US futures

Dow futures 0.27% at 41467

S&P futures 0.48% at 5686

Nasdaq futures 0.5% at 20170

In Europe

FTSE 0.20% at 8556

DAX 0.77% at 23530

- Stocks rise on trade deal hopes ahead of China talks this weekend

- Trump's sees 80% China tariffs as a good place vs 145% currently

- Oil rises on trade deal optimism

Stocks rise on trade talk optimism

U.S. stocks are set to rise modestly as investors react to Trump's comments ahead of trade talks with China this weekend and ongoing concerns about inflation.

The president suggested that Beijing should open its market to the US, and that 80% tariffs on Chinese goods seemed appropriate. This is down from the current level of 145%.

His comments come as the US and China are set to hold ice-breaker talks this weekend. The best-case scenario would be that the two sides agreed to formal trade negotiations, fueling optimism surrounding a de-escalation in the trade war. Such a scenario could see stocks rally on Monday.

These talks come after the US and the UK agreed to a trade deal framework yesterday, the first of its kind since Trump paused his initial Liberation Day tax last month.

The US economic calendar is quiet today. Earlier in the week, the Fed left rates unchanged and warned about rising risks to inflation and unemployment. Several Fed officials are due to speak.

Looking ahead to next week, US CPI is due. However, trade headlines remain the key focus for the markets.

Corporate news

Coinbase is falling after disappointing Q1 results. The cryptocurrency exchange posted revenue of $2.03 billion, below the $2.12 billion forecast. EPS fell to $0.24 per share, down from $4.40 in the same quarter a year earlier.

Strategy is set to rise further, adding to yesterday's 5% gains. Bitcoin pushed over 100 K. MSTR trades up 9% in May, adding to gains of 31% in April.

They did 11% after the ride-sharing firm increased its share buyback plan to 750 million. Q1 revenue missed expectations, but gross bookings topped estimates.

Pinterest is rising 14% after providing a stronger-than-expected Q2 revenue forecast. Q1 revenue also beat expectations at $855 million, ahead of the $847 million forecast. Adjusted earnings of $0.23 per share were slightly below the $0.26 forecast.

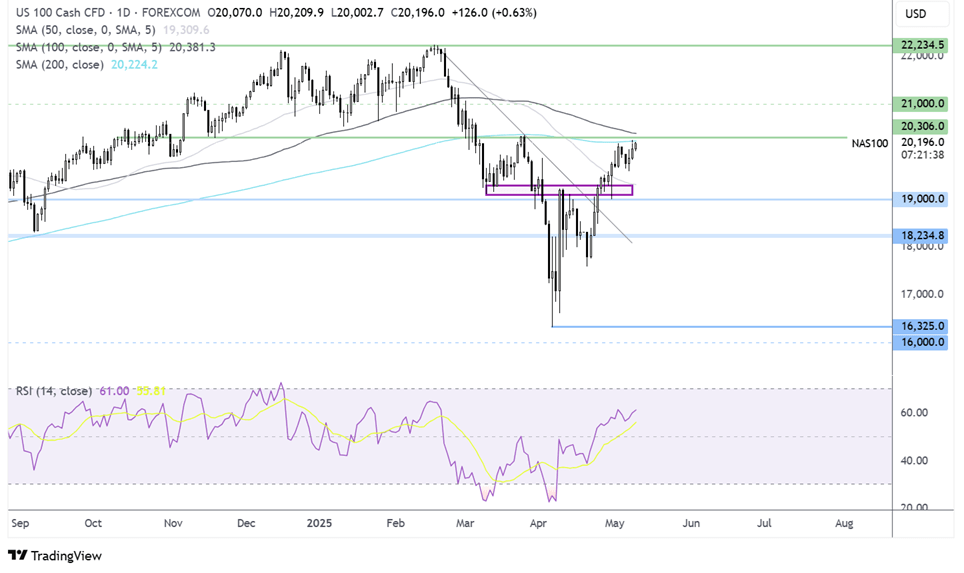

Nasdaq 100 forecast – technical analysis.

The Nasdaq’s recovery from the 16325 low has run into resistance at the 200 SMA at 20,220. The RSI is above 50, supporting further gains given the right catalyst this weekend. Buyers will look to rise above the 200 SMA to extend gains towards 21k. Support can be seen at 19,000-19300 zone.

FX markets – USD falls, GBP/USD rises

The USD is falling, but the DXY is still above the 100.00 psychological level. The USD is on track to rise 0.3% this week, marking its third weekly rise amid optimism towards a de-escalation of trade tensions and more trade deals

The EUR/USD is rising after two days of losses; however, the pair is set to fall 0.4% across the week, marking its third straight weekly decline. ECB officials have expressed confidence in eurozone inflation returning to the 2% target.

GBP/USD is rising, snapping a 2-day losing run as the US dollar rally pauses for breath. On Thursday, the Bank of England reduced rates by 25 basis points and maintained its cautious stance on future rate cuts

Oil rises ahead of US – China trade talks.

Oil prices are rising over 1%, adding to yesterday's gains. This puts oil prices on track for gains of almost 5% this week following two straight weekly declines.

Oil prices recovered above $60 as trade tensions between the US and China showed signs of easing, and after the UK and the US announced a trade deal.

The market will be watching trade talks between the US and China this weekend for signs of easing tensions.

Separately, Chinese exports increased faster than expected in April, while imports narrowed their decline, providing some relief to Beijing ahead of any tariff talks. Oil imports in April rose 7.5% year on year, down slightly from March, buoyed by stockpiling by state refiners.

Separately, OPEC+ plans to increase output, maintaining pressure on oil prices.