Japanese Yen Talking Points:

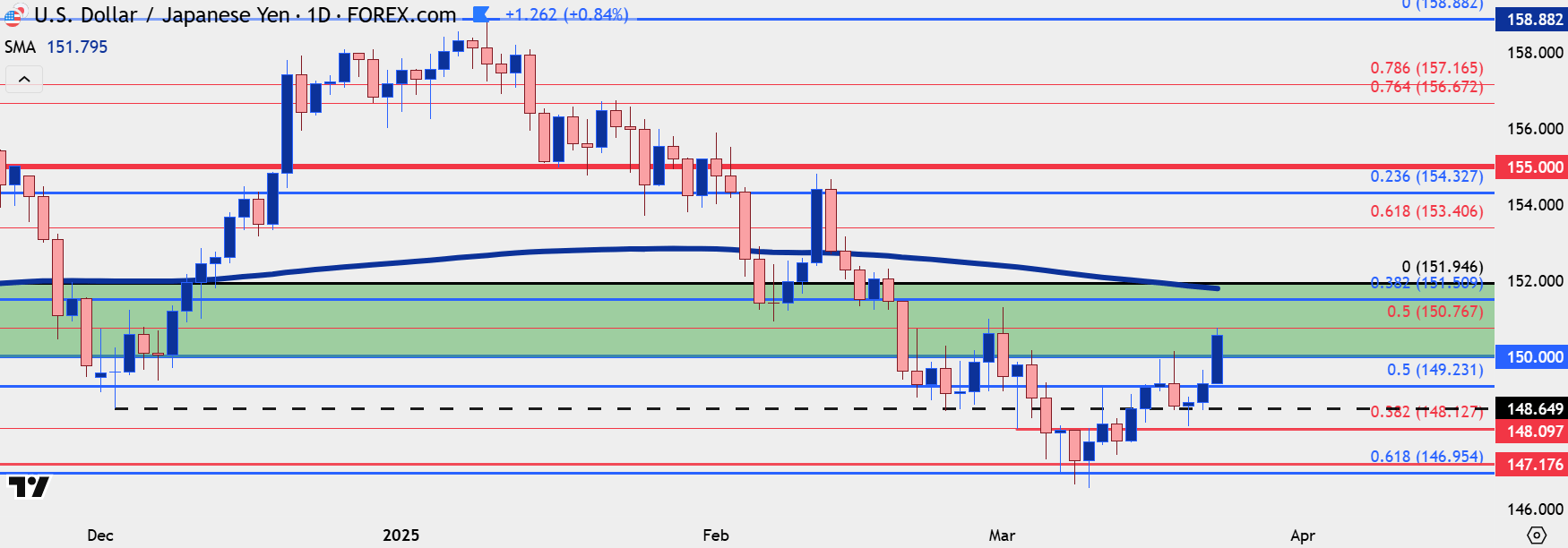

- USD/JPY has just tested a key Fibonacci level at 150.77 as the pair extended the recent bullish sequence after breaking above the 150.00 level.

- JPY continues to be tough for Yen-bulls as USD/JPY has brewed several bear traps so far this year. For those looking for Yen-strength, EUR/JPY could present more attraction. And for Yen-weakness, GBP/JPY may be more attractive than USD/JPY.

- I’ll be looking at each of these pairs in tomorrow’s webinar and you’re welcome to join:

USD/JPY has continued to push higher-highs and lows with the pair re-testing a key Fibonacci level this morning at 150.77. That’s the 50% mark of the sell-off that started last July, and most recently this helped to set the highs on the final day of February and the first day of March.

Perhaps more notable is the recent sequencing of higher-highs and lows that have printed, as last week’s swing high at 150.00 was soundly broken as buyers pushed a fresh three-week-high this morning.

As looked at last week, the pair has been a tough one for bears to chase and there’s been several bear traps brewed along the way. But now that price is nearing resistance, there could be an opportune area for sellers to take their shot; although there’s a valid question as to whether USD/JPY would be more accommodative for that than a pair such as EUR/JPY, which I’ll look at below.

In USD/JPY, 150.00 is now higher-low support potential for bulls to defend, and the 149.23 level lurks below that. Above the current Fibonacci resistance level is another Fibonacci retracement from a different setup at 151.51, and that’s followed by 151.95 which is about 15 pips away from the 200-day moving average.

USD/JPY Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

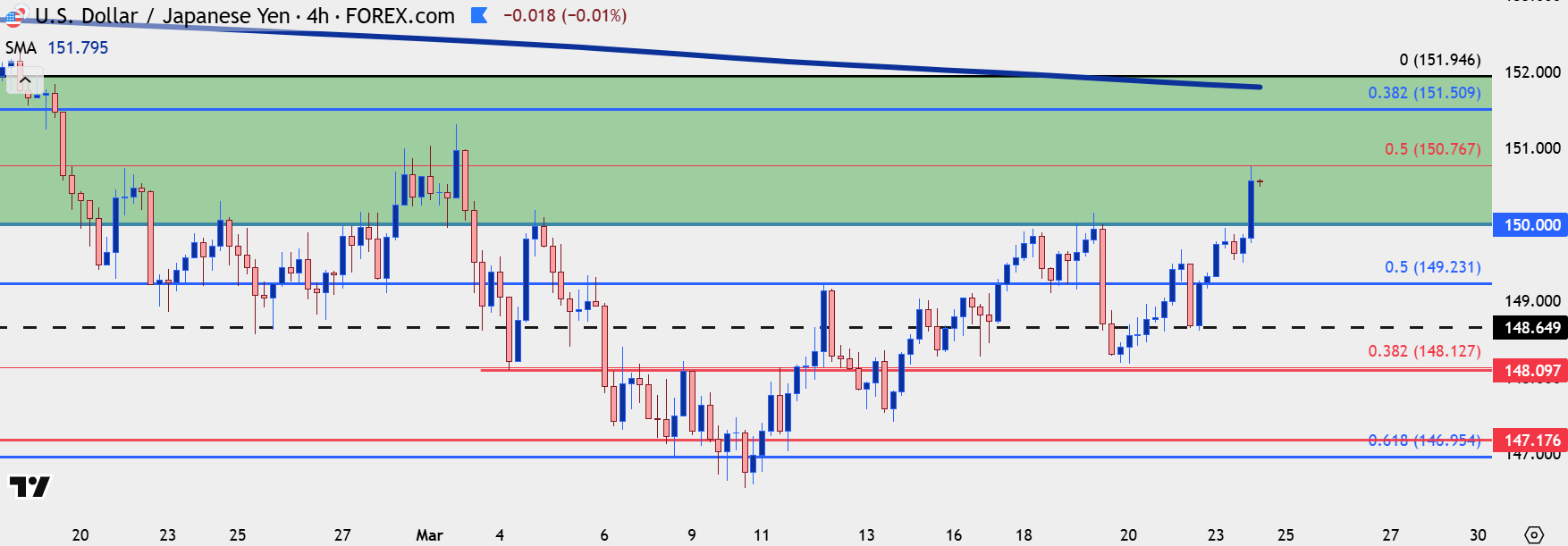

USD/JPY Shorter-Term

At this point, bulls have some context with which to defend USD/JPY, and that would be marked by the breakout over the 150.00 handle which is now higher-low support potential.

If bears can push price below that, then 149.23 is the next level up, after which 150.00 could then be sought for lower-high resistance with bearish continuation; but if 150.00 does remain defended, then 150.77 is still a big level and that’s followed by the two resistance levels looked at above, 151.51 and 151.95.

