- USD/JPY rising with bitcoin, S&P 500

- Yen correlations to gold, franc fading

- Fed seen on hold, little guidance expected

- U.S. data and trade headlines key risks

- Technicals favour upside above 144.00

Summary

USD/JPY has become more reactive to swings in risk appetite, with strong correlations emerging between the pair and assets like bitcoin and S&P 500 futures. That stands in contrast to the limited influence of Fed rate expectations and Treasury yields, suggesting risk sentiment may matter more than monetary policy this week. With Powell unlikely to offer much forward guidance at the May FOMC, traders should watch U.S. data and trade headlines closely. Meanwhile, a strong technical breakout above 144.00 keeps upside risks intact heading into a quiet calendar.

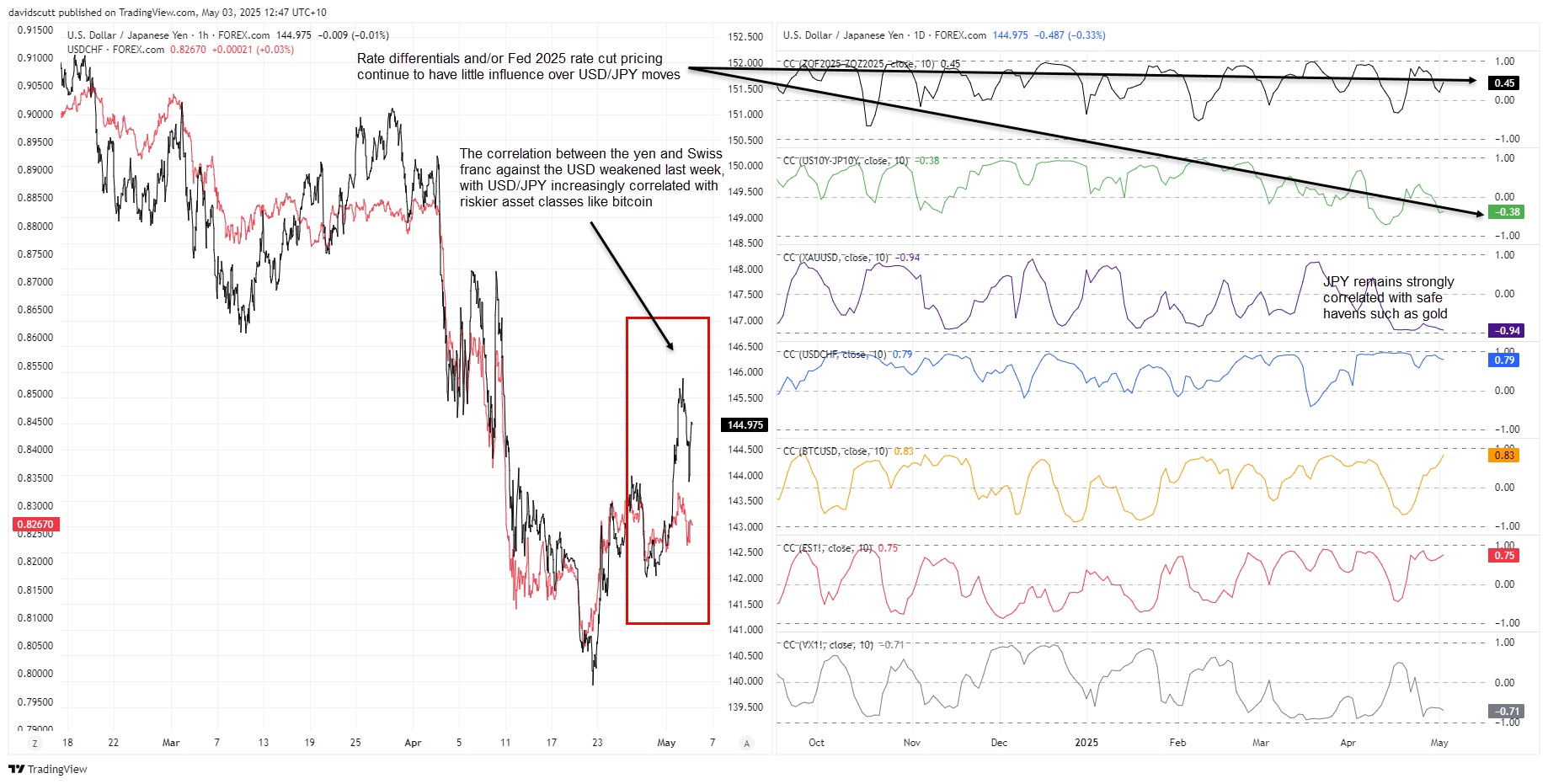

Yen trades more like a risk proxy

USD/JPY has become increasingly correlated with riskier asset classes over the past fortnight, recording correlation coefficients with bitcoin and S&P 500 futures (yellow and red, respectively) of 0.83 and 0.75. While the yen remains strongly correlated with safe havens such as the Swiss franc (blue) and gold (purple) against the U.S. dollar—logging scores of 0.94 and 0.79, respectively—its relationship with the latter weakened over the past week, as shown in the left-hand pane below.

Source: TradingView

While the franc continues to behave more as an outright safe haven, weakening only marginally, USD/JPY has been far more reactive to shifts in risk appetite. That means the performance of riskier assets next week may prove more influential on USD/JPY than movements in other asset classes.

