US futures

Dow futures 0.35% at 40360

S&P futures 0.03% at 5524

Nasdaq futures -0.08% at 19404

In Europe

FTSE 0.08% at 8430

DAX 0.39% at 22414

- Stocks are flat after a quiet start to the week

- Trump completes 100 days in office

- Big Tech earnings and US data dump this week

- Oil falls on demand worries

Stocks are little changed with Trump, data & earnings in focus

U.S. stocks are mixed on Tuesday as investors await key economic data and Q1 earnings from mega-caps such as Apple, Amazon, and Microsoft.

Major indices were slightly higher on Monday, but the NASDAQ was fractionally lower after a choppy session as investors digested more headlines regarding Trump's trade tariffs.

Treasury Secretary Besson said that many countries had offered good tariff proposals. He also added that the US and China are in contact, but that it was up to China to de-escalate the situation. President Trump could also partially ease his tariffs on autos to cushion the economic impact of his levies on the US economy.

Trump has completed 100 days in office and will give a speech shortly.

This week is a key week for U.S. economic data. US GDP, core PCE, and non-farm payrolls data this week will help provide insight into the potential impact of trade tariffs. Today, JOLTS job opening data will be released, and it is expected to show that vacancies fell modestly to 7.5 million from 7.58 million.

This week is also a key week for earnings with a Magnificent seven mega-caps, including Apple, Microsoft, Amazon, and Meta, set to release numbers. Microsoft and Meta will report on Wednesday, and Apple and Amazon are due to report earnings on Thursday.

Corporate news

Spotify is 5% lower after posting Q1 operating income of €509 million, below the €519.9 million forecast. Revenue was in line with expectations at €4.2 billion on monthly active users of 678 million, also in line with prior guidance.

General Motors is falling 2% ahead of the opening despite beating Q1 estimates on both the top and bottom line. However, I said it would be looking at its full-year outlook due to Trump's tariffs and macroeconomic uncertainty.

Coca-Cola is rising 1% after posting Q1 adjusted earnings of $0.73 per share, beating expectations of $0.71, on revenue of 11.22 billion,, ahead of the 11.14 billion forecast. The company also reaffirmed its its full-year outlook, saying that the impact of the global trade conflicts should be manageable.

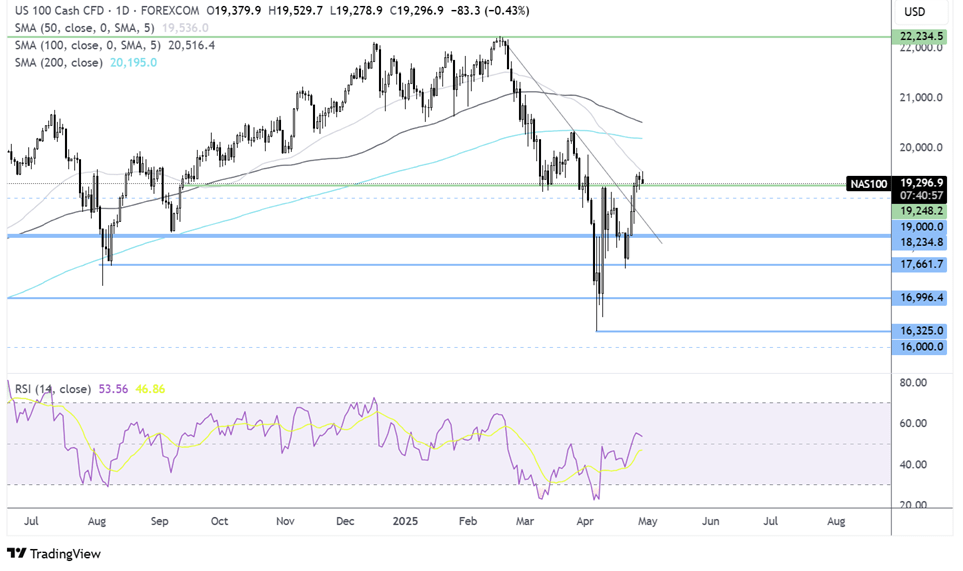

Nasdaq 100 forecast – technical analysis.

The Nasdaq has recovered from 16,320 low running into resistance at the 50 SMA at 19,500. Buyers, supported by the RSI above 50, will look to rise above here to expose the 200 SMA at 20,200. Failure to retake the 50 SMA could see the test of 19100 – 19300 support zone and 19000. Below here the falling trendline support at 18500 comes into play.

FX markets – USD rises, EUR/USD falls

The USD is rising, recovering from its recent 3-year low, boosted by easing trade war fears. Attention will be on data this week for signs of potential impact from the trade tariff turmoil.

The EUR/USD fell unexpectedly after the Eurozone economic sentiment fell, and Spanish GDP slowed slightly to 0.6% below the earlier reading of 0.7%. Power has returned to Spain and Portugal after an outage yesterday.

GBP/USD is falling modestly but remains close to its 38-month high with gains of 3.8% in April, despite recent data flagging mixed signals about the UK economy. Retail sales last week showed resilient demand but PMI data was disappointing.

Oil falls on demand concerns

Oil this is all falling for a second straight day, dropping 22 week low mid fears over the demand outlook due to the ongoing trade war between the US and China.

A drawn out trade war between the world's two largest economies is likely to SAP demand and could push the global economy into a recession.

Barclays cut its 2025 Brent forecast to $70 a barrel due to trade tensions and the pivot in production strategy by the OPEC+, which is increasing it's oil supply. Members of OPEC are expected to suggest an increase of output hikes for a second straight month in June.