Oil eases as Middle East tensions remain in focus

Oil prices have seen heightened volatility on Monday, opening 4% higher before quickly reversing as the conflict between Israel and Iran remains in focus.

Oil prices jumped 12% last week on fears that the tensions between Israel and Iran could broaden out into the wider region and affect oil supply.

However, oil prices have eased back from the multi-month high on the assumption that the conflict won't impact the Strait of Hormuz, through which around 20% of the world's oil consumption passes. A blockade on this Strait could boost oil prices significantly and could pull the US into the conflict.

Meanwhile, OPEC and its allied producers do have spare capacity equivalent of Iran's output, which could offset any disruptions. This knowledge is bringing some calm to oil markets.

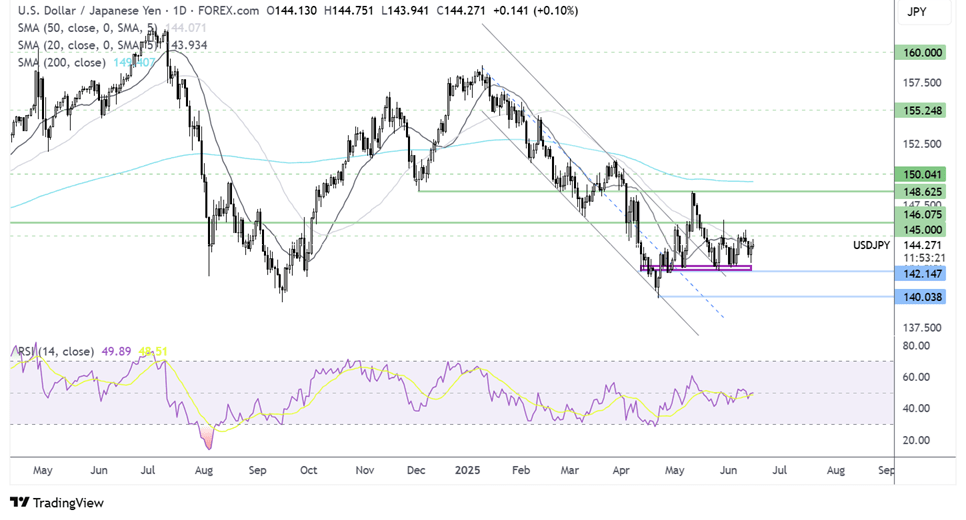

Oil forecast -technical analysis

Oil recovered from 55.30 May low, rising above the 200 SMA and the 70.00 psychological level before running into resistance at 77.60, the upper band of the falling channel dating back to late 2024, keeping the longer-term downtrend intact. The RSI is deep in overbought territory.

The fall lower is testing the 72.50 March high. A break below here exposes the 70.00 round number and the 200 SMA at 68.60. Below here, sellers could gain traction.

Should the 72.50 support hold, buyers will look towards 77.60, last week’s high, and the falling trendline. A rise above her creates a higher high, bringing 80.00 into focus.

USD/JPY unchanged with central banks in focus

USD/JPY is unchanged at 144 after modest losses last week and ahead of a key week for central banks. The Federal Reserve and the BoJ will announce rate decisions, while geopolitical tensions could drive safe-haven flows.

The USD/JPY posted 0.5% losses last week after the yen benefited from safe haven flow after Israel attacked Iran on Friday and Iran retaliated. The conflict continued over the weekend, although the market opened steadily, with equities rising.

Attention is turning to the Bank of Japan's rate decision early on Tuesday. The central bank is widely expected to leave rates unchanged.

The focus will be on the BOJ's plans to taper its bond purchases further, although any near-term changes are unlikely, given increased uncertainty over economic growth and trade. BOJ governor Ueda, who is expected to strike a hawkish tone, especially given recent stickiness in Japanese inflation.

. The Federal Reserve will also be announcing its interest rate decision on Wednesday, and the central bank is expected to leave rates at 4.25 to 4.5%. The meeting comes as signs of weakness have started to appear in the US jobs market and as inflation ticked higher to 2.4%. With no rate cut expected, the focus will be on updated growth and inflation projections as well as the Fed's dot plot. The market is pricing in two more rate cuts of 25 basis points this year, roughly in line with the Fed's March dot plot.

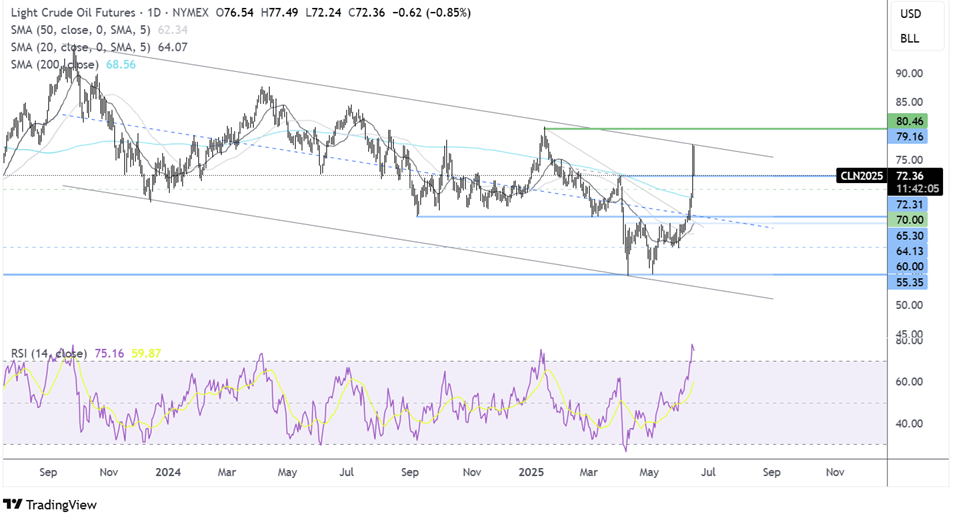

USD/JPY forecast – technical analysis

USD/JPYA is trading in a holding pattern, capped on the upside by 146 and by 142 on the downside. The RSI is neutral. This setup lends itself to a breakout trade.

Buyers would need to rise above 146 to extend gains towards 148.65, the May high.

Sellers would ned to break below 142.00 to open the door to 140.00, the 2025 low.