Over the past 10 trading sessions, the Nasdaq 100 index has shown a strong recovery, gaining more than 13%, driven in part by easing trade tensions between the United States and China, which has helped restore short-term market confidence. However, a phase of neutral price action has recently emerged as markets await the next decision from the Federal Reserve.

How is the trade war evolving?

Currently, a 145% tariff remains in place on goods imported from China, as part of the White House's measures to protect the U.S. economy. However, recent comments from President Trump have been interpreted by markets as a possible sign of easing tensions, which could improve short-term investor sentiment toward U.S. equities.

China, for its part, has indicated that it would be reasonable to eliminate the existing tariffs in order to move forward with negotiations and reach an agreement. Still, the U.S. has not announced an official date to begin reducing tariffs.

This issue directly affects the Nasdaq 100, which is heavily exposed to global technology companies like Apple, Microsoft, and Nvidia. Many of these companies rely on supply chains, sales, or manufacturing operations in China. Therefore, higher tariffs could increase operating costs and reduce profitability, negatively impacting overall confidence in the index.

In this scenario, a concrete trade agreement between the U.S. and China could boost market confidence and support the current bullish pressure in the Nasdaq 100. However, if negotiations continue without meaningful progress, it could be perceived as a negative signal for bilateral cooperation, potentially reviving the uncertainty that dominated the early part of the year.

How is market sentiment holding up?

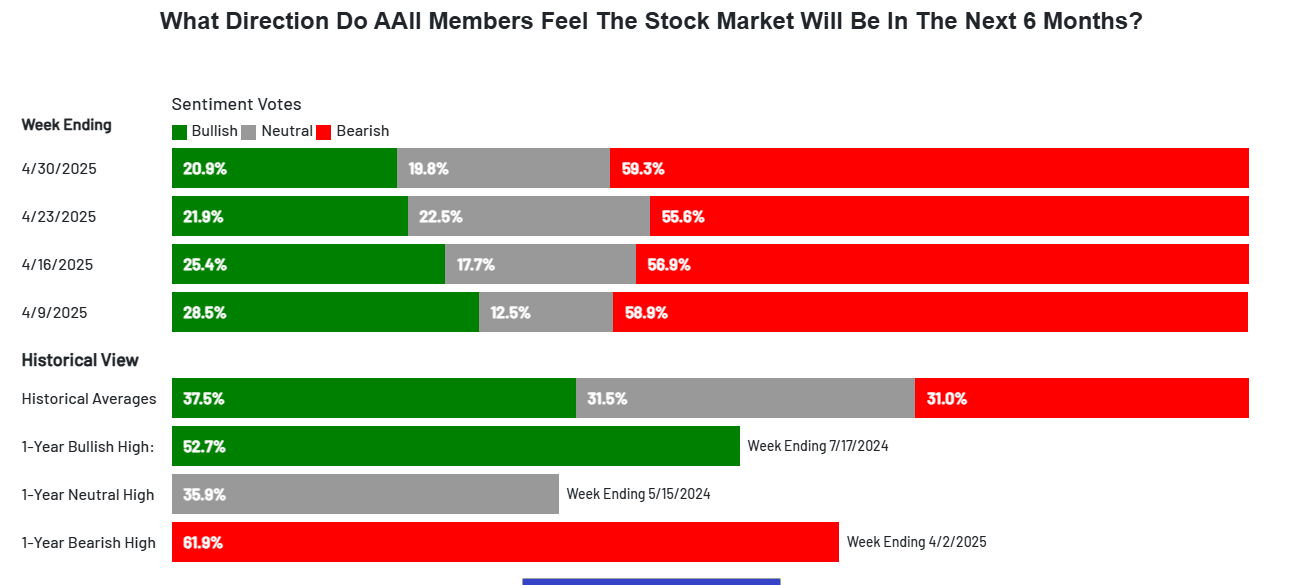

The AAII Investor Sentiment Survey, which gauges investor expectations for the next six months, revealed in its most recent reading (as of April 30) that 20.9% of respondents are bullish, 19.8% are neutral, and 59.3% hold a bearish outlook on the market.

Source: AAII

This reflects a predominantly bearish sentiment, likely due to the lack of a clear resolution to the trade dispute. If confidence fails to stabilize, investors may seek safer assets, such as Treasury bonds, which could increase downside pressure on the Nasdaq 100 if no agreement is reached in the short term.

The Week of the Fed Has Arrived

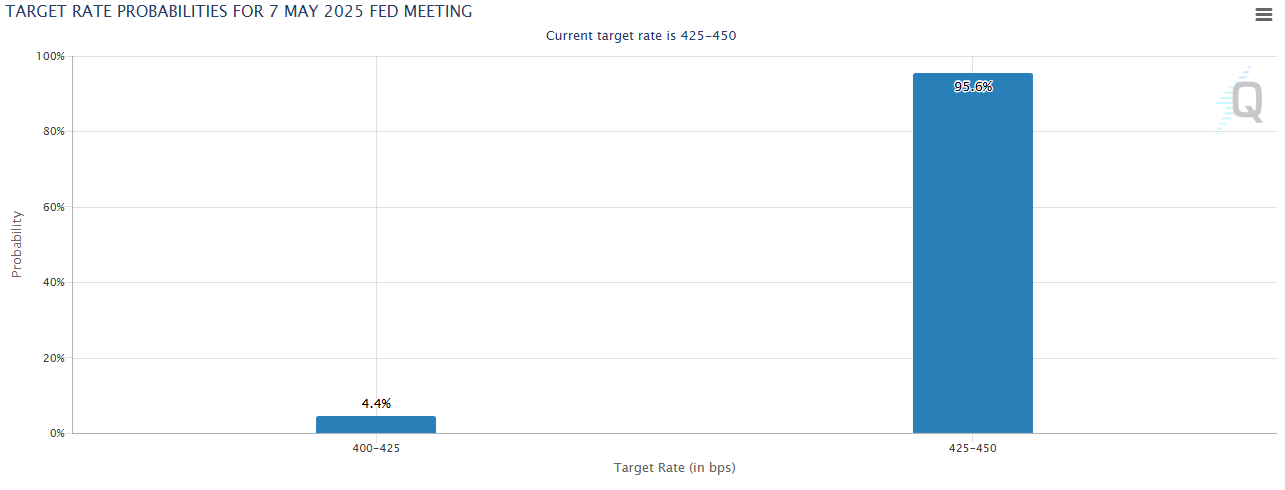

This week, the Federal Reserve's interest rate decision is scheduled for May 7. According to CME Group, there is a 95.6% probability that the rate will remain in the current 4.25%–4.5% range.

Source: CME Group

Although markets are closely watching for key signals from Jerome Powell, expectations for future rate cuts remain elevated. The current high rate has increased the cost of borrowing in the U.S. and has started to weigh on consumer spending, a key factor in corporate growth. If the central bank adopts a more hawkish stance and refrains from lowering rates in upcoming meetings, it is likely that confidence and the current bullish trend in the Nasdaq 100 may begin to weaken, amid concerns over a less favorable environment for domestic consumption.

Nasdaq 100 Technical Outlook

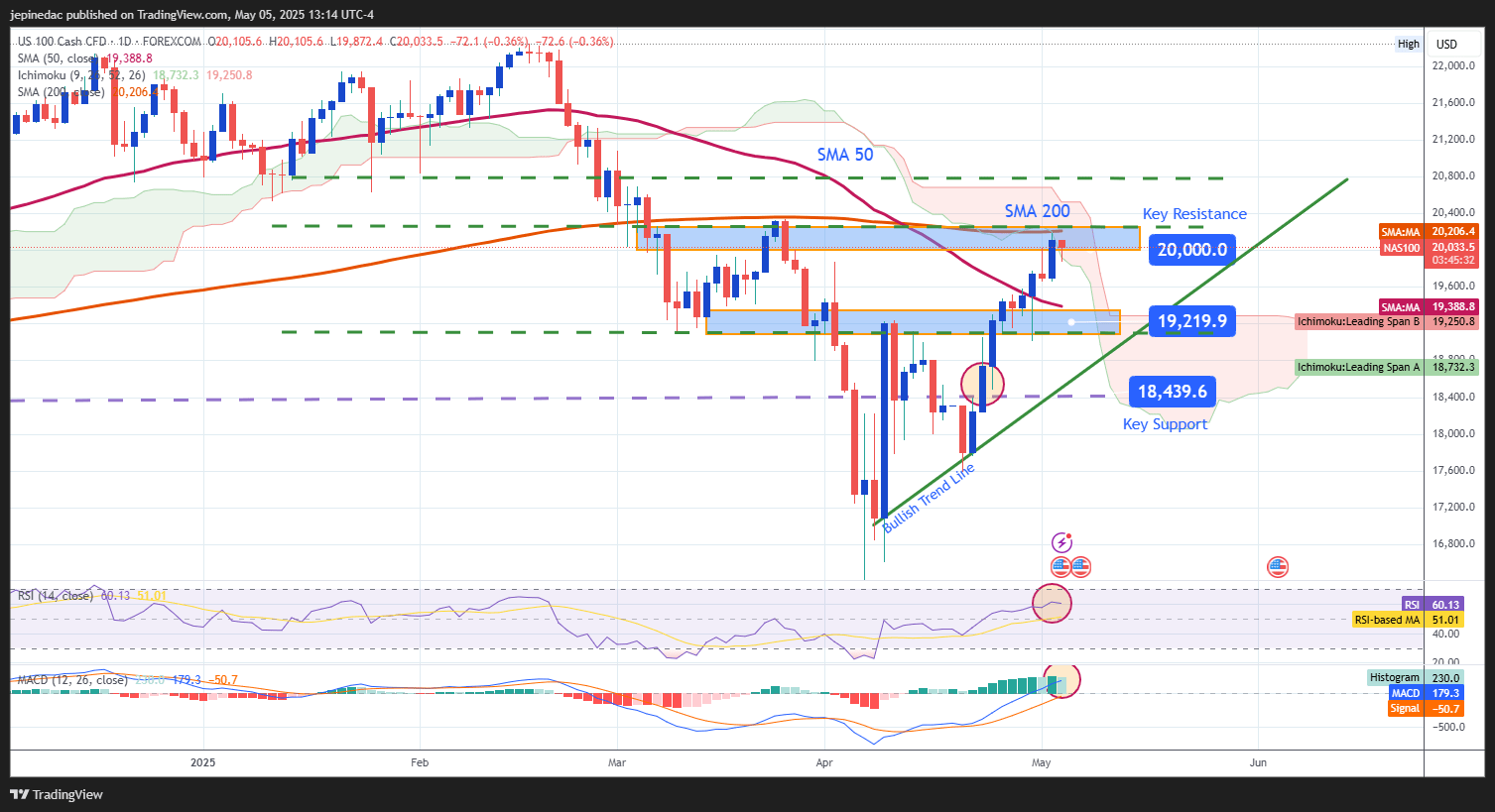

Source: StoneX, Tradingview

- Bullish Trend: Since early April, a solid uptrend has formed, highlighting the dominance of bullish momentum. However, the price has encountered resistance around the 20,000-point level, which is now the most relevant technical barrier. So far, there are no signs of bearish corrections that could threaten the existing upward structure on the chart.

- Momentum Weakens in Technical Indicators:

- MACD: Although the MACD histogram remains above the neutral zero line, it has started to flatten, which may indicate a phase of consolidation in the strength of the moving averages.

- RSI: The RSI line recently approached overbought territory (level 70), but has also begun to flatten, suggesting that buying momentum over the past 14 sessions is fading, which could lead to a pause in price movement.

Both indicators reinforce the perception of no clear short-term direction as the price tests the 20,000-point resistance.

Key Levels:

- MACD: Although the MACD histogram remains above the neutral zero line, it has started to flatten, which may indicate a phase of consolidation in the strength of the moving averages.

- 20,000 points – Main Resistance: This level aligns with the 200-period simple moving average, the Ichimoku cloud, and recent neutral zones. A breakout above this level could strengthen the bullish trend and extend buying pressure.

- 19,000 points – Nearby Support: This level coincides with the 50-period simple moving average and may serve as a short-term rebound zone in case of light corrections.

- 18,400 points – Final Support: This area lies below the current bullish trendline. A decline to this level could undermine the current bullish structure and potentially trigger a trend reversal.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25