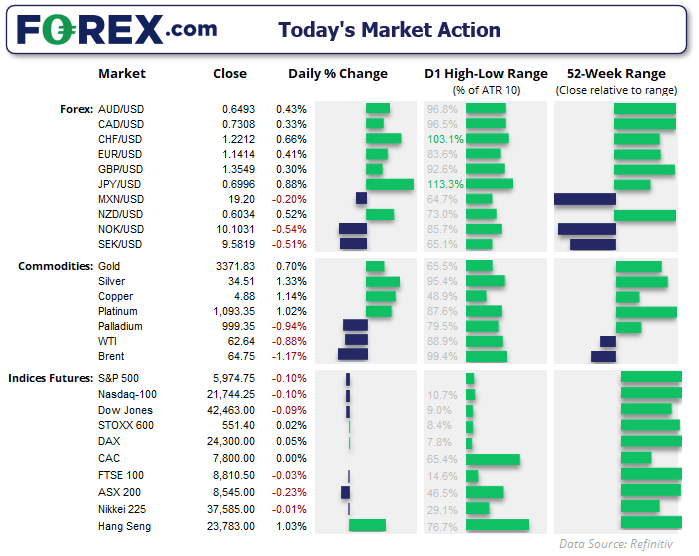

Hopes of a ceasefire between Israel and Iran sparked a bout of risk-on trade late on Monday, which essentially saw a reversal of many of the moves heading into the weekend. Safe-haven currencies lost their appeal in exchange for risk assets.

Wall Street futures were higher, led by the Nasdaq 100 and S&P 500 – both forming bullish engulfing candles and closing just off last week’s highs. The Dow Jones was the laggard, though it managed to recoup around two thirds of Friday’s selloff.

A 2-bar bearish reversal (dark cloud cover) formed on gold futures at the may high. Should sentiment continue to improve, it could allow for a deeper pullback from current levels and revives the potential for a ‘double zig zag’ move and to break below 3120.

WTI crude oil fell -1.7% after failing to take out Friday’s high by a cats whisker. Like gold, crude oil shows the potential to retrace further against last week’s rally should the ceasefire hold and sentiment continue to improve.

View related analysis:

- USD Net Shorts Hit Record as AUD Bears Rise, CAD and EUR Gain – COT Report

- AUD/USD Weekly Forecast: Fed Decision and Australian Jobs Eyed

- WTI Crude Oil Surges, AUD/JPY Slides After Israel’s “Pre-Emptive Strike” on Iran

- USD/JPY Outlook: Japanese Yen Gains as Risk-Off Mood Lifts Safe Havens

Japanese Yen Drops on Ceasefire Hopes as Traders Eye BOJ and FOMC Decisions

The Japanese yen (JPY) and The Swiss franc (JPY) were the weakest currencies. Traders are seemingly looking past today’s BOJ interest rate decision, with markets pricing in ~90% chance of them holding rates at 0.5%. A recent Reuters poll revealed that the BOJ will hike rates to 0.75% by the end of Q1, maintain their current pace of bond purchases today with a small minority expecting that pace to slow by April. Ultimately, nothing major is expected to be announced by the BOJ today, which allowed the Japanese yen to broadly weaken amid a risk-on environment.

- EUR/JPY formed a bullish engulfing day and rose to an 11-month high

- GBP/JPY posted a marginal break above the May high to reach its most bullish level since early January

