- Nasdaq 100 forecast darkens after Trump’s latest tariff threats spark sharp market sell-off

- Trump targets Apple and the EU in a double-barrelled trade offensive

- Fiscal uncertainty compounds the pressure on risk assets

The markets were in a fragile state to begin with – and now they’ve been hit by a full-blown geopolitical squall. US index futures were already facing headwinds from the recent rise in bond yields, but the latest salvo from Donald Trump sent them into a tailspin. Pre-market trading saw a sharp decline in Apple shares and major US indices after the US president took to social media with threats that could upend global trade dynamics. The latest developments darkens the Nasdaq 100 forecast again.

Trump reignites trade war fears

It all began suddenly, with a warning shot aimed squarely at Apple. Trump declared that unless iPhones sold in the United States are made domestically, a 25% tariff would be imposed. That was enough to rattle investors – but what came next turned a market stumble into a rout.

Moments later, Trump recommended a 50% tariff on all EU imports starting June 1. The reaction was swift and brutal: Germany’s DAX shed more than 500 points, and US index futures followed suit. Whatever optimism had been priced in around trade resolutions evaporated in seconds.

Here’s what Trump posted first:

"I have long ago informed Tim Cook of Apple that I expect their iPhone’s that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else. If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S. Thank you for your attention to this matter!"

Then came the EU broadside:

"The European Union, which was formed for the primary purpose of taking advantage of the United States on TRADE, has been very difficult to deal with..."

Markets, already skittish, buckled further under the weight of this renewed belligerence. The Nasdaq 100, which had recently enjoyed a 30% rebound from its April lows, found itself at a crossroads. What was previously regarded as a healthy breather in the uptrend may now mark the start of a more meaningful downturn.

Bond markets still casting a long shadow

Meanwhile, longer-dated US Treasuries managed to regain a bit of composure on haven flows, but this failed to offer any relief to risk assets. Should the bond sell-off resume – and there’s every reason to think it might – then yields will push higher, amplifying the strain on equities, especially those with lofty valuations like the tech-heavy Nasdaq 100.

The broader issue remains America’s unsustainable fiscal trajectory. Without a fundamental rethink of spending and taxation, the market is left contending with rising borrowing costs, widening deficits, and – inevitably – greater volatility. Trump’s latest tariff tirades may well be the spark.

Nasdaq 100 forecast: Caution replaces confidence

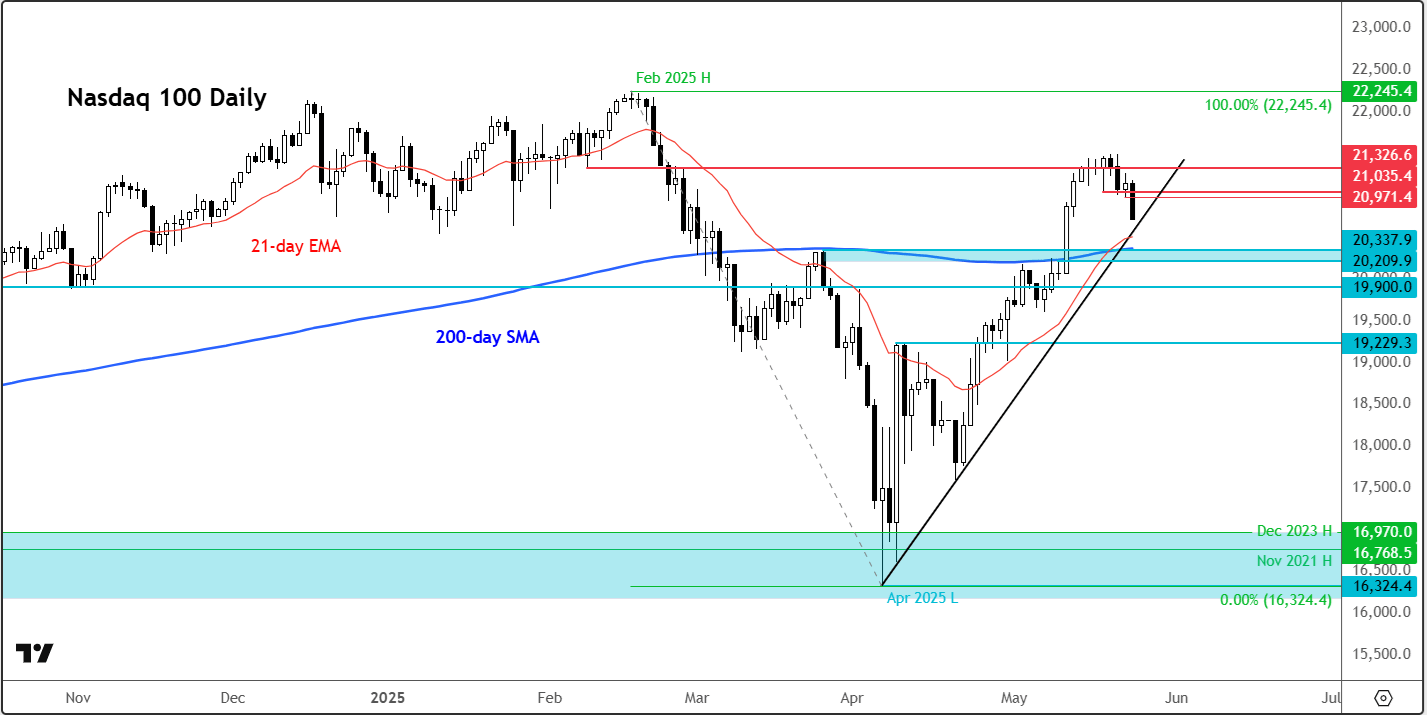

Source: TradingView.com

From a technical standpoint, our US Tech 100 chart, which is derived from the underlying Nasdaq 100 futures, had looked fairly resilient until this week. Despite pulling back slightly, the trend had remained broadly bullish, supported by strong momentum and higher lows. However, Thursday’s engulfing candle and today’s sell-off change the complexion of things.

This week’s earlier support at 20,970 - 21,035 region is now broken, so a deeper drop towards the trend line support has now started. Below the trend line, the 20,210–20,335 region – where the 200-day moving average also comes into play – is well within reach. Should that give way, the psychologically significant 20,000 level will come into play.

On the upside, bulls must reclaim the 20,970 - 21,035 range in the coming days and week to reassert control. Only then can we talk credibly about a push towards this week’s highs or even a new record high at 22,425. For now, however, the Nasdaq 100 forecast leans more defensive than optimistic.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R