USD/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

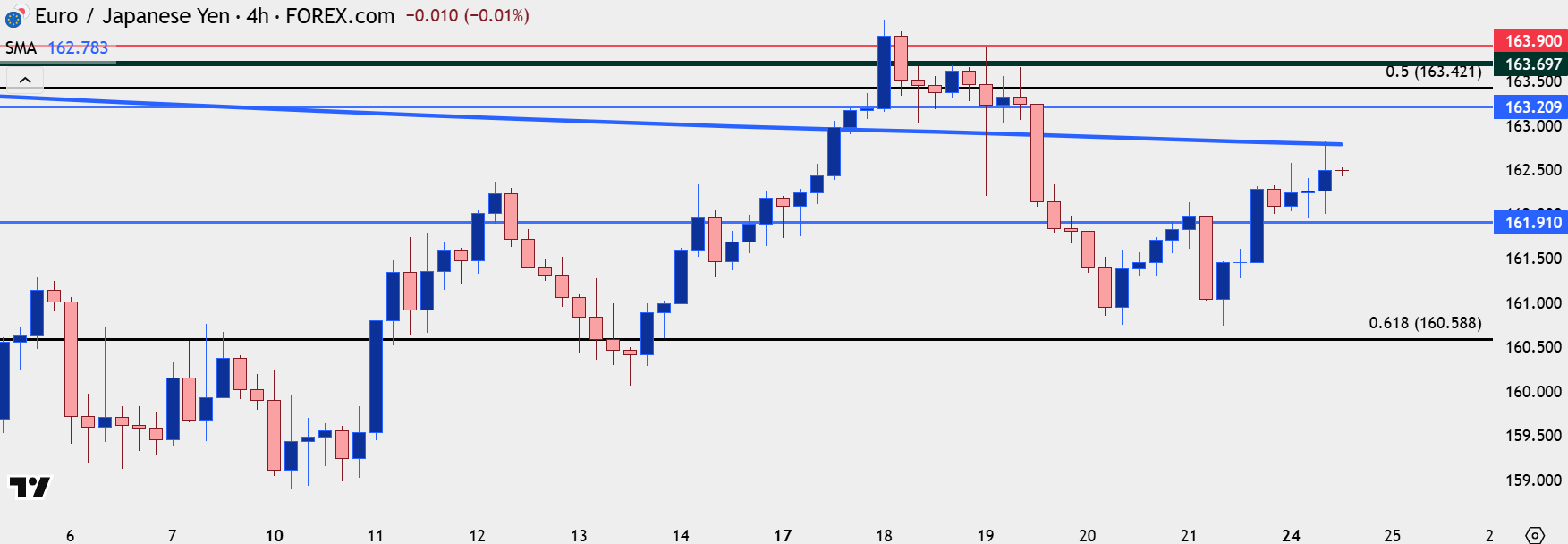

EUR/JPY

As mentioned multiple times in the past, chasing Yen-strength has been a challenge as there’s been several bear traps brewed in USD/JPY. But for those that are looking for Yen-strength, there could be a more attractive backdrop in EUR/JPY and that pair has set a recent lower-low on the four-hour chart that can justify such a stance.

As of right now, I have the pair re-testing the underside of the 200-day moving average, and just a bit higher is a spot of prior support that was in-play last week ahead of the FOMC rate decision. This is from around 153.21 up to around 163.70. If sellers can hold the pair in that region, an argument can be made for a lower-high which, when meshed with the recent lower-low, can establish a backdrop for bearish continuation scenarios.

EUR/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

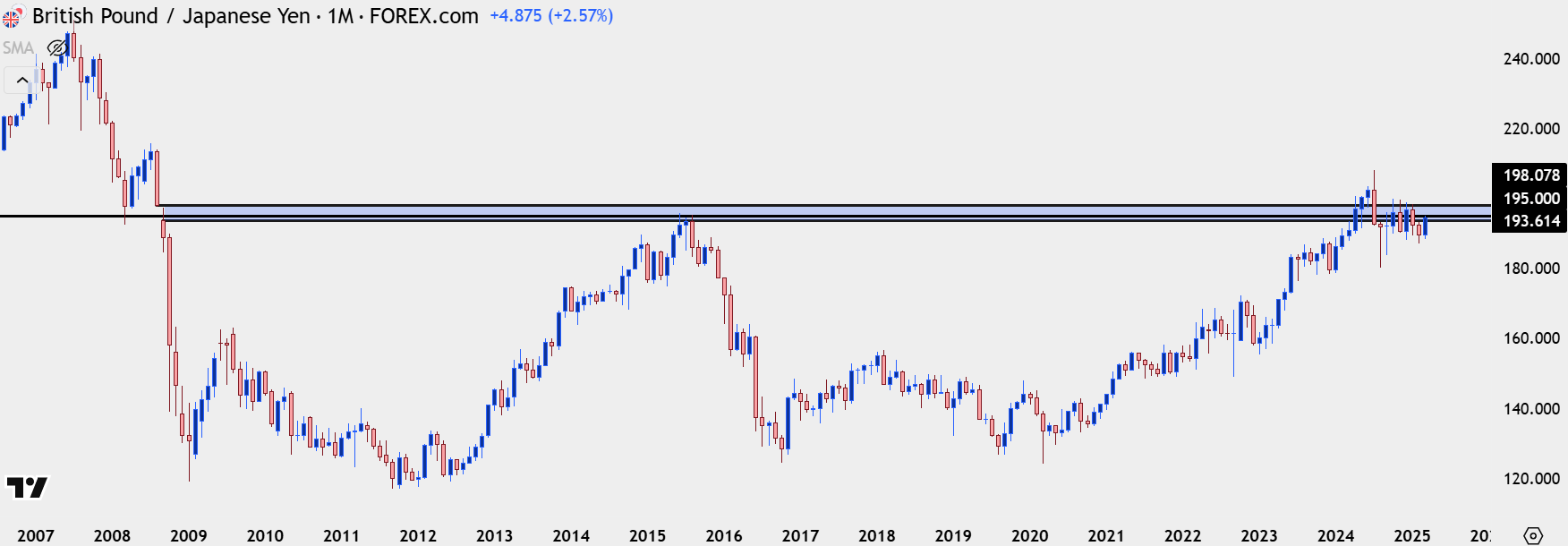

GBP/JPY

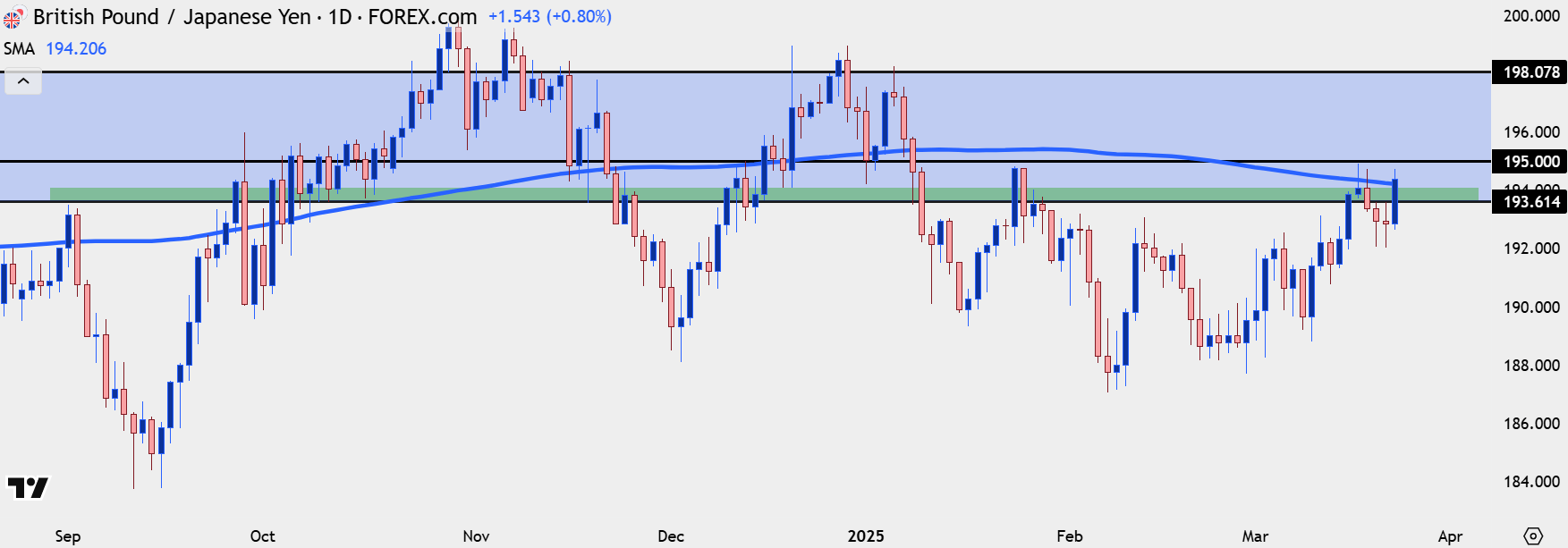

As I had looked at earlier in March, I still think GBP/JPY could be a more attractive venue for Yen-weakness scenarios. At the time, the pair was trying to re-establish strength above the 190 handle, which it has since done. And now the pair is back in a long-term zone of interest as taken from the gap in 2008, which begins at 193.61.