- CAD/JPY reached a 4-month high

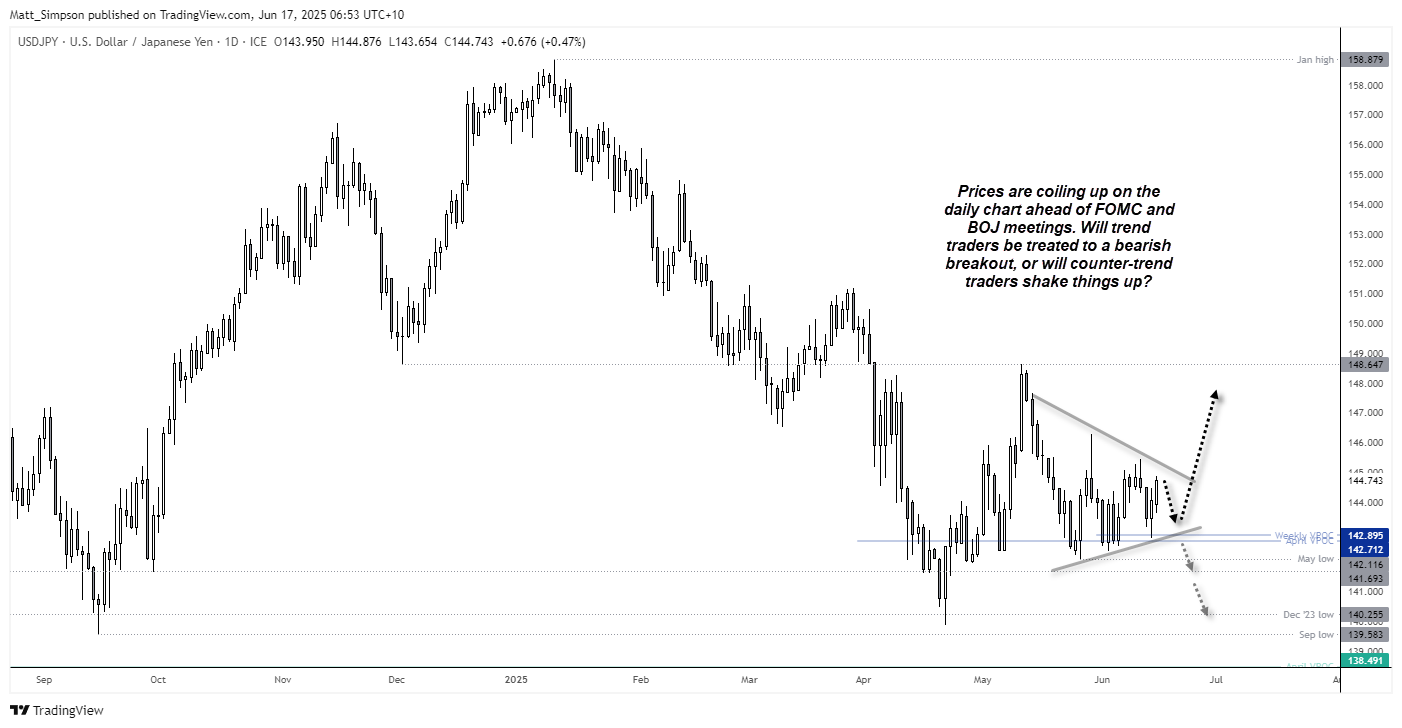

- USD/JPY rose for a second day, though remains within a coiling pattern on the daily chart

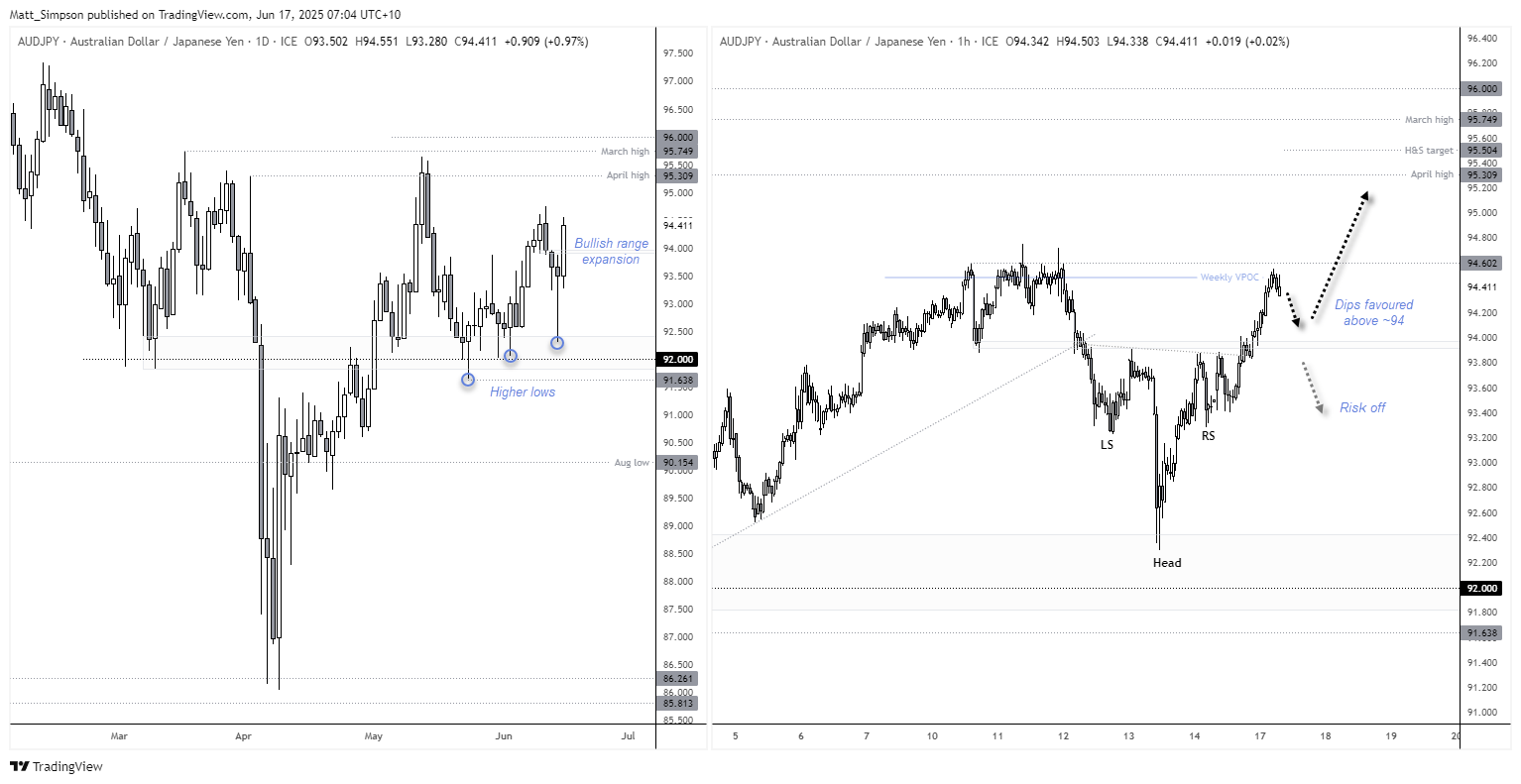

- AUD/JPY snapped a 3-day losing streak and saw bullish range expansion after a bullish hammer on the daily charts

USD/JPY Technical Analysis: US Dollar vs Japanese Yen

The main observation on USD/JPY is coiling nature of prices on the daily chart, with its contracting series of lower highs and higher lows suggesting a breakout is building (one way or the other). Trend traders and the asset managers who are at a record-level of net-short exposure are no doubt vying for a classic bearish breakout. Yet countertrend traders could point to a ‘sentiment extreme’ on the US dollar index futures market and point out that USD/JPY is indeed holding key support levels, to build a case of a bullish breakout.

With the upcoming FOMC meeting, a period of lower volatility is also plausible — potentially keeping USD/JPY confined within the past two days' range. Still, my bias leans toward a bullish breakout. This view is based on expectations that the Fed won’t deliver an overly dovish message, a ceasefire is on the horizon, the impact of Trump’s trade war headlines has diminished, and sentiment in US dollar and Japanese yen futures markets has reached near-term extremes.

AUD/JPY Technical Analysis: Australian Dollar vs Japanese Yen

The risk-on tone helped AUD/JPY snap a 3-day losing streak and provide a prominent day of bullish-range expansion. The Fact that AUD/JPY sprang higher from a bullish pinbar, whose lower wick formed a higher low above the 92 support level, adds to the bullish case in my view.

A move to at least to the 95 handle seems within easy reach, with the April high (95.30), March high (95.75) and 96 handle also making viable targets for bulls.

The 1-hour chart shows AUD/JPY has broken out of an inverted head and shoulders (H&S) reversal pattern, which suggest an upside target of 95.50 if successful. Dips towards ~94 are favoured for an eventual bullish break above last week’s high. A move beneath the neckline assumes a risk-off environment and invalidates the near-term bullish bias.

Economic Events in Focus (AEST / GMT+10)

08:45: NZD FPI (MoM) (May) (NZD/USD)

12:30: JPY BoJ Monetary Policy Statement (USD/JPY)

13:00: JPY BoJ Interest Rate Decision – forecast: 0.50%, prior: 0.50% (USD/JPY, Nikkei 225)

16:30: JPY BoJ Press Conference (JPY crosses)

18:00: USD IEA Monthly Report (Crude oil, energy stocks)

19:00: GBP 5-Year Treasury Gilt Auction (GBP/USD)

19:00: EUR ZEW Surveys (Jun): German Current Conditions, Economic Sentiment, Eurozone Sentiment (EUR/USD, DAX)

22:00: NZD Global Dairy Trade Price Index (NZD/USD)

22:00: USD Milk Auctions (Dairy futures)

22:30: USD Retail Sales & Inflation Metrics (May) – including Core Retail Sales, Retail Sales (YoY), Import/Export Price Indexes, Retail Control (S&P 500, USD crosses)

22:30: CAD Foreign Securities Purchases (Apr) (USD/CAD)

22:55: USD Redbook (YoY) (USD)

23:15: USD Industrial & Manufacturing Production (May) – including Capacity Utilization (USD)

00:00: USD Business Inventories, NAHB Housing Market Index, Retail Inventories Ex Auto (Apr/Jun) (USD)

03:00: USD 5-Year TIPS Auction & Atlanta Fed GDPNow (Q2) (Treasuries, USD)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge