WTI crude prices surged by over 12% in recent hours, once again surpassing the $75 mark, a level not seen since January of this year. This sharp bullish volatility in the short term is largely attributed to rising tensions between Israel and Iran, which have raised concerns about oil production in the Middle East. If this uncertainty persists, the buying pressure on WTI could become a key catalyst in the upcoming trading sessions.

Geopolitical Tensions on the Rise

In recent hours, Israel has launched an aerial offensive targeting strategic sites in Iran, focusing particularly on nuclear facilities and military bases. The attack resulted in the deaths of high-ranking Iranian officials and was described by Tehran as a direct declaration of war.

Several members of the international community have responded to the event. Countries within both the European Union and the United States have called for moderation in the short term to avoid further escalation. The event has cast doubt on the region’s political stability and raises the risk of a broader conflict, especially as both countries find themselves in an increasingly fragile relationship.

Although Iran’s oil infrastructure has not been directly affected so far, there is a possibility of retaliation targeting key extraction facilities. Such actions could pose a direct threat to global oil supply.

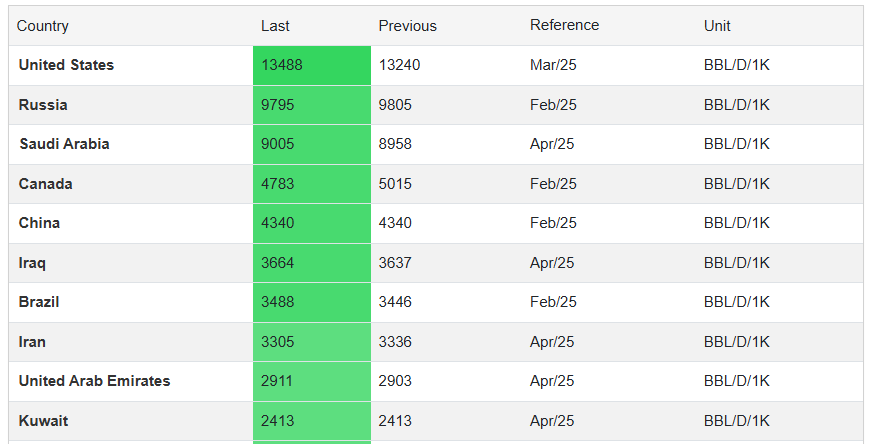

It is worth noting that several Middle Eastern countries rank among the world's top 10 oil producers: Saudi Arabia (3rd), Iraq (6th), Iran (8th), and the United Arab Emirates (9th). This highlights the strategic importance of the region for global energy markets. Any escalation that disrupts production could significantly weaken global supply, leading to sustained upward pressure on crude prices.

Source: TradingEconomics

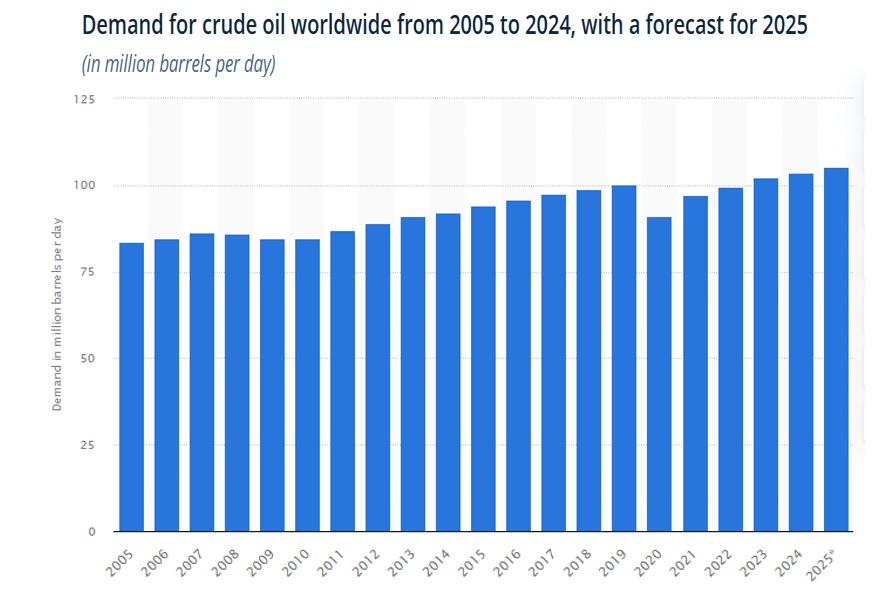

Moreover, global oil demand has remained stable and, on the rise, so far this year. Forecasts suggest this upward trend will likely continue through the end of 2025.

Source: Statista

As such, the evolving geopolitical backdrop suggests a scenario of tightening supply alongside steady demand. This imbalance may further intensify upward pressure on oil prices if tensions continue to escalate.

WTI Technical Outlook

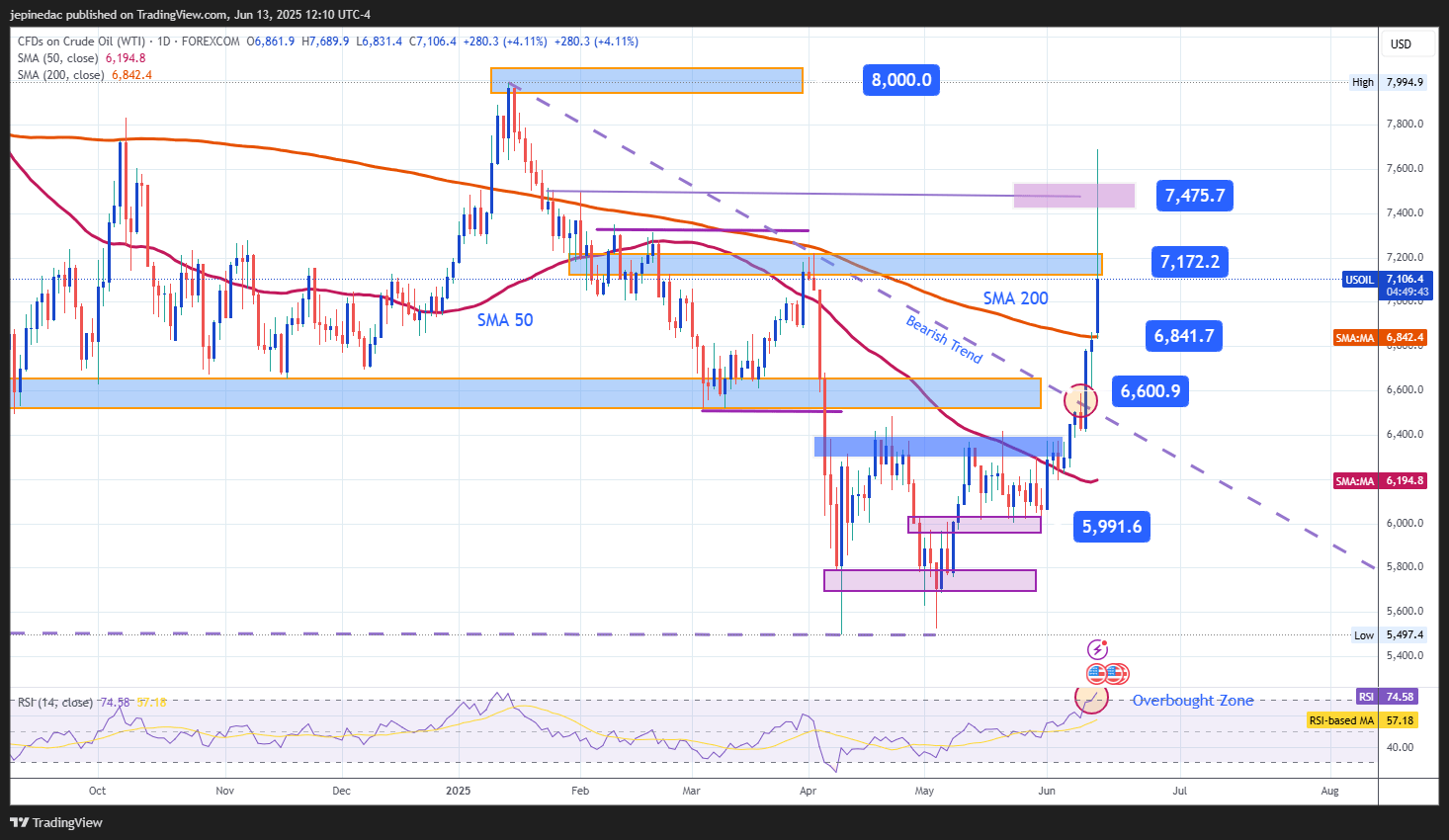

Source: StoneX, Tradingview

- Volatility Spike: Recent fundamental developments have triggered a significant increase in bullish volatility, with WTI surpassing the 200-period moving average, a key technical barrier. However, rather than confirming a sustained trend, this move introduces short-term uncertainty, which may result in a neutral phase with potential downward corrections. A new bullish trend may only be confirmed if prices stabilize above this key moving average.

- RSI: The RSI indicator has climbed rapidly and is now in overbought territory, indicating an imbalance between buyers and sellers. As long as the indicator remains at these elevated levels, there is a heightened risk of short-term pullbacks.

Key Levels:

- $74 – Major Resistance: Marks the highest price levels seen since January. A return to this area supported by sustained buying could signal a more robust bullish trend.

- $71 – Current Resistance: This is a critical neutrality level where potential selling corrections may emerge. As long as prices remain above this zone, the bullish bias may hold.

- $68 – Key Support: Aligns with the 200-period moving average. A drop below this level could undermine the current bullish sentiment, leading to a more prolonged phase of indecision.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25