You’ll notice from the monthly chart below that this gap has held resistance multiple times since it came into play last year.

GBP/JPY Monthly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

The bottom of that longer-term gap at 193.61 is what helped to set the high last Thursday and Friday, and buyers have made a strong push towards the 195.00 level and the 200-day moving average is currently being tested on the daily chart.

GBP/JPY Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

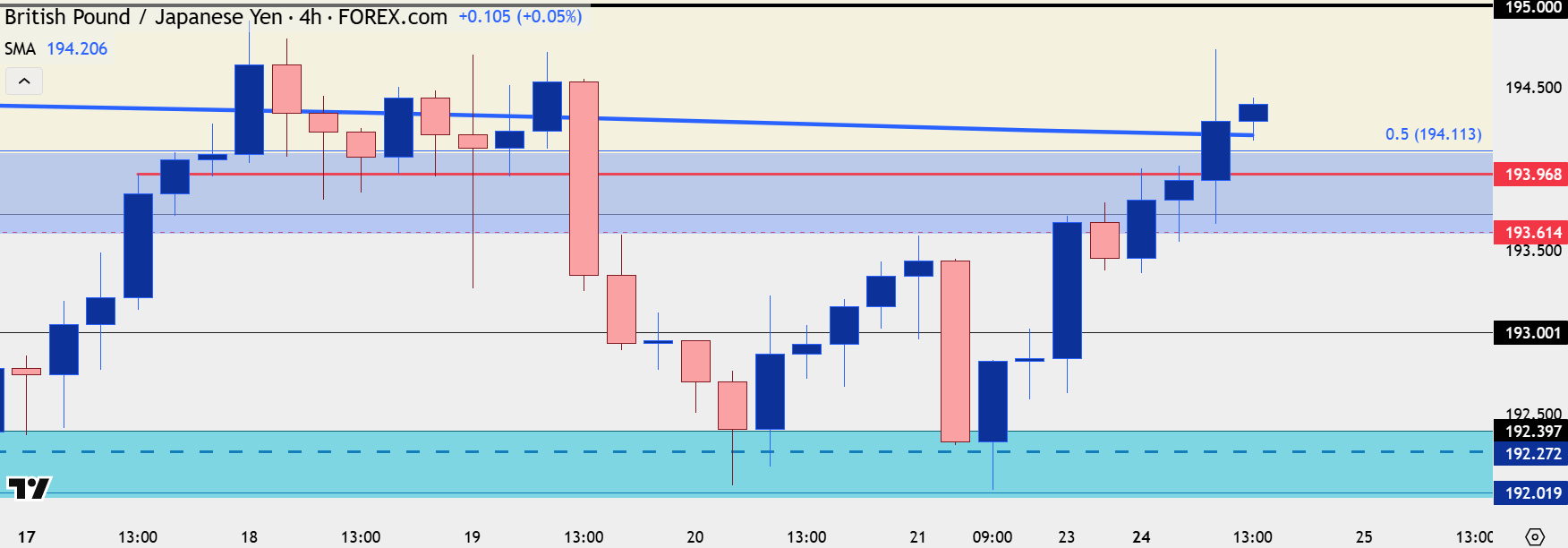

GBP/JPY Shorter-Term

The four hour is interesting here as the pair is already making a push back above the 200-day on a shorter-term basis. Prior swing high resistance at 193.97 represents a spot of higher-low support potential, with 193.61 below that. For bullish continuation, 195.00 is the next big test and buyers shied away from that level last week, so I’d be careful about getting too aggressive on initial breakouts beyond that level until more evidence presents that buyers will be able to leave that price behind.

GBP/JPY Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist