NFP Key Points

- NFP report expectations: +133K jobs, +0.3% m/m earnings, unemployment at 4.2%

- Leading indicators point to near-expectation reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 125-165K range.

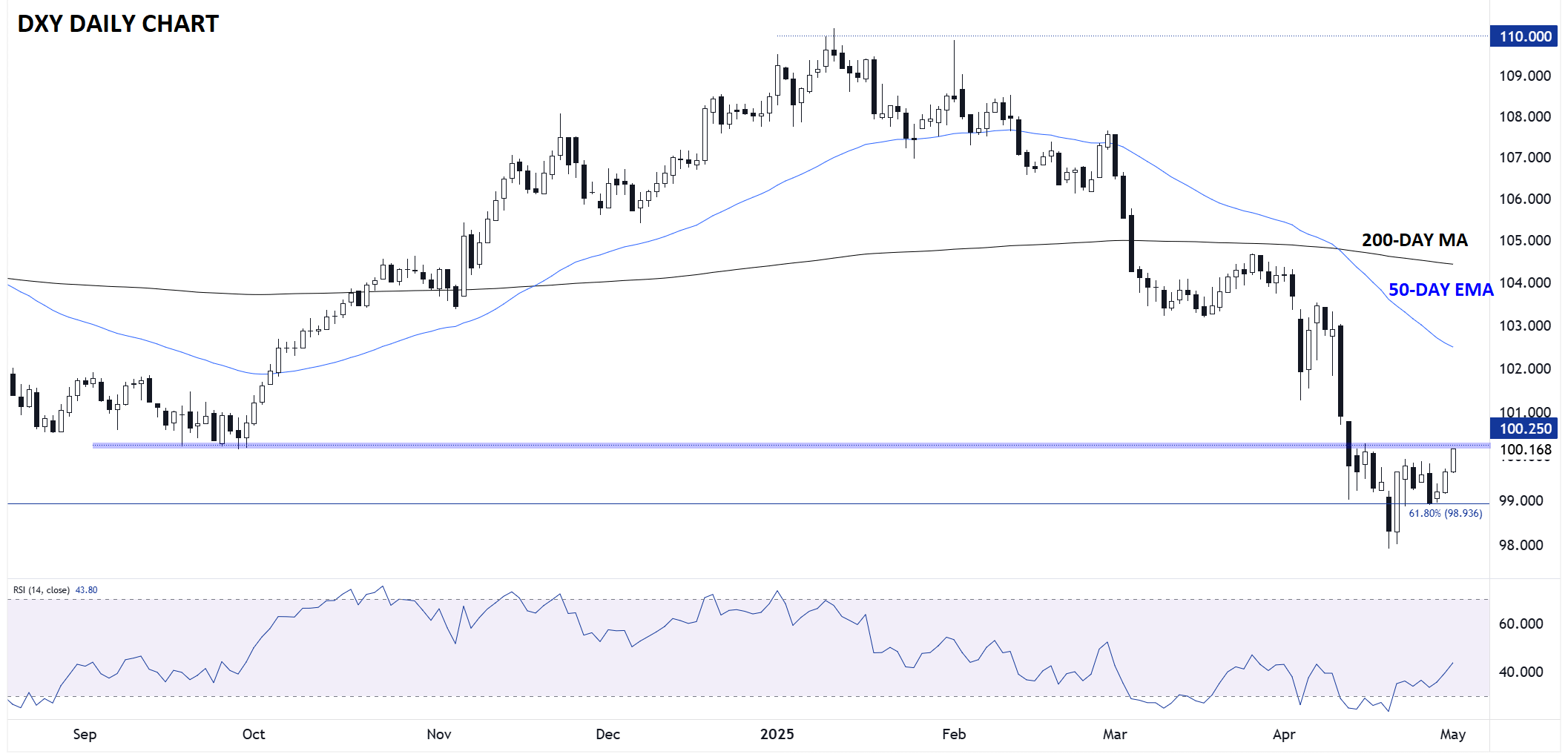

- The US Dollar Index (DXY) has seen a counter-trend bounce off its intramonth lows but remains in a well-established downtrend, tilting the risks to the downside unless the NFP reading is substantially better than expected

When is the April NFP Report?

The April NFP report will be released on Friday, May 2, at 8:30 ET.

NFP Report Expectations

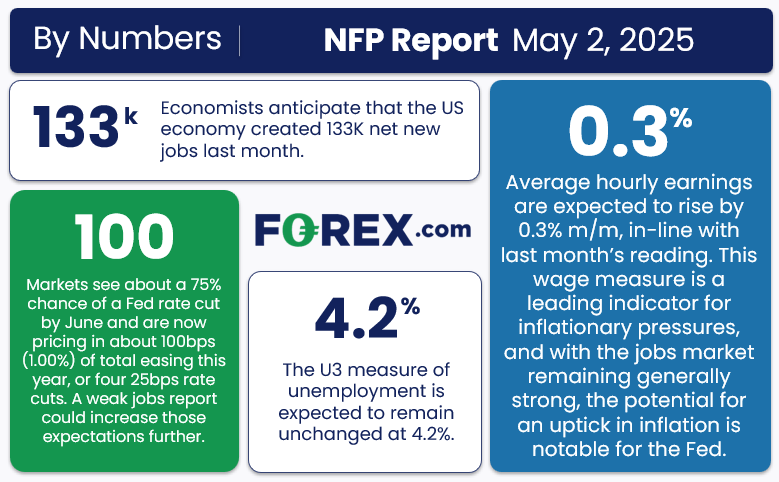

Traders and economists expect the NFP report to show that the US created 133K net new jobs, with average hourly earnings rising 0.3% m/m (3.9% y/y) and the U3 unemployment rate holding steady at 4.2%.

NFP Overview

The US labor market is in a strange spot heading into this month’s NFP report.

Despite the impact that the (currently paused) “reciprocal tariffs” are having on global trade, the proverbial “tidal wave” of economic and supply disruption stemming from the tariffs has not yet hit the US shores in a major way. Notably, the NFP survey was conducted several weeks ago, so it’s likely to show only a slowdown in hiring and relatively few outright layoffs as businesses broadly froze current employment levels until there was more certainty around the levels and duration of the “Liberation Day” tariffs.

When it comes to this month’s jobs report, expectations are for a decline to +133K jobs, with the unemployment rate to hold steady at 4.2%. One key area to watch will be the average hourly earnings measure, which is expected to come in unchanged from last month at 0.3% m/m:

Source: StoneX

As the lower left box below suggests, traders now expect a full four interest rate cuts from the Federal Reserve this year, though that is unlikely to start at the Fed meeting later this month.

NFP Forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Manufacturing PMI Employment component improved to 46.2 from 44.7 last month.

- The ADP Employment report showed 62K net new jobs, down sharply from last month’s (downwardly-revised) 147K reading.

- Finally, the 4-week moving average of initial unemployment claims ticked up to 226K, up slightly from last month’s 222K reading

Weighing the data and our internal models, the leading indicators point to a near-expectations reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 125-165K range, albeit with a big band of uncertainty given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.3% m/m in the most recent NFP report.

Potential NFP Market Reaction

|

|

Wages < 0.2% m/m |

Wages 0.2-0.4% m/m |

Wages > 0.4% m/m |

|

< 100K jobs |

Strongly Bearish USD |

Bearish USD |

Bearish USD |

|

100-170K jobs |

Slightly Bearish USD |

Slightly Bearish USD |

Neutral USD |

|

> 170K jobs |

Neutral USD |

Slightly Bullish USD |

Bullish USD |

As we outline below, the US Dollar Index (DXY) has seen a counter-trend bounce off its intramonth lows but remains in a well-established downtrend, tilting the risks to the downside unless the NFP reading is substantially better than expected.

US Dollar Technical Analysis – DXY Daily Chart

Source: TradingView, StoneX

The US Dollar Index (DXY) extended its drop further through the first three weeks of April before bouncing back modestly over the last week or so as we go to press. The counter-trend bounce has alleviated the oversold condition on the 14-day RSI, potentially setting the stage for another leg lower, especially if the jobs report comes in weaker than anticipated. While the jobs market is likely to be increasingly important in driving the Federal Reserve’s deciusions as we move through the year, tariff headlines and any potential trade deals may be bigger market movers in the near term.

Technically speaking, the April low around 98.00 is the most important support level to watch, whereas the nearest clear level of topside resistance comes from the September/October lows around 100.25. Traders should prepare for continued volatility regardless of the NFP report as markets adjust to the new global trade regime.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX