- USD/JPY bearish signals strengthening

- Yen acting as a haven, not tracking U.S. yields

- Correlation with gold, CHF and VIX highlights risk-off flows

- Tokyo CPI, U.S. consumption data next key macro catalysts

- Bond shifts, trade headlines amplify headline risk

Summary

Donald Trump’s decision to revive trade tensions on Friday heaped further pressure on the U.S. dollar, reflecting the view that tariffs will negatively impact the U.S. economy far more than other nations. Combined with existing concerns regarding the U.S. fiscal trajectory, it created an environment that favoured safe havens like the Japanese yen.

While a backflip from Trump on threats made to the E.U., Apple and Samsung is likely given prior form, the difficulty lies in predicting when it will occur. Regardless, the constant state of unpredictability undermines the dollar fundamentally, amplifying recession fears. With technicals firmly in the bearish camp, it suggests USD/JPY remains a sell-on-rallies play for now.

Yen a Barometer of Risk Appetite

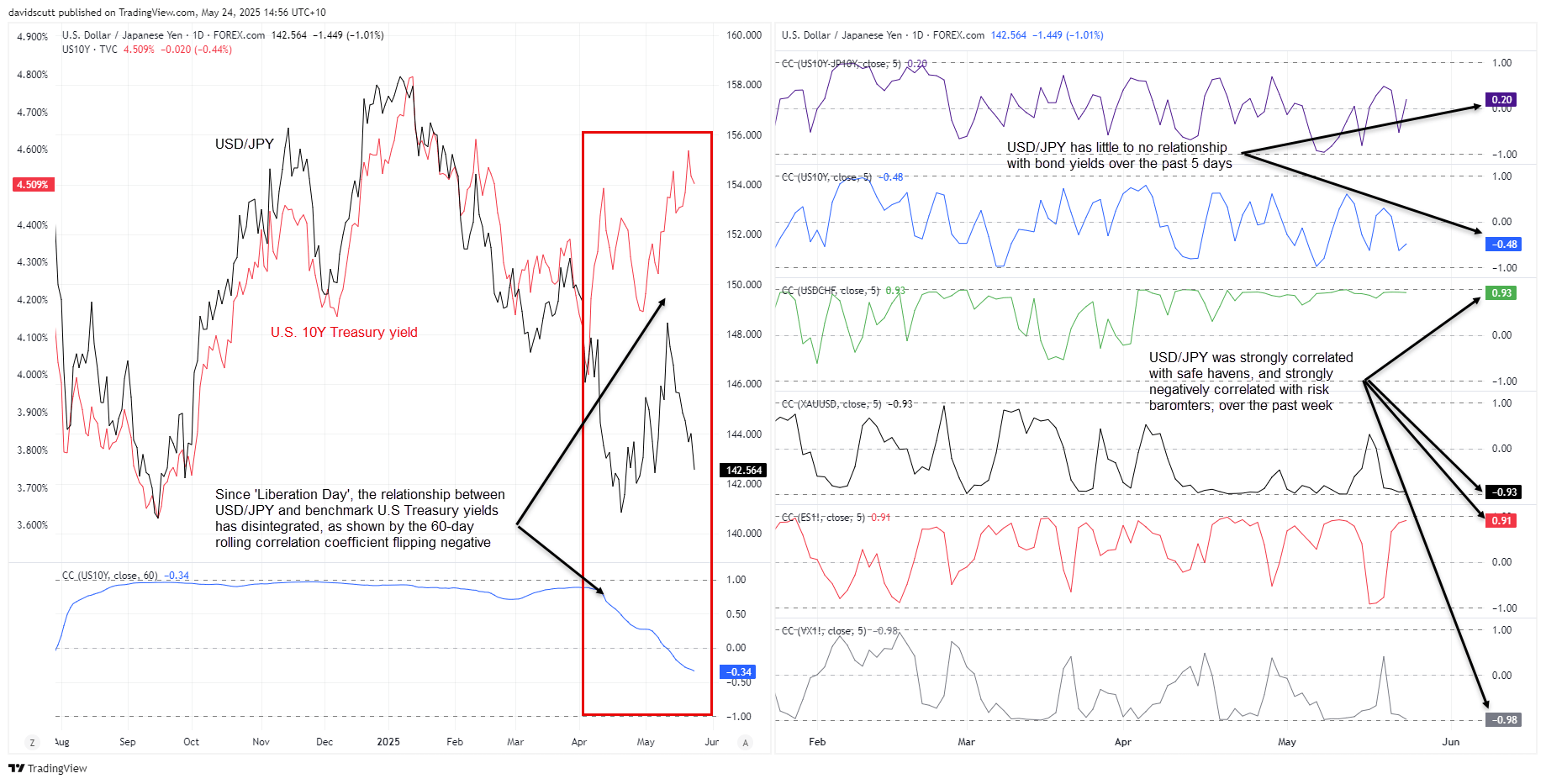

The days of USD/JPY moving in lockstep with U.S. Treasury yields are over—at least for now—replaced by the yen continuing to behave like a barometer of broader risk appetite.

Source: TradingView

The rolling five-day correlation coefficient scores below underline that point, with its relationship with 10-year U.S. Treasury yields and spreads with Japanese equivalent bonds insignificant over the past week. In comparison, scores of 0.93 apiece with gold and the Swiss franc against the U.S. dollar suggest it’s behaving like a haven—a view bolstered by the near-perfect relationship with U.S. S&P 500 futures over the same period. At -0.98 with VIX futures, it hints that carry trades funded by the yen are being pressured by spikes in volatility and rising Japanese yields.

U.S. Bond Rout in Focus

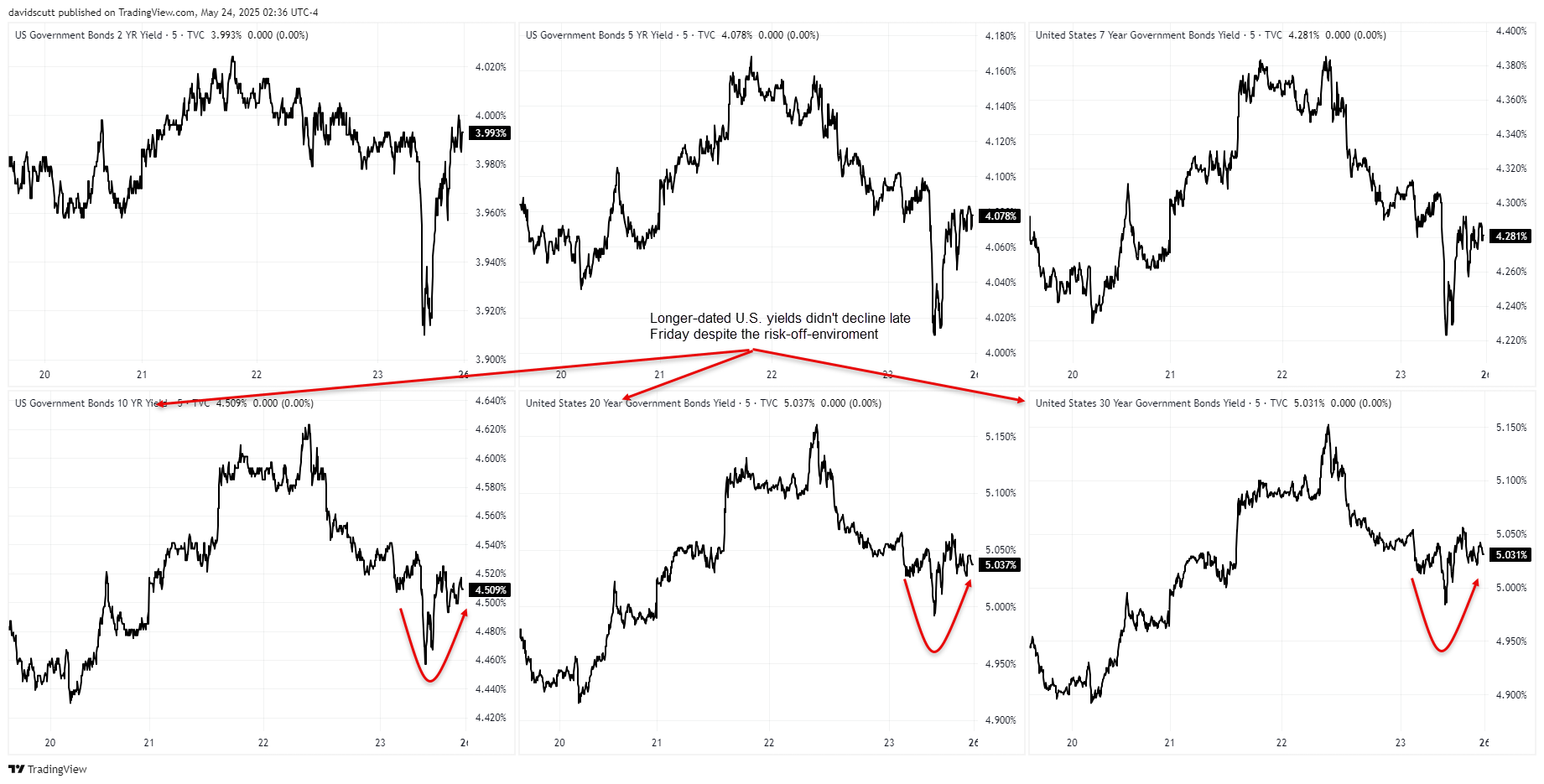

If the week ahead resembles the last, USD/JPY traders should keep an eye on movements in U.S. long bond yields, especially with the U.S. dollar index (DXY) maintaining a relatively strong inverse relationship with them in recent weeks. The somewhat unusual development suggests that rather than being seen as a reason to buy Treasuries, higher yields are now viewed as a sign of eroding confidence in the longer-term U.S. budget position. That was seen again on Friday with longer-dated Treasury yields closing well off their session lows despite the risk-off environment, suggesting they no longer carry strong safe haven appeal.

Source: TradingView

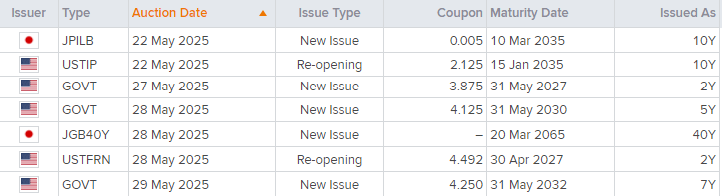

There are fresh auctions of two, five and seven-year Treasuries on the docket this week, along with a top-up of 10-year Treasury Inflation-Protected Securities (TIPS). Even though they’re not long-dated securities, they will provide additional information on investor demand, including from offshore. Japan will also offer a new line of 40-year ultra-long bonds, providing a litmus test of demand following a poor 20-year auction last week.

Source: Refinitiv

Traders need to be mindful that we’re closing in on month-end, posing the risk that portfolio rebalancing flows may provide modest tailwinds for long bonds given how far they’ve sold off. It’s not guaranteed, but it may slightly aid the dollar. Combined with the risk of a tariff backflip from Trump and the possibility of further trade deal agreements being reached, substantial downside for USD/JPY may be hard won in the absence of a major risk-off event.

Economic Data Takes a Backseat

Even though economic data in this volatile environment is arguably useless for accurate signals, it’s clear markets still react to it—evident in what was seen earlier this month.

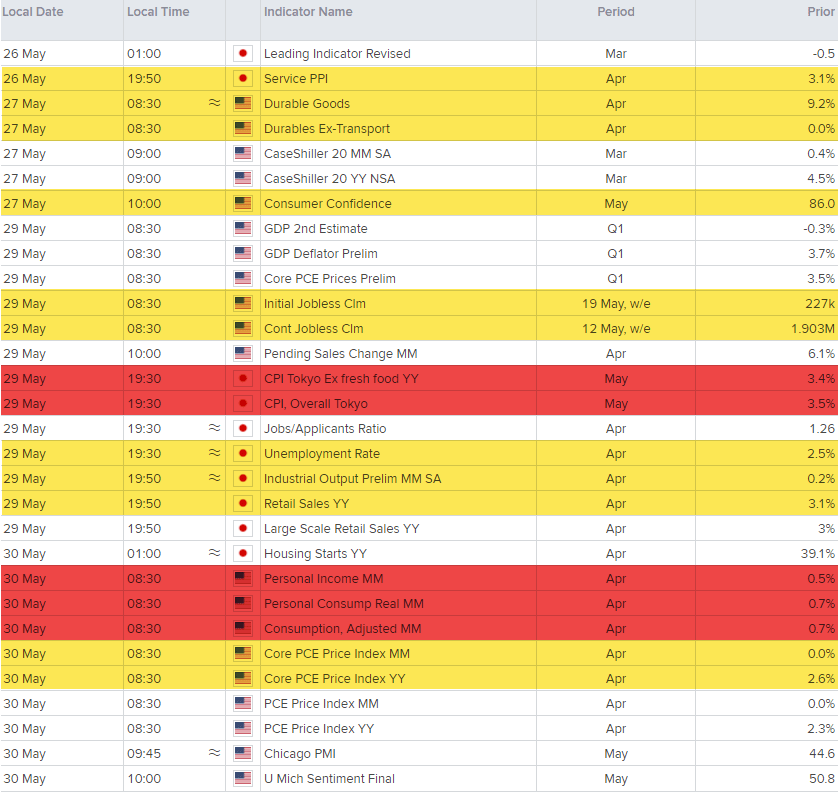

The economic calendar for the U.S. and Japan is shown below, noting the U.S. will be off Monday for the Memorial Day Holiday. Events highlighted in red are deemed high importance, with those in yellow carrying the potential to generate volatility.

