The Nasdaq index began the week with steady bullish momentum, posting a gain of just over 1.4% in the short term. This upward bias has been supported by positive sentiment surrounding ongoing trade war negotiations. Despite the escalating conflict in the Middle East, market confidence has remained strong, and this could continue to serve as a key catalyst in the coming trading sessions.

Trade War Developments

Although the trade conflict between the United States and China remains ongoing, partial progress has been made in the negotiations. The outlook now appears to be moving toward a potential short-term agreement to end the standoff.

For the time being, the proposal includes maintaining initial tariffs of 55% on certain Chinese goods and just 10% on U.S. exports to China, as part of a preliminary deal reflecting both countries’ immediate needs. This would serve as the basis for a partial understanding, barring any unexpected disruptions to the diplomatic plans.

It’s important to note that the Nasdaq index has historically shown sensitivity to trade war news, experiencing sharp drops during heightened tensions. Currently, it appears to be pricing in a renewed sense of confidence, supported by the latest progress in talks between the two economic powers.

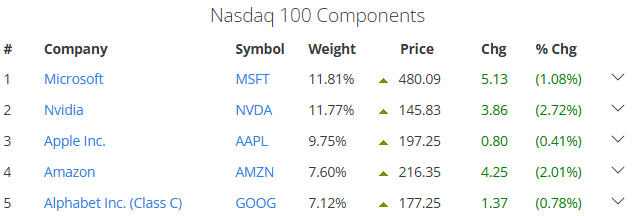

This renewed optimism has also been bolstered by the strong performance of the top five stocks in the index: Microsoft (+1.08%), Nvidia (+2.72%), Apple (+0.41%), Amazon (+2.01%), and Alphabet (+0.78%) during the start of the trading week. Their strength reinforces the growing risk appetite for the Nasdaq, as long as positive expectations for negotiations persist.

Source: Slickcharts

Therefore, Nasdaq’s confidence remains tightly linked to trade war outcomes. If optimism continues, buying pressure may remain the primary driver for the index over the coming weeks.

Is the Geopolitical Conflict Having an Impact?

Since last week, a significant conflict has erupted in the Middle East, with ongoing attacks between Israel and Iran. Although the conflict remains active, global powers have begun diplomatic efforts to establish a non-aggression agreement between the two countries.

Initially, this military escalation triggered uncertainty in financial markets. However, sentiment appears to have stabilized, mainly because the conflict has so far remained geographically contained, without directly impacting other countries or critical trade routes. As a result, market confidence has absorbed the geopolitical risks, shifting focus to a possible diplomatic resolution.

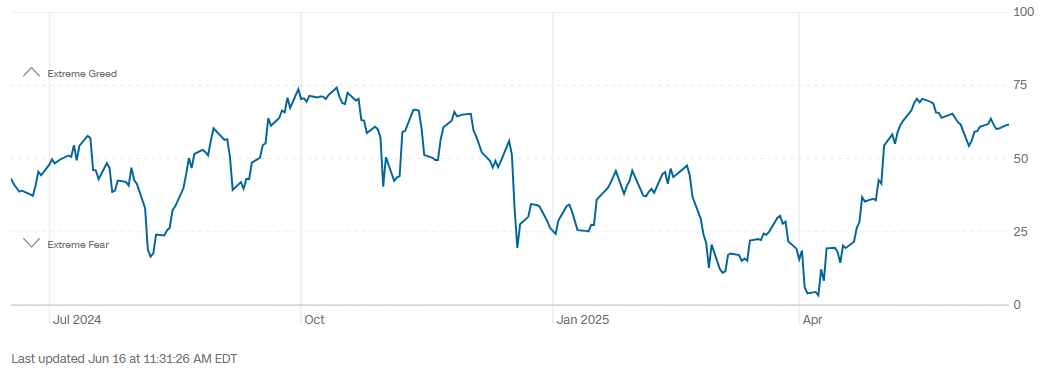

This sentiment is reflected in CNN’s Fear and Greed Index, which currently stands at 62 points, squarely in the "greed" zone, with an upward trend that shows no immediate signs of retreating into “neutral” territory. This performance suggests that despite recent risks, investor appetite for risk assets remains intact in the short term.

Source: CNN

As long as this positive sentiment holds, it could act as a tailwind for Nasdaq’s performance, reinforcing demand for tech-oriented risk assets, provided the geopolitical situation doesn’t worsen further.

Nasdaq Technical Outlook

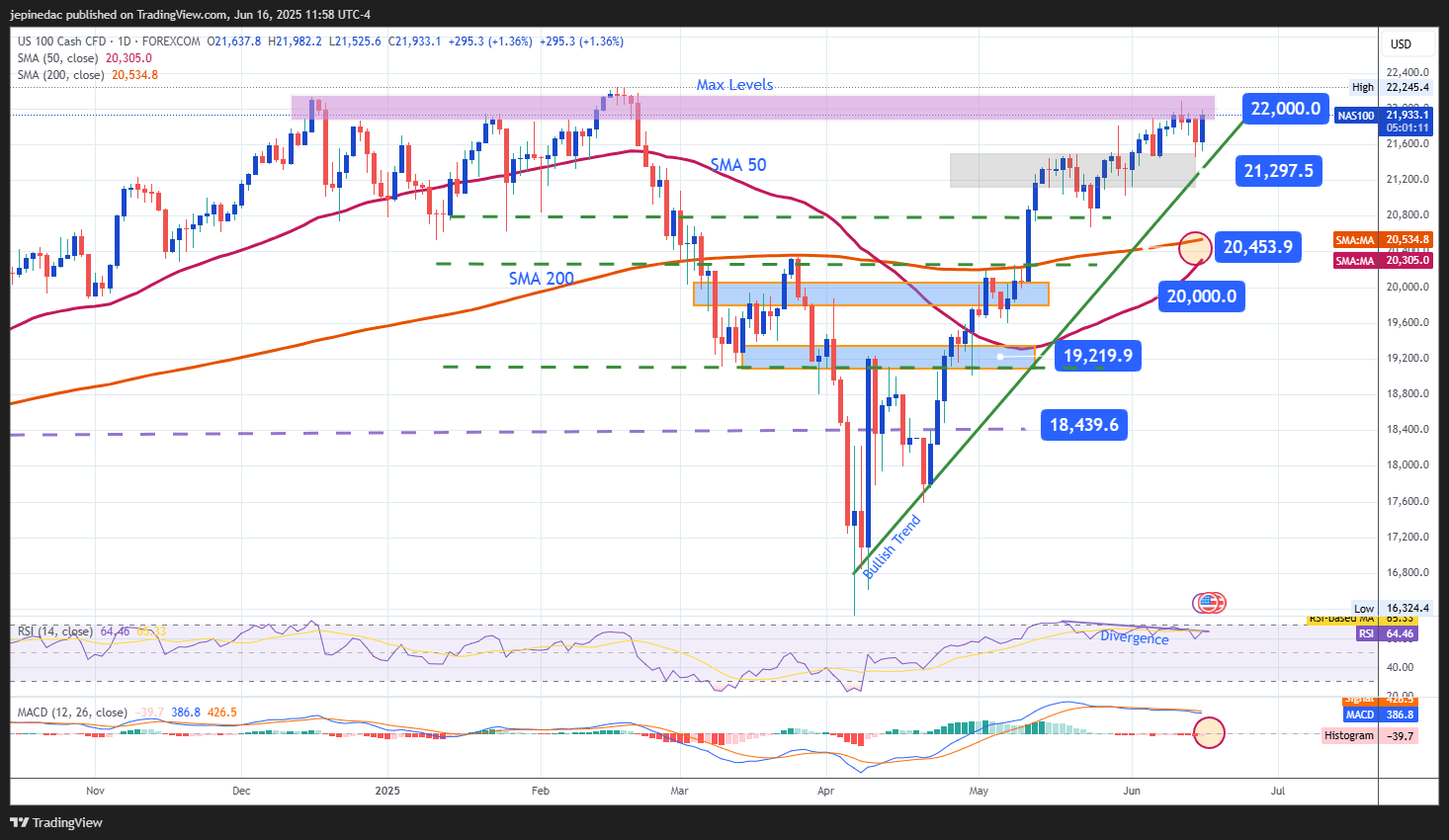

Source: StoneX, Tradingview

- Uptrend: Since early April, Nasdaq has maintained a bullish trend, consistently trading above the 21,000-point mark. Bullish price swings have sustained this buying trend, with no significant bearish corrections observed so far. However, the index is once again approaching its historical highs, which could act as a key resistance and potentially trigger short-term selling pressure.

- RSI: The Relative Strength Index (RSI) remains above the neutral 50 level, but has begun to show lower highs, while the Nasdaq index is printing higher highs. This bearish divergence may indicate short-term imbalance, raising the risk of downside corrections in upcoming sessions.

- MACD: The MACD histogram is fluctuating near the neutral zero line, signaling a balance between bullish and bearish momentum. This may lead to a sideways movement if prices fail to break through key resistance levels.

Key Levels:

- 22,000 points – Near-Term Resistance: This level aligns with the index’s historical highs. A breakout above this zone could strengthen the current bullish bias and open the door to new record highs.

- 21,297 points – Near-Term Support: This area reflects short-term neutrality and aligns with an upward trendline, possibly acting as a key buffer against bearish corrections.

- 20,453 points – Critical Support: This level coincides with the 50- and 200-period moving averages. A drop to this level may revive a bearish bias and threaten the current bullish trend in Nasdaq.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25