures on Thursday. Honestly, the importance of these numbers is diminished somewhat given the rapidly changing macroeconomic backdrop. The inflation data may show evidence of higher tariffs flowing through to consumer prices, but nobody knows how long and high the tariffs will remain in place on trade partners. Another soft outcome, as seen in March, would provide flexibility to the Federal Reserve to begin lowering rates even before signs of an economic slowdown emerge—albeit at the margin.

The key figures to watch within the inflation report will be core services prices ex-shelter and energy, and goods prices given they are the ones subject to tariffs further up the supply chain. More broadly, the core rate is seen accelerating to 0.3% in April, up from 0.1% in March. As for the retail sales report for April, it will likely be a mess—initially subjected to the tariffs announced on Liberation Day, which were then subsequently paused for 90 days less than two weeks later. What that did to consumer demand is anyone’s guess. A 0.1% gain is forecast, with sales excluding autos seen rising by a larger 0.3%.

Outside those events, the only release that carries the ability to generate meaningful volatility is jobless claims on Thursday. It’s the nearest thing markets have to a real-time indicator on actual economic activity, making it important in uncertain times like these. Data elsewhere—including the initial read of Japan’s Q1 GDP—screens as either extremely old news and/or irrelevant. I don’t want to waste your time trying to portray something as important when it’s not. Sorry not sorry.

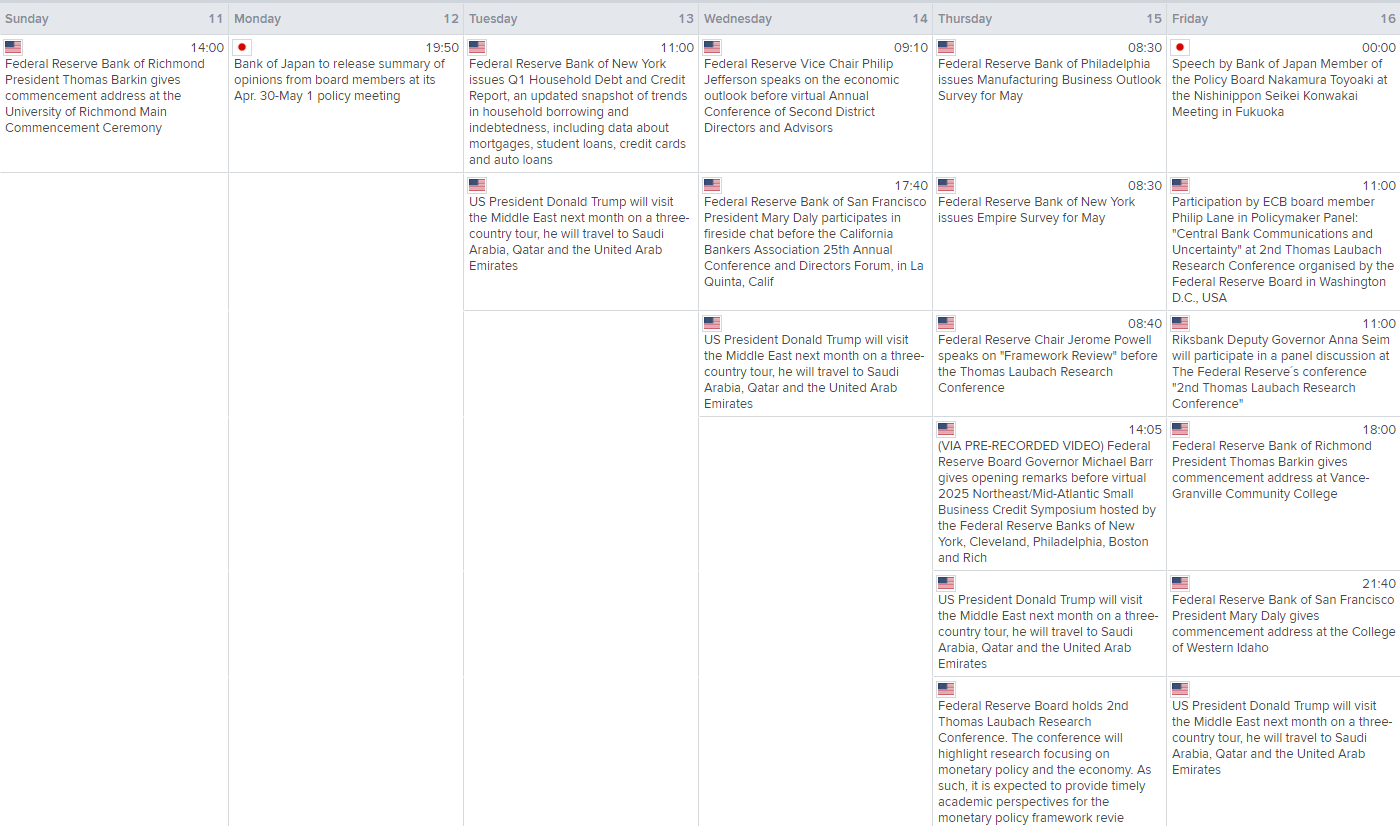

Limited Risk From Fedspeak

Aside from the data calendar, there will also be a smattering of Fed speakers throughout the week, although it’s questionable whether they’ll be able to add much to the discussion on the rates outlook other than they stand ready to support the economy when needed. Remarks following the inflation print on Tuesday may be of interest, but really it comes down to tariff policy to drive monetary policy right now.

Source: Refinitiv

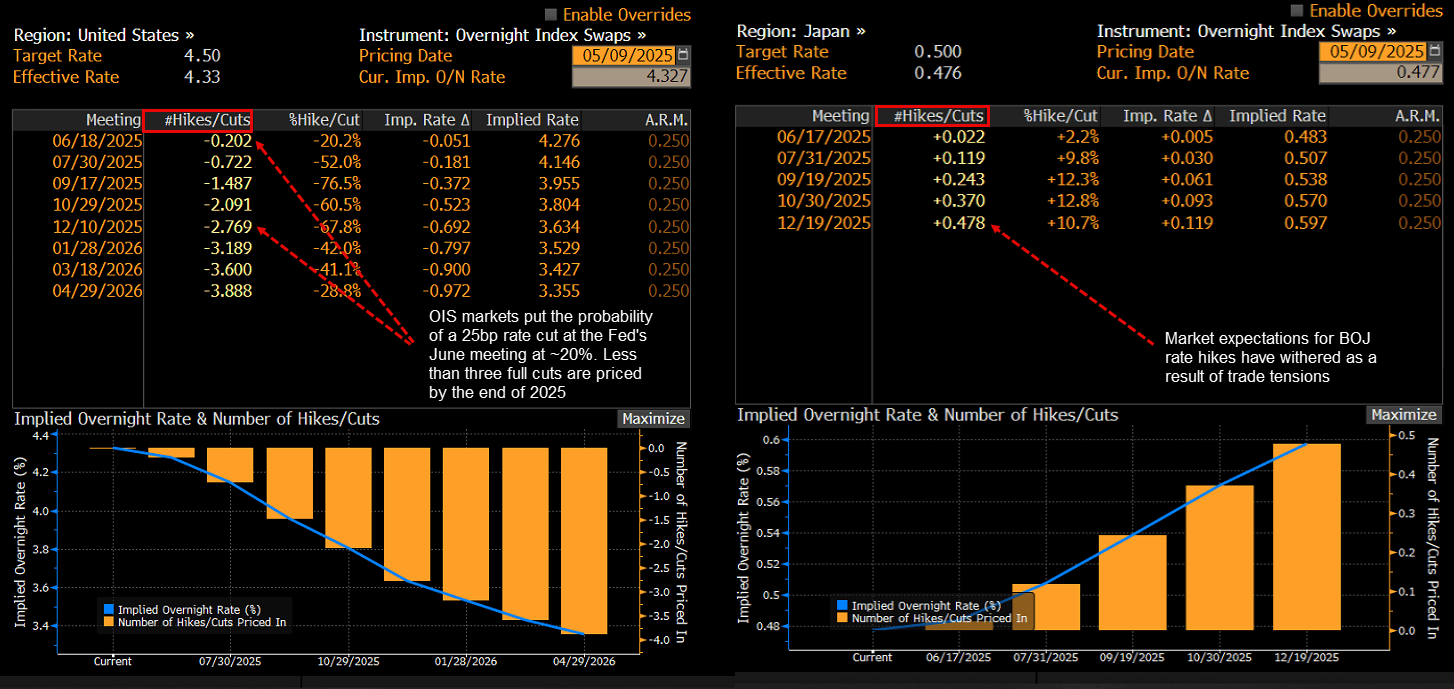

Trade Negotiations Key for Fed, BOJ Rate Pricing

Source: Bloomberg

Heading into the week, rates traders are not fully pricing a Fed rate cut until September, although a 25bp cut in July is deemed a strong possibility. By the end of 2025, less than 70bps of cuts are priced—or less than three 25-pointers. Fed pricing screens as fair around these levels, assuming a worst-case trade scenario can be avoided. As for the Bank of Japan (BoJ), just 12bps of hikes are priced by year-end. That’s far less than the 30bps of hikes that were priced in late March. If not for the trade tensions, the BoJ would likely be readying to hike again. That means if trade barriers are reduced, the prospect of renewed tightening may limit USD/JPY upside.

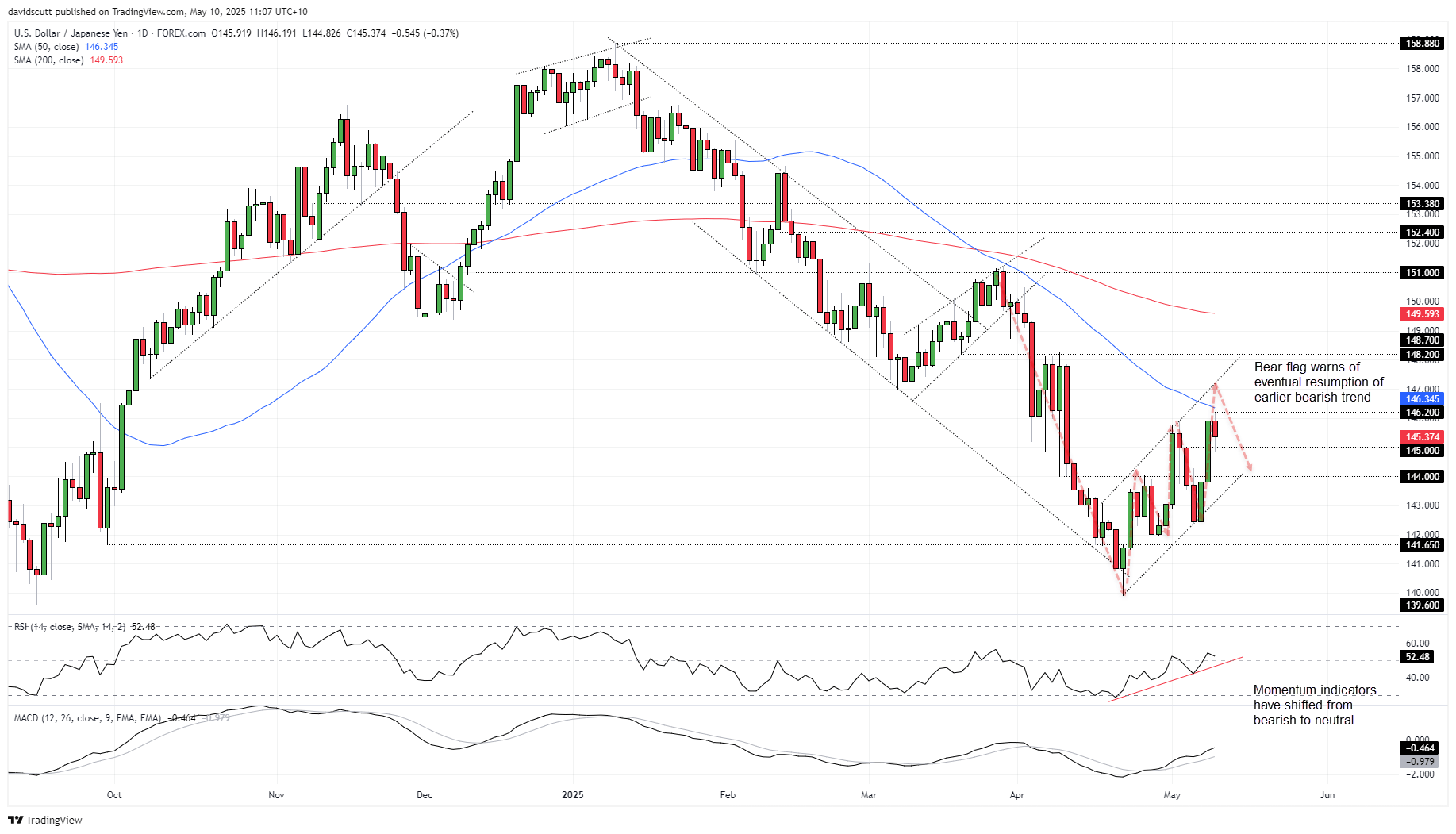

USD/JPY Bias Shifts Neutral

Source: TradingView

The near-term bias for USD/JPY is now neutral following the bullish move over the past few weeks. Yes, the price has been trending higher, but it’s sitting in what looks to be a bear flag—a continuation pattern that points to an eventual resumption of the broader bearish trend. Momentum indicators validate the neutral stance, with RSI (14) and MACD trending higher but yet to shift into outright bullish territory. Put more weight on price signals in this environment.

Support levels include 145, 144 and 141.65. Resistance is found at 146.20, the 50-day moving average, and 148.20.

-- Written by David Scutt

Follow David on Twitter @scutty