US futures

Dow futures 0.17% at 42,780

S&P futures 0.18% at 6013

Nasdaq futures 0.16% at 21830

In Europe

FTSE 0.61% at 8882

DAX -0.36% at 24099

- US-China trade talks enter a second day

- US CPI data tomorrow is expected to show CPI +2.5%

- Tesla rises after Trump adopts a more neutral tone to Musk

- Oil rises for a fourth straight day

US-China trade talks enter the second day

U.S. stocks are pointing to a muted start as investors await the outcome of ongoing trade talks between the US and China, which aim to ease tensions between the two powers.

Trade talks between the two sides are entering their second day in London, and reports have been positive. Any improvement in relations between the US and China or signs that the two countries are building on the preliminary deal struck last month could boost risk sentiment.

The US will seek the restoration of rare earth mineral exports from China, which, if agreed upon, this could see the US lift export controls on some semiconductors in return.

The Nasdaq is just 3% below its record high reached in December, having rallied hard across May, booking its best monthly gain since November 2023.

Still, gains could be limited today as investors look ahead to US CPI inflation data tomorrow for clues on the Federal Reserve's path for interest rates.

CPI is expected to rise to 2.5%, which will likely keep the Fed on the side lines until there is more evidence on the tariff's impact on the economy.

Corporate news

Apple is falling 0.3%, extending yesterday's losses. The iPhone maker's keynote address at its developers conference only included small improvements to its AI features.

Tesla is rising 2.2% after President Trump took a more neutral tone towards CEO Musk in a press conference after a very public spat between the two last week.

Nvidia is rising 0.3%, and Hewlett-Packard Enterprise rose 1.2% after the tech companies announced they are partnering with the Leibniz Supercomputing Centre to build a supercomputer using innovative next-generation chips.

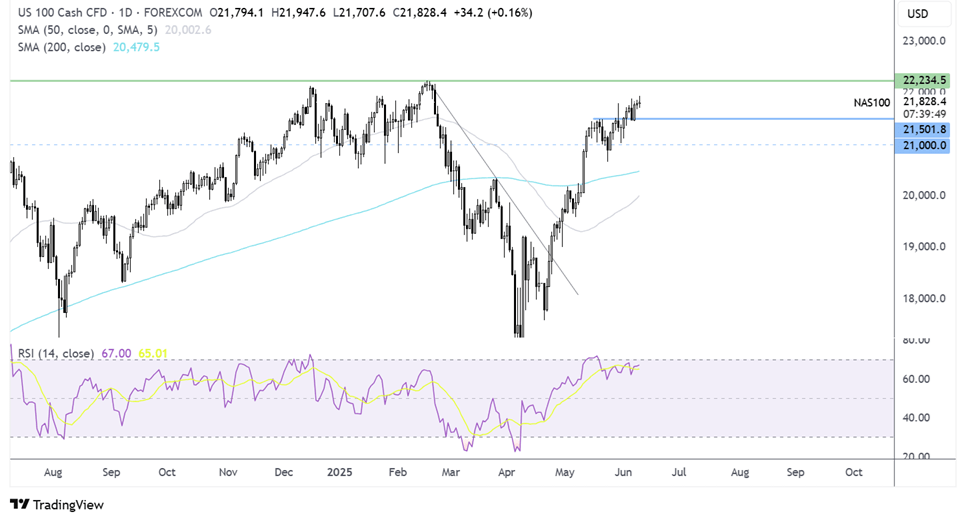

Nasdaq 100 – technical analysis

.

The Nasdaq has recovered from its 16,325 and has run into resistance at 21,950. The rally appears to be losing steam with the RSI bearish divergence. Buyers will look to extend gains towards 22,000 and 22,245 and fresh record highs. Immediate support can be seen at 21,500; below, 21,000 comes into play.

FX markets – USD rises, GBP/USD falls

The USD is holding gains against its major peers but is down from earlier highs. While the US dollar is supported by optimism surrounding US-China trade talks, investors are still cautious ahead of tomorrow's inflation data.

The EUR/USD is modestly higher after June's Senix, when investor confidence leaped to positive 0.2, up from -8.1 previously. The jump came amid a notable upturn in German sentiment, which, although still negative at -5.9, was at the highest level since March 2022. The initial shock from Trump's tariffs appears to be subsiding.

GBP/USD is falling after weaker-than-expected UK jobs data. The unemployment rate rose to 4.6% from 4.5%, marking the highest since May 2021. Meanwhile, pay growth slowed sharply to 5.2%, its weakest level since September, and down more than expected from 5.5% in January to March. The downturn in the UK labour market is gathering pace after April, which saw an increase in employer Social Security contributions.

Oil rises for a fourth day on trade talk optimism

Oil prices are rising for a fifth straight session, boosted by optimism surrounding US-China trade talks. Saudi Arabia's crude supply to China is set to slow slightly.

You have tried the China trade talks are set to continue for a second day in London met easing tensions between the while the largest oil consumers. The optimism is supporting oil pries as traders await an update.

Meanwhile, Saudi Arabia's state oil firm Saudi Aramco must ship 47 million barrels to China in July 1 million barrels less than June's volume. This could be an early sign that OPEC+’s unwind may not actually mean that much additional supply.