- Nasdaq 100 forecast remains cautious amid carry trade tensions and rising yields

- Japanese and US bond markets signal volatility ahead for tech-heavy indices

- Nasdaq still bullish on the bigger picture, but short-term risks are mounting

The Nasdaq 100’s impressive spring rally hit a wobble this week, and all eyes are on the bond markets – both in the US and Japan – for clues on what’s next. Futures for major US indices did stage a modest rebound on Thursday morning after Wednesday’s dip, but the mood remains unsettled. Japan’s 30-year yields have surged to unprecedented levels, rattling global investors, while US bond yields also continue their upward march ahead of a critical vote on President Trump’s tax and spending legislation. Rising yields are notoriously unfriendly to risk assets, and this environment is especially hostile to those playing the yen-funded carry trade. We’ve seen before how such an unwind can send shockwaves across global equity markets – last summer being a prime example. While Wall Street’s recent pullback has been relatively contained, there’s a palpable sense of trepidation that more turbulence could be on the horizon, raising doubts over the bullish narrative for US stocks and the Nasdaq 100 forecast.

Yields on the rise: A carry trade conundrum

US 30-year yields breaking through the 5.00% threshold is a red flag in itself – and they’re now edging towards the multi-year high of 5.178% set in October 2023. But the real story lies across the Pacific, where Japanese yields have hit a record 3.197%. It may not seem much by Western standards, but for Japan, a land long ruled by zero rates and easy money, it’s a seismic jolt.

This sharp move could spell trouble for the famed yen-funded carry trade, where investors borrow cheaply in yen to invest in higher-yielding assets elsewhere. As the Bank of Japan inches towards normalising policy and inflation running hot, the rug may be pulled out from under this strategy – just as we saw last year.

Nasdaq 100 forecast: Rally pauses, but trend intact?

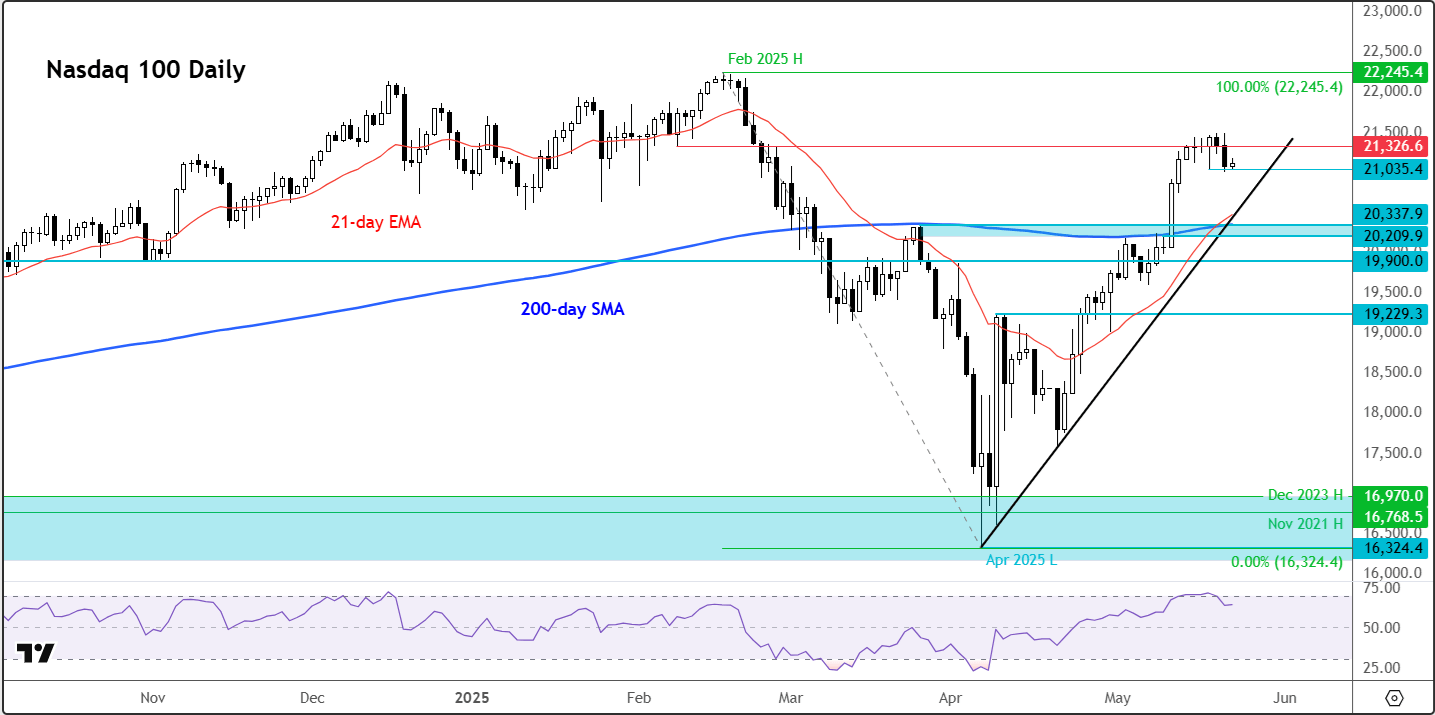

Technically speaking, the Nasdaq 100 had been flying – up 30% from its April lows in just over six weeks – before this week’s breather. That sort of move doesn’t go unnoticed, with daily RSI and momentum indicators moving swiftly from oversold to overbought territory. The index needed a pause, and that’s what it’s getting. So far, this appears more of a healthy consolidation than a reversal of fortunes.

Source: TradingView.com

We’re still trading above key moving averages, and there’s a textbook pattern of interim higher highs and higher lows on our US Tech 100 chart, which is derived from the underling Nasdaq 100 futures chart. February’s peak remains untested, but with a few European indices like the DAX, as well as Bitcoin, printing fresh all-time highs, it would be premature to count the Nasdaq out. Another push to a new record could well be on the cards – just not quite yet.

Still, Thursday’s bearish engulfing candle pattern is a warning sign. It suggests the bears may have a bit more room to roam in the short term before the bulls return to the helm.

Technical levels to watch on the Nasdaq 100

Here’s where the chart-watchers are focusing their attention. Short-term support around the 21,000 region is trying to hold, but the more robust zone lies lower – between 20,200 and 20,335. This blue-shaded area on the chart previously acted as a firm resistance zone and now coincides with both the 200-day moving average and the 21-day exponential. If the selling intensifies, the psychologically significant 20,000 mark is the next key battleground.

On the upside, Tuesday’s low, at 21,225, now marks the first test for any attempted rebound. Above that, 21,325 is the next hurdle. Should the bulls regain momentum, 22,000 may soon come into view, with a possible run at the all-time high of 22,245 thereafter.

In short, the Nasdaq 100 forecast remains delicately poised – bullish over the longer term, but the short-term outlook is fraught with risk as the bond market continues to throw curveballs.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R