Source: Refinitiv (U.S. EDT)

Not everyone will be familiar with the Tokyo consumer price inflation (CPI) report, but it’s arguably the most important release following another upside surprise in the nationwide survey in April. While it only covers the capital, the report is for May, providing a lead indicator on what may be seen nationally. Elsewhere, U.S. consumption and income data will offer insight into how consumers responded post-Liberation Day in early April. Weakness will fan recession fears.

The Fed’s preferred inflation measure—the core PCE deflator—is unlikely to deliver major volatility given how accurately forecasters now track it, and elevated uncertainty around how much and when higher import tariffs impact the data.

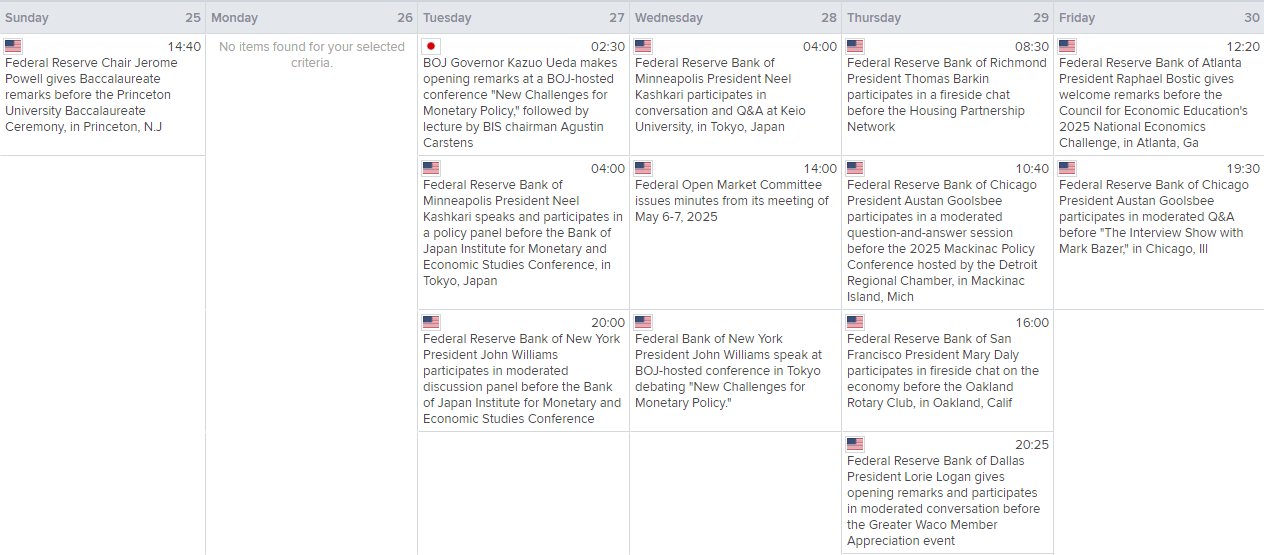

Source: Refinitiv (U.S. EDT)

The Fed speakers’ calendar is steady but unlikely to generate major volatility unless multiple members break from the prevailing view that the FOMC can be patient with policy adjustments. It’s far more likely that when a pivot comes, it will lean dovish—but nailing down the timing is extremely difficult without clarity on the economic outlook.

Bank of Japan Governor Ueda speaks on Tuesday. With last Friday’s hot inflation report still fresh in the minds of traders, watch for commentary hinting at a resumption of policy tightening.

USD/JPY: Bears in Control

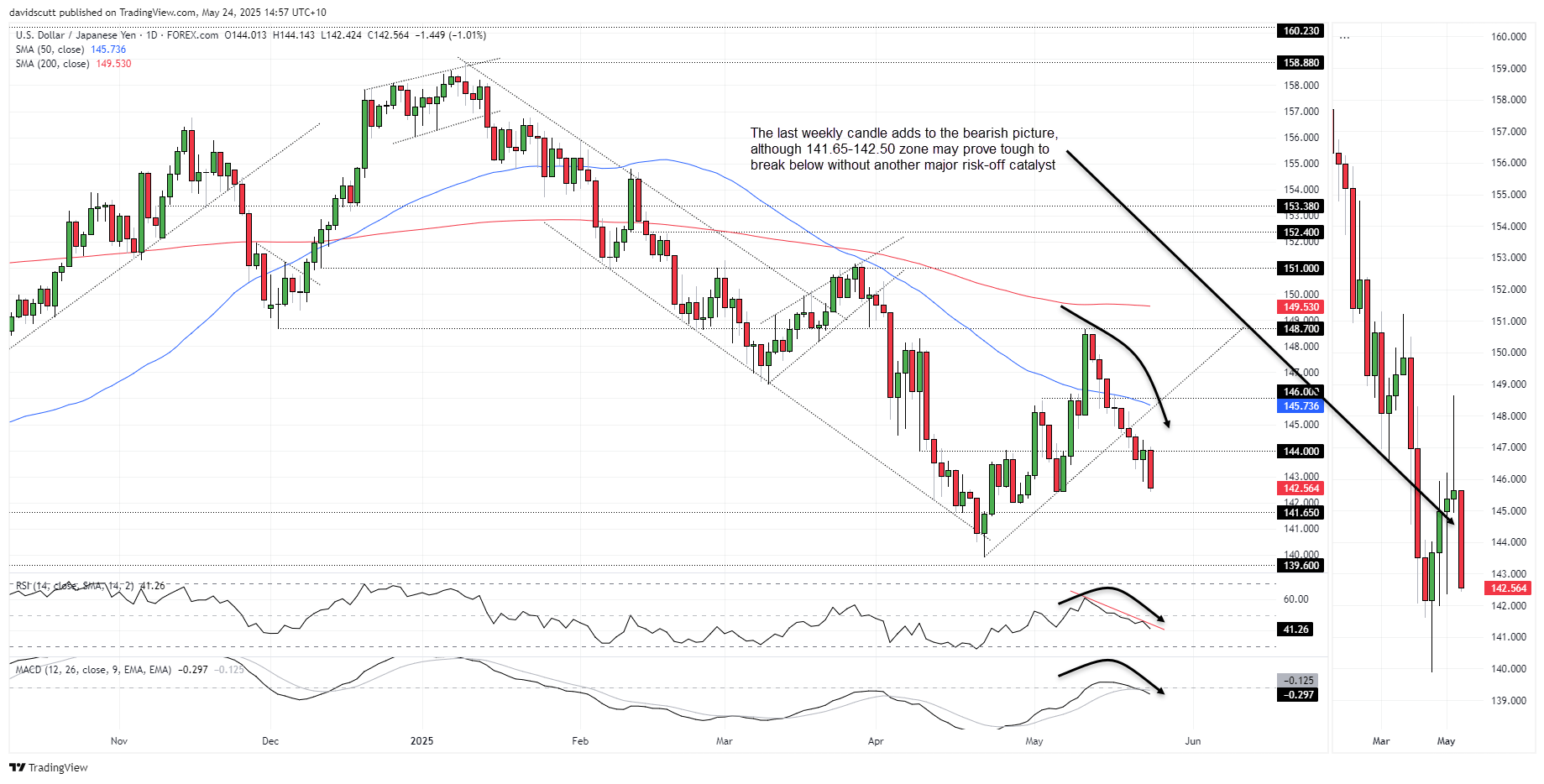

Source: TradingView

Last week saw the break of the uptrend USD/JPY had been in since bottoming on April 22, skewing directional risks lower. The 144 support level was then breached, reverting to resistance late in the week. With RSI (14) and MACD generating outright bearish signals, and the price trading below both the 50- and 200-day moving averages which are trending lower, the broader picture favours downside.

When zooming out to the weekly timeframe, while it’s not a textbook three-candle evening star pattern, the large bearish candle last week—finishing near its lows—further bolsters the bearish signal.

Bids may be encountered at 142.50 and 142.00, with longer-running support found at 141.65. A break of the latter puts the April low and September 2024 trough at 139.60 into play. Above, resistance is located above 144.00 and 146.00, with the 50-day moving average in between.

-- Written by David Scutt

Follow David on Twitter @scutty