- Nasdaq 100 forecast supported by trade optimism and renewed boost in chipmakers

- No major bearish catalysts in play, allowing dip-buyers to dominate

- Technical signs point to new highs for Nasdaq amid strong bullish momentum

After a powerful rally to start the week, the stock markets are consolidating, with US index futures barely moving in overnight trading. Also catching their breath, we have seen a bit of a pause in European equities, as sentiment awaits its next macro driver. A key macro catalyst so far has been optimism around de-escalation in the US-China trade war—an issue that had weighed heavily on sentiment earlier this year. But with the US and China reducing tariffs on each other and willing to come up with a trade deal, those concerns are no longer a major force driving sentiment. Tuesday’s cooler-than-expected US inflation data also helped ease fears that Trump’s trade tariffs would stoke persistent price pressures. Still, while this was a relief for risk assets, it's inflation data in the coming months that will determine whether economic growth can absorb recent trade policy disruptions. For now, there are no major bearish catalysts and investors are warming towards technology sector once again, chipmakers in particular with Nvidia, for example, rising another 1.7% in premarket after yesterday’ 5.6% rally.

Big Tech, Big Deals: Nvidia rides AI wave in the Middle East

The AI race got another boost, this time from the Middle East. On Tuesday, news of big-ticket artificial intelligence deals in the Gulf, helped to propel shares of chipmakers. The sector will be in focus again today with shares of several chipmakers rising in pre-market trading.

Front and centre was Nvidia stock which surged over 6% on Tuesday after unveiling a landmark deal with Saudi Arabia’s AI outfit, Humain. The two are teaming up to build a massive AI data centre, powered by Nvidia’s next-gen hardware, with hundreds of thousands of GPUs rolled out over five years. The first phase alone will deploy 18,000 Grace Blackwell GB300 superchips, all interconnected by Nvidia’s InfiniBand tech.

Not to be left out, AMD shares were also buoyed by the broader optimism surrounding Nvidia’s Middle East expansion. AMD’s also part of a newly revealed $80 billion tech consortium that’s channelling investments across both the US and Saudi Arabia — another sign that AI money is going global fast.

So, US chipmakers are cashing in on the AI boom — and the Middle East just became a serious partner in the game. In the meantime, the rollback of tariffs on China should also help the sector.

Nasdaq 100 forecast: Technical analysis

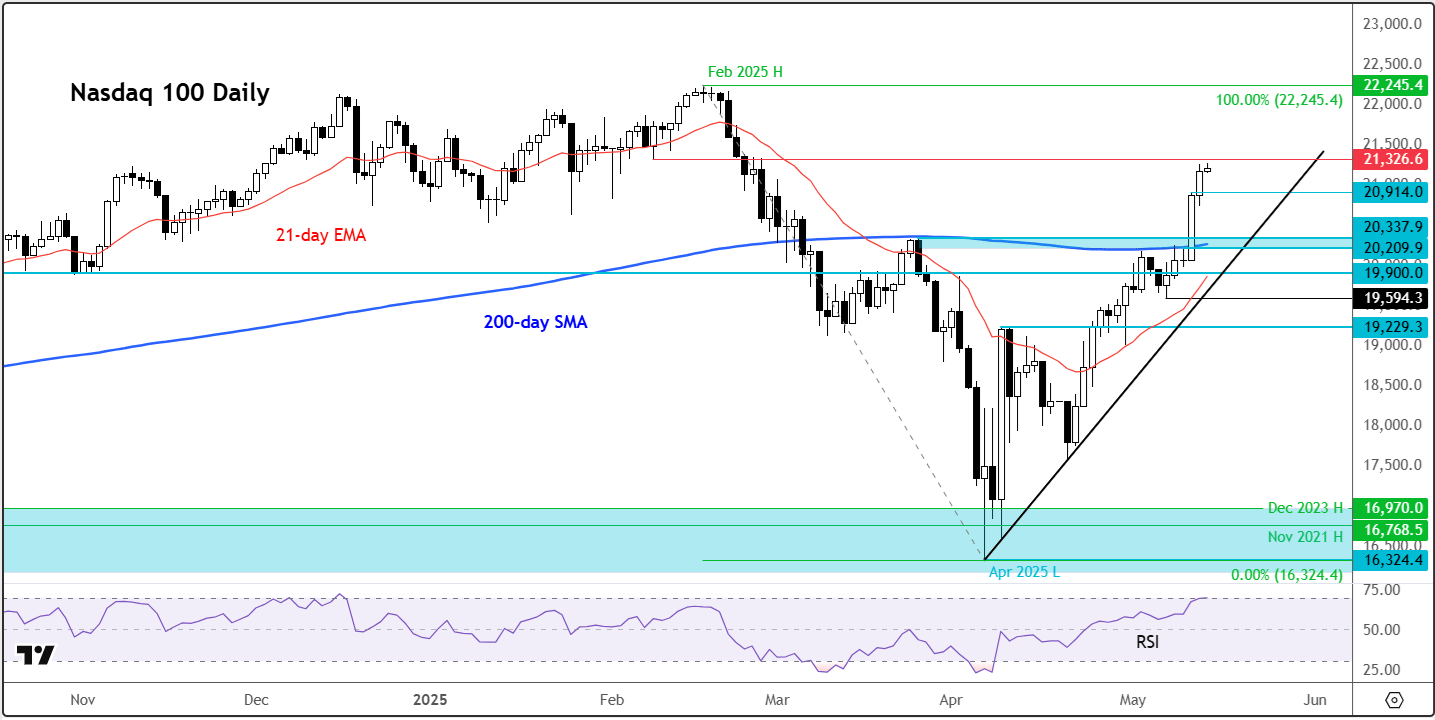

From a technical standpoint, the Nasdaq’s recovery from its April low marks a near 30% rally, pushing the RSI on the daily chart in overbought levels again. That’s not necessarily a sell signal, but it does warn that momentum could cool off – though no big sign of that yet either. If we do get a bit of a pullback, there will be a cluster of key support to watch which could turn into support, and lead to a bounce. For indeed the trend is clearly bullish with the market making interim higher highs and higher lows and moving back above lots of old support levels as well as moving averages as per the chart.

Source: TradingView.com

Meanwhile, last week’s positioning data – Commitment of Traders (COT) – hints at a potential change in investor posture. Asset managers had been scaling back long exposure for the past 15 months, but net-long positions on Nasdaq futures have now stabilised and we saw a reduction in gross shorts. So, it seems like traders are no longer keen to bet against tech’s recovery. If trade tensions continue to ease, we may see broader participation in this rally, especially among institutional players who’ve been sitting on the side-lines.

Key levels to watch

The big area of support now comes in between 20,210–20,340 area. The upper end of this range was a big resistance level marking the top from March 26, which preceded a big drop. This area then turned into a bit of a ceiling earlier this month, before the bulls powered right through it on the back of the China-US trade truce announced a few days ago. The 200-day average also comes into play there. A potential re-test of this area could at least provide a bounce trade. But will the Nasdaq drop all the way to that area again, given the strong bullish momentum? It is possible the index just continues to march higher without a major pause until it potentially reaches new highs. An interim support level to watch include 20,9145, marking the high from Monday.

In terms of resistance levels, well there aren’t many left. The 21,325 area looking interesting given that it was the last major support area before that big drop started. Above this, 22,000 is the next big psychological level ahead of the all-time high of 22,245.

How to trade these markets?

All told, the Nasdaq 100 forecast remains bullish, and momentum is on the side of the bulls, with technicals supporting the case for further upside while there are no obvious bearish catalysts in play. From a trading point of view, looking for dips at support rather than chasing highs, make sense.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R