Last week I suggested that Wall Street futures were hinting at swing lows. While price action is yet to see a sustained rally, I continue to suspect they can move higher from here. That said, it really is down to how Trump’s trade war plays out this week as to whether indices can rally or roll over.

Trump has given trade partners until tomorrow to provide their best trade deals, or tariffs will be applied. The basic playbook for strong tariffs has been to short the US dollar against pretty much everything else, gold rallies, and Wall Street indices retrace a little. It could therefore be assumed that indices could rally if trade deals are reached and investors embrace another bout of risk-on.

Wall Street traders have even dubbed this setup the TACO trade: Trump Always Chickens Out.

View related analysis:

- AUD/USD, NZD/USD Outlook: US Dollar Slides as Tariff Risks Resurface

- Japanese Yen Slips, Wall Street Futures Rally as US Court Blocks Trump’s Tariffs

- Nasdaq 100 Leads Wall Street Higher on Consumer Sentiment Rebound

- Wall Street Futures, ASX 200 Hint at Swing Lows

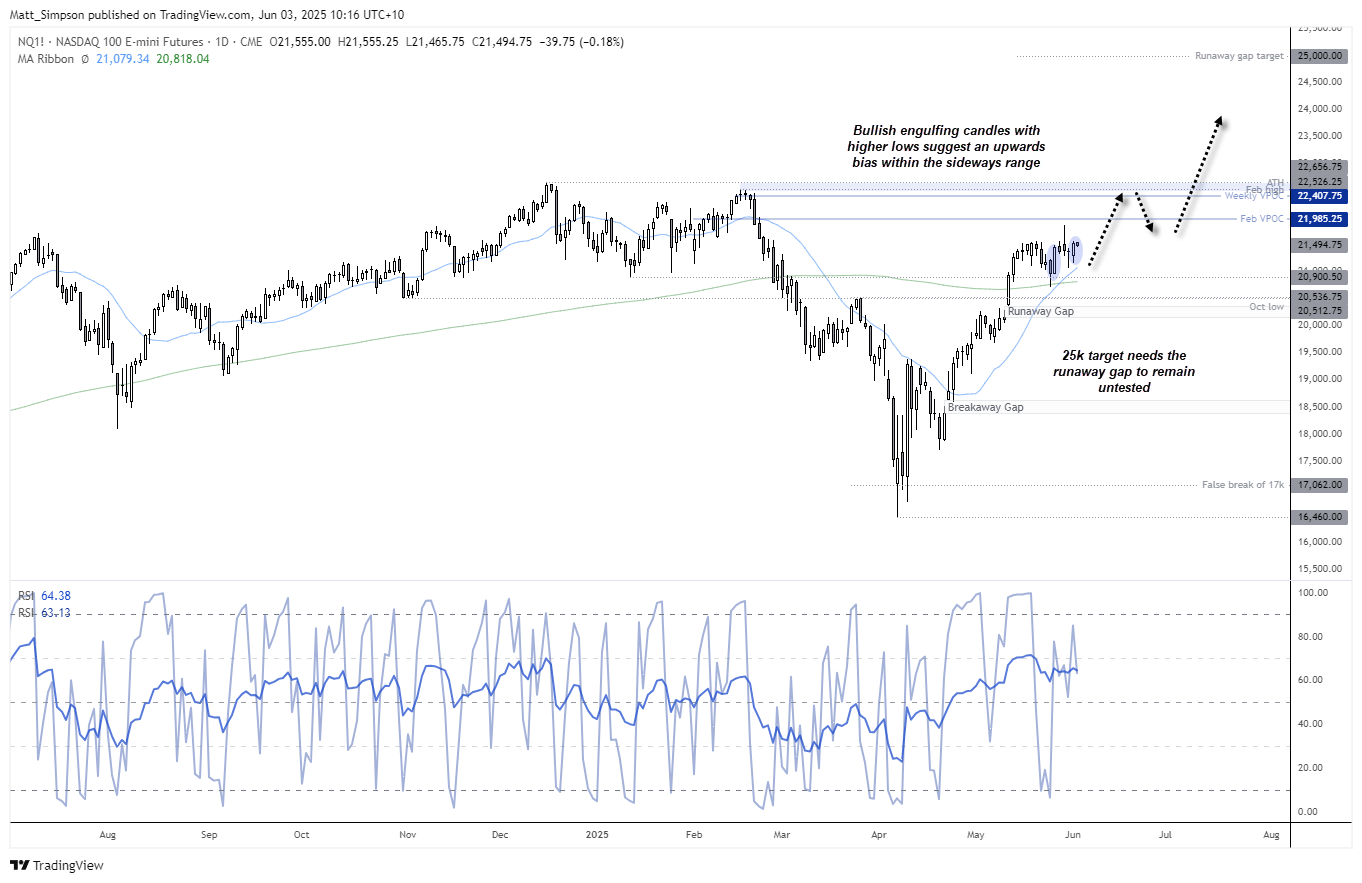

Nasdaq 100 Futures (NQ) Technical Analysis

As outlined in previous articles, I have an upside target of $25k for Nasdaq 100 futures — so long as the ‘runaway gap’ remains unclosed. Runaway gaps tend to appear around the middle of a move, so it is critical that the gap remains open for the upper target to remain alive. Even so, we should allow plenty of wriggle room for the potential Nasdaq 100 target.

The daily RSI (2) reached its most oversold level in a month on Friday 23 May. This suggests the 23 May low to be significant. And while price action has been a tad choppy these past two weeks, an upside bias seems apparent, given the two bullish engulfing candles with higher lows on the daily chart.

My near-term Nasdaq 100 bias remains bullish while prices hold above 20,700, and the upside target of 25k remains in play while the ‘runaway gap’ remains open.

Traders could seek dips down to the 200-day SMA and target the February VPOC (volume point of control) just below 21k, and a weekly VPOC near the February and all-time high.

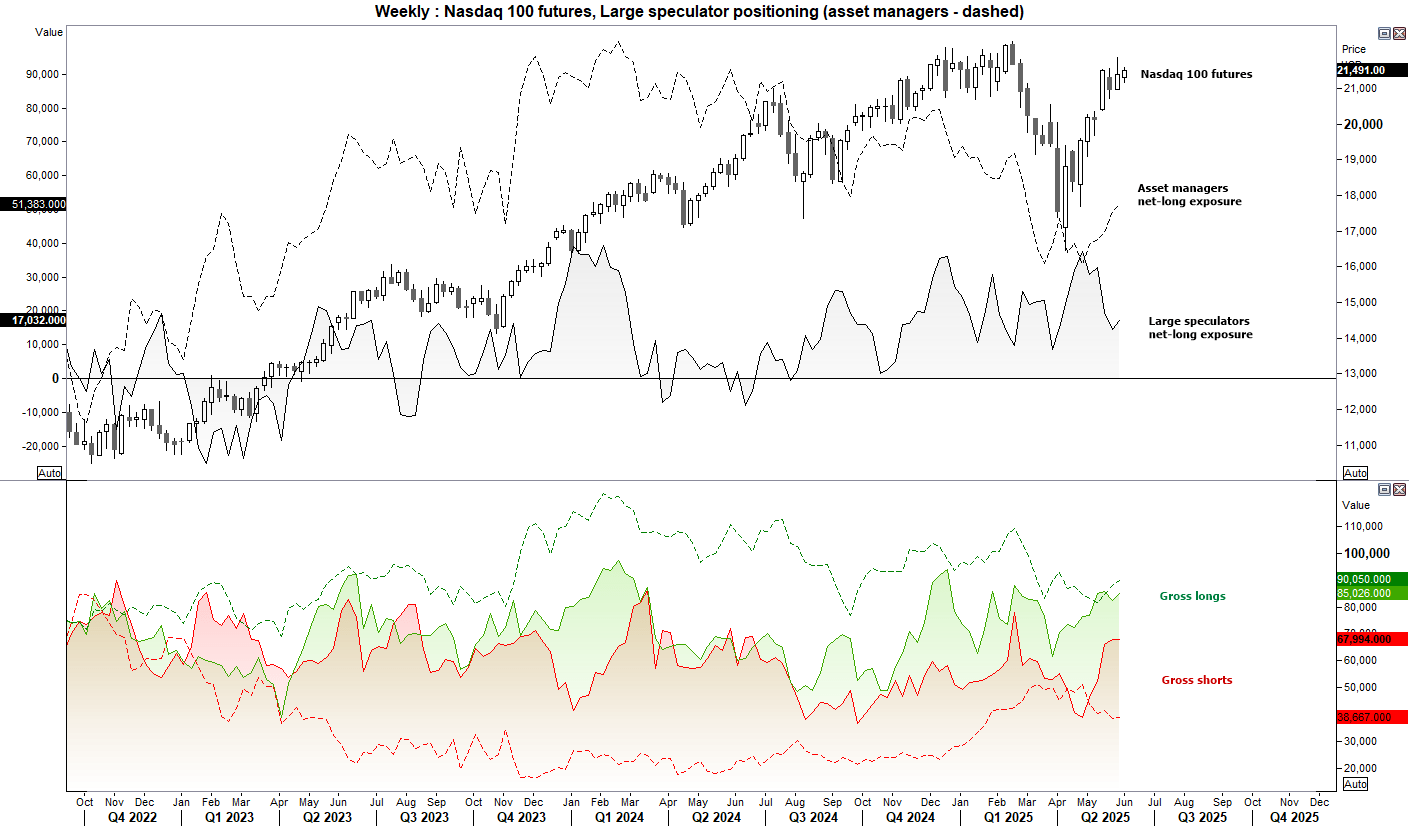

Nasdaq 100 Futures Positioning (NQ): Weekly COT Report Analysis

- Asset managers increased their net-long exposure to Nasdaq1 00 futures to a 13-week high last week

- Large speculators increased net-long Nasdaq 100 exposure by 2.5k contracts, taking the combined increase of net-longs up by 4.5k contracts

- This was achieved almost entirely by an increase of gross-long exposure among both sets of Nasdaq traders, with gross-shorts remaining effectively flat on the weeks

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge