- Nasdaq 100 outlook clouded by faltering US-China hopes

- Stocks reverse gains, dollar down and gold up

- Safe havens rally as global investors grow cautious

A day after we saw the unwinding of “Sell America” trade, index futures were back down as a rally in global equities lost momentum. Once again, optimism over a swift resolution to the US-China trade spat was dealt a blow. Remarks from both Washington and Beijing have cast a long shadow over markets, prompting investors to reassess recent enthusiasm. Until we see meaningful resolution on the tariff front, it may well be the case that markets remain in a choppy environment with larger-than-usual swings. The back and forth will go on for a while, and this should be good for traders looking to pounce on volatility, but probably more on the frustrating side for long-term investors. In an environment where the narrative can change on a daily basis, the Nasdaq 100 outlook is murky at best, and trading from level to level continues to be my preferred strategy.

Bessent poured cold water on imminent progress

The latest risk-off trade comes after US Treasury Secretary Scott Bessent poured cold water on the idea of imminent progress, while China confirmed that no formal talks are currently underway. A couple of days ago, US President Donald Trump had raised hopes about the US-China trade spat, triggering a sharp rally in US and global markets. But it looks like that momentum has now ended, with “Sell America” trade back on. Along with falling US index futures, the USD/JPY was down 0.7%, while EUR/USD was bouncing back to near 1.14 handle, and gold was shining again.

Meanwhile, Trump hinted yesterday that China may face a new tariff structure in the coming weeks, but Bessent's comments suggested no firm offer is on the table to unilaterally lift US duties. He indicated that broader concerns—beyond tariffs—remain at the heart of Washington’s China stance, adding that any true rebalancing may span years, not months. Let’s hope that is not the case, but so far it looks like the stalemate will continue for a while.

Indeed, China’s Ministry of Commerce offered a firm rebuttal, insisting that the US must revoke all unilateral tariffs if it wishes to restart meaningful negotiations. Beijing wants Washington to “show sincerity” before any talks can resume. They want more than kind words—seeking respect, consistency, and a designated US representative before returning to the table.

Alphabet earnings to come after the bell

Alphabet, the parent firm of Google, is due to report its fiscal first-quarter earnings after the closing bell today. On the face of it, analysts aren’t expecting any nasty surprises — tariffs, for now, are not seen as having dented revenue or earnings per share in the opening quarter.

But the real interest lies not in the rear-view mirror, but in what’s ahead. Investors will be listening closely for any guidance on how the tech behemoth expects to weather the second half of the year, particularly if trade tensions or regulatory pressures begin to bite.

There’s also a growing unease among advertisers. As users increasingly turn to generative AI and social platforms to search for information, traditional ad spend is being reassessed — a shift that could pose longer-term challenges for Google’s core business.

As it stands, consensus from Bloomberg suggests Alphabet is expected to post earnings of $2.01 per share on revenue of $89.1 billion. Respectable figures, no doubt — but the commentary accompanying them may prove far more revealing than the numbers themselves.

Other corporate news

With all the trade uncertainty at the forefront, not much attention is currently being paid to the earnings season, with lots of companies reporting their results. Today’s deluge of results were mostly negative. IBM shares tumbled in pre-market trade after posting lacklustre results. Results from the likes of PepsiCo, P&G and American Airlines are set to come before the bell, before attention shifts to Alphabet (see above). Across the Atlantic, investors in Europe were grappling with earnings from big names. Unilever climbed after reporting better-than-expected sales, while Nestlé edged lower. BNP Paribas disappointed, shedding ground as profits missed the mark.

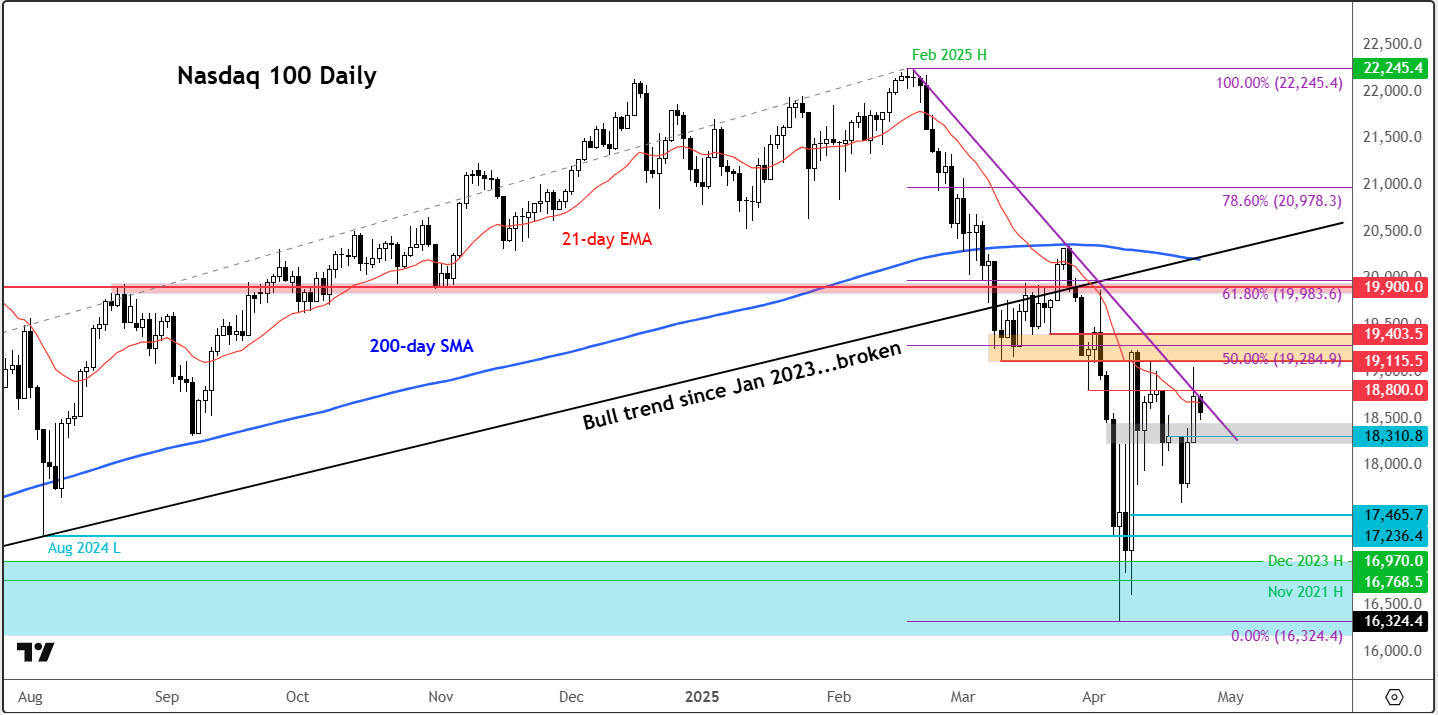

Technical Nasdaq 100 outlook: Don’t be fooled by recent bounce

Despite a spirited rebound in the previous couple of days, the broader picture for the Nasdaq 100 outlook remains cloudy from a technical standpoint. The index continues to face headwinds, and it would be premature to declare a shift to bullish territory while it remains pinned beneath its short-term descending trend line. Until such a time we start to see higher highs, it is essential to stay alert, trade from level to level and move on to the next opportunity, when it comes to trading the index or stocks in general.

Source: TradingView.com

At the time of writing, the major US indices such as the S&P 500 chart and Nasdaq 100 were coming off their earlier lows, after bumping up against its resistance trend yesterday, which held once more.

Among key levels to watch, 18,800 is important to watch closely which has not broken convincingly yet, and is a level where the abovementioned bearish trend line comes into play. Above here, the area between 19,115 to 19,400 is the most important short-term resistance zone to watch, which was previously support. Should recent momentum carry it higher, traders will have their eyes on the next resistance area at 20,000.

On the downside, should the selling pressure resume later in the session, the next target is around 18,310. Below that, then next support levels to monitor include 18,000 and then 17,465.

Tactical approach: Play the levels, not the narrative

In a market swayed by shifting headlines and absent of firm conviction, adaptability is key. The best advice? Avoid becoming wedded to any particular view. Instead, trade level by level, stay nimble, and keep risk on a short leash, with the Nasdaq 100 outlook being highly uncertain. Now’s not the time for heroics — it’s a trader’s market, not an investor’s.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R