Data and headlines may drive direction

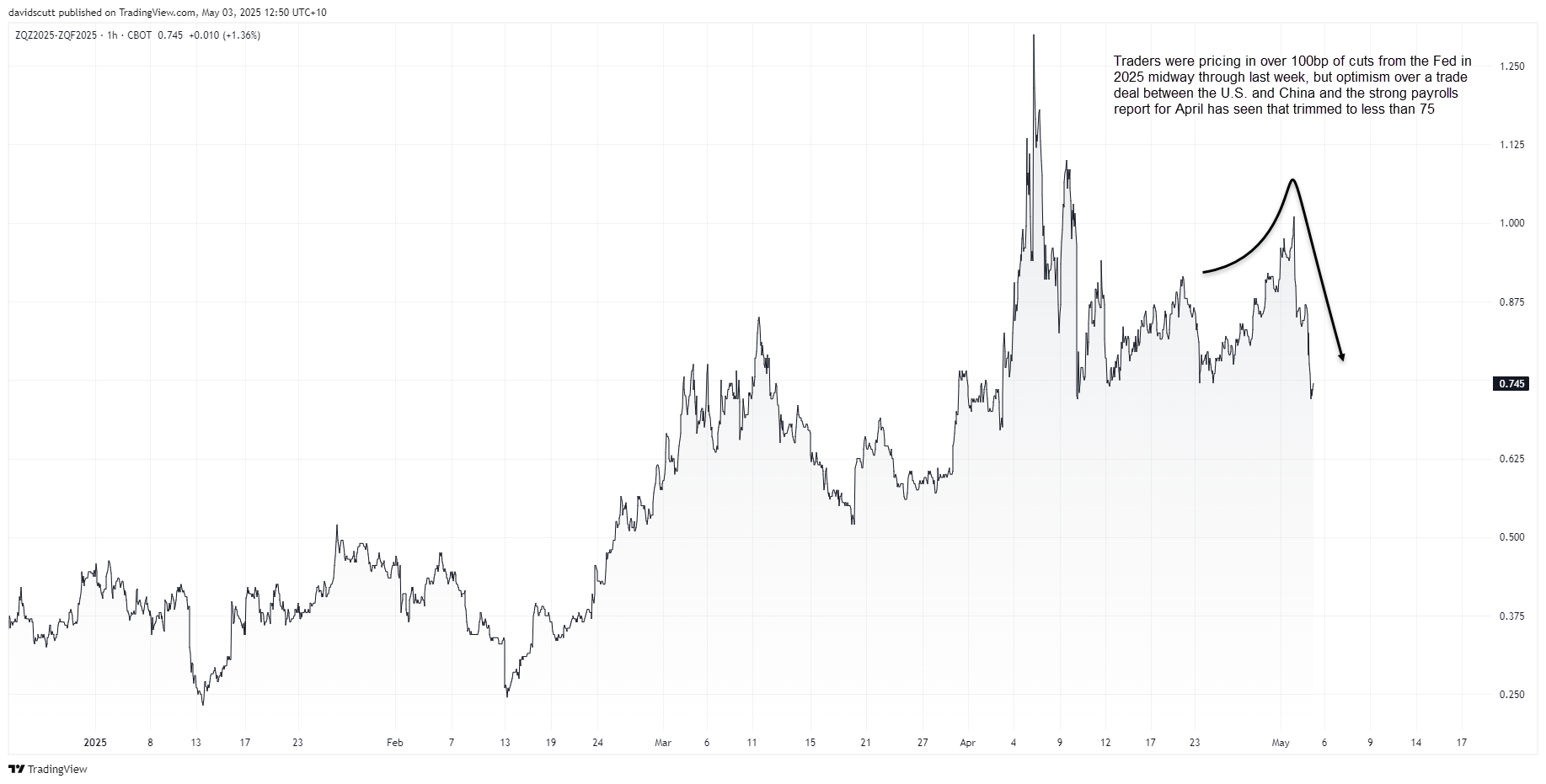

Underlining that point, interest rate differentials, Fed rate cut pricing and outright moves in U.S. Treasury yields continue to show little to no relationship with the yen. That suggests the Federal Reserve’s May interest rate decision may not be the key risk event for USD/JPY traders this week. Instead, headlines relating to trade negotiations between the U.S. and other major economies, along with any fresh information on the health of the U.S. economy, could carry more weight when it comes to directional risks.

Powell unlikely to shift market view

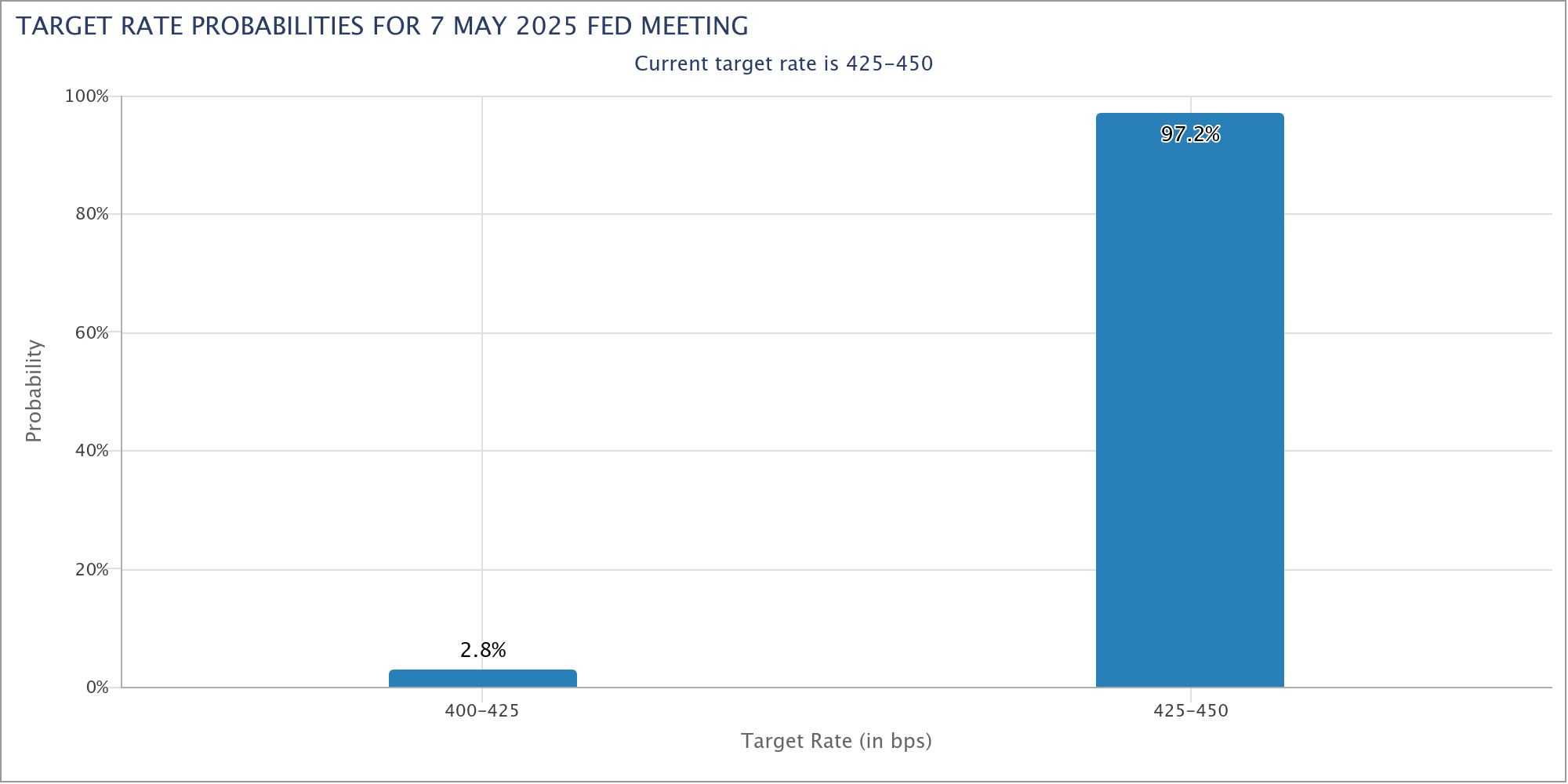

Source: CME

Heading into the May FOMC meeting, markets expect the Fed will keep the funds rate unchanged at 4.25–4.50%, assigning only a 2.8% probability to a 25bp cut. Across 2025, around 75bp of cuts remain priced in, implying three 25bp reductions will be delivered.

Source: TradingView

As this meeting will not include updated economic or year-end rate projections, the statement and Chair Jerome Powell’s press conference will carry extra influence over market pricing.

In the statement, the prior assessment that economic activity had “continued to expand at a solid pace” will likely be revised given the negative Q1 GDP result—though that should be expected. Unemployment remains “low” and labour market conditions “solid”, so those views are unlikely to change. Inflation was described as “somewhat elevated” at the last meeting. While the latest PCE report was very weak, Powell has recently stressed the FOMC does not like to revise its outlook based on a single data point. If that line of thinking holds, this assessment may also remain unchanged.

Given the high degree of uncertainty, Powell is unlikely to offer much clarity on the future path for interest rates, instead repeating that the Fed is well positioned to wait for greater clarity before making any adjustments. Watch closely to see whether he maintains the view that progress towards achieving the dual mandate of full employment and price stability has stalled—that will be important. Other FOMC members will have their say on Friday, with a raft of Fedspeak to end the week.

Source: Refinitiv

Watch ISM and jobless claims closely

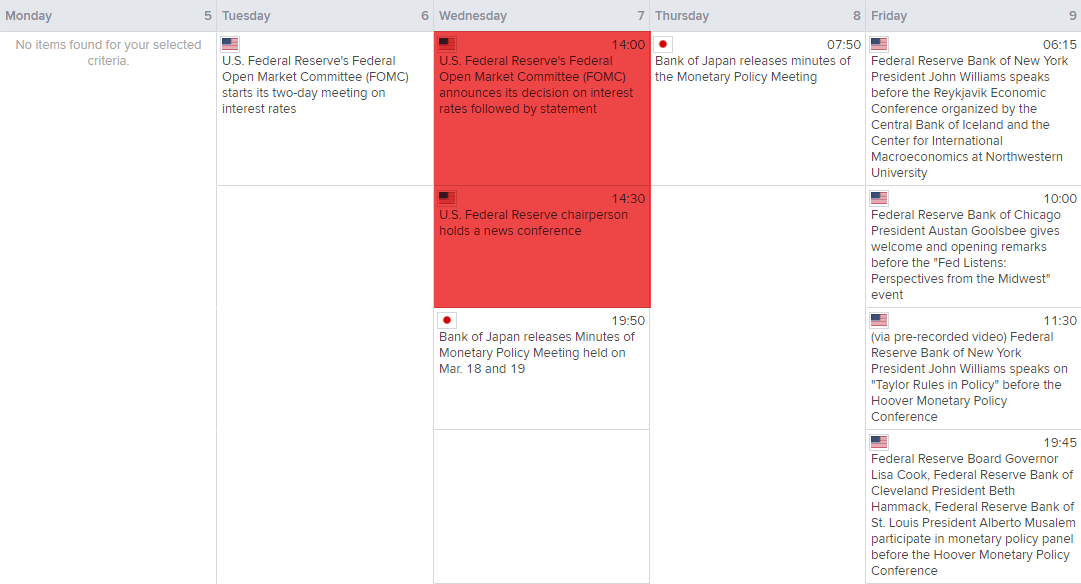

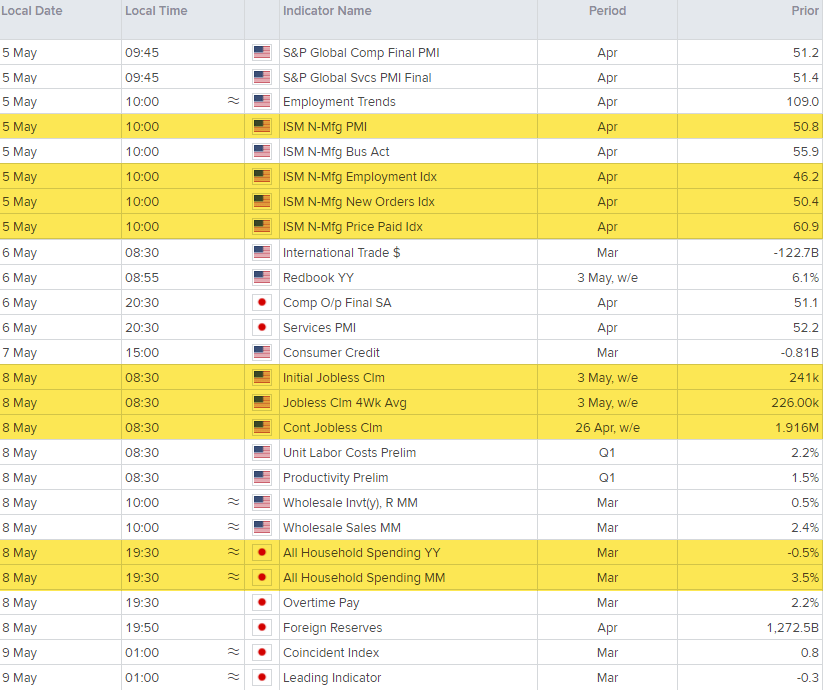

Besides the Fed, the events calendar is fairly sparse, especially when it comes to hard economic data, which is now far more influential for markets than soft sentiment surveys. Data with potential to move USD/JPY has been highlighted in yellow.

Source: Refinitiv

Even though it's soft data, the ISM services PMI remains market-moving. But unless it reveals undeniable weakness across the largest and most important sector in the U.S. economy, its influence may be fleeting. Watch the prices paid, new orders, and employment subindices—they’ll be closely scrutinised. While trade policy remains a hot topic, the U.S. trade data for March offers little signal, distorted by front-loaded demand ahead of Liberation Day.

Of all releases, weekly jobless claims on Thursday loom as particularly important—especially after a sharp increase last week. We've seen plenty of one-off jumps in claims recently, but never back-to-back. If we do this time, it could amplify concerns about a potential U.S. recession and weigh on riskier asset classes.

Following the Bank of Japan’s downgrade to its GDP growth forecasts last week, Japan’s household spending data may generate volatility given it accounts for more than 50% of the economy. Japanese markets will be closed Monday for a public holiday.

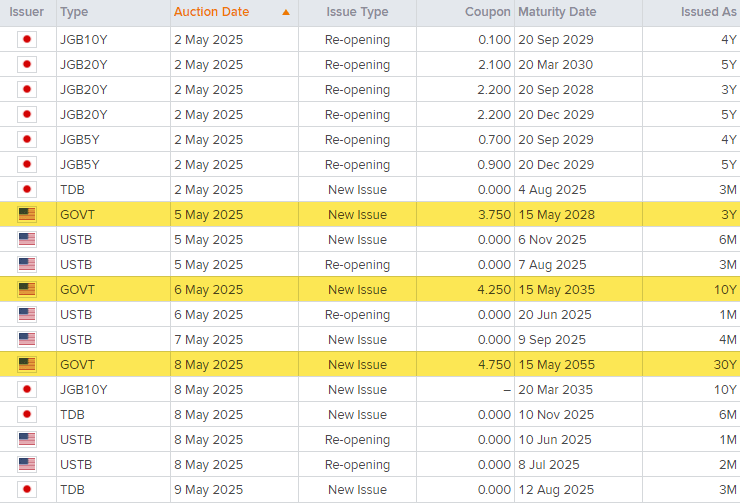

U.S. bond auctions another wildcard

Source: Refinitiv

While they can be hit and miss in terms of market impact, traders should be aware the U.S. Treasury will auction new three-, 10-, and 30-year debt this week. It’ll be a big test of foreign demand following recent volatility. Indirect bids and allocations will be watched closely, as they serve as a loose proxy for foreign investor interest.

In recent auctions, indirect allocations were near or at record highs, fuelling speculation the auctions were being used by the Trump Administration as leverage in trade negotiations—along the lines of “buy our bonds and we may lower our tariffs.”

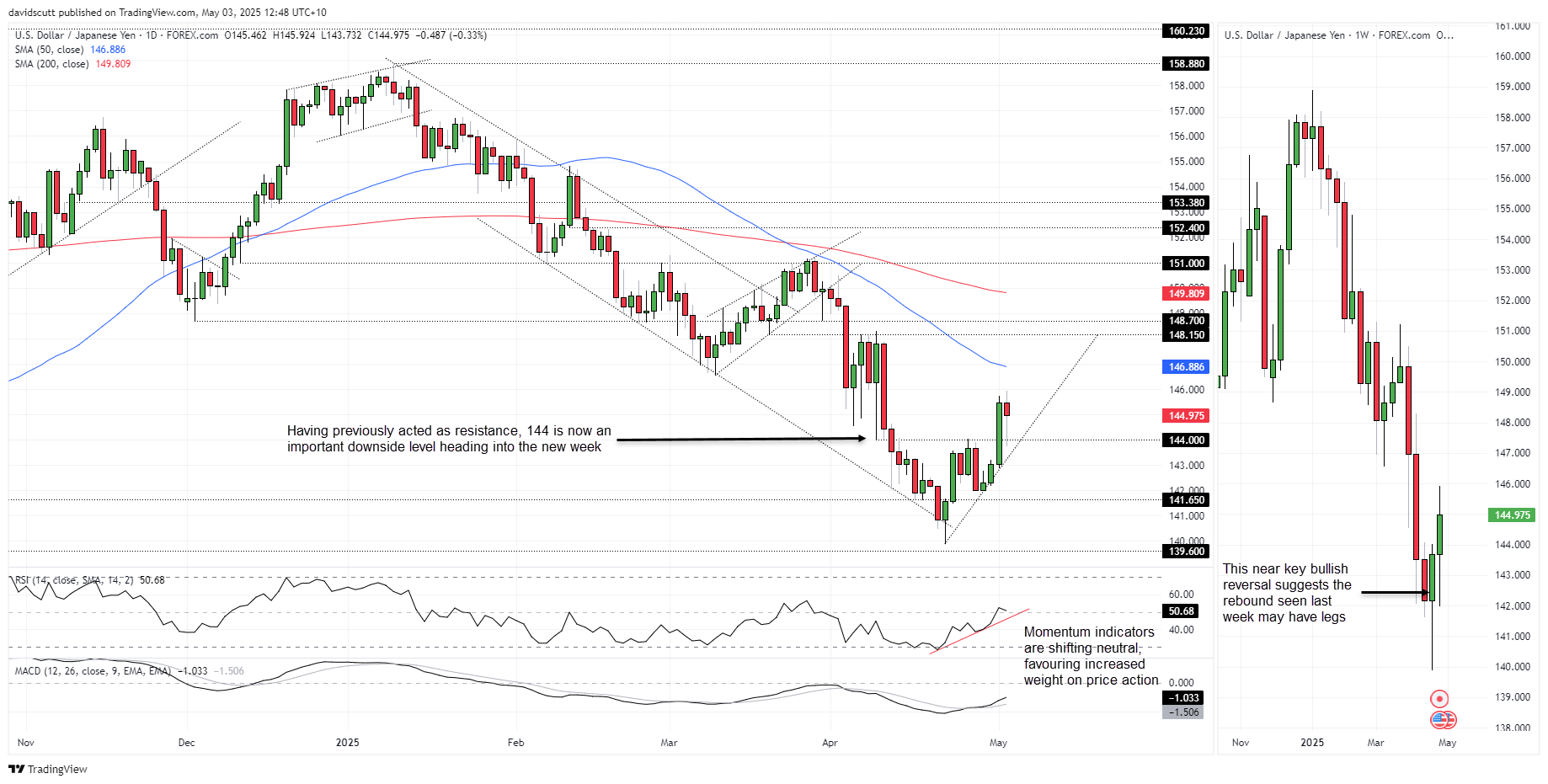

Breakout above 144.00 keeps upside in play

Source: TradingView

The upside risks flagged in last week’s USD/JPY outlook ultimately materialised, triggering a powerful move back above resistance at 144.00 on Thursday. The bullish break and successful back-test of the level on Friday suggest directional risks remain skewed higher into the new week, especially with momentum indicators such as RSI (14) and MACD turning neutral after a prolonged period of downside pressure.

On the topside, Friday’s high at 145.90 is the first level of interest, followed by the 50-day moving average. A more pronounced resistance zone is located between 148.15 and 148.70. Beneath 144.00, the uptrend from the April swing lows, along with 141.65, are levels to watch.

-- Written by David Scutt

Follow David on Twitter @scutty